Key Notes

- Bitcoin stalled below $120K while Ethereum surged to fresh all-time highs.

- Weak whale demand and ETF outflows limited BTC upside.

- Derivative market data shows a $3 billion cluster of short positions at $117,800.

Bitcoin’s price stalled at around $117,000 on Saturday, Aug 23, with intraday gains capped at just 3%. By contrast, Ethereum (ETH) surged more than 10% to reach a fresh all-time high of $4,900. This move followed dovish comments from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium, signaling lower interest rates.

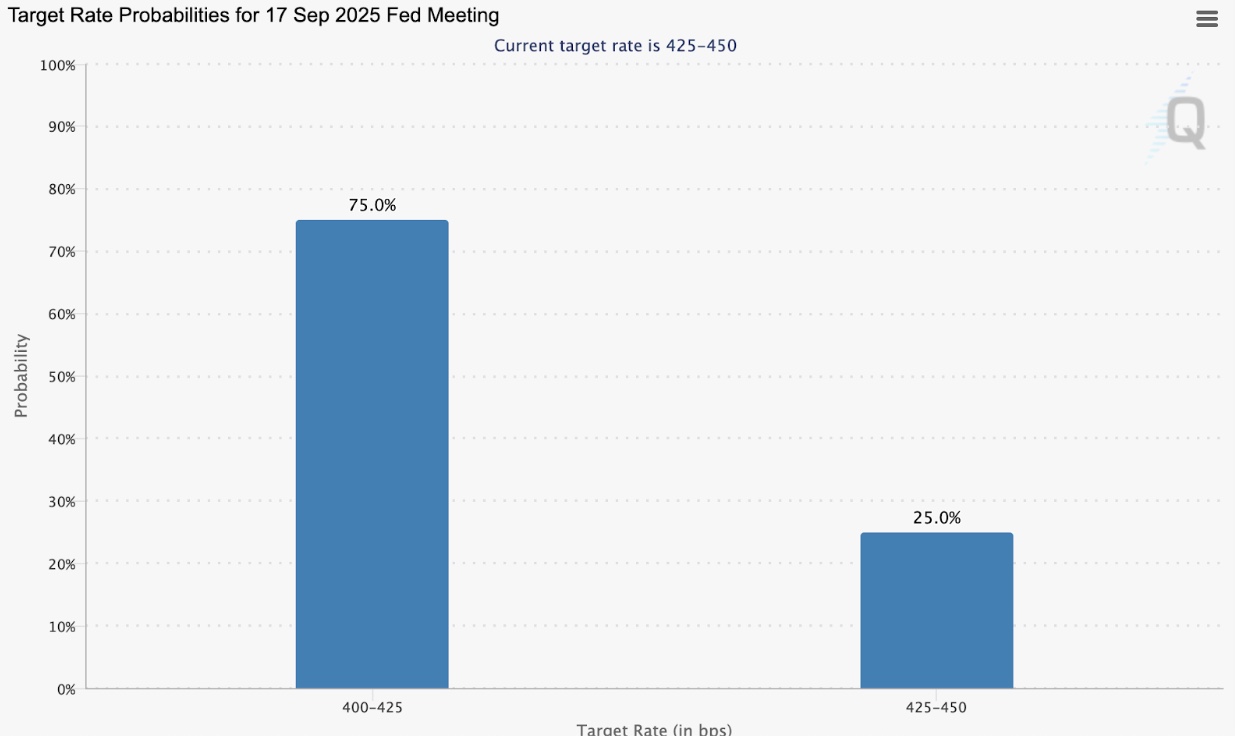

Fed Watch Tool Shows 75% chance of rate cut after Fed Chair Speech on Friday | Source: CME Group

Powell noted that downside risks to employment have risen, opening the door for a possible rate cut in September. In response, CME Group’s Fed Watch tool shows analysts now pricing in 75% of a rate easing in the next FOMC slated for September 17, 2025.

