JuSun

Introduction

It’s time to talk about Automatic Data Processing (NASDAQ:ADP), a stock I called “One Of The Most Impressive Dividend Growth Stocks On My Radar” in the title of my most recent article, which was written on February 5.

What makes ADP so special isn’t just its double-A credit rating, massive business portfolio, or the fact that it’s one year away from becoming a Dividend King with 50 consecutive years of dividend growth but also that it tells us a lot about the economy.

Since my February article, the stock has fallen 1%, including dividends, lagging the S&P 500 by almost eight points.

In this article, I’ll revisit the bull case, take a closer look under the hood, and assess the risk/reward in light of rising pressure on the employment market.

So, as we have a lot to discuss, let’s get right to it!

A Massive Addressable Market

Automatic Data Processing is all about streamlining operations.

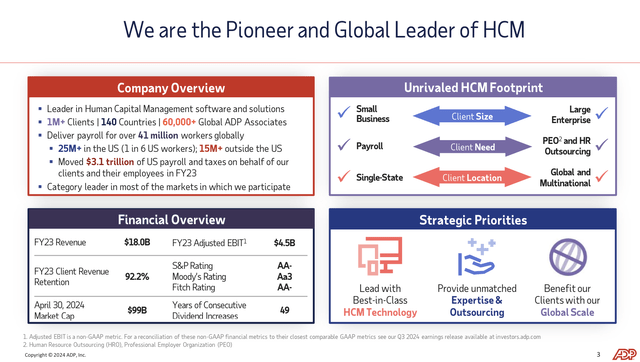

The company has become a leader in Human Capital Management software and solutions. It currently has more than 1 million clients in 140 nations, which are serviced by more than 60,000 associates.

The company’s services help to deliver payroll for more than 41 million workers. This includes more than 25 million employees in the United States (one in six!).

Moreover, while it’s fair to make the case that employment services are cyclical, automation of human resource tasks benefits from secular tailwinds.

According to the company, we’re dealing with a $150 billion addressable market that is growing by 5-6% annually.

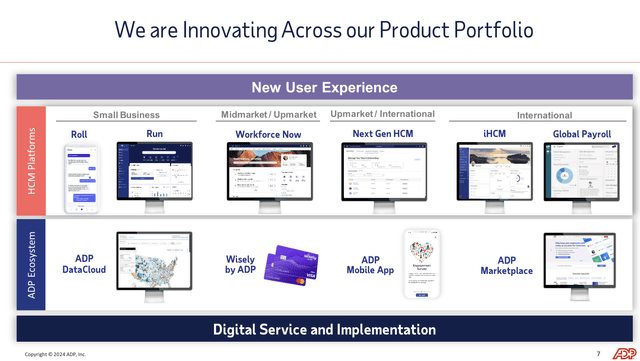

That’s a big deal and an opportunity for the company’s innovation, which includes next-gen human resource platforms to efficiently run processes.

The company, which turned 75 years old this year, believes it has unmatched service and expertise, which allows it to consistently grow market share in an ever-increasing addressable market.

This includes the adoption of new technologies to further improve the “new user experiences” listed in the overview above.

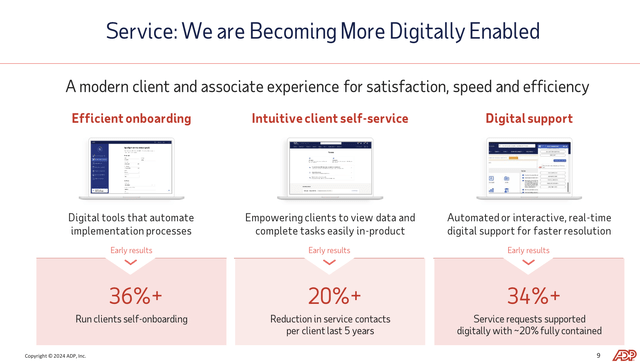

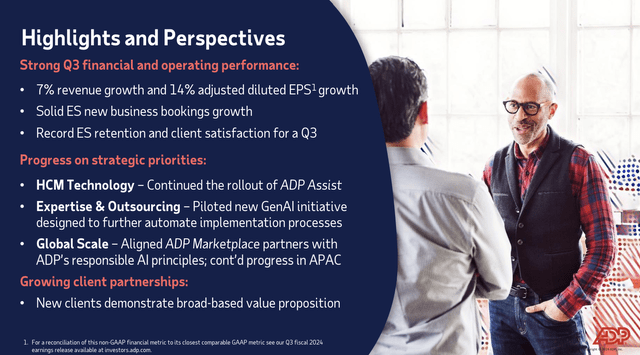

During the recent JPMorgan Annual Global Technology, Media & Communications Conference, the company noted it has heavily invested in generative AI and other advanced technologies to enhance its product offerings and operational efficiencies.

