sasacvetkovic33/iStock via Getty Images

Introduction

I’m not breaking any news when I say that energy is one of our most-discussed segments on Seeking Alpha – mainly because I’m currently such a big fan of the value these companies bring to the table.

This mainly includes upstream producers, midstream pipeline owners, refiners, and royalty companies.

I have neglected oil and gas service and equipment providers, with one exception: SLB Ltd. (NYSE:SLB), which was formerly known as Schlumberger.

On April 3, I wrote an article titled “Champion Move: Why SLB’s Acquisition Makes It An Even Bigger Steal.”

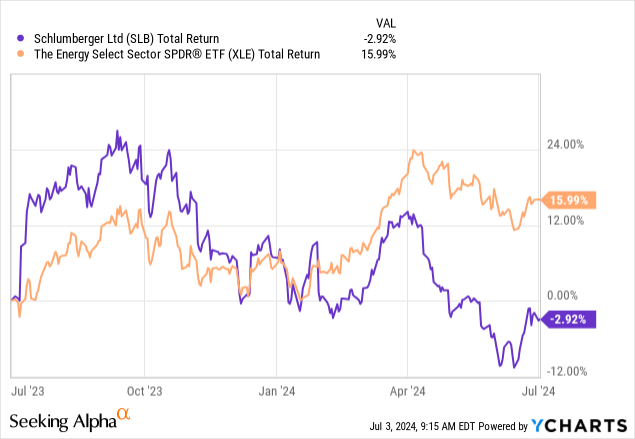

Unfortunately, SLB shares are down 14% since then, lagging the S&P 500 (SP500) by roughly 20 points.

Over the past 12 months, SLB has lagged The Energy Select Sector SPDR® Fund ETF (XLE) by almost 20 points as well, as it has failed to “catch a bid” in a market that has become increasingly favorable for energy equities.

The good news is that SLB is in a great spot to generate value, including new deals with major operators like TotalEnergies SE (TTE).

In this article, we’ll discuss all of that and more as I explain why I believe SLB continues to offer tremendous long-term value.

So, let’s get to it!

