chaofann

Actual Property Funding Trusts (REITs) (VNQ) are immediately priced at close to their lowest valuations in a decade, with many REITs buying and selling at giant reductions relative to their honest worth of their actual property.

Valuations have gotten so low that even non-public fairness gamers like Blackstone and Starwood at the moment are aggressively shopping for REITs.

Only in the near past, Blackstone (BX) introduced one other $10 billion REIT acquisition (AIRC), bringing the overall to over $40 billion value of REITs since 2022.

Starwood, however, purchased extra shares of Camden Property Belief (CPT) within the final quarter, and its billionaire CEO, Barry Sternlicht, made the next remark in regards to the REIT sector final yr:

“There are some unbelievable bargains in REITs. We did the same thing during the pandemic. We bought a dozen stocks all over the world and we had a 70% IRR on that stuff. We are already buying some stuff in the public market…”

– Barry Sternlicht, CEO/Chairman, Starwood, Q3 2023 CNBC Interview

And they’re proper.

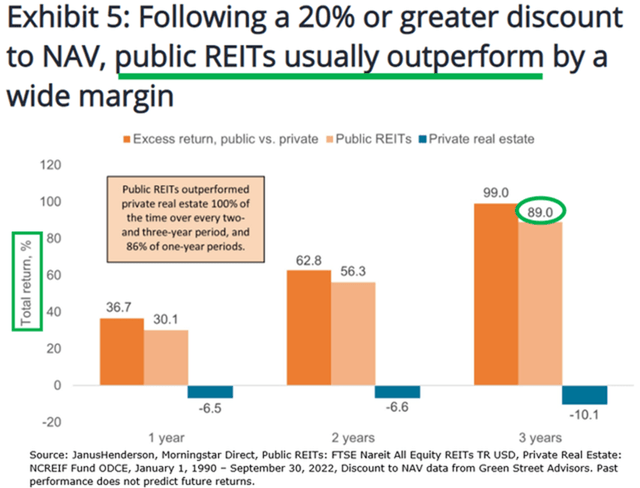

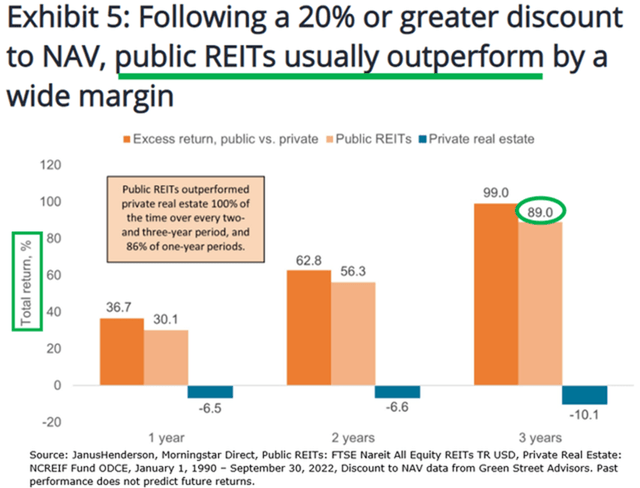

Traditionally, it has all the time been a good suggestion to purchase REITs following a market crash, as they’ve all the time recovered and strongly rewarded these traders who had the braveness to purchase them once they have been discounted:

Janus & Henderson

However the window of alternative may now be closing.

See, the one cause why REITs are discounted is the concern that we’ll stay in a “higher for longer” setting and that rates of interest will proceed to rise farther from right here.

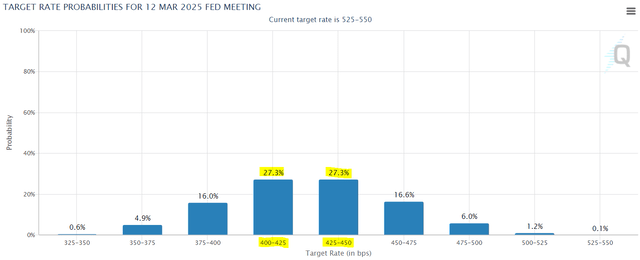

However as we famous in a current report, this seems most unlikely. Quite the opposite, rates of interest are more likely to head right down to decrease ranges within the coming years now that now we have introduced inflation again underneath management.

