acavalli/E+ via Getty Images

Investment Thesis

Even with all the positive developments in China, there is a lack of enthusiasm toward Alibaba’s (NYSE:BABA) stock, reflecting the market’s stubborn pessimism. The key developments, including new capital market policies likely soon to be announced by the China Securities Regulatory Commission, $42 billion pledged by the People’s Bank of China to prop up the real estate sector, and revised-up GDP growth forecasts for China by the IMF—have yet to be fully priced in by investors.

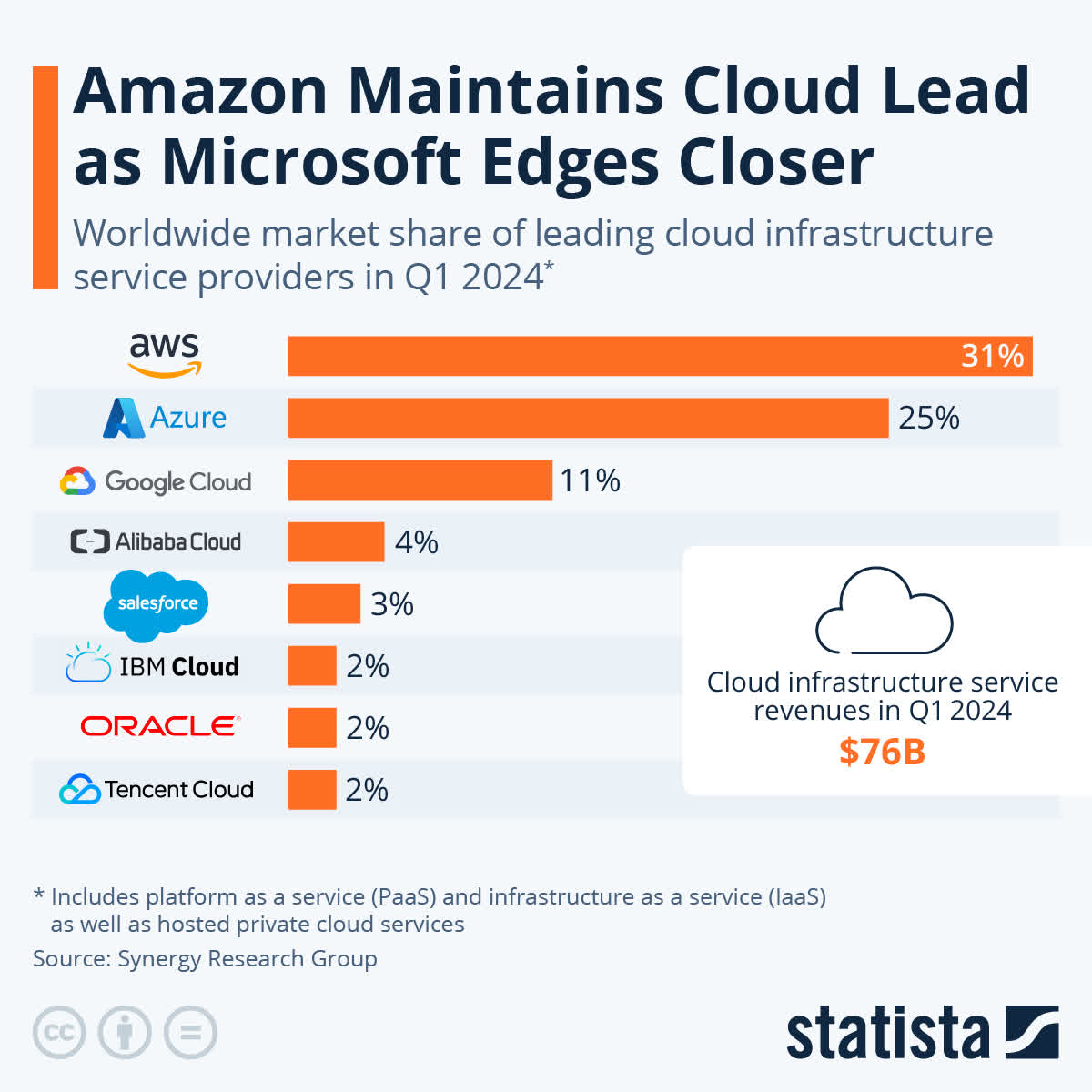

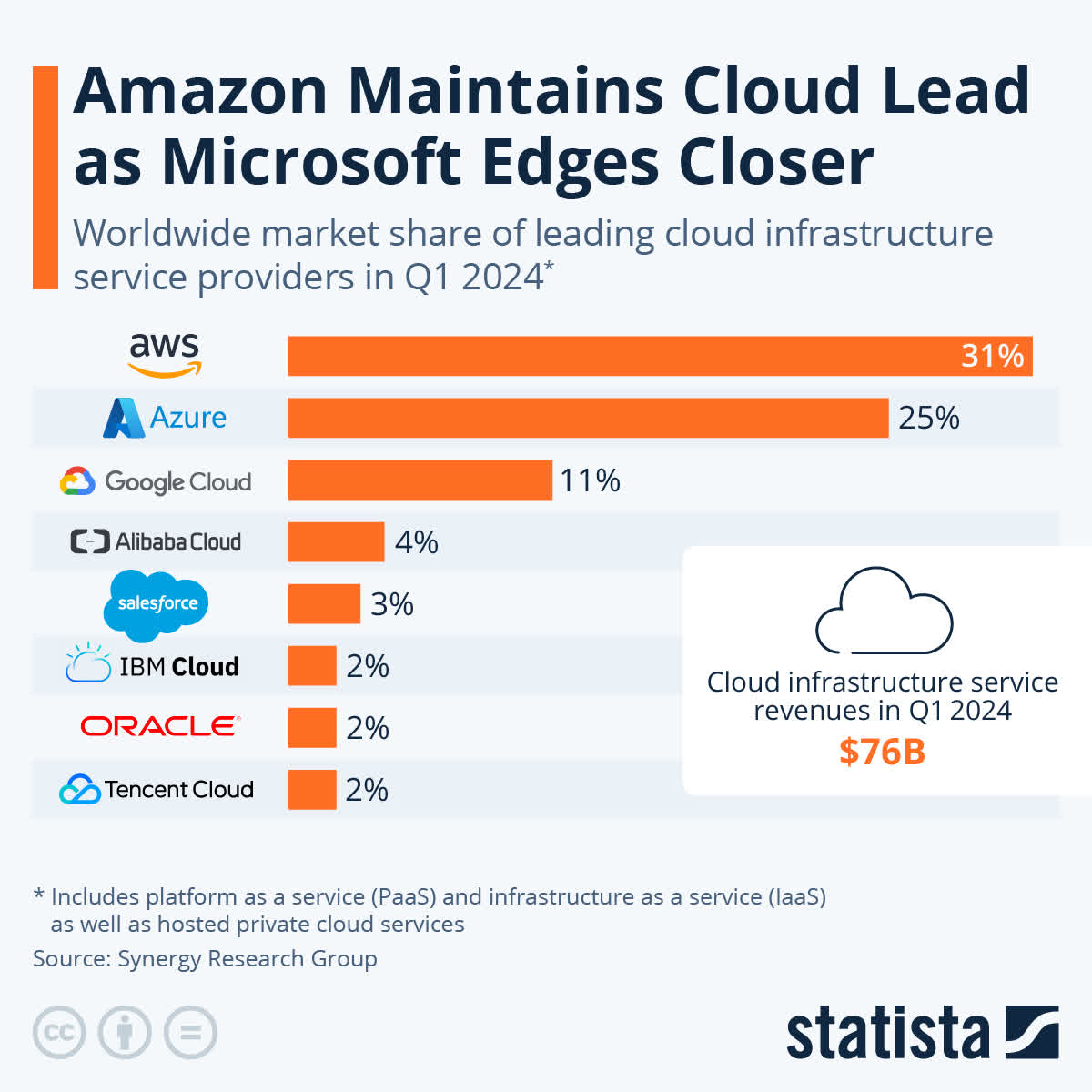

Moreover, Alibaba’s strategic investments in AI start-ups and the fact that the Chinese cloud sector could grow from $32 billion in 2021 to $90 billion by 2025, sets up the company for significant future gains. These are some of the drivers that underline how the market already misprices Alibaba based on its core strengths.

