Wirestock

One theme that has rung consistently throughout this earnings season: it’s taking a lot for investors to be impressed. Though “beat and raise” quarters have been prevalent across the tech sector, there have been very few rallies and many more disappointments.

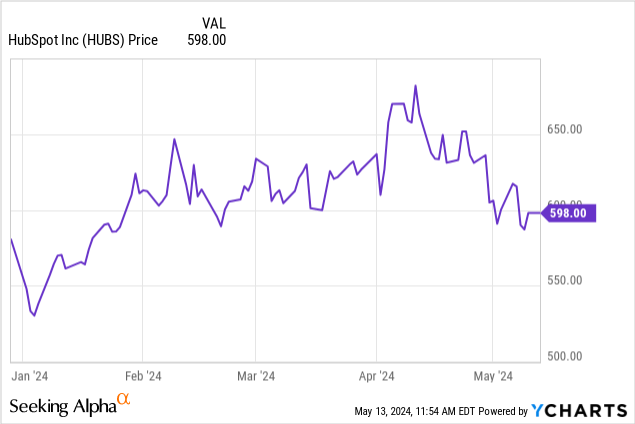

HubSpot (NYSE:HUBS), unfortunately, is in the latter category. The stock has slid nearly 15% from April highs near $700, and a positive earnings release for Q1 in early May did little to renew enthusiasm for this name:

High valuation propped up by acquisition hopes; upgrading HubSpot to neutral

I last wrote a bearish note on HubSpot in February, when the stock was hovering at similar levels just above $600. At the moment, there are twin opposing forces at play for HubSpot, in my view: the possibility of an acquisition by Alphabet (GOOG), anchored by the risk of a downward multiples re-rating. While I still view HubSpot as expensive, it’s difficult to argue that the company’s sales execution has been admirable amid a tough macro, and that the acquisition possibility helps to counterbalance the downside risk. With all this considered, I am now neutral on HubSpot.

Acquisition chatter by Google surfaced in early April, which provided a temporary lift to HubSpot’s shares. The conversations are still in the early stages, and no indication of a valuation premium has been hinted at. On paper, an acquisition makes sense. Google is a search and consumer internet powerhouse, but it doesn’t have the enterprise software chops that some of its large mega-cap tech rivals do.

HubSpot, by that regard, is one of the best fits within the enterprise software industry. The company’s inbound marketing software serves primarily SMB (small and midsize business) customers, not “true” enterprise software companies – which makes for a nice package with Google Workspace, which is the company’s homegrown suite of small business collaboration tools.

It’s this hope of a takeover, needless to say, that is helping to prop up HubSpot’s expensive valuation. At current share prices just under $600, HubSpot trades at a market cap of $30.44 billion. And after we net off the $1.83 billion of cash and $456.7 million of debt on the company’s most recent balance sheet, HubSpot’s resulting enterprise value is $29.07 billion.

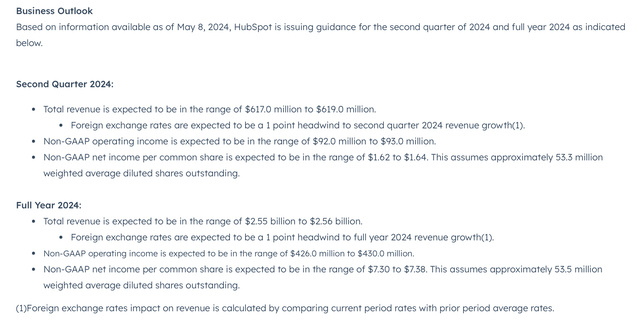

HubSpot technically had a “beat and raise” quarter in Q1, and raised its full year outlook. Though its nominal dollar range of $2.55-$2.56 billion in revenue (+18% y/y) is unchanged from its prior outlook, this range now includes one point of negative FX impact from the recent strengthening of the dollar (whereas the prior outlook assumed no currency impact at all), so on a constant-currency basis, the company raised its outlook by one point y/y.

HubSpot outlook (HubSpot Q1 earnings release)

And for next year FY25, Wall Street analysts are also expecting 18% y/y growth to $3.03 billion in revenue. This puts the stock’s valuation at:

- 11.4x EV/FY24 revenue

- 9.6x EV/FY25 revenue

Note as well that the company has several fundamental risks on top of its expensive valuation, the core of which are:

- CRM is one of the most competitive arenas in software. HubSpot operates in arguably the most competitive vertical in enterprise software, competing against deeper-pocketed incumbents like Salesforce.com (CRM). Though HubSpot has certainly made a niche for itself in focusing on inbound marketing, the current macro landscape has many enterprises shrinking down their vendor counts and trying to consolidate their tech infrastructures as much as possible – which may favor larger “portfolio software” vendors like Salesforce and Oracle.

- Tough macro environment for sales and marketing. HubSpot’s core customer base is the exact headcount that most of corporate America is trying to reduce. Layoffs in sales and marketing departments have continued well into 2024, which will pressure HubSpot’s seat expansion as well as ability to land new clients in an age of downsizing.