Altcoins reacted strongly with ETH, Ripple (XRP), Solana (SOL), and Cardano (ADA) all posting double-digit gains in the past 24 hours, consolidating above key resistance levels at $4,750, $3, $200, and $0.90, respectively, at the time of publication.

Bitcoin, however, failed to keep pace, quickly retreating to $115,600, after a rejection from its intraday peak of $117,370. Market metrics highlight three main reasons behind BTC’s underwhelming performance compared to its rivals.

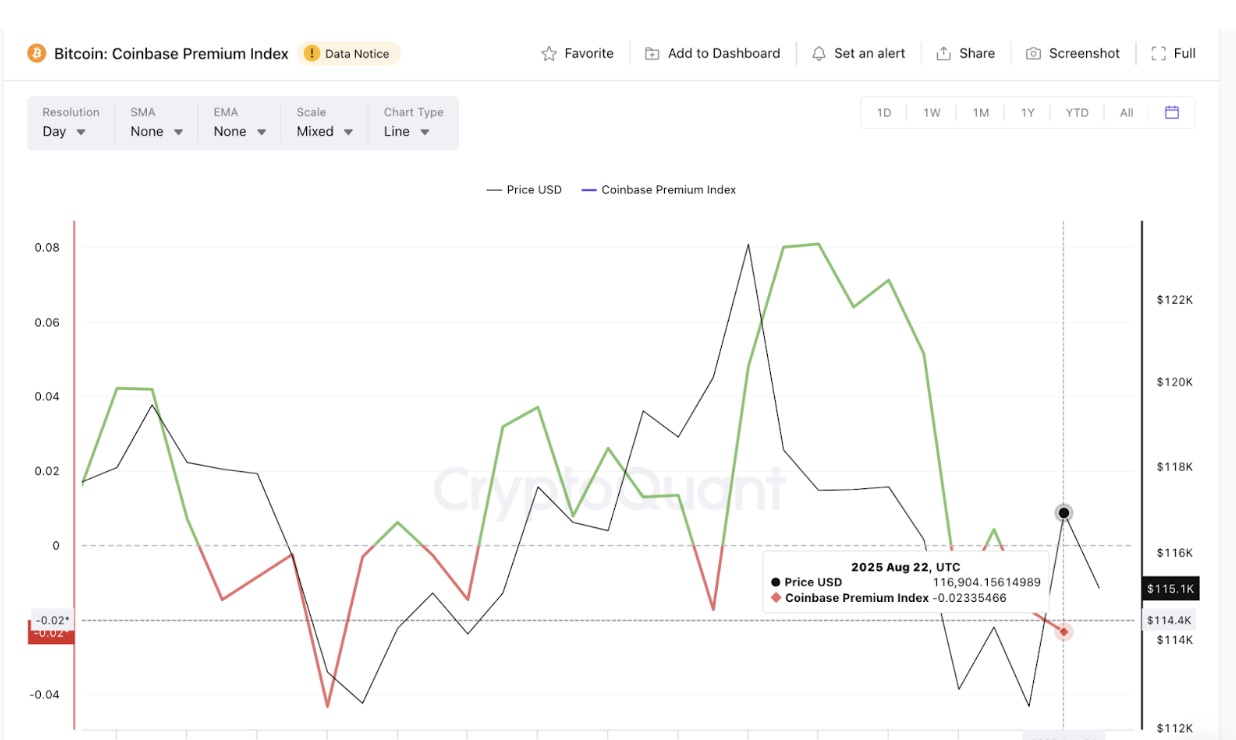

1. Bitcoin Sees Weak Demand Among Coinbase Whale Traders

One major factor has been weak institutional demand. Cryptoquant’s Coinbase Premium Index, which measures the difference between Bitcoin prices on Coinbase Pro, dominated by US-based corporate investors and retail-dominated Binance, fell to 0.002%, its lowest since Aug. 1.

