Key Notes

- An astonishing 99% of Bitcoin’s circulating supply is now in profit.

- BTC briefly flipped Google (Alphabet), becoming the world’s fifth-largest asset.

- Analysts eye the $126K price level as the “make-it- or break-it” level for BTC.

Bitcoin

BTC

$120 854

24h volatility:

0.2%

Market cap:

$2.41 T

Vol. 24h:

$68.38 B

has pushed into uncharted territory this week, with nearly the entire circulating supply now in profit.

With the Fear and Greed Index showing massive elevation in buyer demand, investors question if this is the final stage of the BTC rally.

Record Highs on Inflation Relief

On-chain analytics from Glassnode show that 99% of Bitcoin’s supply is currently in profit. Even during July’s pullback, the figure only dipped to 95%, suggesting that most holders have maintained strong conviction.

99% of $BTC supply is now in profit, but even during July’s correction this metric was as high as 95%. The metric found support at its +1σ band, suggesting investors continued to anchor around unrealized gains, reinforcing a resilient market structure through the volatility. pic.twitter.com/mpWDDLYWTl

— glassnode (@glassnode) August 14, 2025

The metric has repeatedly found support at its +1σ band, indicating that investors continue to anchor around unrealized gains despite volatility.

The latest surge followed US inflation data for July, which showed the Consumer Price Index rising 2.7% year-over-year, unchanged from June and slightly below expectations.

Monthly CPI rose just 0.2%, helping risk assets extend their gains. Bitcoin responded by setting a fresh all-time high of $124,457 on August 14, adding roughly $40 billion to its market capitalization in a single day.

JULY #CPI INFLATION DATA IS OUT…

🟢 Headline CPI: 2.7%, proj. 2.8%

🟡 Core CPI: 3.1% ,proj. 3.0%$qqq $spy $btc $eth $gld pic.twitter.com/3Q8rS2SPDD— ₿IGRYANPARK 🧲 (@BigRyanPark) August 12, 2025

At the time of writing, it is trading near $121,881, with daily trading volumes up more than 30%.

Analysts Watch $126K

Analysts are closely watching the $126,000 level, described as a pivotal price point that could open the door to further gains if breached convincingly.

Venture capitalist Chris Burniske has forecasted that Bitcoin could peak in October, with a possible target near $142,690 if bullish momentum holds.

Aiming for an October top in BTC, if I were to pick numbers, which we all know is a grade above guessing, I’d say $BTC $142,690, $ETH $6900-8K, $SOL ~$420.

NFA, it’s a meme world we live in ¯_(ツ)_/¯

— Chris Burniske (@cburniske) August 13, 2025

However, he cautioned that a sharp pullback in the coming months could extend the bull market into 2026.

The Potential Final Push

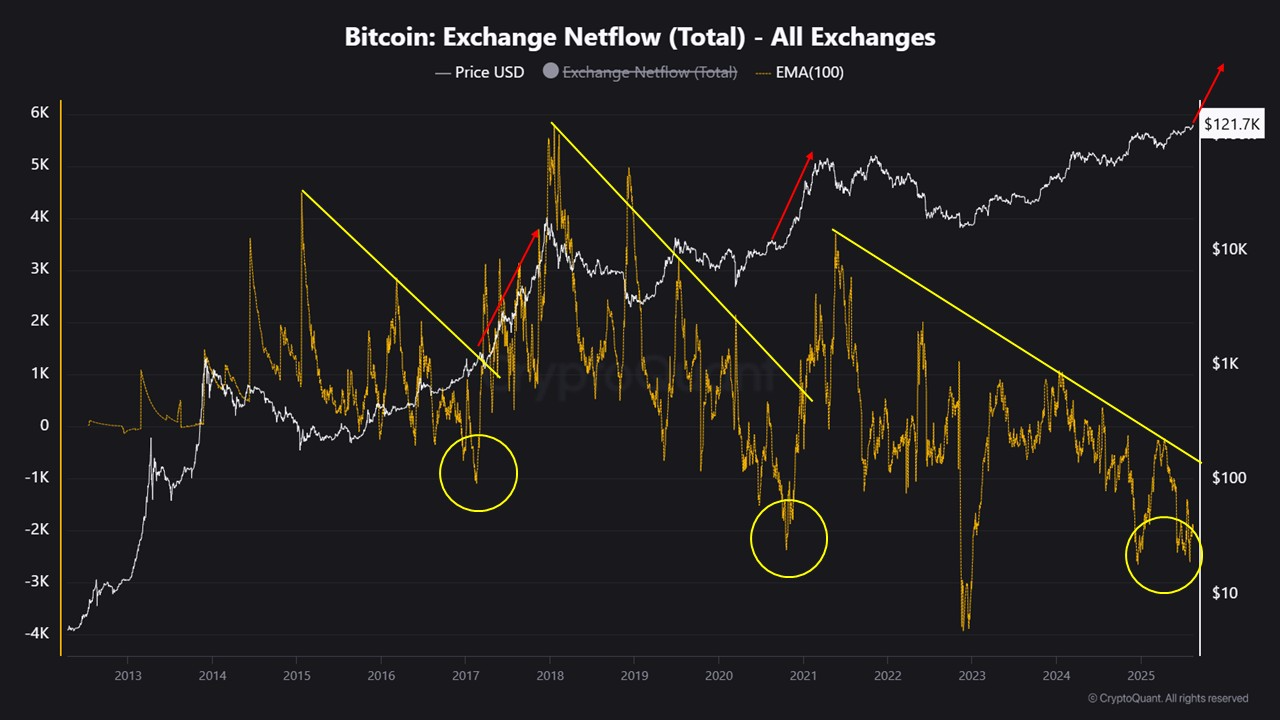

As pointed out by CoinCare on CryptoQuant’s Quicktake, the net inflows and outflows from exchanges remain one of the most reliable measures of market pressure.

Historically, Bitcoin’s final rally in the 2017 and 2021 cycles began shortly after exchange netflows reached a local negative low, signaling reduced sell pressure. Current readings suggest that a similar bottom may be forming, although confirmation is still pending.

Net inflows and outflows on crypto exchanges over time. | Source: CoinCare via CryptoQuant

If this proves to be the case, Bitcoin could be entering the last and most rapid stage of its bull market. Long-term whale holders continue to hold back from selling, a pattern that typically precedes major price explosions.

Bitcoin to $340K?

Analyst Jason Pizzino has pointed out that a move to $340,000 would mark the first time Bitcoin has delivered a higher percentage return than in the previous cycle. This would imply a $6.7 trillion market capitalization, making Bitcoin the second most valuable asset globally after gold.

If Bitcoin hits $340,000 this cycle, it would be the first time in its 16-year history that it has a greater return than the previous cycle. It is a very big ask, but many are asking if it’s possible. That is a $6.7 trillion market cap, less than a third of gold’s market cap at… pic.twitter.com/ntMJ0FS1tu

— Jason Pizzino 🌞 (@jasonpizzino) August 11, 2025

While Pizzino sees this outcome as unlikely, prominent industry figures such as Cathie Wood and Michael Saylor remain confident in far higher valuations, making BTC the best crypto to buy in 2025.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.