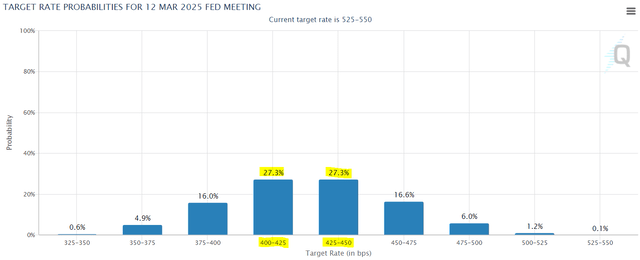

In line with Truflation, inflation is now already at simply 1.8% if you happen to merely alter the reported information for real-time shelter, and in consequence, the market is predicting that rates of interest will likely be about 100-150 foundation factors decrease someday in 12-18 months from now:

FedWatch

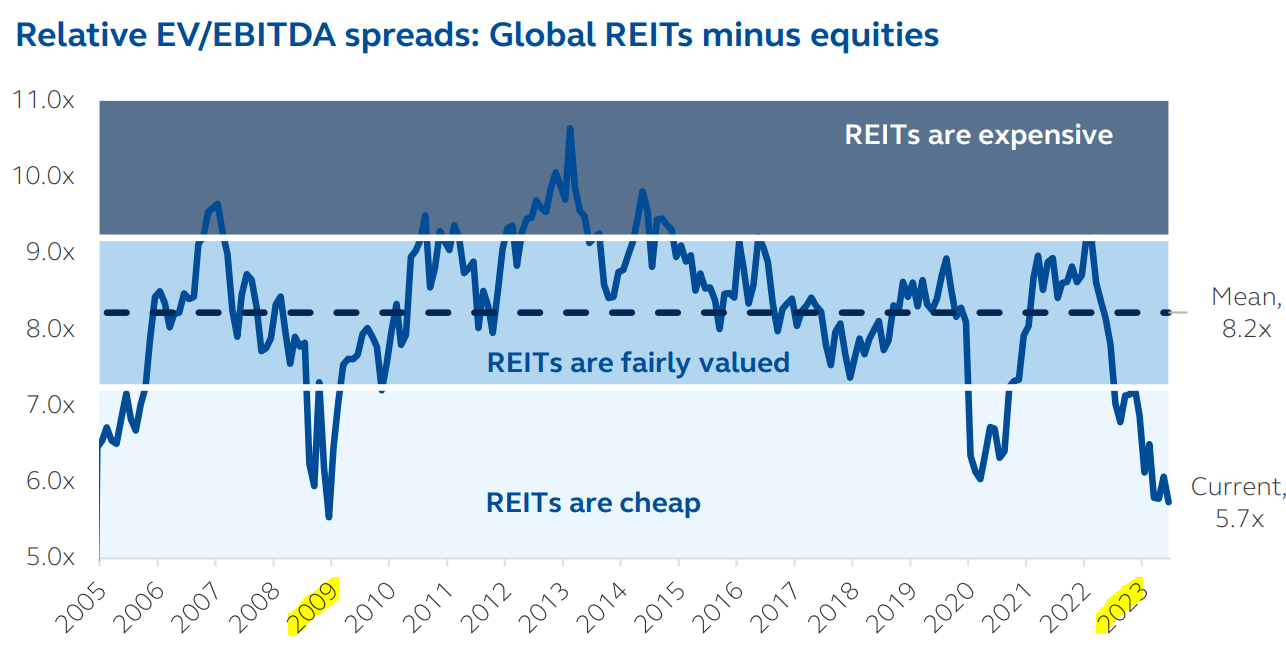

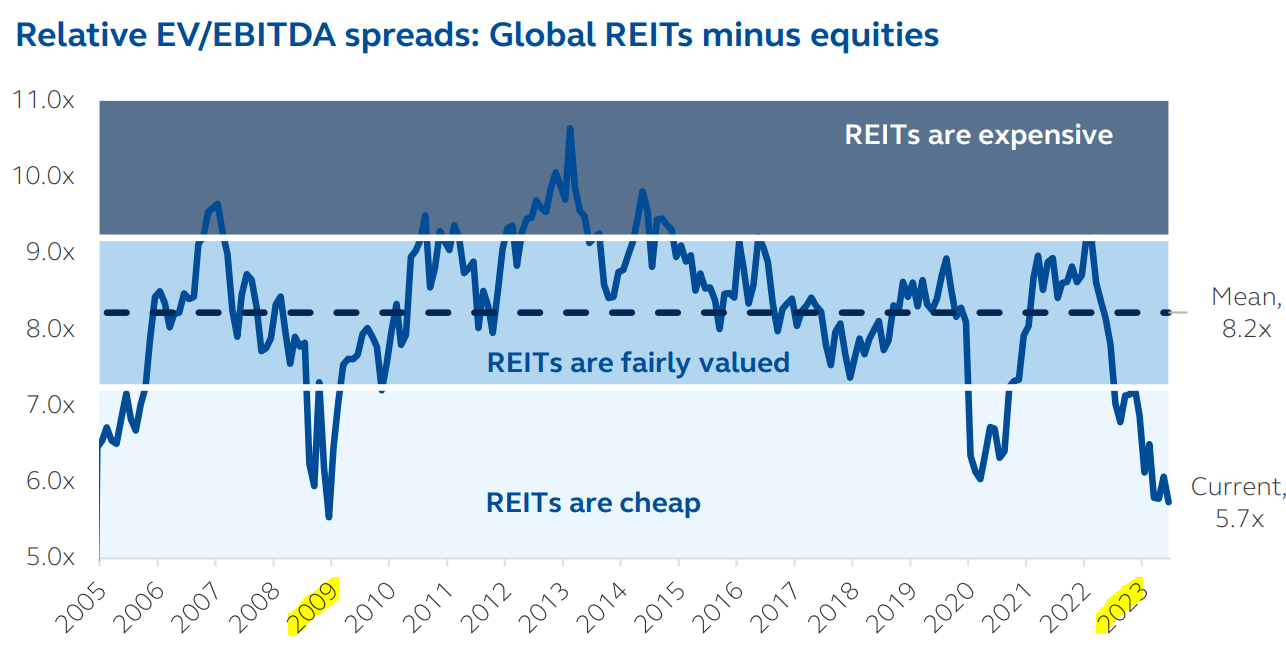

This bodes very properly for REITs, however they’re immediately nonetheless priced at close to their lowest valuations in over a decade:

Principal Asset Administration

Listed below are two once-in-a-decade shopping for alternatives so that you can contemplate:

EPR Properties (EPR)

EPR Properties is my favourite decide within the internet lease property sector proper now. It is a internet lease REIT that focuses on experiential properties equivalent to film theaters, golf complexes, ski resorts, water parks, scorching springs, and many others.

EPR Properties

EPR Properties

EPR Properties

