On-chain knowledge exhibits greater than 70% of the Ethereum provide hasn’t displayed any motion in over a 12 months, a brand new report for the community.

Ethereum HODLers Now Management Over 70% Of The Asset’s Provide

Based on knowledge from the market intelligence platform IntoTheBlock, the overall quantity of provide owned by the ETH long-term holders has reached a brand new all-time excessive.

The analytics agency defines “long-term holders” (LTHs) because the addresses who’ve been carrying their cash since at the least one 12 months in the past. Statistically, the longer a holder retains their cash nonetheless, the much less doubtless they turn into to promote them at any level.

As such, the LTHs are the arms who’re the least possible to maneuver their cash. This cohort lives as much as this truth in observe as nicely, as its contributors not often promote it doesn’t matter what’s happening within the wider market, even when it’s a worthwhile rally or a deep crash.

Due to this purpose, the occasions the LTHs do promote might be ones to observe, because it means that the market has pushed even these diamond arms in the direction of breaking their resolve.

One technique to monitor the actions of the HODLers is thru the mixed quantity of provide that they’ve saved locked inside their wallets since at the least a 12 months in the past.

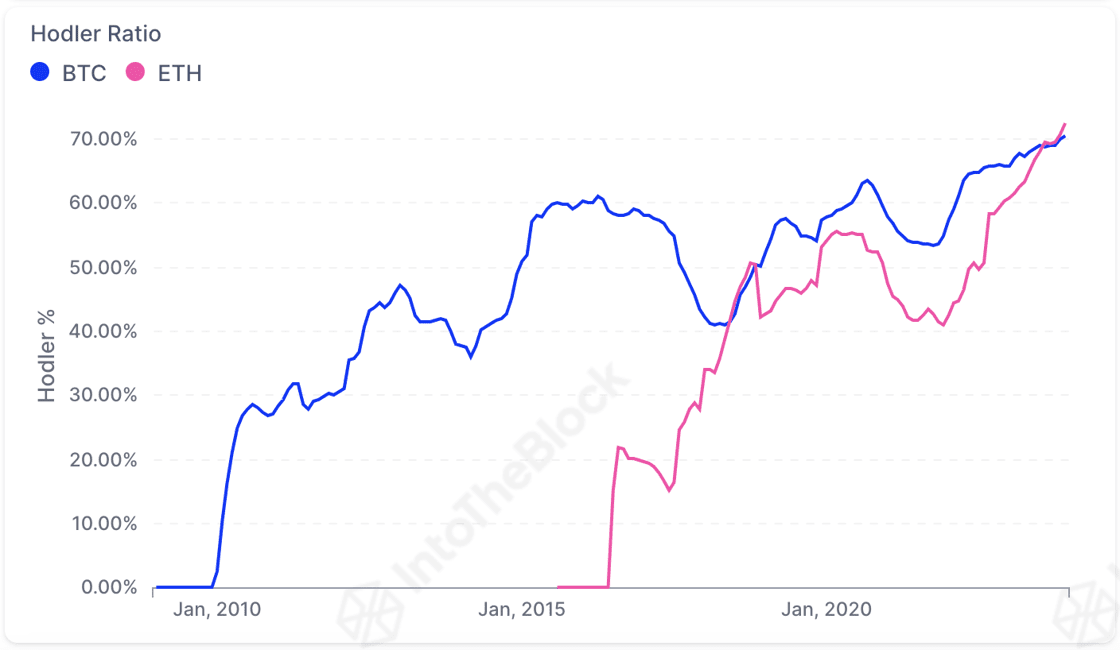

The beneath chart exhibits the development within the LTH provide as a proportion of the overall circulating provide for each Ethereum and Bitcoin over the course of the historical past of the respective belongings.

The indicator seems to have seen an increase for each of those belongings lately | Supply: IntoTheBlock on X

As displayed within the above graph, the availability held by the HODLers has been going up for each Bitcoin and Ethereum lately. One thing to bear in mind is that this improve doesn’t point out that these traders are accumulating within the current.

Quite, what this implies is that some shopping for from the traders came about a 12 months in the past and people cash have now stayed dormant for lengthy sufficient to mature into this cohort.

A 12 months in the past, the cryptocurrency sector was nonetheless inside a bear market, so the rise within the HODLer provide of the previous few months would have come from those that purchased on the low-cost bear market costs.

It could seem that regardless of these holders carrying some very substantial earnings by now due to this 12 months’s rally, they’re nonetheless not thinking about promoting, because the HODLer ratio has solely gone up for each Ethereum and Bitcoin.

From the chart, it’s seen that the expansion within the indicator has been significantly sharp within the case of ETH because it has now outpaced BTC. With greater than 70% of your complete circulating provide locked contained in the arms of those LTHs, the metric is presently sitting at a brand new all-time excessive for the quantity two cryptocurrency.

ETH Value

On the time of writing, Ethereum’s value is floating round $2,290, up 6% previously week.

ETH seems to have been transferring sideways lately | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com