Since our last coverage, BABA has remained muted. Even though the market still looks gloomy and Alibaba has likely been tagged as a “value trap,” my long-term view of the company remains intact. Alibaba is positioning itself strategically for many years of growth, focused on AI and cloud services, which are supposed to drive tremendous revenue. The pessimism of the market in BABA presents an excellent buying opportunity for long-term investors, as it has continuously penalized the stock regardless of positive or negative developments.

Finally, China’s broader economic improvements support Alibaba’s potential for a powerful rebound, given its robust infrastructure and innovative investments.

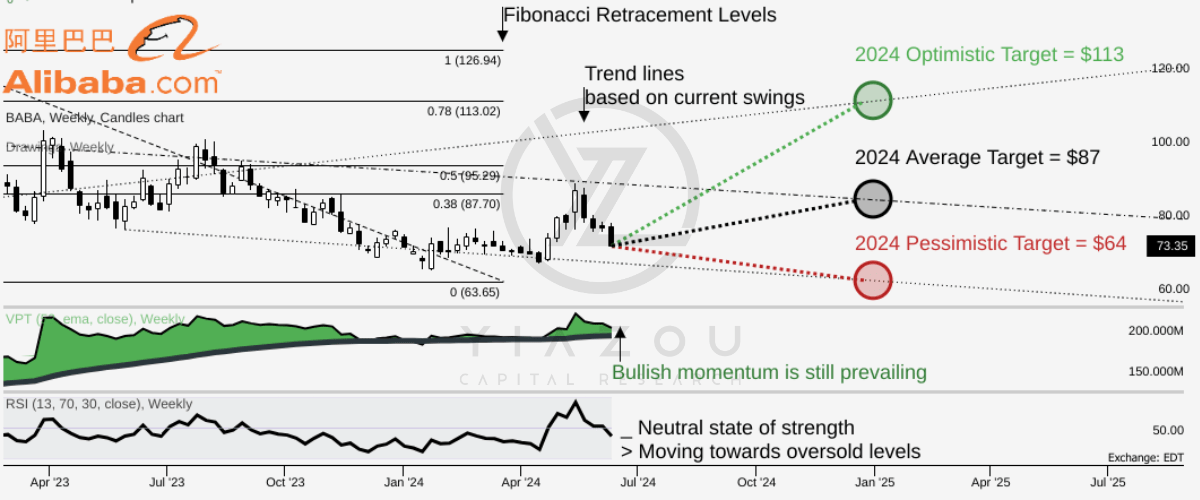

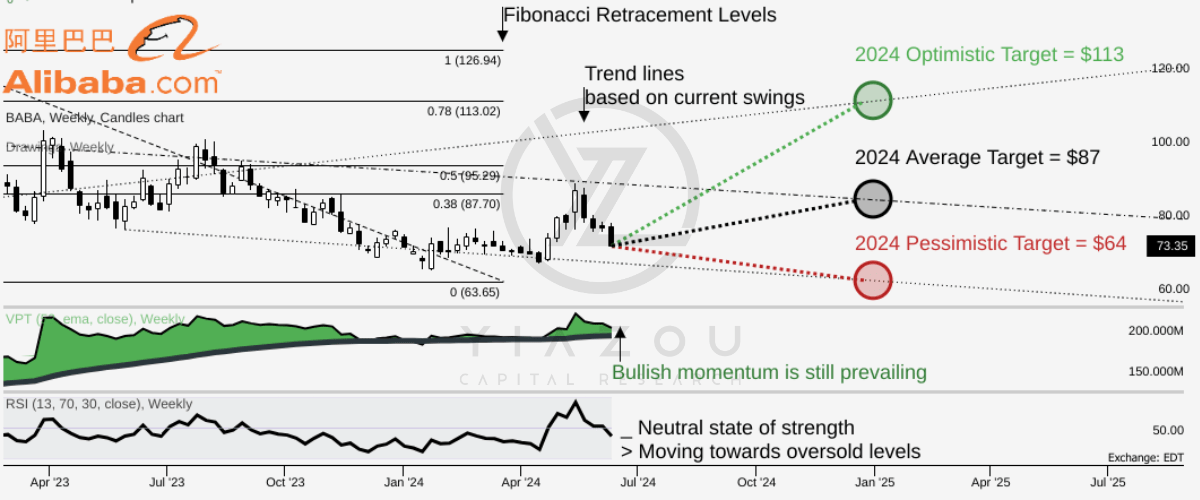

Mid-Term Downtrend with Bullish Momentum to $113 by Year-End

BABA is experiencing a downtrend over the mid-term. Currently trading around $73, the stock may hit $87 by the end of 2024. This is an average price target based on the mid-term trend in price swings projected over the Fibonacci retracement (0.38 level).

Optimistically, the stock price may reach $113 by the end of the year. The target is based on the mid-term trend in change in polarity in line with the 0.78 Fibonacci level. On the downside, the price may be near $64 (critical mid-term support). This pessimistic price target represents the prevailing weakness in the price strength.

Looking at the relative strength index (RSI), at 45, signifies neutrality in the stock price strength. The trend in the RSI line is downward, which points to further potential downside for the stock price in the short term. However, the volume price trend (VPT) signifies resumed bullish momentum in the stock price. This momentum may last for the remainder of the year, justifying the possibility of materializing a technical bullish perspective (average or optimistic price target) in the short term.

trendspider.com

Rise of China and Its Implications on Big Tech and Alibaba

Scholars like Alvin Toffler, Francis Fukuyama, and Paul Kennedy, in the second half of the 20th century, constructed grand narratives estimating developments of trends in society that encompassed significant sectors: ideology, technology, religion, and culture.

