John D

Founded in 2013, Rigetti Computing (NASDAQ:RGTI) is a company developing full-stack quantum supercomputer services available through its cloud-based platform, Forest.

Having gone public through a SPAC transaction in 2021, share performance has been disappointing so far. Trading around $9 price level back then, the stock has lost -89% of its value since. Currently, RGTI is trading at $1 price level. Nonetheless, RGTI has gained some momentum YTD, with the stock up about 16% YTD so far.

I rate the stock a buy. My 1-year price target of $1.4 per share projects about 35% upside. At this level, RGTI presents a decent buy opportunity. In my opinion, the recent QPU partnership program launch will benefit RGTI significantly, allowing it to unlock and capture greater opportunities in the quantum computing industry in many ways. Risk-reward seems attractive.

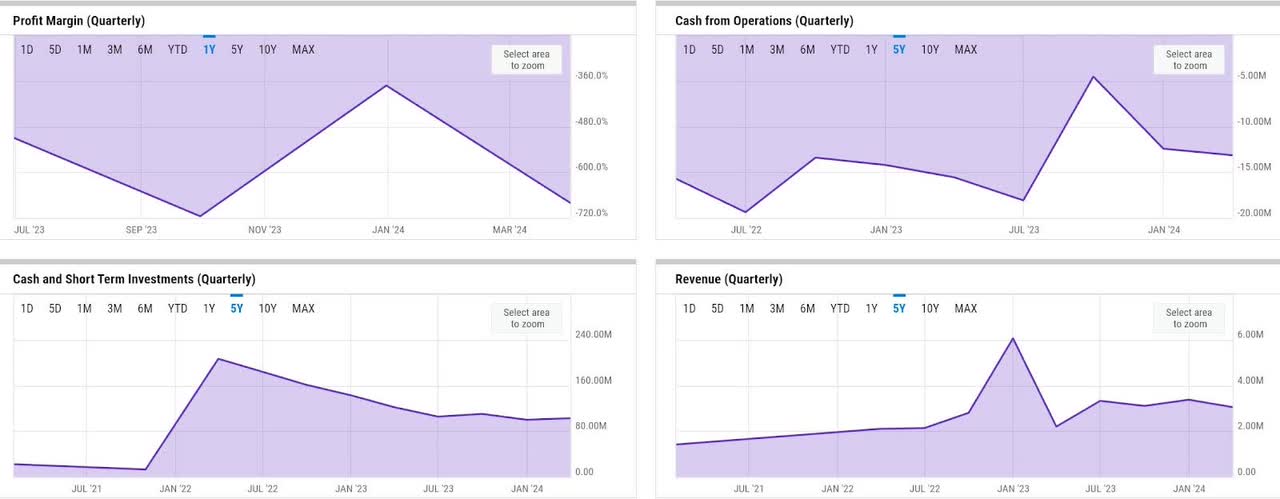

Financial Reviews

As in any company developing a very novel and disruptive technology, I consider RGTI to be in an investment phase today. In Q1, RGTI generated over $3 million of revenue, a 39% YoY growth. Its revenues are mainly driven by the technology development contracts and QPU sales. As a company in the investment phase, RGTI spends a lot on R&D. In fact, R&D spend was more than three times its revenue as of Q1, driving -$16.5 million of operating loss in the quarter. However, operating and net loss narrowed by -25% and -10% in Q1, suggesting a considerable improvement there. The consistent losses have been driving negative operating cash flows (OCF). Though OCF losses also have narrowed in the last five years, RGTI still appears a bit far away from turning cash flow positive. This has put pressure on liquidity since going public, though the liquidity level has been relatively steady as of late. In Q1, RGTI even saw a small uptick of liquidity, having ended the quarter with over $102 million of cash and short-term investments. Primarily, the $20.7 million cash injection from the common stock issuance has helped RGTI boost liquidity in Q1.

Catalyst

In my opinion, the recently launched Novera QPU partnership program should position RGTI well in not only advancing the quantum computing industry further but also driving more QPU sales going forward.

Since the quantum computing industry is still at a very early stage, I believe ecosystem development approach through partnerships to advance technology development across various parts of the stack is a strategic move. First off, it should cement RGTI as a leading name in the field, further allowing it to be in a position to secure dominant market share in the future.