Bitcoin Premium Index falls to 21-day low on August 22 | Source: CryptoQuant

When this metric trends negative or near-zero, it signals that corporate investors are showing little appetite, leaving retail traders to drive market activity. The 21-day low reading on Fridays suggested that while retail participation was strong, whale buyers in the U.S. remained hesitant.

This cautious stance among institutions has weighed heavily on Bitcoin’s ability to push higher against its layer-1 rivals.

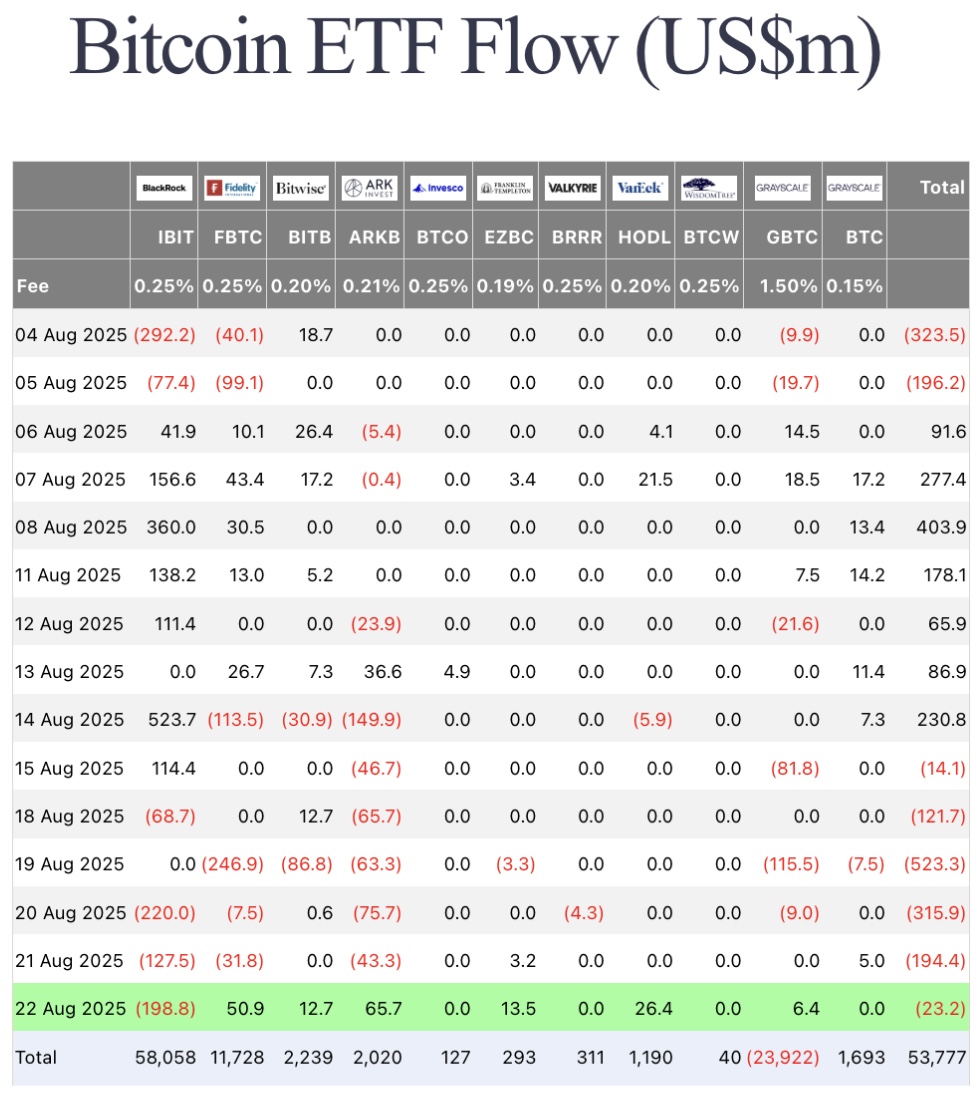

2. Bitcoin ETFs Failed to Register a Single Day of Inflow this Week

ETF flows this week further emphasized investor preferences, sidelining Bitcoin. According to Farside Investors, Bitcoin funds recorded $23 million in outflows on Friday.

