On-chain information suggests round 729,400 Bitcoin wallets cleared themselves out within the final month. Right here’s what might be behind this pattern.

Bitcoin Wallets Carrying A Stability Have Taken A Sharp Hit In Previous Month

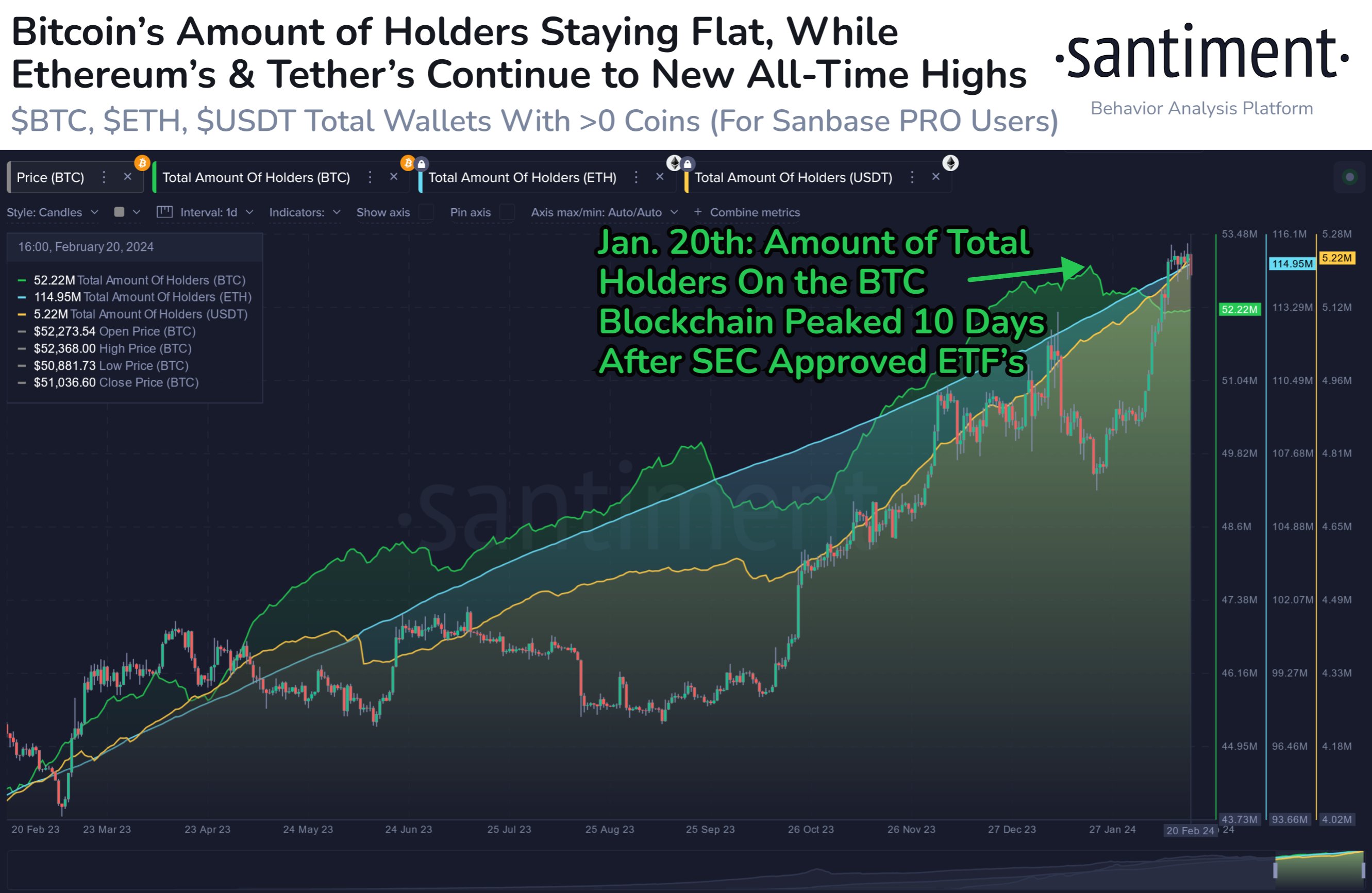

In a brand new post on X, the on-chain analytics agency Santiment mentioned the pattern within the “Total Amount of Holders” for Bitcoin and the way it has differed from that of Ethereum (ETH) and Tether (USDT).

The “Total Amount of Holders” right here refers to an indicator that retains monitor of the entire variety of addresses which might be carrying a non-zero steadiness on the blockchain.

When the worth of this metric rises, it signifies that both model new addresses are popping up on the community or some previous buyers have returned again to the cryptocurrency.

Regardless of the case is perhaps, this type of pattern generally is a constructive signal for the cryptocurrency (at the least within the long-term), because it means that extra adoption is happening.

Then again, the indicator happening implies some buyers have determined to promote all the quantity sitting of their wallets. Such a pattern suggests a web quantity of holders have determined to exit the asset.

Now, here’s a chart that reveals the pattern within the Complete Quantity of Holders for Bitcoin, Ethereum, and Tether over the previous 12 months:

The worth of the metric appears to have gone down for BTC in latest weeks | Supply: Santiment on X

As displayed within the above graph, the “Total Amount of Holders” has been heading down for Bitcoin since January twentieth, whereas the indicator has continued to rise for Ethereum and Tether.

This is able to suggest that an exit has been taking place from BTC, whereas the opposite main property within the sector have continued to get pleasure from extra adoption. What’s behind this discrepancy? The reply to that will lie in an occasion that’s particular to solely the unique cryptocurrency.

On January 10, the US Securities and Trade Fee (SEC) lastly accepted spot exchange-traded funds (ETFs) for Bitcoin. ETFs are funding automobiles that permit buyers to realize oblique publicity to their underlying property.

The ETFs commerce on conventional markets, so they could be a extra engaging possibility for individuals who are unfamiliar with how cryptocurrency wallets and exchanges work.

It’s maybe not a coincidence that the metric hit its peak ten days after the ETFs have been accepted and has since been happening. “This is attributed to the increased interest in hodlers having exposure through ETF’s instead,” explains Santiment.

As this selection isn’t out there for the opposite cryptocurrencies, it’s not stunning that their adoption has solely continued to additional in the identical interval. For each Ethereum and Tether, the “Total Amount of Holders” is sitting at all-time highs of 114.95 million and 5.22 million, respectively.

“For any future asset with ETF’s, there would be an implied drop in active wallets on their respective network,” says the analytics agency.

BTC Worth

Bitcoin is in a little bit of a rut proper now because the asset’s value has general consolidated sideways prior to now week.

Appears to be like like the value of the asset has been stale just lately | Supply: BTCUSD on TradingView

Featured picture from Erling Løken Andersen on Unsplash.com, Santiment.web, chart from TradingView.com