Secondly, as commented by the management in the Q1 earnings call, partnerships will allow the industry to advance further and faster. This could be due to the fact that Quantum computing is a complex technology that requires deep focus on a particular part of the stack to achieve continuous improvements more rapidly:

fundamentally believe open modular approach is the right way to allow innovation to come in faster. So, we are allowing other partner companies to develop what they are good at. For instance, we have partnered with Riverlane in Cambridge, UK, who is very good at error correction. And we have partnered with Quantum Machines in Israel and Zurich Instruments in Switzerland, who are very good in control systems. So, we are allowing our QPU to interface with other parts of the stack from other companies. We think that’s the right approach to develop a quantum computing system in a faster and more efficient manner.

Source: Q1 earnings call.

Last but not least, I believe the success of the partnership program should indicate future revenue growth, since the most obvious early adopters of the on-premise quantum computing solution would be one of the partners in the program. In Q1, we saw this happening when RGTI made the Novera QPU sales to Horizon.

Risk

Given the relatively early stage of the technology today, RGTI remains a very high-risk investment opportunity, in my opinion. For instance, as commented by the management in Q1, in addition to the industry still being in the development phase as of today, further education about the current and potential state of the technology to potential customers remains important to manage the expectation:

Overall, if you look at the number of customers, we have active discussions going on right now, it’s in the neighborhood of 10 to 15 customers. We also make sure that, A, they are funded, B, they are serious, they understand their quantum computing is. Clearly, we are not at a point where quantum computers can demonstrate superiority over classical computers today. So, these are primarily for research purposes. So, we make sure that the customer understands what exactly they are going to get, and they are going to get value out of it before pursuing every single lead that we get.

Source: Q1 earnings call.

As such, it is important to note that the potential TAM for RGTI will be quite limited in the near term. Furthermore, since RGTI may continue to see relatively high R&D spend as % of revenue, investors interested in the stock should also anticipate further share dilution going forward. In my opinion, RGTI will still rely on financing cash flow as opposed to OCF generation in the near to medium term.