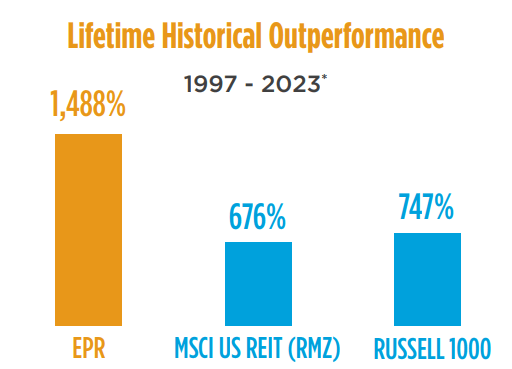

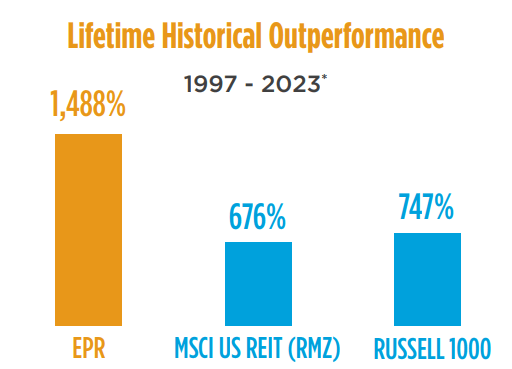

Its distinctive method of specializing in experiential properties has traditionally been very rewarding as a result of there may be little competitors for these property, and it has allowed EPR to purchase them at excessive cap charges and with enticing lease phrases, which resulted in robust spreads over its value of capital and speedy development. To today, most internet lease property traders would fairly keep away from experiential classes due to the extra unsure releasing prospects in case of a emptiness, however EPR can mitigate this threat by structuring stronger leases (incl. grasp safety) and proudly owning a big and well-diversified portfolio. The method remains to be a bit riskier, however it finally ends up incomes superior risk-adjusted returns ultimately over lengthy intervals:

EPR Properties

However immediately, its share worth is closely discounted, buying and selling at simply 8.4x FFO and an 8.2% dividend yield, due to one major cause.