The New SLB Is Impressive

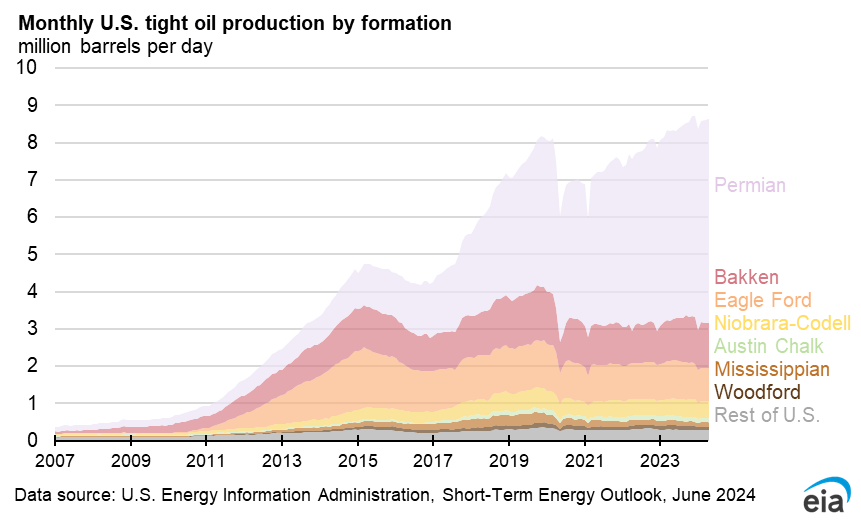

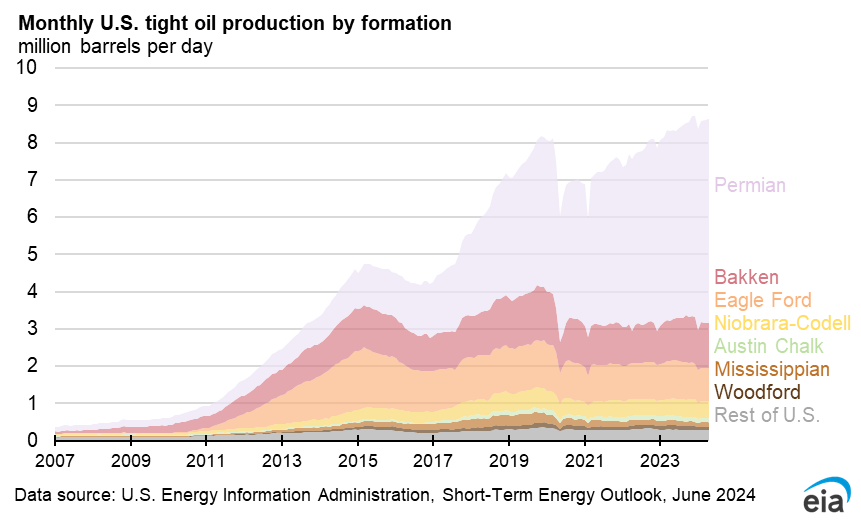

Generally speaking, I’m a bigger fan of oil producers than suppliers of equipment. That is based on the end of the U.S. shale revolution. While output is still growing in attractive regions like the Permian Basin, the rapid growth we witnessed before the pandemic is gone.

This has shifted pricing power back to OPEC and supported oil prices due to lower supply growth risks. Especially the wave of mergers in the U.S. Permian has caused fears that major producers will cut CapEx to focus on high-quality reserves.

Energy Information Administration

Based on this context, earlier this year, Bloomberg wrote that because of this shift, the world’s biggest contractors are looking to find growth in other areas.

Demand for oilfield services is growing elsewhere, particularly offshore and in the Middle East. After the collapse in spending following the pandemic, international markets are in the midst of a multiyear expansion in capital expenditures.

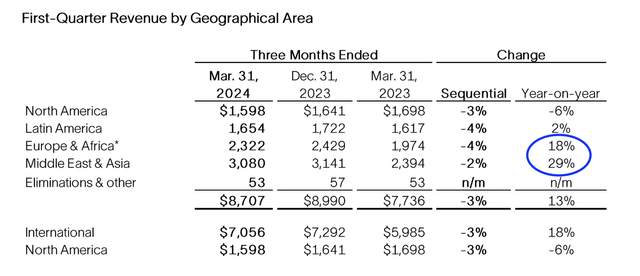

That, according to Le Peuch, will more than offset the slump in North America, where SLB’s sales declined 6% in the first quarter.

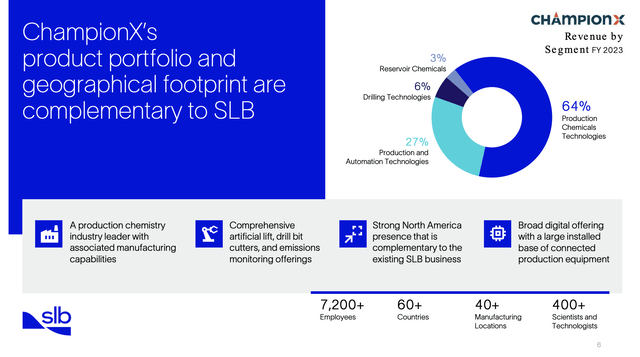

As part of this transition, SLB isn’t sitting still. As I discussed in my prior article, it bought oilfield service rival ChampionX in a deal of almost $8 billion.

This deal diversified SLB’s business, allowing it to capture more growth in the production chemicals area, which helps companies generate more money from their reserves.

In addition to aggressive innovation in artificial intelligence, which EY said, “has the potential to unlock efficiencies across the oil and gas value chain,” the company is in a fantastic position to benefit from growth in the U.S. and abroad.

In light of these deals, the company just announced a 10-year partnership with TotalEnergies, one of the largest energy companies in the world.

According to SLB, the two giants aim to co-develop scalable digital solutions to enable TotalEnergies access to energy resources with improved performance and efficiency.

