bjdlzx

Downsized small cap oil&gas

Unit Corporation (OTCQX:UNTC), is one of the better-yielding small-cap oil and gas companies in the market with a current yield that exceeds 13%. At one point the yield was borderline ridiculous at well over 20%, that was before the company sold off significant non-core assets and returned the capital to shareholders.

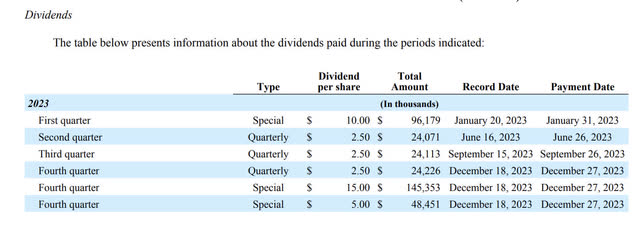

We can see in 2023, the company had $7.50/share of regular dividends and $30/share in special dividends for a total return of capital to shareholders of $37.50/share. This resulted in a year-end yield of 86.85%. However, the shedding of assets now results in a smaller company with lower dividend potential. Even so, the company remains a good debt-free option for investors looking for a big yield on a cheap oil and gas company if you’re bullish on a near-term energy demand crunch.

Details of the most recent asset sale

TULSA, Okla. – On December 13, 2023, Unit Corporation (OTCQX: UNTC) (Company) completed the previously announced sale of certain non-core oil and gas assets in the Texas Panhandle (the “Divested Assets”) to a third party for net cash proceeds received at closing of $50 million, subject to customary post-closing adjustments pursuant to the terms of the purchase and sale agreement.

The proceeds from the sale will be used to fund the Company’s previously announced conditional special cash dividend of $5.00 per share of common stock to be paid on December 27, 2023, to shareholders of record as of the close of business on December 18, 2023.

The Divested Assets consist of approximately 51,000 net acres in the Texas Panhandle held by the Company’s wholly owned subsidiary, Unit Petroleum Company (UPC). UPC is retaining its core Granite Wash properties located in Roberts and Hemphill Counties, Texas.

Phil Frohlich, the Company’s Chief Executive Officer, stated, “This transaction is a great example of our strategy to prune our non-core assets and return value to our shareholders.”

In essence, this company is shrinking and refocusing its attention on core assets, returning both cash on the balance sheet and cash from asset sales to shareholders. The company thesis has been debated a bit about whether this is a liquidation play or whether the new CEO Phil Frohlich intends to maintain and grow the core business.

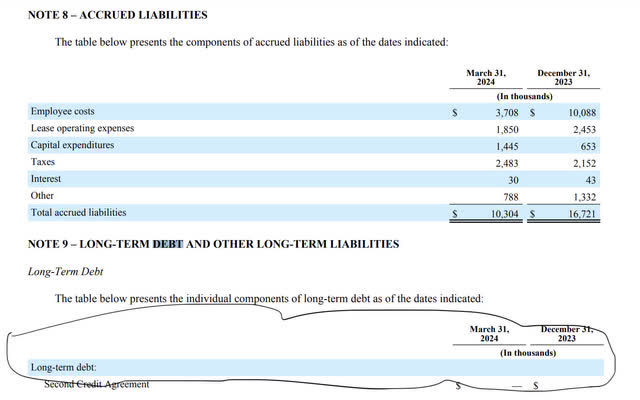

This has also created some skewed trailing dividend numbers and expectations that are probably not going to occur again in the short term. Cash on the balance sheet has been reduced significantly and the company appears to have sold all the assets they had earmarked to sell for the time being. This should be looked at as a small/micro-cap value oil and gas play that is trading cheaply based on its cash flows. Also, a company without any long-term debt is another point of emphasis.

