rzelich

Dear subscribers,

I have for some time covered self-storage and storage REITs, and my two main investments in the NA geography here are National Storage (NYSE:NSA) and Public Storage (PSA). This article will be an update on National Storage, a company that since my last piece on the company has seen a significant outperformance of over 20%.

This, and the subscriber/reader request for an update, warrants me updating my thesis on NSA at this time, and showing you why I’m still of a positive mindset as to this company.

When last reviewing National Storage Affiliates, I made a point of not, at the time, having massive exposure to the self-storage space. Since that time, I’ve allowed myself increased exposure based on attractive valuations. I’ve taken advantage of companies, including NSA, dropping as the pressure on the market has increased. I’m not talking about the self-storage market specifically, but all markets.

So I’m happy to say that the outperformance in this particular case has certainly paid some attractive dividends, and I’m of a mindset to continue investing here if the company continues to show attractive trends.

Let’s look at what we have as of 1Q24.

National Storage Affiliates – The REIT shows us upside

There are a few key differences between NSA and PSA. One of the primary relevant ones is that NSA, unlike PSA, isn’t estimating growth for the next two years, but an FFO decline. This continues to be the case as of this time – but this does not mean that the company is not investable.

It’s all about pricing the REIT for the growth that’s estimated and then making sure you’re getting “value” at the right price.

What I focus on when I now look at NSA, is that the company’s progress on the strategic initiatives is good – because we obviously want the company to get away from the “declining FFO” sort of trend.

NSA has addressed this with asset rotation. As of 1Q24 and the latest company information. NSA has executed a non-core strategic asset sale for around $540M for 71 assets to a private buyer. This moves NSA into better portfolio concentration, a better overall cap rate and generates capital for more balance sheet initiatives.

The company is also moving to more JV’s, with the current contribution of 56 assets moving into a new JV as of 2024. This, again, generates more capital for balance sheet initiatives, and it allows the company to more efficiently fund and handle CapEx planning. Obviously these are not ideal situations – if it was, the company would not move to JVs or these sort of rotations. It’s something the company believes that it must do to get back on track.

Another reason why the company share price is up here is due to the recent buyback executed by the company – over 18M common shares totaling over $650M with of cash since launching this program in -22, which means that NSA has retired nearly 12% oof SO/OP outstanding at an overall discount to consensus NAV. This was an okay move as well.

Aside from this, the company is using the remaining proceeds from sales and other things to fund the repayment of floating-rate debt, a good strategy at this particular time. The way the company has moved has certainly lowered NSA’s risks. However, all of the things that the company has done also mean that there’s a very low likelihood of continued near-term dividend growth. Between JV’s and other things.

NSA IR (NSA IR)

Also – the big news is that there’s an incoming internalization of the PRO. All of the agreements and details are already finished, with NSA paying 4x EBITDA from the management of the PRO-managed properties. NSA is also purchasing the PRO’s share of the tenant insurance policies and cash flow.

The impact of this internalization is not trivial, and will be staggered over the coming few months, but will include more sales over the coming 24 months, as well as pursuing growth opportunities with the former PROs.

It will also have a non-trivial impact on the company’s share count. There’s an incoming adjustment for the SP unit conversion, with 12.1M outstanding SP units converted to 18.2 million OP units, and all will be included in the calculation of FFO per share. The total payment is expected to be between $80-$90M.

Here is the rationale behind the internalization, and what brands are affected.

I consider this to be a positive and a good plan – as simplification in this industry is an absolute must- and this is exactly what the company is doing here. NSA has a lot of recycling potential for its assets, and this unfortunately means that the future growth in FFO is more likely than not to be hampered.

We’re seeing this in projected FFO and AFFO growth on a forward basis. Despite hoping for improvement here, the company is projecting, and analysts are projecting lower growth.

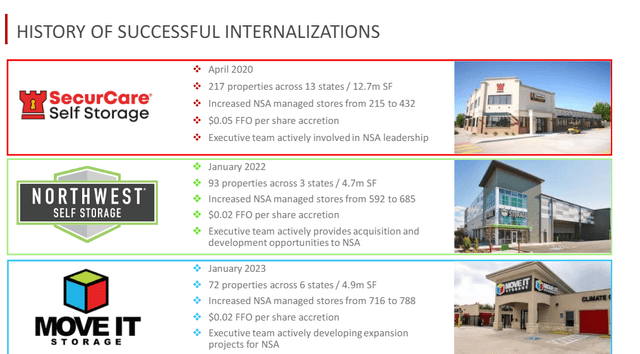

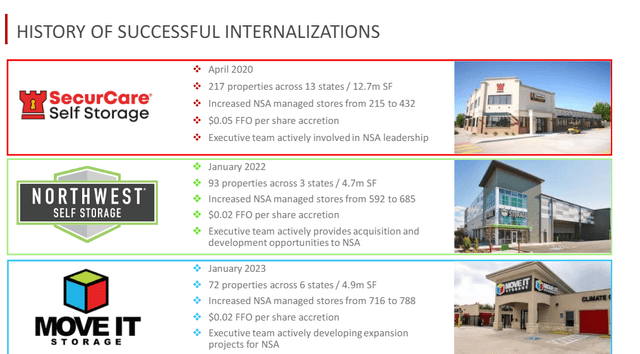

NSA will, even after internalization, remain diversified. The company also has a track record of successful executions of internalizations, delivering FFO accretion according to expectations. There are no reasons that I see to doubt that NSA will execute at a similar level when it comes to this internalization. Big internalizations that NSA has done in the past include SecurCare, Northwest Self-Storage, and Move-it – all of these together is almost 400 properties that the company has successfully integrated.

