Peter Clayton Photography/E+ via Getty Images

Dear readers/followers,

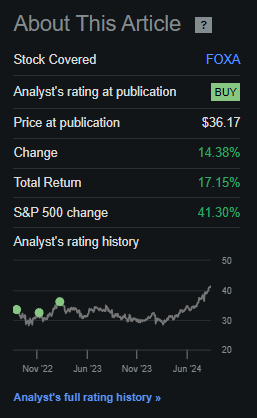

Following several bullish articles over the past 1.5 years and more, the company Fox (NASDAQ:FOX) (NASDAQ:FOXA) finally had a bit of an upward swing towards a better and more realistic level of valuation, fulfilling an expectation I have held for some time. My last article on Fox can be found here, and it’s resulted in positive overall returns of 17.15% inclusive of dividends. It unfortunately doesn’t measure up to the overall S&P500, which is up far more – but it’s nonetheless a positive RoR. From my lowest investment level, the company is up almost 30%, which is a far better RoR.

My latest article can be found here – and here is the return we’re looking at so far.

Seeking Alpha Fox RoR (Seeking Alpha Fox RoR)

I previously called the company attractive due to its good fundamentals and growth potential. Many of these expectations have materialized. This is no surprise to me. But the question now becomes, how far higher should, and could the company go, given its fundamentals and its growth expectations in the next few years?

It’s this that will form the basis of my continued thesis – and as you can see based on my title for this article, I believe that there is time for a change in 2024-2025.

Fox Corporation – Upside materialized, time to look it over (and potentially leave it behind).

Previously, I was a B&H forever investor. I would buy something with the plan of never letting it go. While such companies probably exist, and while such a strategy is not a bad way to about things as such, I believe the approach is riddled with flaws to an extent where I stopped doing so years ago. Every company I invest in has a buy target, a hold target, and a sell target (or rotate, which is a combination of hold/sell to me). Fox is no different.

As before, I ignore the politics of the issue when looking at a company like Fox – or any business. It’s all about the money for me. Can Fox make me money? It has done so. It does so because the company continues to own some of the most appealing media assets in the country – and this doesn’t just include its namesake TV channel or shows. In fact, we’re talking about programming across the entire board – cable, production, licensing, distribution, television, local, regional, and national. It’s all part of the deal you’re getting when you’re investing here.

It’s no doubt to me that the future is going to be as content-driven as the last 10 years. However, I doubt if there’s anyone that would have the guts to with conviction say, “this direction, this is where the next 10-20 years of media and content are going”.

Because there’s a lack of this, and because I, personally, experienced streaming and content exhaustion many years ago because I believe that this is something that many people see, and because I’ve become very selective in what content I choose to watch (I don’t subscribe to any service), I believe trends here are going to be hard to forecast.

And for that reason, I don’t want to invest in “just” content, such as Netflix (NFLX). I’m more interested in owning multi-approach/asset plays like Fox. The company remains incredibly bouncy in its valuation, moving from ups of 15x to lows of 8.5x between relatively short intervals without really and sort of material reason – more fear and news, as opposed to actual earnings trends. The company’s earnings trends show a solid long-term growth trajectory of around 5.5% per year, which makes a discounted valuation considering the company’s trends, and considering the low 1.31% yield valid.

The latest results for the company that we have here are less than a month old and concern the 2024 FY and 4Q24 period.

The company’s revenues grew by 2% for the quarter of 4Q24, and net income dropped a bit – but this was due to fair-value recognition of investments in the non-operating segments. Adjusted net income was up for the year. Quarterly EBITDA was down slightly – again, quarterly.

For the full year (FY24), the results were slightly different. Revenue was down about a billion, but the company saw an increase in affiliate fees and a 9% growth in television. But advertising, part of the company’s bread & butter, is where the company’s results dropped. This was in part due to strong previous-year trends such as the Super Bowl and the FIFA Men’s World Cup, as well as lower political advertising spending due to no midterms during the period. However, things are likely to revert this year given the upcoming election cycle.

Despite lower full-year revenue though, net income was up, and this is why Fox’s share price has likely continued to grow until now.