This meant that the Bitcoin ETF failed to register a single day of net inflows this week, shedding $1.2 billion as withdrawals exceeded deposits in six consecutive trading days dating back to Aug. 15.

Bitcoin ETF Flows August 2025 | Source: Farside Investors

In contrast, Ethereum ETFs pulled in $337 million in net inflows on Friday after taking in $287 million on Thursday.

This divergence highlights how investor capital rotated toward Ethereum and other altcoins following Powell’s remarks, leaving Bitcoin sidelined in the rally. Without ETF inflows to support upward pressure, BTC’s upside trajectory was inevitably capped.

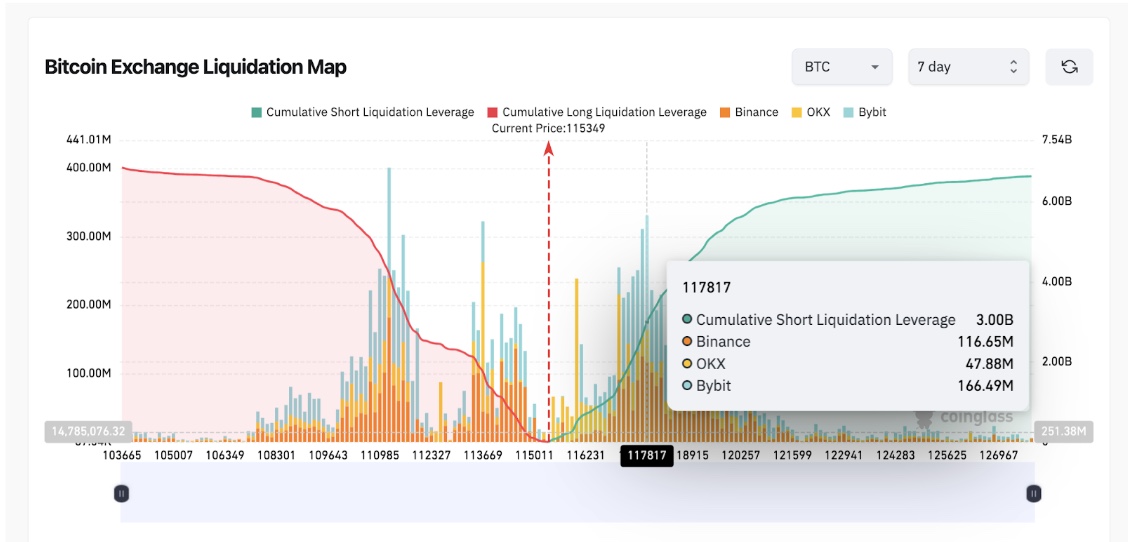

3. BTC Bulls Face $3B Resistance Cluster at $117,800

Derivative market data adds further insights into Bitcoin’s laggard price action below $120,000 on Friday. Coinglass liquidation maps show the distribution of leveraged positions across key price levels. At first glance, sentiment leans bullish, with total long leverage of $6.86 billion narrowly exceeding shorts at $6.64 billion.

Bitcoin Liquidation Map as of August 23, 2025 | Source: Coinglass

However, a deeper look reveals over $3 billion worth of shorts clustered at $117,800, nearly 50% of all active downside bets. Such concentrated short leverage incentivizes strategic sell-offs, as traders attempt to prevent a breakout beyond that key price level. Bitcoin’s rejection from the intraday high of $117,377 aligns closely with this resistance wall.

Bitcoin Price Forecast

Given the $117,800 resistance cluster, Bitcoin is unlikely to sustain a clean break above $120,000 without fresh inflows. Unless bullish liquidity overwhelms short incentives, near-term price action may consolidate between $113,500 support and $118,000 resistance.

A decisive close above $118,000 could trigger a short squeeze, setting the stage for a push toward $123,000. Conversely, failure to defend $113,500 may open a retracement path back toward $110,000.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.