Macro historians predicted considerable changes in economics, power relationships, and geopolitics. Of course, no one has predicted how China would rise to challenge US dominance on the world stage. The late 20th-century development evaded these grand narratives, which, according to postmodernist critics, were Eurocentric in approach and ignored diverse cultural standpoints. The surprise over the recent rapid modernization of China needs to be put in a historical context—where it was essentially the largest economy in the world for much of recorded history, only overtaken by the US at the end of the 19th century.

Perhaps more astonishing is that China did this in fewer than 50 years, while it took the West two centuries to industrialize. More recently, China has shifted production from low-cost products to sophisticated electronics and green technology, which are produced with the help of robotics and AI.

In the book “When China Rules the World,” Martin Jacques commented that many predicted it would dramatically alter the political and cultural world order when China rose economically. It was against these economic changes in China that one of the critical participants of this change, Alibaba, was cashing in to consolidate its position. The rollouts of capital market policies by the China Securities Regulatory Commission and the $42 billion commitment by the People’s Bank of China to help the real estate sector were part of these more extensive economic reforms.

These measures come in addition to the revised GDP growth forecasts by the IMF for China, and investments by Alibaba in AI start-ups point toward a massive gap between potential and current market valuation. Alibaba’s shift to AI and cloud services, currently underway with the strategic focus of CEO Eddie Yongming Wu, has made the company adapt to new economic scenarios unfolding in China. Even though the “value trap” label was tagged, owing to the pessimism in the market, the infrastructural setup and strategic investments that Alibaba has made point to a solid long-term outlook.

As the company responds to increased competition and regulation challenges, Alibaba’s AI and cloud infrastructure investments could position it for massive future gains. As internet giants in China dominate AI financing, Alibaba’s strategic moves may drive colossal growth. The current undervaluation of Alibaba by the market is a good setup for long-term investors, since the company will benefit from China’s economic growth and technological development.