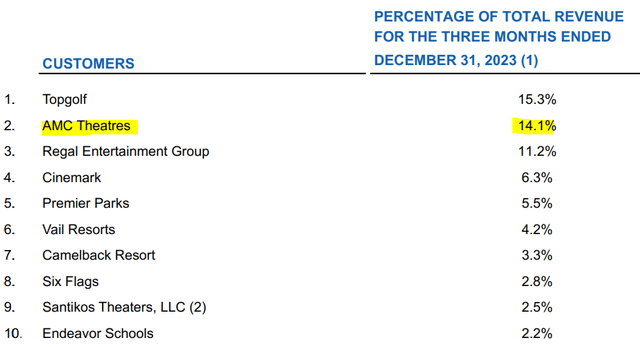

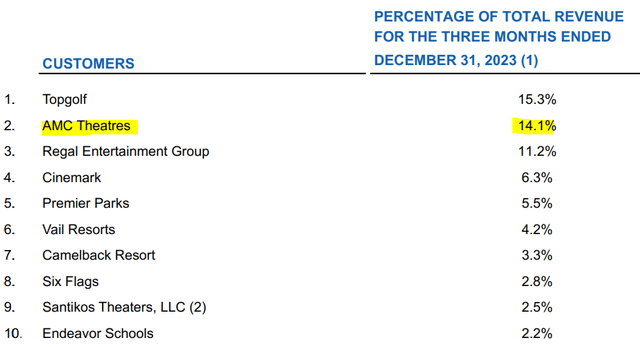

The market fears that it’ll face extreme losses as AMC (AMC) finally information for chapter. It’s EPR’s second-biggest tenant, representing 14% of its income, and if it needed to take again these properties, it could be a extreme blow to the corporate.

EPR Properties

However this threat is tremendously misunderstood.

Briefly,

- The AMC lease has already been renegotiated.

- The current chapter of Regal led to the next (not decrease) hire.

- EPR’s theaters are already as worthwhile as they have been previous to the pandemic.

- AMC has raised a lot of capital and can probably elevate some extra if wanted. Subsequently, it’s removed from sure that they may ever have to file for chapter.

- EPR owns the best theaters within the nation, and people are right here to remain for so long as folks need to watch new blockbuster motion pictures.

Nicely, EPR’s administration lastly addressed this threat extra instantly on the Citi International Property Convention, and it was very reassuring.

Right here is the important section: [emphasis added]

Citi Analysis Analyst: Smedes Rose

So if AMC have been to undergo a much bigger form of occasion, I do not know loads about AMC, however once we discuss to different shoppers, there’s kind of this assumption that there is extra to go there. I do not know if you happen to agree with that. However do you’re feeling like this lease would maintain up and never be rejected if there was like a reorganization?

Greg Silvers

We’re very comfy with that, the final or that this lease would maintain up. Once more, you in all probability would not hear this from most landlords, however starting in ’20, we have been encouraging AMC to file. Once more, as a result of clear up your steadiness sheet. The enterprise is recovering, the enterprise seems to be good, you may have a unhealthy steadiness sheet. So now we have already accomplished the restructuring with them. Like I stated, we did it again in ’20. We’re very comfy with how we will find yourself because of that.

In the event you take a look at it now, in our two giant — of our three largest theater tenants, AMC, Cinemark, and Regal, Cinemark and Regal have a number of the finest steadiness sheets within the experiential space. I imply, implausible. They mounted in all their downside. AMC is the one one on the market, we’d simply comparatively like them to go forward and get it accomplished as a result of that is how comfy we’re with our lease construction and the way necessary our property are to them.

So primarily, what they’re telling us is that if AMC filed for chapter, it could be optimistic, not unfavorable to them.

The lease has already been restructured forward of a possible chapter. This restructuring was accomplished in 2020 within the early days of the pandemic when the uncertainty was at its peak.

Subsequently, any future chapter probably would not materially change the lease. Nonetheless, it could enable AMC to repair its steadiness sheet and get better as a a lot stronger and safer tenant.