The best thing is that these investments are already bearing fruit.

According to the company, AI-driven tools have improved service agent productivity by reducing call handling times, while advanced analytics have optimized sales processes.

Additionally, the company is expanding its services beyond traditional payroll services into areas like benefits administration, talent acquisition, and compensation planning.

These services are boosted by increasing demand for 401(k) retirement planning demand and workers’ compensation insurance.

Currently, the company manages 401(k) plans for roughly 150,000 clients out of its 850,000+ client base.

It’s doing this highly successfully, as the company achieved a record-high retention rate of 92.2% in the past year.

That’s not only a record number but also a fantastic number in general.

The numbers below show the average retention rates per industry, with 35% to 84% being considered a “good” retention rate.

- Media and professional services earn the highest average retention rate at 84%

- Healthcare companies earn a 77% retention rate

- IT and software retain 77% of their customers

- Retail businesses have an average CRR of 63%

- Hospitality, restaurants, and travel companies earned the lowest average rate at 55%

But wait, there’s more!

In 2023, the company generated 89% of its revenue in the United States, with Europe being its largest international market, accounting for roughly 7% of total revenues.

The company wants to capture a bigger market share in international markets, as it has proven its business model is highly successful in the United States.

This growth strategy includes organic growth as well as M&A opportunities.

Consistent Growth & Shareholder Returns

With all of this said, right now cyclical growth is not the company’s biggest friend.

While overall economic conditions remain stable, we’re seeing a deterioration in key factors like consumer confidence, loan quality, and hiring plans.

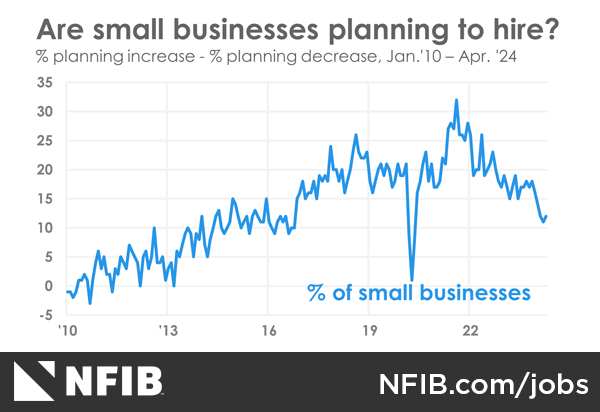

As we can see in the latest report from the NFIB, small-business hiring plans have taken a turn for the worse, with net hiring plans of 10%.

NFIB

Nonetheless, the company continues to do well.

In the third quarter of its 2024 fiscal year, the company achieved 7% revenue growth, which led to 14% higher adjusted EPS.

Moreover, the Employer Services segment, which is a significant part of the company’s business (67% in 2023), reported 8% revenue growth on a reported basis and 7% on an organic constant currency basis.

This segment saw record 3Q bookings, which keeps the segment on track for its full-year guidance.

EPS outperformance was supported by higher margins, as adjusted EBITDA margins rose by 140 basis points.