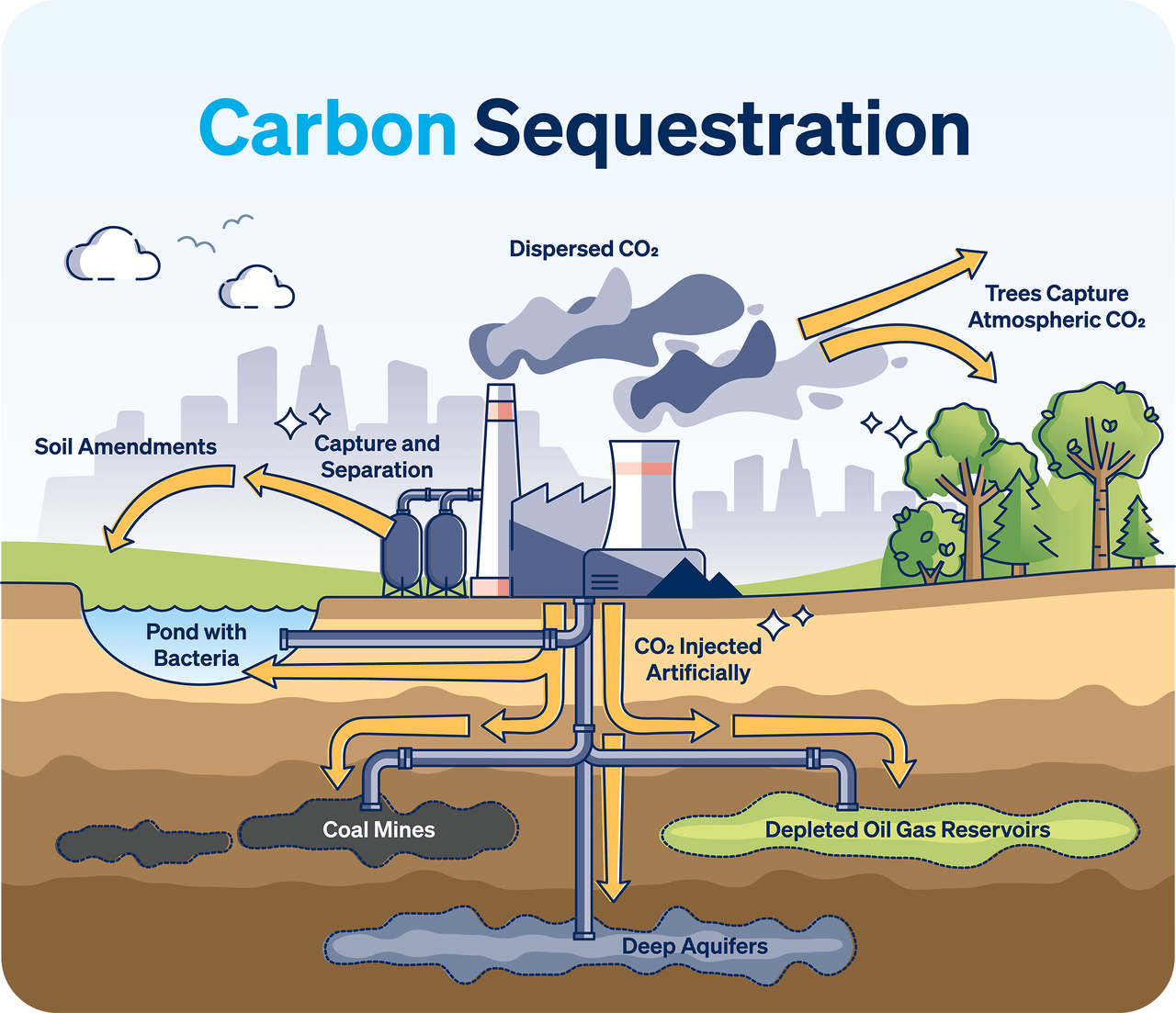

They aim to work together across the entire energy value chain, including carbon capture, utilization, and sequestration.

