Nikada

In December last year, I issued a bullish thesis on PennantPark Floating Rate Capital (NYSE:PFLT) arguing that it is one of the best risk and reward plays in the overall BDC space. The substance behind this assumption was that in the context of PFLT’s double-digit dividend yield, the underlying fundamentals are very strong and arguably stronger than what could be implied by the current yield level. On top of that, the amount of external leverage is below sector average, which in combination with a nuanced focus on already cash generating and established businesses renders the investment thesis even more enticing (on a risk-adjusted basis).

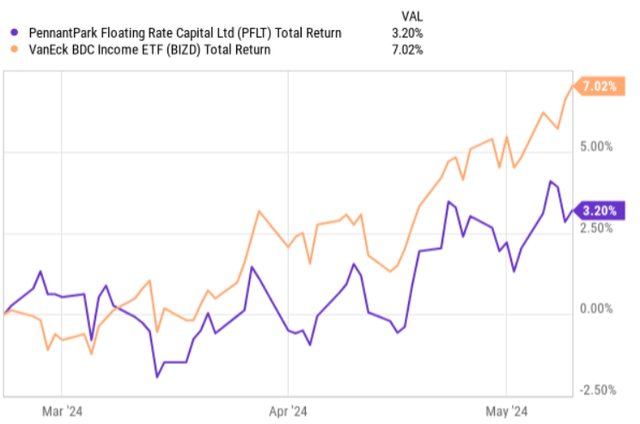

In February this year, I wrote a follow-up article on my initial bull thesis, assessing Q1, 2024 earnings report. Since all of the core metrics kept improving, while the P/NAV remained the same (P/NAV at 1.01x), I decided to, obviously, maintain my bullish stance against PFLT. This was done despite the fact that up until the circulation of Q1, 2024 earnings report, PFLT had meaningfully underperformed the broader BDC market.

Since then, PFLT has done a better job in terms of the total return performance, but still, there is a notable gap between the BDC and the index.

Let’s now dissect the most recent earnings report pertaining to the Q2, 2024 performance and try to understand whether it is still worth holding PFLT in a portfolio.

Thesis review

All in all, the Q2, 2024 report was strong, with all of the main metrics that really matter coming in at improved levels relative to the quarter in a comparable period.

For the three months ended March 31, 2024 (i.e., Q2, 2024), the top line landed at $44.4 million, where the majority of this was explained by income stemming from first lien secured debt. The remaining (roughly $5.4 million) was captured from other investments, such as equity-like products and more junior type of loan instruments. The Q2 top-line results this year really surpassed the top-line (or investment income) that was generated during Q2, 2023 – at $34.6 million.

There are multiple reasons behind this improvement, but the key one is the increase in portfolio size, while keeping the investment yield levels somewhat stable. Granted, in Q2, 2024 the total portfolio investment yield was circa 50 basis points lower than in Q2, 2023, but the higher volume component was sufficient to compensate this and even to drive the expansion in the investment income generation.

Apart from the positive operational performance dynamics, this quarter showed again that PFLT is able to source in fresh deals to keep the portfolio growth momentum alive. Namely, for the three months ended March 31, 2024, PFLT deployed circa $334 million mostly across the existing portfolio companies (11 new and 48 existing portfolio companies) at a weighted average yield on debt investments of 11.6%. This amount was much higher than the organic paydowns or the overall portfolio outflows, which for Q2, 2204 landed at about $150 million.

Here one could pinpoint to the yield level at which these new investments were underwritten as it differs from the weighted average yield on PFLT’s current debt investments that currently sits at 12.3%.

However, in this case, we have to consider two things. First, the fact that PFLT has managed to attract new funding volumes at such amounts that will help offset the decline in margins through higher volumes (just as in the case with the top-line as outlined above). Second, this is a clear indicative that PFLT is not willing to sacrifice its investment policy by assuming new commitments at lower quality.

If we look at the current portfolio quality, all of the key metrics remain strong. The portfolio’s weighted average leverage ratio across the debt investments is 4.4 times, and the weighted average interest coverage is 2.2x.

Below is a relevant commentary by Arthur Penn – Founder, Chairman and CEO – who during the most recent earnings call emphasized PFLT’s continued focus on defensive names:

As you know, Mark, we underwrite our scenarios as lenders always assuming there is a soft economic environment early on in the deal. And whether there is one or not, we have no idea. No one really does. But we assume that, which is why we generally structure these loans is very conservative low leverage, high equity cushion, good covenants, good information rights, kind of, believing at some point, there may be a bump. It could be sooner and we need to structure these deals as if there’s a bump sooner, but we don’t have any prognostication about that.

Now, if we transition to the non-accrual side, we will not notice any major surprises, which goes hand in hand with the aforementioned points – i.e., PFLT’s conservative lending standards and unwillingness to sacrifice quality to get huge volumes in.

During the quarter there was one non-accrual that came off, which was successfully sold, thereby allowing to realize some gains as previously the management had written of the value of it. Meanwhile, PFLT had to incur one additional non-accrual for a company that faced restructuring process a while back, but currently exhibits some signs of a deteriorating performance. It still continues to perform and generate cash, but just for the sake of conservatism, the Management has decided to put this under non-accrual.

As a result of these dynamics, PFLT ended the quarter at a non-accrual level which consumed only 0.3% of the total fair value of the portfolio. This could be easily deemed as one of the safest and lowest levels in the BDC sector.

The bottom line

Q2, 2024 results yet again proved that PFLT is a defensively structured vehicle that is able to slowly but surely increase its portfolio and cash generation profile without suffering notable bumps in the process.

In my humble opinion, PennantPark Floating Rate Capital remains a solid investment case with a monthly dividend yield of 10.7% that is underpinned by one of the soundest BDC portfolios out there.