EPR’s theaters are already worthwhile on the property degree with a 1.7x hire protection ratio, and issues will solely get higher within the coming years because the field workplace continues its restoration. The one concern is their steadiness sheet, and that is why EPR has been encouraging them to file for chapter to restructure their money owed.

With that in thoughts, it appears illogical to low cost EPR so closely based mostly on this one threat issue. We already knew that the danger was misunderstood, however EPR’s administration goes a step additional and says this isn’t a threat, however a chance for them.

EPR Properties

Nonetheless, it’s true that if AMC filed for chapter, it may nonetheless result in some volatility within the close to time period, and that’s what seems to be scaring traders who aren’t following the scenario as carefully.

Most traders are short-term oriented, in order that they merely do not need to threat proudly owning EPR on the day AMC information for chapter because the headlines would probably push it decrease, whatever the precise implications.

That is why EPR is immediately nonetheless priced on the lowest a number of and highest dividend yield within the internet lease sector, even regardless of having fun with a number of the finest development prospects and having one of many lowest payout ratios.

| EPR Properties | Common Internet Lease REIT | |

| FFO A number of | 8.4x | ~12-14x |

| Dividend Yield | 8.2% | ~5% |

| FFO Per Share Progress | ~4% | ~2-3% |

| Payout Ratio | 70% | ~75% |

When Regal filed for chapter, EPR noticed its share worth dip to the mid-30s. At present, it’s buying and selling at $42 per share, so that might suggest ~20% draw back threat if an identical sell-off occurred and that is why nobody needs to personal EPR immediately. Regal is a barely smaller tenant than AMC (11 vs. 14% of income) for EPR, so all else held equal, the sell-off may very well be even sharper.

However all else is not equal right here.

As we famous earlier:

- AMC’s lease was already negotiated in preparation for a possible chapter.

- We now know that Regal’s lease was not materially altered, even regardless of its chapter. Actually, the hire was elevated on most of its properties.

- EPR is telling us clearly that if AMC information, will probably be a great factor for the REIT.

- Hire protection ratios have already recovered to pre-covid ranges and can proceed to rise as extra huge motion pictures come out within the coming years.

Subsequently, I consider that that is an incredible setup for long-term-oriented traders who can concentrate on the precise fundamentals and ignore the short-term noise.

EPR simply hiked its dividend by one other 3.6% and guided to develop its FFO per share by barely over 4% in 2024 (adjusted for the one-time lease cancellation charges acquired in 2023). The administration additionally reaffirmed that they need to have the ability to continue to grow their FFO per share by roughly 4% yearly within the coming years with out accessing the capital markets and whereas sustaining their present leverage degree.

Furthermore, they’ll drive this development all whereas bettering the standard of their portfolio as they promote film theaters and put money into different classes to regularly decrease their publicity.

At present, they’re getting ~8.5% cap charges on new acquisitions, they usually consider that they might promote theaters at across the identical cap price degree. They famous on the Citi convention that they count on to start out lowering their publicity extra aggressively within the coming years: [emphasis added]

Once more, that is positively a part of our long-term technique is grow to be extra balanced in our diversification. So the thought course of is to proceed. We have stated we’re not rising, the truth is, we will cut back that publicity. However once more, what Greg and his crew have accomplished by way of that’s form of produced the best producing theater portfolio within the trade. In the event you take a look at our numbers, we management 3% of the theaters, however we’re in all probability 8.5% to 9% of the field workplace. So once more, it is a reflection of the standard of the portfolio and the way we have been capable of put that collectively. So there will likely be, as time strikes on, events in proudly owning one thing of that top high quality. In order the debt markets form of begin to heal, we’ll take a look at lowering a few of that publicity.

Their publicity was 41% a number of years in the past. It’s 37% immediately and by the tip of this yr, it needs to be round 35% based on their steerage. The administration talked about that they count on to regularly convey it down to fifteen% and remember that they’re promoting the weaker, not the stronger theaters.

I consider that that is finally the catalyst that may result in important upside for shareholders who purchase it immediately. The movie show publicity is the one concern that is inflicting the corporate to commerce at such a low valuation. The remainder of the portfolio is immediately doing higher than ever. Subsequently, if you happen to now cut back this publicity, the market won’t have a great cause to low cost EPR anymore.