This most recent quarter 2024 vs 2023

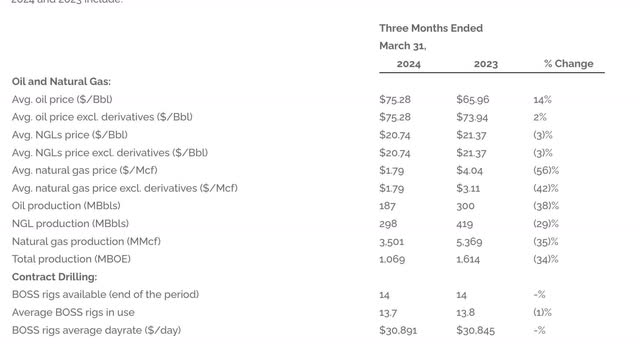

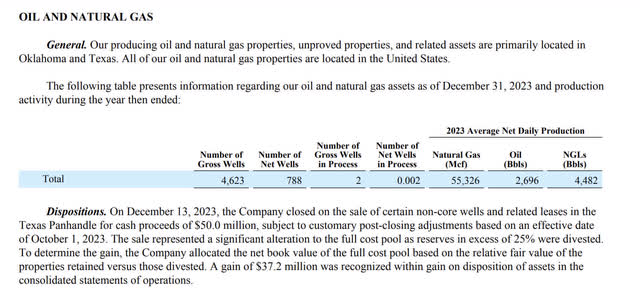

A detailed report of the underlying assets and derivatives that Unit Corporation deals with in comparing the MRQ to the same quarter of 2023 shows some positives and negatives. Firstly, the average oil price per barrel is up 14%, a plus. The second plus is that the company still has 14 BOSS drilling rigs that are almost at full capacity. The average operating day rate is almost the same as in 2023 which means this should be a reliable source of revenue going forward.

The negatives are almost everything in natural gas has plummeted. The price per Mcf is down 56%. The plus to that negative is that natural gas prices are probably near the bottom. As I’ll discuss later in the article, nat gas having a forward demand use case is an interesting thesis that has led me to seek out more natural gas producers that may be undervalued.

Most recent quarter results

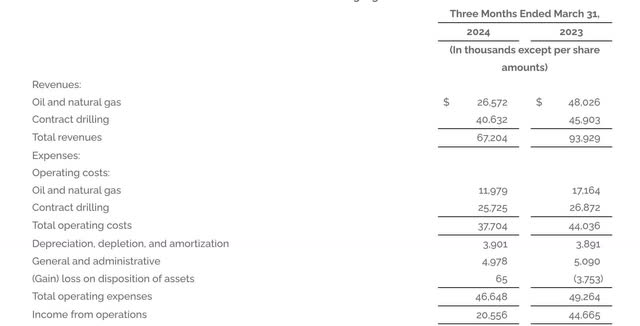

We can see a rather significant drop in revenue year over year at -28%. The biggest decrease is the oil and natural gas segment which dropped -44% year over year by a combination of divestitures and lower nat gas prices. The contract drilling remains the bread and butter in the cash flow equation and remains fairly consistent.

Free cash flow estimates

Free cash flow:

Most recent quarter data from 3/31/2024:

| MRQ cash from operations | 19189 | In thousands of USD | |

| CAPEX | 3442 | ||

| free cash flow | 15747 | 62988 | projected FWD 4 quarters static results |

| 9758 | shares outstanding | ||

| 6.45 | FCF per share |

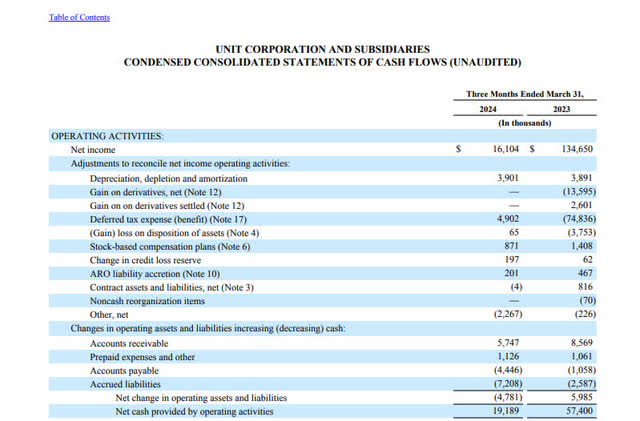

Projecting out static forward results for free cash flow per share shows roughly $15.747 million in free cash flow for the most recent quarter. If nothing improves and stays static, realistic free cash flow for all 4 quarters of the year would be $62.98 million USD or $6.45 a share.

Cash and equivalents update:

Most recent quarter data from 3/31/2024:

In thousands of USD

| proceeds from property disposition | 1853 |

| cash and cash equivalents | 65,599 |

As the company seems to be content running very lean and debt-free, the cash balance is an important part of the balance sheet. With about a year’s worth of free cash flow in the coffers, this could be used to supplement the dividend or shortfalls in CAPEX.

