Anthony Bradshaw

In today’s “$10,000 in…” series, we’re taking a look at the gold ETF (NYSEARCA:GLD). The SPDR Gold Trust began trading nearly 20 years ago in November 2004. It marked the first time that investors could easily allocate funds to gold in a brokerage account.

When GLD began trading on 11/18/2004, it had total assets of just under $600 million after its first day of trading. By the end of 2004, AUM had more than doubled, up to more than $1.3 billion.

Today, GLD has more than $68 billion in AUM. At its last quarterly filing, it held more than 26 million ounces of physical gold, valued at more than $62 billion.

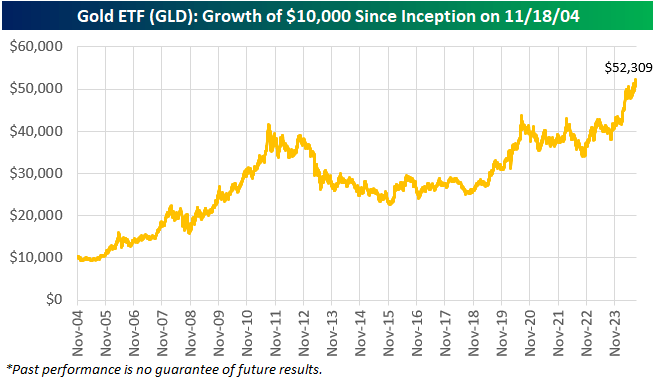

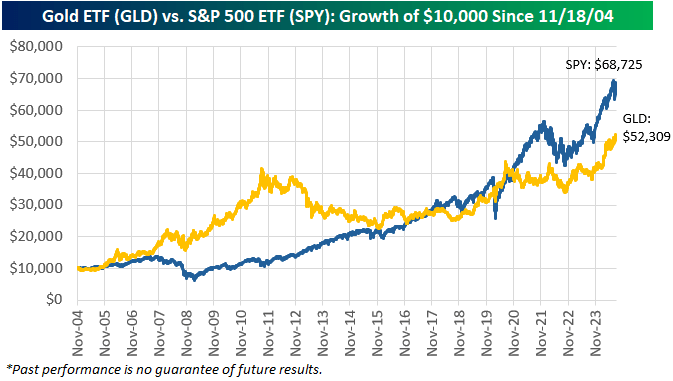

So what would a hypothetical $10,000 investment in the GLD ETF on its release date in November 2004 be worth today? As shown below, $10,000 would now be worth roughly $52,000. That’s an annualized return of about 8.73%. Not bad for a piece of metal, right?

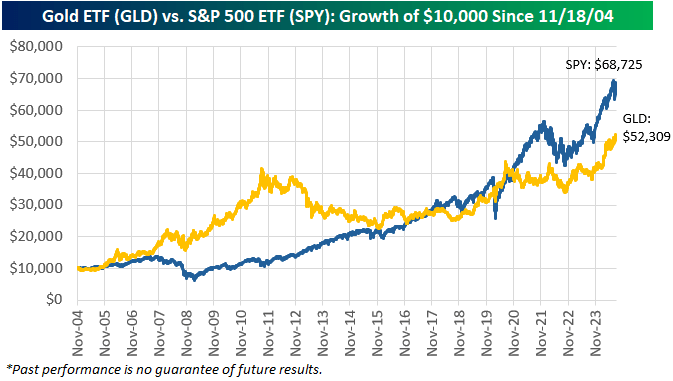

How does that $10k investment in GLD when it began trading nearly 20 years ago compare to something like the stock market? If we use the S&P 500 ETF (SPY) as a proxy for US large-cap stocks, a $10,000 investment in SPY on the same day that GLD began trading back in November 2004 with dividends re-invested would be worth about $68,725 today. That’s an annualized return of roughly 10.2%, or about 1.5 percentage points better than GLD annually. You can see how both GLD and SPY got to their current levels in the chart below.

As always, past performance is no guarantee of future results!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.