Mix that with some rate of interest cuts, and I might count on EPR to reprice within the 12-14x FFO vary within the coming years. That will unlock 50%+ upside and when you wait, you earn a rising 8% month-to-month dividend yield and the corporate will continue to grow by about 4% every year.

That is a recipe for robust outperformance, and that is why we need to personal extra of it. After immediately’s addition, EPR is now the third-largest holding in our Core Portfolio.

Large Yellow Group (BYG / OTCPK:BYLOF)

Large Yellow Group is my favourite self-storage REIT, and I’ll preserve this one shorter as a result of the thesis could be very easy, and I’ve highlighted a number of instances on Looking for Alpha.

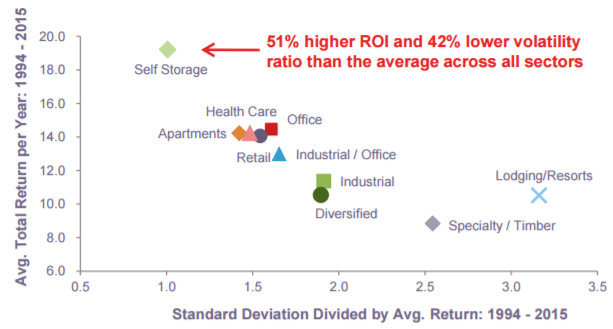

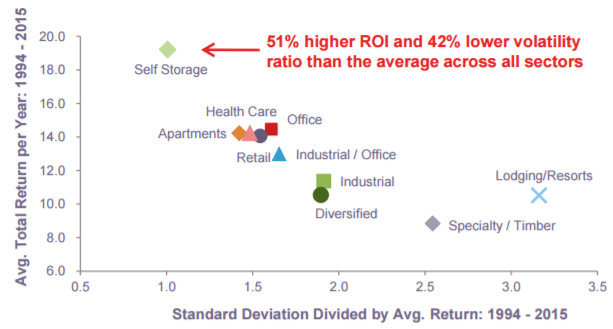

Briefly, probably the most rewarding property sector within the US has been self-storage for the previous 30 years. Self-storage REITs have been capable of earn practically 20% common annual whole returns as a result of the idea was rising in reputation and these REITs have been capable of construct new services and earn unusually giant spreads over their value of capital:

Nationwide Storage Associates

However now the US self storage market has grow to be extremely aggressive and future returns are more likely to endure.

Nonetheless, the European self storage market remains to be 20 years behind, and I count on Large Yellow to duplicate these robust returns by following the identical mannequin.

Proper now, there may be nonetheless 10x much less space for storing per capita within the UK than within the US, however the idea is quickly rising in reputation. Identical to within the US, folks additionally transfer within the UK… In addition they undergo divorces… Older generations go away lots of stuff behind… Folks have to now make house for a house workplace… and many others. Furthermore, houses are sometimes even smaller in Europe and particularly so in costly, extremely dense cities like London, the place Large Yellow is closely investing.

In consequence, 50% of Large Yellow’s new shoppers are first-time customers. They’ve sometimes heard about self-storage from a good friend, seen an advert, and/or simply pushed by a facility and determined to offer it a strive.

Large Yellow Group

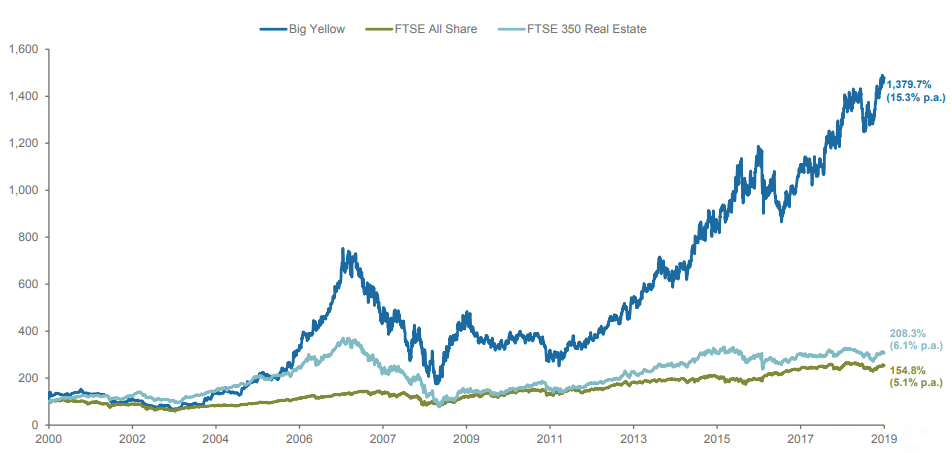

Large Yellow has been capitalizing on this chance for the previous 20 years, and its early outcomes are very robust. It has been capable of earn roughly 15% common annual whole returns, even regardless of struggling a serious setback through the nice monetary disaster. Adjusted for that, its whole returns have been nearer to twenty% yearly:

