The cryptocurrency funding panorama has not too long ago witnessed a big uptick in exercise, with digital asset funding merchandise recording inflows of roughly $1.1 billion, based on a latest blog post shared by Coinshares, a number one digital asset funding agency.

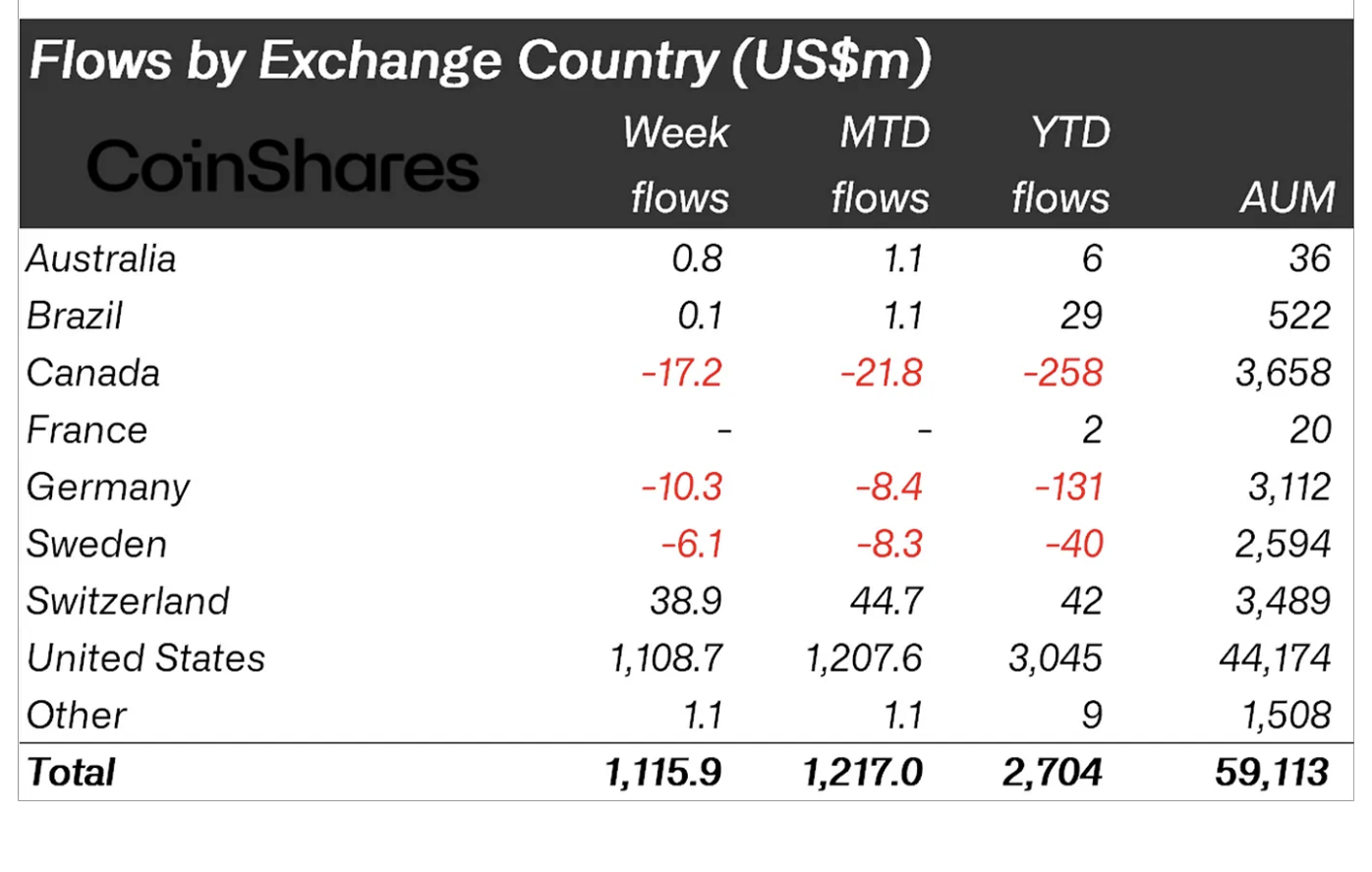

This surge has propelled the year-to-date inflows to roughly $2.7 billion, as reported by the agency. Moreover, Coinshares has highlighted this growth, noting that the entire belongings below administration (AuM) have reached their highest degree since early 2022, at $59 billion.

Inflows of US$1.1bn into digital asset ETPs, momentum of inflows into new issuers not slowinghttps://t.co/IERahbmYhO

— James Butterfill (@jbutterfill) February 12, 2024

This resurgence in funding exercise underscores a rising confidence in digital belongings, reflecting each institutional and retail traders’ renewed curiosity.

Bitcoin Dominates Crypto Asset Inflows Amid ETF Growth

A notable focus of those inflows has been the emergence of spot Bitcoin exchange-traded funds (ETFs) in the US. Coinshares reported that these funding autos attracted $1.1 billion in web inflows final week alone, with complete inflows since inception reaching $2.8 billion.

It’s price noting that the highlight on these newly issued ETFs highlights the market’s urge for food for regulated and accessible Bitcoin funding merchandise, suggesting a paradigm shift in how traders are selecting to interact with cryptocurrency.

In keeping with Coinshares, the latest funding inflow has been predominantly directed in direction of Bitcoin, which accounted for practically 98% of the entire inflows. This important focus of funds into spot Bitcoin ETFs has underscored the main crypto’s dominant market place and its perceived potential for progress amongst traders.

Regardless of the optimistic inflows, James Butterfill, Head of Analysis at Coinshares, famous:

The outflows from incumbents have slowed considerably, however the potential sale of the Genesis holdings of US$1.6bn might immediate additional outflows within the coming months.

Moreover, different areas akin to Switzerland, Australia, and Brazil have reported optimistic inflows. On the similar time, Canada, Germany, and Sweden nonetheless recorded outflows although “minor,” indicating a “cooling off” of outflows, based on Butterfill.

Along with Bitcoin, different cryptocurrencies like Ethereum and Cardano additionally skilled optimistic sentiment, with inflows of $16.5 million and $6.1 million, respectively. In the meantime, Avalanche, Polygon, and TRON noticed minor inflows.

Market Dynamics And Future Outlook

In the meantime, the cryptocurrency market continues to exhibit volatility and growth potential, with Bitcoin not too long ago approaching the $50,000 mark.

Nonetheless, analysts like Ali have pointed to historic patterns suggesting potential corrections when sure valuation ratios are exceeded.

#Bitcoin has proven a sample of coming into a quick correction part each time the 30-day Market Worth to Realized Worth (MVRV) ratio exceeds 11.50% over the previous two years. The MVRV ratio not too long ago crossed this threshold once more, serving as a cautionary sign for $BTC merchants! pic.twitter.com/7vdu3T80UT

— Ali (@ali_charts) February 12, 2024

Moreover, upcoming financial indicators, such because the US Client Worth Index (CPI) report, might influence market dynamics, probably affecting Bitcoin’s worth trajectory in regards to the power of the US greenback.

❖ U.S. CPI Knowledge Might Transfer Greenback

The U.S. greenback might strengthen if the U.S. shopper worth report on Tuesday suggests higher-than-expected inflation, reinforcing much less urge by the Federal Reserve to chop charges, Abdelhadi Laabi, chief advertising and marketing officer at KAMA Capital.…

— *Walter Bloomberg (@DeItaone) February 12, 2024

Featured picture from Unsplash, Chart from TradingView