China Prepares for Bold Reforms to Tackle $13 Trillion Debt and Ignite Economic Revival

China is on the verge of dramatic economic reforms to handle its $13 trillion debt problem, which emerged from local government financing vehicles and a troubled property sector. The big headaches brought by these two issues now combine with global uncertainties to create a precarious economic scenario. However, the upcoming policy meeting in mid-July could mark a turning point as China’s leadership plans to address these problems head-on.

While economic problems plague China, the property crisis seems overhyped about far broader debt issues that envelope its municipalities nationwide. Given the explosion of LGFVs—with most off the balance sheet —it explodes almost at near parity with China’s annual Gross Domestic Product.

Understandably, this has made global investors wary about the intrinsic strength of China’s economic foundations, much less during these unusually uncertain times. With high US bond yields, Japan is teetering toward recession and stagnation in Europe. The second half of 2024 is a different propitious time for China to crank up exports. However, there is one source of optimism. Reports suggest that Xi Jinping’s Communist Party is possibly ready to tackle the LGFV debt bomb at a long-delayed economic strategy session scheduled for July 15-18.

The Third Plenum is likely to include reforms that allow local governments to retain more of the fiscal revenues they generate, which are directly accruable to Beijing. This is a radical step toward more excellent financial stability, investment in high-value-added manufacturing sectors, and stimulus to domestic consumption. Mainlanders save more than they spend, owing to a lack of social safety nets. More significantly, increased revenues would give local governments a more leisurely time investing in innovation and productivity-enhancing industries with less reliance on property and land sales to keep them afloat, reducing the need for debt issuance.

Therefore, if the economic reform is successful, it should enhance financial stability, stimulate domestic consumption, and boost investment in high-value sectors, aligning with Alibaba’s strategic focus on AI and cloud computing. This improved economic landscape could increase demand for Alibaba Cloud’s services and bolster consumer spending on its e-commerce platforms, positioning the company for sustained growth amidst reduced financial uncertainties.

Cloud Fuels Rapid Growth with Strategic AI Start-Up Investments

Alibaba Cloud is poised for rapid growth by strategically investing in China’s leading AI start-ups and leveraging its extensive cloud infrastructure. Instead of traditional cash-for-equity funding, Alibaba provides these start-ups with cloud computing credits, addressing the scarcity of advanced cloud resources in China due to US export restrictions on advanced chips. This approach is more valuable in the Chinese market and positions Alibaba as a crucial backer of AI innovation. CEO Eddie Yongming Wu’s focus on AI investments underscores the company’s commitment to reinventing itself as an AI leader, aiming to replicate Microsoft’s success with OpenAI by taking stakes in prominent start-ups like Moonshot, Zhipu, MiniMax, and 01.ai.

Moreover, Alibaba Cloud’s strategic moves come at a pivotal time, as it grapples with rising competition in its core e-commerce market and seeks new growth avenues. By investing heavily in AI and cloud infrastructure, Alibaba aims to capitalize on its stockpile of AI chips, ensuring they are utilized before losing value due to upcoming US restrictions. This investment strategy boosts Alibaba Cloud’s revenue and solidifies its role in China’s AI ecosystem. As domestic internet companies, including Alibaba, dominate AI financing due to strained US-China relations and a downturn in China’s VC industry, Alibaba Cloud is set to benefit from increased demand for cloud services and AI advancements, fueling its growth.

statista.com

Takeaway

Despite the market’s persistent pessimism towards Alibaba’s stock, the company’s strategic investments in AI start-ups and the burgeoning Chinese cloud sector present significant long-term growth opportunities. Alibaba is well-positioned to benefit from China’s anticipated economic reforms, which aim to enhance financial stability and stimulate domestic consumption. These reforms, combined with Alibaba’s focus on AI and cloud services, could increase demand for its offerings and drive substantial future gains. This undervaluation by the market provides a prime buying opportunity for long-term investors, as Alibaba’s robust infrastructure and innovative investments set the stage for a powerful rebound.