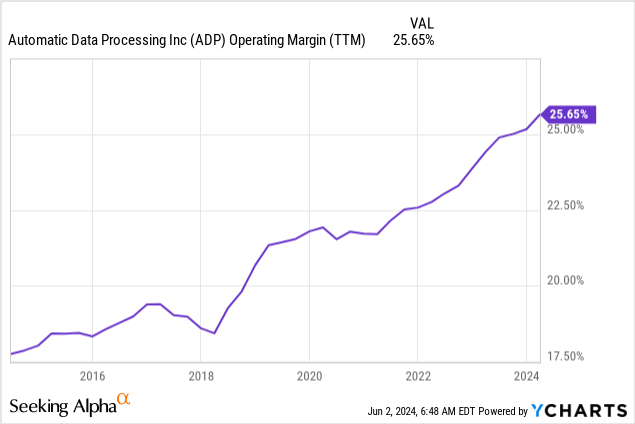

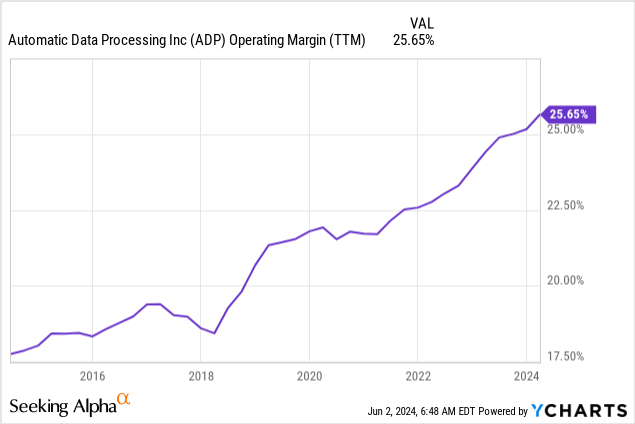

Over the past ten years, the company has consistently grown its portability, growing its operating margin from roughly 17.5% to almost 26.0% – despite higher inflation since the pandemic.

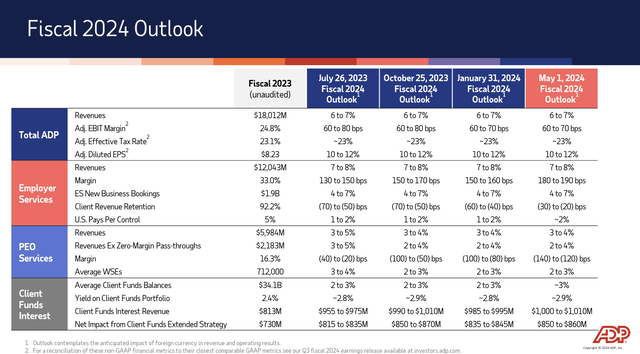

Looking ahead, the company has provided a positive outlook for the fiscal year, as it expects consolidated revenue growth of 6% to 7% and an adjusted EBIT margin improvement of at least 60 basis points.

Please note that the total company guidance trends below show that despite weakening employment fundamentals, the company has maintained revenue and earnings guidance.

This bodes well for shareholders.

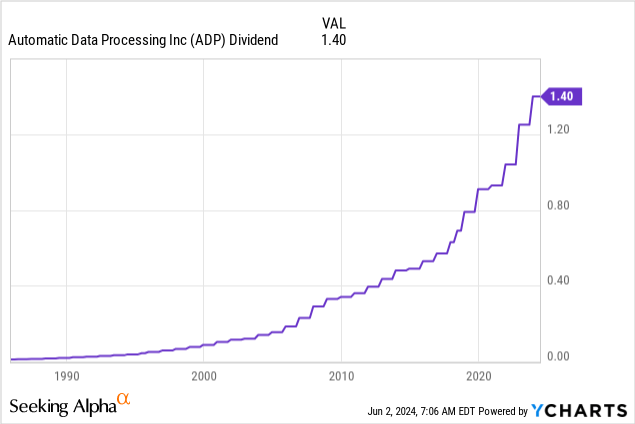

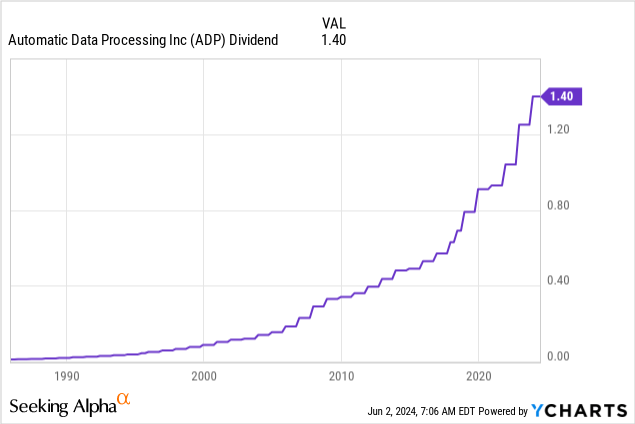

On November 8, 2023, the company hiked its dividend by 12% to $1.40 per share per quarter. This was the 49th consecutive dividend hike, which means the company is one year away from official Dividend King status.

This dividend has a 2.3% yield, a 59% payout ratio, and a five-year CAGR of 12.4%, which means it would become a mature dividend grower with elevated dividend growth.

On top of a healthy payout ratio, the dividend is protected by a healthy balance sheet.

This year, analysts expect the company to end up with more than $100 million in net cash, which translates to more cash than gross debt.

It also has an AA- credit rating, one of the best ratings in the world.

Moreover, if it’s up to analysts, we can expect consistently elevated dividend growth to last.