Large Yellow Group

And the fascinating factor right here is that Large Yellow remains to be simply getting began and I feel that it may possibly preserve this going for one more decade or two.

It’s immediately the chief within the UK, however it’s nonetheless about 20x smaller than Additional Area Storage (EXR) and Public Storage (PSA) within the US.

It presently owns simply 100 services, and it has one other 11 underneath development, which ought to increase its capability by 15-20% within the coming years. It’s anticipating to earn a ~9% common yield on these tasks, which represents a steep ~300-400 foundation level unfold over its value of capital. It additionally has about as a lot capability vacant capability already constructed out however not leased but.

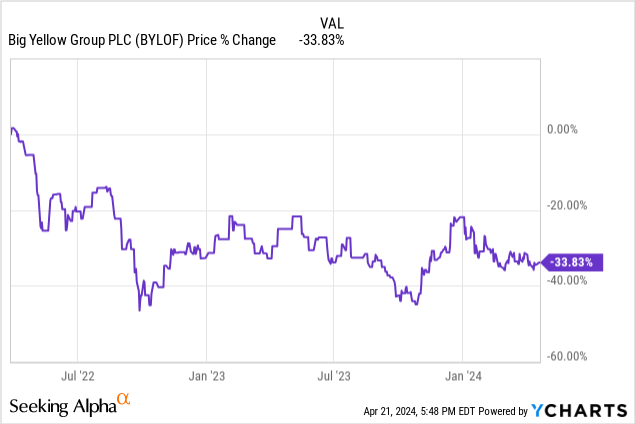

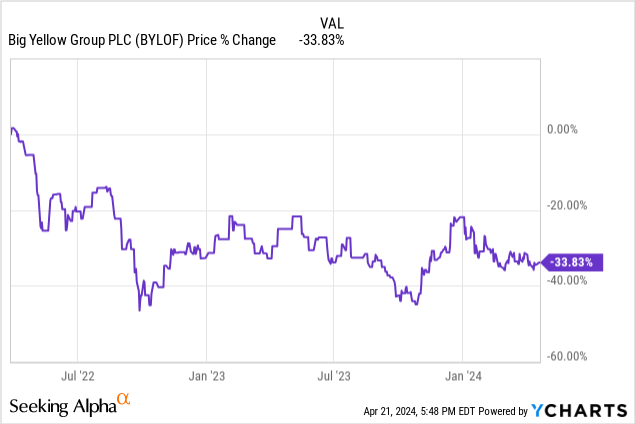

That, plus some natural development, and a drop in rates of interest, bodes very properly for Large Yellow within the coming years, however regardless of that, its share worth has crashed together with the remainder of the REIT market, and it’s immediately priced at a traditionally low valuation:

At present, it’s priced at simply 16.5x FFO, a 4.5% dividend yield, and an estimated 20% low cost to its internet asset worth.

That will not appear that low to a few of you, however remember that it is a REIT that has managed to develop its FFO per share by 11% per yr on common for the previous 20 years and will have the ability to continue to grow at such a speedy tempo sooner or later. Furthermore, it has little or no debt with a 15% LTV, which additionally warrants the next a number of.

So with that in thoughts, I really suppose that Large Yellow is likely one of the finest offers in immediately’s market. Amongst the REITs that develop at such a speedy tempo and use so little leverage, it’s providing the very best worth for the time being and that is why I feel that it’s a historic alternative.

Closing Word

REITs are immediately providing a once-in-a-decade probability to win huge, however the window of alternative may slam shut already within the close to time period.

In the event you missed the bargains of the pandemic, that is your second probability to purchase actual property at a big low cost to its honest worth.

I’ve carefully adopted REITs for over a decade and have not often seen such offers, so do not miss out on it.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.