Downsized dividend and coverage

Most recent quarter data from 3/31/2024:

| dividend payments mrq | |

| 12,300 | total dividends paid in quarter |

| 1.26 | divided by shares outstanding |

| 5.04 | static dividend per share going forward |

- Projected FWD yield 13.8%

- Projected FWD FCF $6.45/ share

- Payout ratio of free cash flow = 78.1%

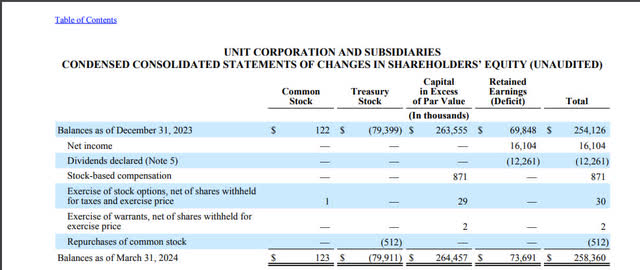

The dividend is covered by free cash flow, but the payout ratio does exceed 60%.

The company updated its dividend policy in March to state the following:

TULSA, Okla – Unit Corporation (OTCQX: UNTC) (Company) announced today that its Board of Directors (the Board) approved a quarterly cash dividend of $1.25 per share for the first quarter of 2024. The first quarter cash dividend will be paid on March 28, 2024, to shareholders of record as of the close of business on March 18, 2024. The dividend will be funded by cash on the Company’s balance sheet.

The Company also announced today that it intends to pay a quarterly cash dividend of $1.25 per share for the second, third, and fourth quarters of 2024.

Phil Frohlich, the Company’s Chief Executive Officer, commented, “We are pleased to be able to continue returning value to shareholders through our dividend policy. In addition to the quarterly dividends, we will continue to consider the possibility of paying another special cash dividend depending on our results this year.”

The declaration and payment of any future dividend will remain at the full discretion of the Board and will depend upon the Company’s financial position, results of operations, cash flows, capital requirements, business conditions, future expectations, the requirements of applicable law, and other factors that the Board finds relevant at the time of considering any potential dividend declaration.

We can see as per the dividend announcement in March, the 13.8% current yield seems to be in the bag for the year. They intend to pay it as per the announcement and have ample cash as a supplement. Any special dividends would probably be due to a rally in the prices of nat gas and oil that creates outsized cash flows. We should also keep in mind that with this being a small-cap, non-listed OTC stock, they could sell assets at any time without the market catching wind of it until it occurs.

Still no long term debt

The above is still my favorite part of the company. Not long term debt. The company is about as straightforward as it comes.

- An oil & natural gas exploration division

- 14 BOSS contract drilling rigs

- No debt

There are some post-bankruptcy spats over previous debtors and warrants, but those risks are outside of my scope of vision. From what I can see, this is a nice undervalued high-yield dividend play.

End 2023 Reserves

New Magic Formula score

- Shareholders’ equity stands at $258,360

- Backing out cash of $65,599 equals $192,761 of invested capital.

- No long term interest bearing debt.

- Net income of $16,104

- Projected forward at a static rate at 4 quarters = $16,104 X 4= $64,416

- $64,416/$192,761=33% ROIC

In this situation, I simply used a static net income projection based on the MRQ.

Using a net income FWD 12 months projected of $6.4 / share would leave us with an FWD P/E ratio of 5.68, or an earnings yield of 17.5%.

The total Magic Formula score based on this assumption would be 17.5+33=50.5.

Keep in mind a number in the 20s would be a really good score, you’d be hard-pressed to find an oil and gas name scoring above 50. While the score has now been reduced to realistic numbers going forward with the return of capital to shareholders post-asset disposition, it’s still dirt-cheap small-cap energy with a big dividend. It may not be cheap solely based on the NAV or book value, but that’s because the assets have an ample ROI.

If interest rates drop and M&A activity picks up, these types of companies could be great targets for larger energy players.