The reason for the year-over-year trends was not necessarily operational, but NRI’s (non-recurring items) such as legal settlement costs, restructuring costs, and the like. Still, we’re talking about a profit of $3.13 per share, and this is impressive for the longer term.

Some developments are worth noting. The company’s moves in streaming are working well. Tubi is now the most watched Free TV and movie streaming service in all of the US, which contributes to share growth and rating growth. This is offsetting the loss of the major aforementioned events. Tubi viewing grew by 57% in a single year, and this is no small feat for the company. Once again, Fox News was the most-watched network and cable news service in the fiscal of 2024, increasing 52% in minutes of viewing than its closest current competitor. It’s therefore clear that the interest in Fox content is higher than ever.

Going into a political cycle, I also expect this to heat up further. So while I am changing my rating for the company here, it’s important for me to note that I am not selling my stake the first thing I’m doing here. I have a small position in Fox, but I do expect it to grow more going forward – I just don’t expect it to grow more to the degree where I could justify buying more here. I will show you why that is – but I want to emphasize that this might not be the time to sell, even if I believe it’s time to change my rating.

Let’s look at what valuation brings.

Fox Valuation – The company’s conservative upside is now down to single digits.

To be clear, the time to buy Fox was back when the company was cheap enough that even a conservative 11-13x P/E saw us generating an annualized RoR of 13%. You may recall that my previous PT for Fox, which is now on the “old side” of things, was $38/share – and still is that level as of this time. The company now trades at $41/share. I am not interested in increasing my share price target here because the increase would not represent an attractive conservative upside.

In layman’s terms, what is attractive at below $30/share is not attractive at this time at above $40/share. If you didn’t invest in this company below $40/share or below $30/share, you shouldn’t be investing now. That’s how I view it. The company’s qualities have been very clear from the get-go. The company, while very young, has never failed to hit its targets or to beat them. I do not think we should expect anything else going forward, either.

Logic remains key here. Fox is an attractive business with a good upside, but only if we can get it cheap enough. The company trends towards a normalized P/E of 11-13x, which gives us a current P/E, at an EPS of $3.43, of 11.91x. This means that if we look at 11x P/E, we’re only getting a 3% annualized RoR at this valuation, and at 13x P/E, around 9% per year. (Source: Paywalled F.A.S.T Graphs Link).

This is not enough for me to consider the company attractive any longer.

What I would focus on here is that we have thesis materialization. The company has reached beyond the share price I put as a target. The analysts following the company have also increased their targets. From being below an average of $35/share, the average is now $42/share, from 22 analysts going from a low of $32/share to a high of $62/share. That high-level target is insane and would imply a very high premium for this business. Out of 22 analysts, only 8 are at a “Buy” now, with most, over 13, at a “Hold”. One has even moved to a “Sell” rating here.

I believe it would be wrong to sell Fox before the election cycle. I believe the coming election cycle will bring about new “action” to these stocks, media stocks like Fox, and there will be at least some growth here.

In any event, I am not ready to sell the company here – but I am ready to, based on valuation and thesis fulfillment change, my rating to a “Hold” at this time.

My thesis for Fox is now as follows.

Thesis

- Fox is one of the most appealing broadcasters and television companies in all of the US. It has solid fundamentals, it has a history, and it seems to have a great future, going forward. Its solid fundamentals and growth prospects make me consider it a “Buy” at a conservative share price.

- After a successful 2024, I believe we’re moving into a very attractive election cycle for the company’s overall trends and assets. Coupled with growth in streaming and with Fox now owning the #1 free streaming service, I believe you need to have very good reasons to consider this company a no-go. I do not believe the politics of it all to be enough for such a consideration.

- The current targeted share price I would consider fair based on targets and estimates is around $38/share. I consider Fox Corp a “Hold” here as of September of 2024.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company is no longer cheap as such, and given that the normalized upside is now down below 10% per year at a conservative P/E, I have to change my rating to a “Hold”. There’s too much premium expected for Fox here – but I’m keeping my stake for the time being.