Valuation / Pricing

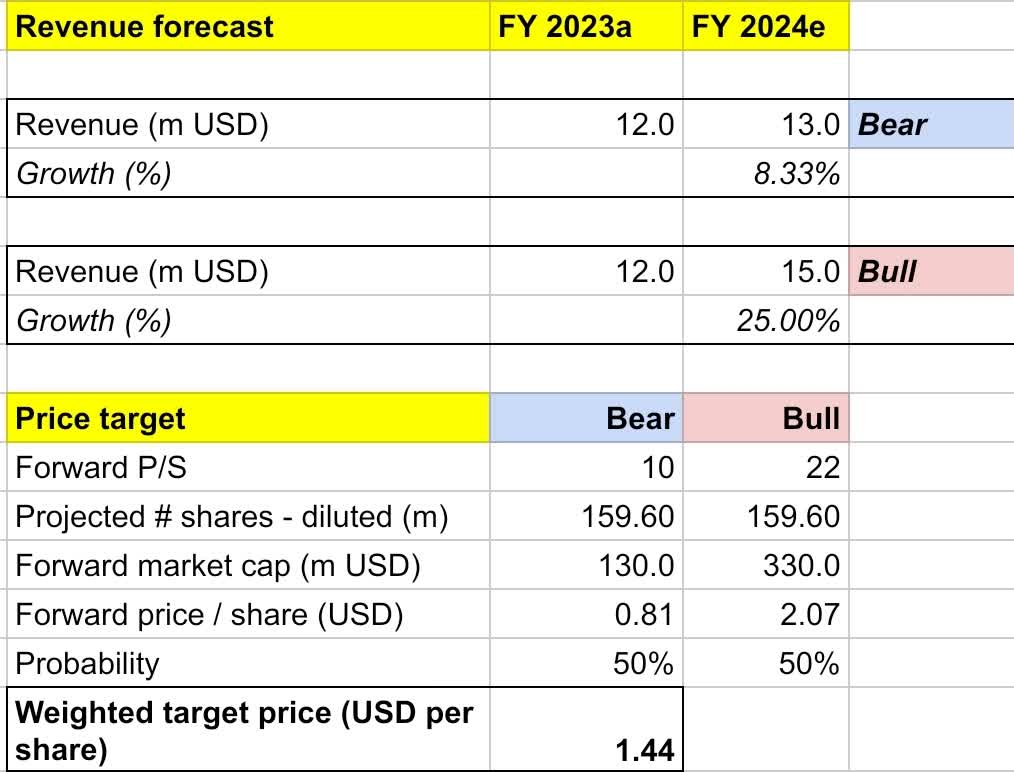

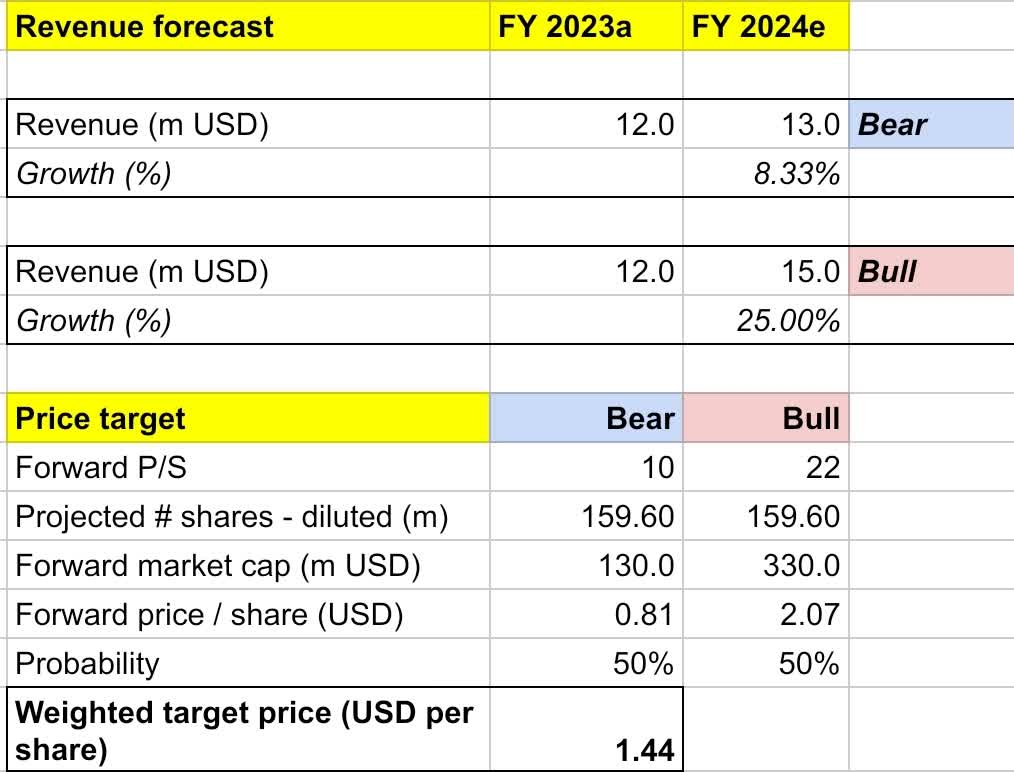

My target price for RGTI is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – I expect revenue to grow by 25% YoY to $15 million, in line with the market’s estimate. I assume forward P/S to expand to 22x, implying a share price appreciation to $2 price level, back to YTD high. I assume that RGTI’s P/S will reach its YTD high once it is able to deliver 25% YoY revenue growth, a significant rebound from 2023.

-

Bear scenario (50% probability) assumptions – RGTI to deliver FY 2024 revenue of $13 million, an 8.3% YoY growth, which is $1 million lower than the consensus’ low-end target. This will result in a potential correction to $0.8 per share.

own analysis

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $1.44 per share, a projected 1-year upside of about 35%. I would rate the stock a buy.

My 50-50 bull-bear probability assignment is based on my belief that despite the promising development so far, revenue growth visibility remains minimal to moderate. However, I believe that RGTI appears undervalued. Having seen a slowdown in 2023, the company appears to be on track to see higher revenue growth and improved bottom-line performance in 2024. Though the company still burned through about $13 million of OCF in Q1, the $102 million of liquidity should provide more than enough cushion to continue executing at the current level into the FY.

Conclusion

RGTI is a company developing quantum supercomputing services. It should continue to benefit from the recently-launched partnership program, which attempts to bring in all the leading names in quantum computing across the technology stack under one ecosystem. This should not only benefit RGTI through unlocking more QPU sales opportunities, but also through advancing the technology to speed up commercialization. Risk remains very high, given the novel and developing nature of the industry. Nonetheless, risk-reward could be attractive, in my view. My price target of $1.4 per share projects about 35% upside. I rate the stock a buy.