All in all, I see a balanced bull and bear case for HubSpot. As long as the company is holding out hope for an acquisition, I think the stock will continue to hover in the ~$600 neighborhood (but even in a buyout scenario, a large premium is unlikely). I wouldn’t confidently buy this stock at current levels, however – I’d wait for HubSpot to fall to $505 before buying, a price target that implies ~15% downside from current levels and an 8x EV/FY25 valuation.

Q1 download

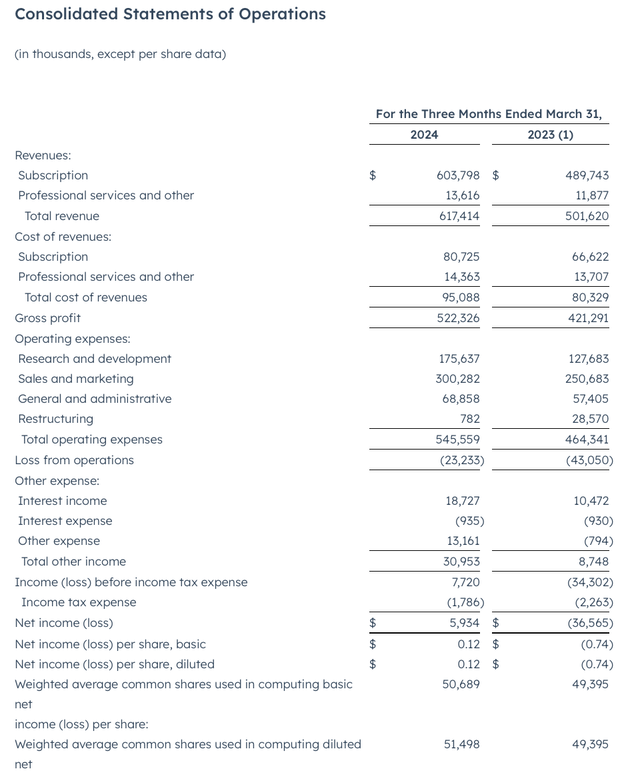

This being said, we should tout the fact that HubSpot, as usual, delivered comfortably above expectations for Q1. The earnings results are shown below:

HubSpot Q1 results (HubSpot Q1 earnings release)

Revenue grew 23% y/y to $617.4 million, well ahead of Wall Street’s expectations of $598.2 million (+19% y/y) by a four-point margin. Revenue growth also barely decelerated from Q4’s 24% y/y growth pace.

Note that these results are against the backdrop of a still-challenging macro. Per CEO Yamini Rangan’s remarks on the Q1 earnings call:

After a strong finish in Q4, we saw a return to weaker demand conditions in the first quarter, similar to what we experienced in 2023. The buyer urgency that we saw in December did not carry over into Q1. Instead, we saw a return to higher scrutiny of budgets, more decision makers getting involved, and a need for more demos and proof-of-concepts before signing-off on purchase decisions.

At the top of the funnel, we saw lead flow shift away from higher quality inbound and partner source leads to lower quality rep source leads. This shift, plus the lower buyer urgency slowed down deal progression and in some cases pushed deals out of Q1 and into Q2. While deal close and upgrade rates remain under pressure, we continue to see strong customer dollar retention in the high-80s which underscores the value that our unified customer platform delivers for our customers.”

Note that HubSpot implemented a big change to its sales execution strategy in March. The company lowered pricing on its starter packages in order to encourage more users to migrate to paid plans. The company expects this to be an upfront drag to ASPs, but eventually benefit from greater additions in user volume. Management noted that user additions in April were stronger than immediately after the price change in March.

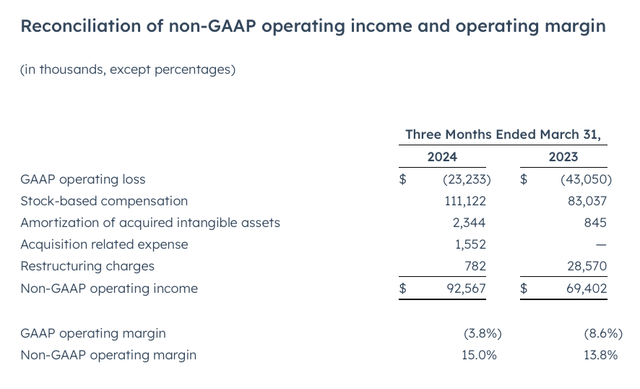

From a profitability standpoint, HubSpot also managed to raise pro forma operating margins to 15.0%, a 120bps increase y/y:

HubSpot operating margins (HubSpot Q1 earnings release)

It’s worth noting that HubSpot continues to hover just around the “Rule of 40” mark, with 23% revenue growth stacked on top of 15% margins – which does help to justify a portion of HubSpot’s premium multiple.

Key takeaways

Acquisition news will likely be a dominant factor moving HubSpot’s stock this year, as fundamental performance on its own seems to be insufficient to excite investors. I prefer to invest in businesses that are trading at low multiples and have solid execution rather than waiting for a takeover scenario to justify my investment, so from that lens, I’m content to watch and wait from the sidelines.