Affected person Capital, a distinguished asset supervisor with over $1.8 billion in belongings underneath administration in response to its most up-to-date portfolio holdings report, has filed with the US Securities and Trade Fee (SEC) looking for permission to allocate as much as 15% of its funds to Bitcoin ETFs.

The transfer comes because the Bitcoin ETF market is experiencing important inflows, reflecting rising curiosity from institutional and retail buyers in these newly accredited index funds.

Affected person Capital Shifts Focus To Bitcoin ETFs

In accordance with the filing dated March 11, Affected person Capital plans to hunt publicity to Bitcoin via investments in exchange-traded merchandise registered underneath the Securities Act of 1933 and primarily deal with Bitcoin (known as “Bitcoin ETPs”).

This marks a shift from the Fund’s earlier publicity to Grayscale’s Bitcoin Belief GBTC, which just lately transformed to a Bitcoin ETF. The Fund will bear its proportionate share of the management fees and different bills related to the Bitcoin ETFs, along with its direct bills, and can incur brokerage commissions when buying and selling shares of those ETFs.

Whereas Affected person Capital is fascinated with Bitcoin ETFs, the submitting additionally highlights a number of considerations relating to the broader cryptocurrency market and Bitcoin itself. The asset supervisor notes that auditing requirements for Bitcoin could differ from these for registered US securities.

The agency highlights the “unregulated nature” and “lack of transparency” surrounding digital asset platforms, which it says may be vulnerable to fraud, manipulation, safety failures, and operational points.

Particularly, whereas Affected person Capital is keen to take part within the newly launched Bitcoin ETF market, it acknowledges that the worth of Bitcoin, and consequently the worth of its funding within the Bitcoin ETF market, could possibly be “adversely affected” by these dangers.

Warnings Of Regulatory Influence On Crypto Investing

The submitting additionally factors out that international locations, together with america, could impose restrictions and even outlaw the longer term acquisition, use, or sale of Bitcoin. Moreover, the asset supervisor notes that the regulatory landscape for cryptocurrencies within the US is “still developing,” and ongoing and future regulatory actions may considerably affect the character of cryptocurrency investments.

Importantly, Affected person Capital additionally acknowledges that the classification of a digital asset as a “security” underneath federal securities legal guidelines stays “complex” and tough to foretell, doubtlessly affecting the asset’s worth.

Furthermore, Affected person Capital acknowledges that market volatility and restricted buying and selling exercise within the secondary market can lead to important premiums or reductions to the net asset value of Bitcoin ETFs. The agency cautions that the shortage of an energetic buying and selling marketplace for the shares could lead to restricted market liquidity and potential losses when promoting the shares.

As well as, Affected person Capital alleges that Bitcoin ETFs have a restricted variety of approved members, market makers, and liquidity suppliers, which may affect buying and selling dynamics and doubtlessly lead to a fabric low cost to internet asset worth, wider bid-ask spreads, buying and selling halts, and even delisting, in response to the corporate’s assertion within the submitting.

Affected person Capital’s submitting to allocate a portion of its fund to Bitcoin ETFs signifies the asset supervisor’s recognition of elevated institutional curiosity in cryptocurrencies.

Nonetheless, the submitting additionally underscores the alleged dangers related to the cryptocurrency market, together with regulatory uncertainties, market volatility, and restricted liquidity.

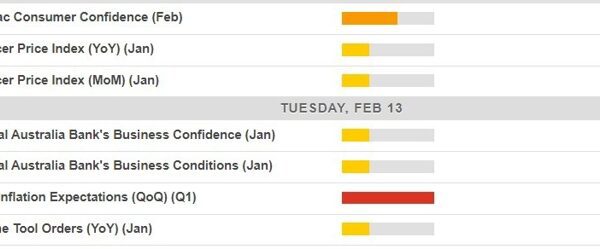

As of this writing, Bitcoin, the most important cryptocurrency out there, is buying and selling at $71,500 and has been consolidating above this key stage for over 24 hours.

Featured picture from Shutterstock, chart from TradingView.com