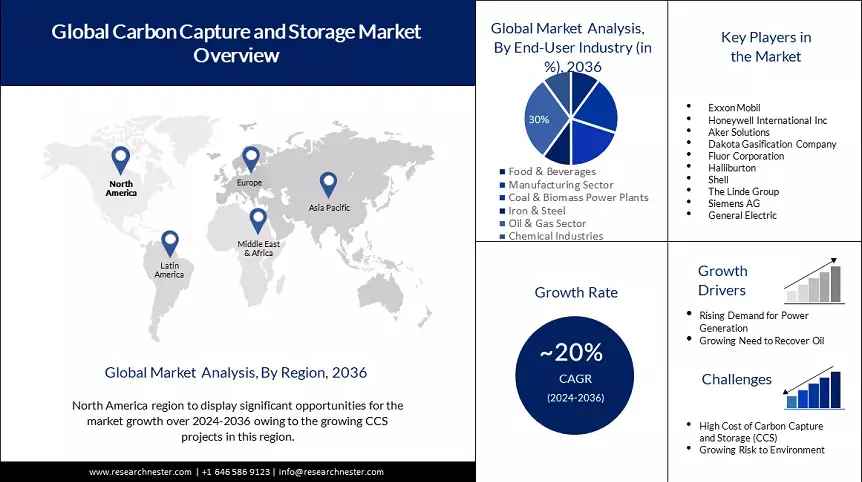

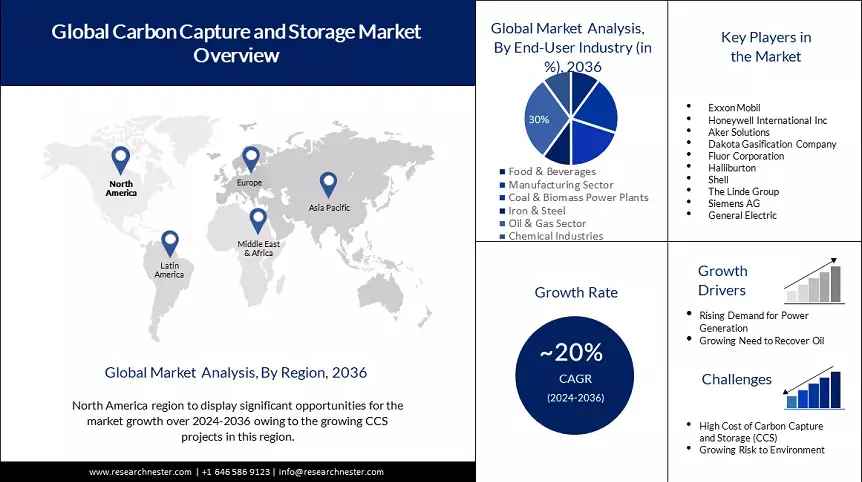

Although I am not a big fan of the carbon capture market, current estimates are that we’re dealing with a segment capable of growing by 20% annually through 2036.

ResearchNester

Moreover, the company will integrate a wide range of other capabilities to help TTE, including the aforementioned artificial intelligence.

The companies will integrate advanced digital capabilities, including artificial intelligence (AI), with new and existing applications on SLB’s extensible Delfi™ digital platform, adhering to the Open Group’s OSDU® Technical Standard. SLB and TotalEnergies will combine digital and domain expertise to accelerate the development and deployment of digital solutions at scale. The co-development will benefit TotalEnergies’ global operations and SLB’s worldwide customer base. – SLB Ltd.

Essentially, TTE will be in a better spot to find untapped reserves, streamline its entire production process, and reduce its carbon footprint.

In general, SLB believes it is in a good spot to grow, as it used its first-quarter earnings release to explain that “the oil and gas industry continues to benefit from strong market fundamentals driven by a growing demand outlook.”

Moreover:

This is resulting in a significant baseload of activity, particularly in the international and offshore markets, closely aligned with the strengths of our business. As the cycle persists, we expect operators to increase their investments in production and reservoir recovery, with the goal of maximizing the efficiency and longevity of their producing assets. This will result in operating expenditures becoming an increasing part of global upstream spending over time.

Especially the Middle East and Europe/Africa are showing outperforming growth, with the Middle East revenue being almost twice as high as North American revenues.

In other words, even if North American activity remains subdued, Middle East growth should be able to significantly grow SLB’s bottom line.

