The brand new 10x’s analysis extends past MicroStrategy, highlighting that a number of crypto-related shares are buying and selling near honest worth primarily based on BTC value.

In a latest report launched by 10x Analysis, the corporate has raised issues concerning the overvaluation of MicroStrategy Inc (NASDAQ: MSTR) shares. The analysis was led by Markus Thielen, the analyst who precisely predicted this yr’s Bitcoin (BTC) rally.

In accordance with him, regardless of MSTR’s spectacular 343% surge this yr, the enterprise intelligence firm is at the moment overvalued by 26%. This prediction was primarily based on the 10x Analysis regression mannequin, which analyzes the connection between MSTR and Bitcoin’s spot value.

Analysts Warns Buyers to Take Revenue

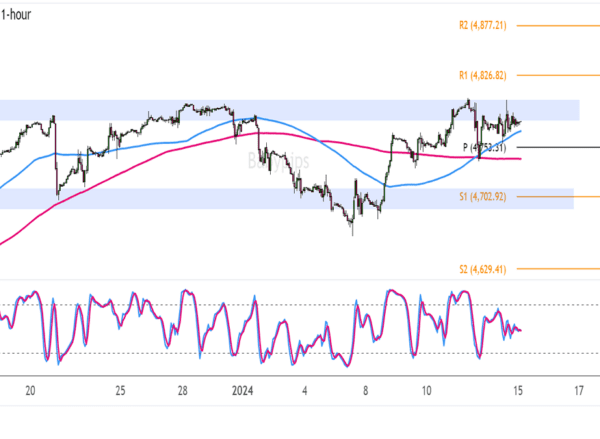

The regression mannequin utilized by 10x signifies that MicroStrategy is at the moment +26% overvalued, with a possible 20% draw back given the prevailing BTC costs.

In mild of their findings, 10x suggested buyers to contemplate taking revenue and scale back lengthy positions. Whereas highlighting that HIVE, HUT, and GALAXY nonetheless provide worth, the corporate underscores that substantial good points might have already been realized in these shares.

“As the regression model shows, MicroStrategy is +26% overvalued and has a 20% downside based on the current Bitcoin prices. It is time to take profit,” 10x mentioned. The enterprise intelligence firm noticed its shares skyrocket on December 27, 2023, quadrupling in worth this yr and reaching a 25-month excessive of $673.

As one of many standout performers within the crypto-related shares of 2023, MicroStrategy presently holds 189,150 of BTCs after its latest buy this week. The corporate began accumulating the crypto asset three years in the past as a reserve asset.

This yr, the king coin skilled a 160% achieve following the bear market final yr with a outstanding 60% surge within the present quarter, largely pushed by the spot ETF narrative.

MicroStrategy Could Probably Buy Extra Bitcoins

The brand new 10x’s analysis extends past MicroStrategy, highlighting that a number of crypto-related shares are buying and selling near honest worth primarily based on BTC’s value.

The crypto asset is at the moment buying and selling at $43,164 at press time in line with CoinMarketCap information.

The corporate mentioned the efficiency of such shares, together with MicroStrategy and Coinbase, is commonly thought-about a barometer for institutional curiosity in digital belongings, providing market contributors publicity with out direct possession.

In the meantime, in a separate submit on X previously Twitter, Max Keiser, an influential BTC advocate and advisor to the president of El Salvador mentioned that MicroStrategy is planning to boost funds by providing a mix of each debt securities and fairness to potential buyers.

SOURCE: $MSTR is prepping a $5 billion combined debt & fairness shelf providing.

One other 100,000 #Bitcoin purchase? pic.twitter.com/pGUmgdRc5I

— Max Keiser (@maxkeiser) December 27, 2023

He believes the corporate could also be contemplating growing its BTC holdings with further purchases.