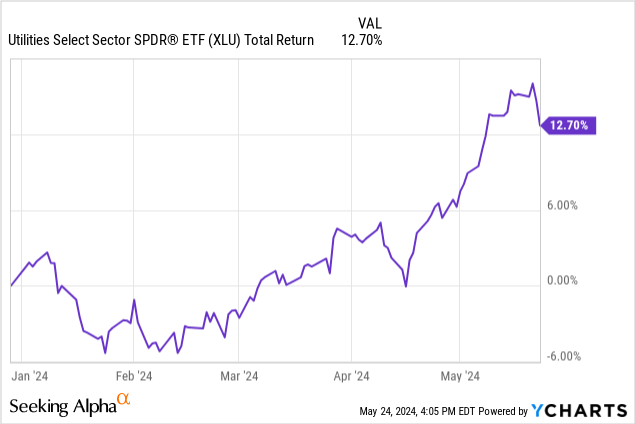

Energy catalysts for electricity demand and Bill Smead

On a recent episode of Compound and Friends, they invited Bill Smead of Smead Capital to discuss some of his market outlooks. He believed the market is due for a flat period for the next decade after this amazing run of outperformance in the previous decade. He is typically a bull but drew up some good analogies. His favorite hedge currently is oil and natural gas, specifically gas as it plays into the current AI chasing.

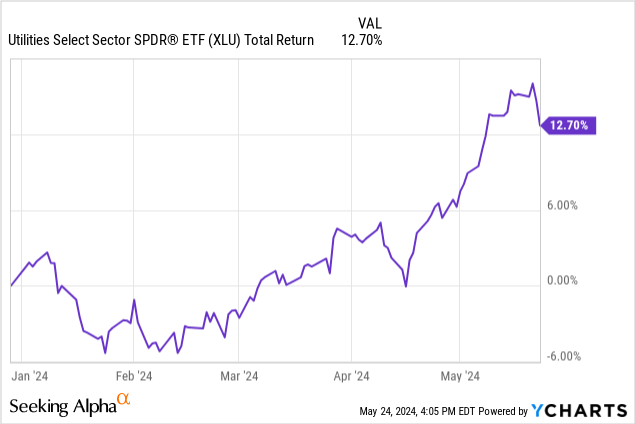

Utilities have risen because the market is anticipating data centers needing more power than ever to run all of these large language and other AI models. Natural gas still makes for the majority of electricity production in the U.S.

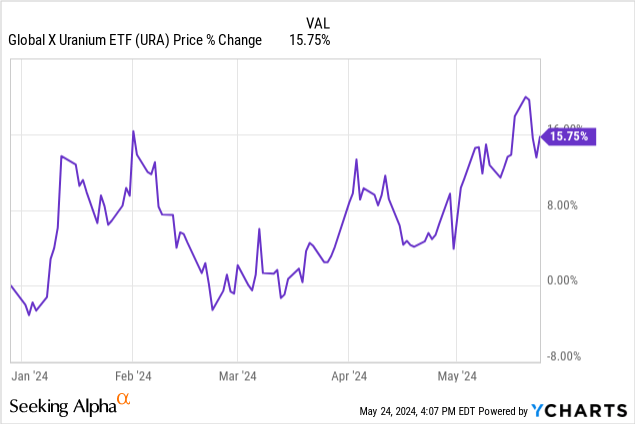

Uranium has been another segment that has rallied assuming that the world is about to re-start nuclear power plant production on a massive scale to accommodate data centers and EVs:

From the U.S. Department of Energy:

Production

According to the U.S. Energy Information Administration, most of the nation’s electricity was generated by natural gas, renewable sources, coal, and nuclear energy in 2022. Renewable sources of electricity include wind, hydropower, solar power, biomass, and geothermal. Together, these sources generated about 20% of the country’s electricity in 2022.

With Natural Gas still being the most prevalent source of electricity, it would seem it’s only a matter of time before demand materializes. With the Mag 7 expected to spend hundreds of Billions on CAPEX focused squarely on data centers running high numbers of GPUs and other chips, energy seems to be very undervalued at this time. Unit Corporation is just one example of many.

Risks

Any OTC stock is a risk due to accounting practices and fewer requirements for disclosure than a stock listed on an exchange. Unit Corporation puts out very detailed and professional unaudited reports, but they do lack the scrutiny of other Nasdaq or NYSE listed companies. Oil & Gas can be volatile commodities and the contract drilling rigs are mechanical equipment that could hinder revenue should one or more break down and need lengthy repairs.

Summary

I originally found this on Joel Greenblatt’s Magic Formula screener and have been learning more and more about the stock with each passing quarter. There is a solid contingent of investors on Seeking Alpha that follow the stock and I enjoy bouncing thoughts and questions off them. I like the stock and still consider it a buy. They have announced the intention to pay $1.25 per quarter for the remainder of the year and there is nothing in their cash flow statements or balance sheet that would lead me to believe that they can’t pay it. Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.