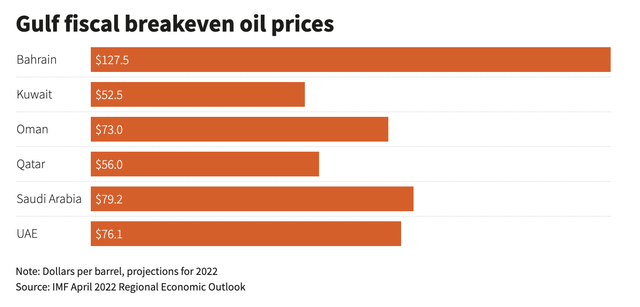

Speaking of the Middle East, using the most recent data (2022) from the IMF (via Reuters), we see that most Middle-East nations are now expected to generate a considerable surplus from oil operations, as Brent is comfortably trading in the mid-$80 range.

Especially the Saudis are now in a great place, which benefits investments in CapEx and should provide SLB with some momentum going forward.

This bodes well for SLB shareholders.

Finding Deep Value In SLB

SLB, which currently yields 2.4%, raised its full-year shareholder return target to $3 billion, which is expected to be evenly split between buybacks and dividends and translates to roughly 4.5% of its market cap.

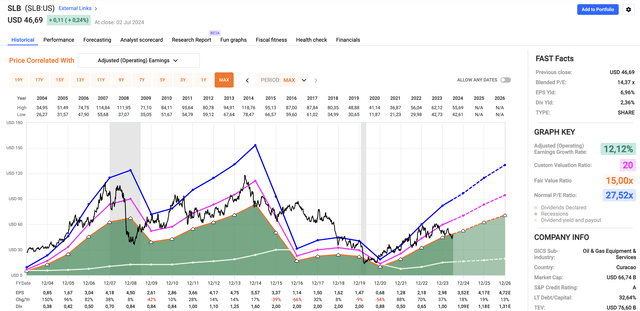

Moreover, analysts agree with my bullish view, as SLB is expected to grow its EPS by 18% this year, potentially followed by 19% and 13% in 2025 and 2026, respectively. These are FactSet numbers used in the chart below.

Even better, after its recent stock price decline, SLB trades at just 14.4x earnings, a mile below its long-term normalized P/E ratio of 27.5x.

That’s remarkable, as we’re likely looking at the strongest and most consistent EPS growth streak since the end of the Great Financial Crisis.

Even a 20x multiple would imply a stock price of more than $90, roughly twice its current price.

Given the company’s transition, focus on next-gen technologies, smart M&A, and deals with the industry’s biggest operators, I believe the stock won’t be cheap for long, especially if oil prices continue to trade in the $80-$90 range.

The only reason I’m not buying is because of my focus on upstream companies, which is an area I prefer over equipment and service providers.

Takeaway

While SLB has faced challenges, its strategic moves and partnerships, particularly with TotalEnergies, place it in a prime position for long-term growth.

The company’s diversification into production chemicals and artificial intelligence, in addition to strengthening international demand, especially in the Middle East, supports its potential.

Furthermore, I believe SLB’s attractive valuation, strong projected EPS growth, and commitment to shareholder returns make it a compelling investment opportunity.

Despite my preference for upstream companies, SLB’s impressive transition and market positioning put it in a great spot to deliver potentially elevated returns on a prolonged basis.

Pros & Cons

Pros:

- Strategic Partnerships: SLB’s partnership with TotalEnergies positions it well for future growth.

- Diversification: The acquisition of ChampionX diversifies SLB’s business, allowing it to tap into attractive production chemicals and expand next-gen tech like AI.

- International Demand: Strong growth in the Middle East and offshore markets will offset sluggish North American activity, boosting SLB’s bottom line. However, I also expect North American demand to rebound.

- Valuation: Trading at just 14.4x earnings, SLB is a bargain compared to its historical P/E ratio, with significant upside potential.

- Shareholder Returns: With a 2.4% yield and a $3 billion return target, SLB is committed to rewarding shareholders through buybacks and dividend growth.

Cons:

- Underperformance: SLB has lagged the S&P 500 and energy ETF XLE, showing a 14% decline since my last article.

- North American Weakness: Sales in North America have declined, and the U.S. shale revolution’s end limits domestic growth opportunities.

- My Doubts On Carbon Capture: While SLB is investing in carbon capture, I remain cautious about its long-term market potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.