On-chain knowledge reveals that Bitcoin miners have participated in a selloff throughout the previous day as they’ve offloaded 3,000 BTC from their wallets.

Bitcoin Miners Have Bought $131 Million Price Of The Asset Throughout Previous Day

As identified by analyst Ali in a brand new post on X, the BTC miner reserve has plunged over the past day. The “miner reserve” right here refers back to the whole quantity of Bitcoin that the miners as an entire are carrying of their wallets proper now.

When the worth of this metric declines, it implies that the miners are taking out a web variety of cash from their wallets. Typically, the primary purpose why these chain validators would withdraw from their reserve is for promoting functions, so this sort of pattern can have bearish implications for the value.

Alternatively, the indicator going up suggests the miners are including to their wallets at present. Such accumulation from this cohort can naturally positively affect the cryptocurrency.

Now, here’s a chart that reveals the pattern within the Bitcoin miner reserve over the previous month:

The worth of the metric seems to have quickly gone down not too long ago | Supply: @ali_charts on X

As displayed within the above graph, the Bitcoin miner reserve had been transferring in a slight total downtrend throughout the previous month, however the decline has been magnitudes extra speedy throughout the previous day.

The miners have withdrawn a complete of three,000 BTC from their wallets throughout this sharp drop, value greater than $131 million on the present trade fee of the cryptocurrency.

It’s unclear whether or not these outflows from the miner reserve have been made for promoting. Nonetheless, provided that they’ve occurred after the asset has registered a sharp rally, it might seem attainable that a few of these chain validators have determined to money in on the excessive earnings.

Miners have fixed working prices in electrical energy payments, which they repay by promoting a few of the cash they’ve earned in block rewards and transaction charges. As such, it’s common to see this cohort taking part in common promoting occasions.

Such selloffs are often readily absorbed by the market and trigger little to no fluctuations within the worth. Nevertheless, the size of the promoting occasion this time continues to be fairly extraordinary in order that Bitcoin would possibly really feel some bearish affect.

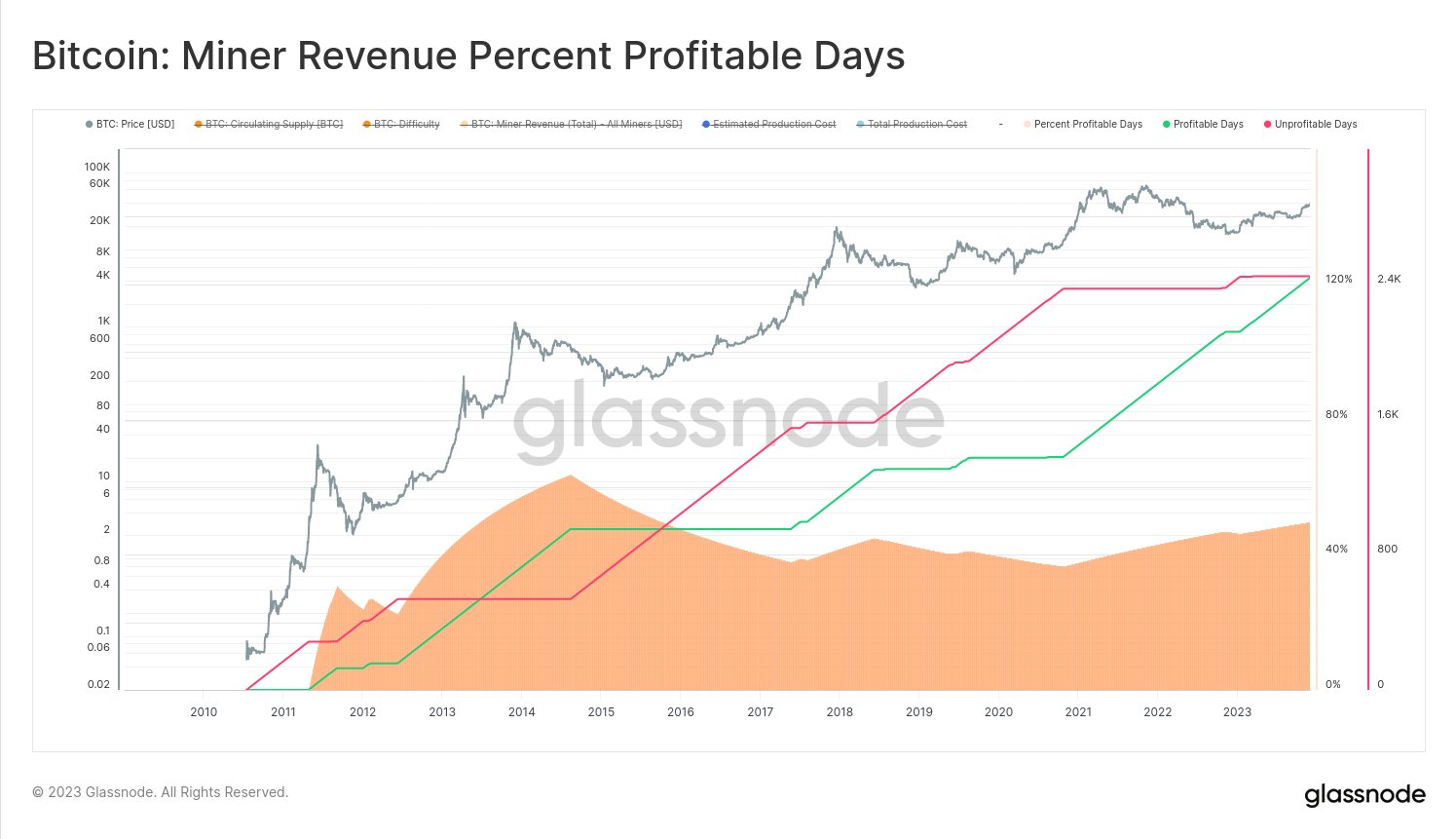

The lead on-chain analyst at Glassnode, Checkmate, has shared an attention-grabbing reality about miners in an X post. It might seem that the miners have been in an ideal equilibrium over the historical past of the cryptocurrency.

The miner worthwhile vs unprofitable days | Supply: @_Checkmatey_ on X

“Our framework for estimating Cost of Production found miners are profitable ~50% of the time!” explains the Glassnode lead.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $43,500, up 14% up to now week.

Appears to be like like the worth of the asset has seen some pullback since its current excessive | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com