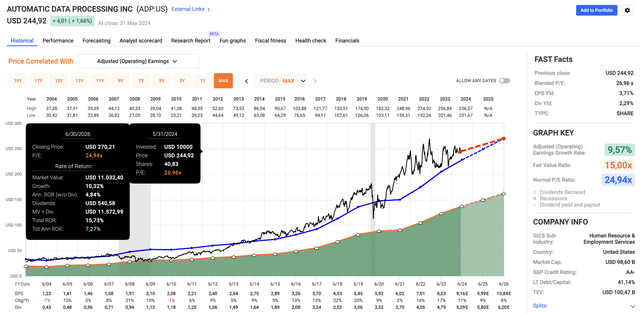

Using the FactSet data in the chart below, the company is expected to grow EPS by 11% this year, which is the midpoint of the company’s guidance.

In 2025 and 2026, EPS growth is expected to be 9% and 8%, respectively.

As ADP currently trades at a blended P/E ratio of 27.0x, with a long-term normalized P/E ratio of 24.9x, we get a fair price target of roughly $270, which is 10% above the current price.

Including its dividend, we could be looking at 7-10% annual returns, which would be below the company’s 11.9% annual return since 2003.

Please note that this performance includes a sideways trend since 2021.

Do you know what happened in 2021?

Employment expectations peaked.

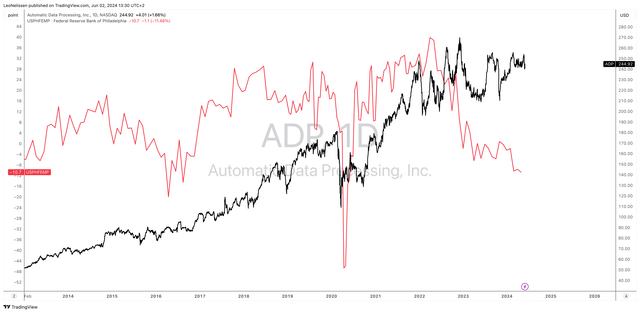

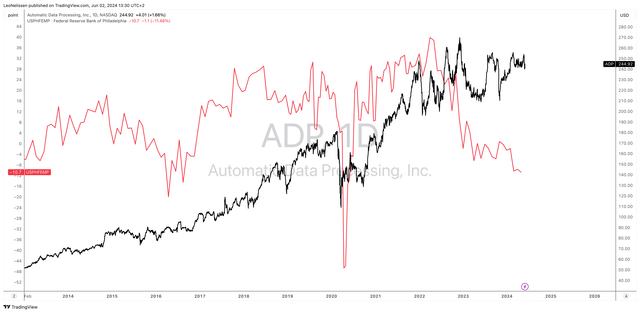

On top of the NFIB employment indicator I already briefly showed, we see that other leading indicators, like the Philadelphia Fed Manufacturing Employment indicator, have gone south since 2021.

TradingView (ADP, Philly Fed Manufacturing Employment)

While ADP is doing well thanks to secular growth, I do not expect a meaningful upside in ADP’s stock until we get a rebound in employment indicators.

Please bear that in mind, as a further deterioration could pressure ADP’s stock price and guidance.

As I believe the Fed will have to keep inflation “higher for longer” to combat inflation, I’m a bit more careful with cyclical stocks and hope to buy ADP a bit lower – despite my bullish thesis.

Takeaway

ADP remains a standout in the dividend growth space with its imminent Dividend King status, supported by strong business fundamentals and consistent innovation that helps the company to penetrate a massive global market.

Moreover, ADP’s wide market reach, strategic investment in AI, and high client retention highlight its resilience and growth potential.

However, with economic indicators hinting at a tougher employment environment, caution is warranted.

Nonetheless, I maintain a bullish outlook on ADP, as I believe ADP has the potential to deliver substantial capital gains and dividend growth on a long-term basis.

Pros & Cons

Pros:

- Strong Dividend Growth: ADP is on the verge of becoming a Dividend King with 49 years of consecutive dividend hikes.

- Market Leadership: With more than 1 million clients and innovative human resource solutions, ADP is a leader in Human Capital Management.

- Robust Financial Health: ADP has an AA- credit rating and a solid balance sheet, which provides stability.

- Technological Innovation: Investments in AI and advanced technologies are supporting productivity and operational efficiencies.

- Expanding Services: Beyond payroll, ADP is growing its offerings in benefits administration, talent acquisition, and compensation planning.

Cons:

- Cyclical Pressures: Economic uncertainties and weakening employment indicators could pressure ADP’s stock price and guidance.

- High Valuation: With a current P/E ratio of 27.0x, ADP trades above its long-term average, which could limit short-term capital gains.