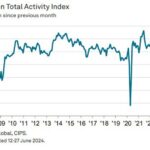

Spot Bitcoin ETFs have made a notable affect within the monetary world, attracting vital inflows and driving the value of Bitcoin to its highest level in over two years, at the moment at $49,900, after briefly touching the $50,200 mark.

In accordance with a Bloomberg report, these ETFs have achieved “unparalleled success” in buying and selling measures, attracting billions of {dollars} in web inflows inside only one month of their historic launch.

Bitcoin ETFs Garner $2.8 Billion In Web Inflows

Knowledge compiled by Bloomberg Intelligence reveals that the Bitcoin spot funds have amassed roughly $2.8 billion in web inflows in the course of the first 21 trading days.

This determine considers the $6.4 billion withdrawn from the Grayscale Bitcoin Belief (GBTC) after reworking into an ETF. BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy Sensible Origin Bitcoin Fund (FBTC) have emerged as frontrunners, attracting round $3.8 billion and $3.1 billion in inflows, respectively.

Per the report, these two funds breached the $1 billion threshold inside 5 days or much less, making them the one ones to surpass $3 billion throughout their preliminary 20 days of buying and selling.

Regardless of an preliminary sell-the-news sentiment, the success of Bitcoin ETFs has propelled Bitcoin’s value to its highest level in over two years. Jane Edmondson, head of thematic technique at TMX VettaFi, instructed the information outlet that any ETF accumulating over $100 million in property inside a month is successful. Nonetheless, the long-term financial viability of all these funds stays to be seen.

BlackRock And Constancy Dominate Buying and selling Volumes

Notably, Bloomberg remarks that whereas IBIT and FBTC lead the pack, different Bitcoin ETFs have skilled various inflows.

The Bitwise Bitcoin ETF (BITB) and ARK 21Shares Bitcoin ETF (ARKB) have attracted roughly $786 million and $918 million, respectively. The Franklin Bitcoin ETF (EZBC) has gathered solely $71 million regardless of having the lowest fees among the many group. Equally, the WisdomTree Bitcoin Fund (BTCW) has invested $15 million. Nonetheless, total flows into these ETFs proceed to stay sturdy.

The excessive buying and selling volumes of the BlackRock and Constancy funds, every surpassing $6 billion in shares traded since their inception, underscore the benefit of buying and selling property underneath an ETF construction. This additional reinforces the long-standing demand for Bitcoin funds amongst buyers.

Nonetheless, in accordance with Bloomberg, whereas these Bitcoin ETFs can be found to most of the people, sure establishments nonetheless preserve reservations.

LPL Monetary, supervisor of trillions of {dollars} in capital, requires additional convincing of the ETFs’ suitability for his or her buying and selling platforms and assurance that the chosen funds is not going to be discontinued.

Even Vanguard Group Inc., a conventional agency, has shunned providing the brand new ETFs on its huge buying and selling platform. Nonetheless, specialists anticipate elevated curiosity and stream as soon as these ETFs acquire wider acceptance and familiarity amongst buyers.

On common, Bitcoin ETFs have made an indelible mark on the financial landscape, attracting billions of {dollars} in inflows inside a month of their launch. The success of those ETFs, led by BlackRock’s iShares Bitcoin Belief and Constancy’s Sensible Origin Bitcoin Fund, has not solely boosted investor confidence but in addition pushed the value of Bitcoin to a 26-month excessive.

Whereas the efficiency of different Bitcoin ETFs varies, total market response stays optimistic. As these ETFs acquire additional traction and acceptance, curiosity and funding are anticipated to proceed to develop, shaping the way forward for cryptocurrency in conventional finance.

Featured picture from Shutterstock, chart from TradingView.com