NSA IR (NSA IR)

The self-storage industry remains highly fragmented, and out of the US, with NSA at less than 3% of than total market share, with public operators in the market not even at 25%. All private operators in this industry still have almost 80% of the total market to themselves, which means that there remains a massive opportunity for consolidation.

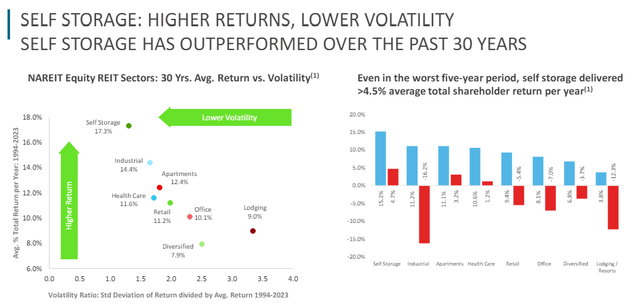

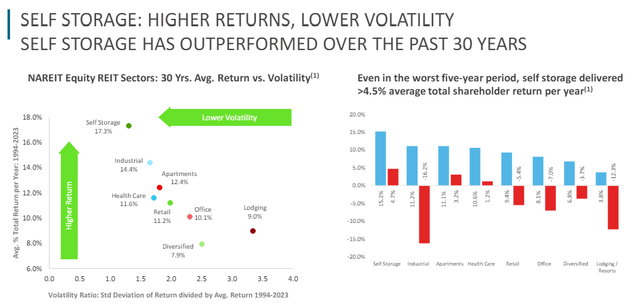

Also, the main investment thesis for NSA remains solid and very much relevant at this particular time – by which I mean the reason I invest in NSA is the conservative volatility and returns that the sector offers. Not just NSA, but PSA.

This is still very much the case – Self-storage is one of the lowest-volatility REIT sectors out there.

NSA IR (NSA IR)

For 1Q, we continued to see the impact of divestments at a negative 1.5% revenue growth, and negative 9.1% YoY FFO/share growth, with NOI on a same-store basis down 3.7% as well. Occupancy is at 85.6% which is neither terrible nor outstanding.

However, the company actually increased the dividend by 1.8% – nothing fantastic or worth writing home about, but still worth noting.

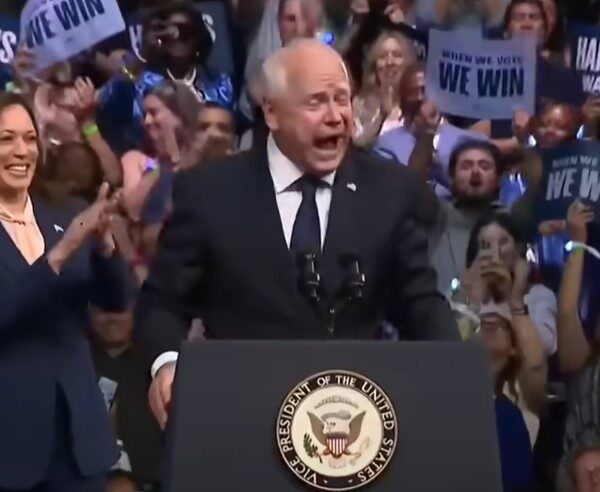

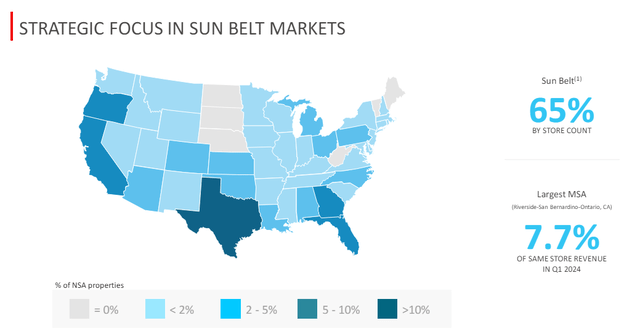

The company’s future focus is the Sun Belt area – like many of the REITs I invest in, and this is a positive to me. Despite an expected decline in FFO, I remain positive on the larger potentials and projections for this business.

This is also visible in the company valuation.

National Storage – The company remains appealing at this valuation

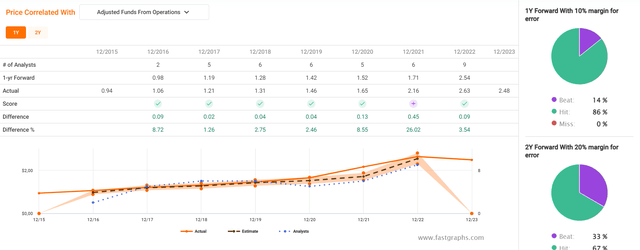

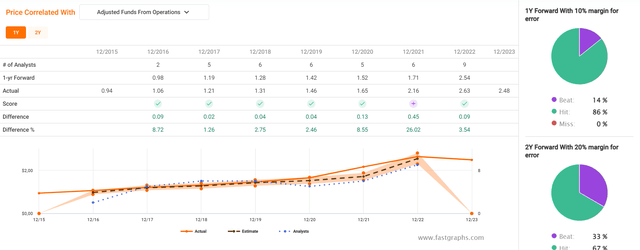

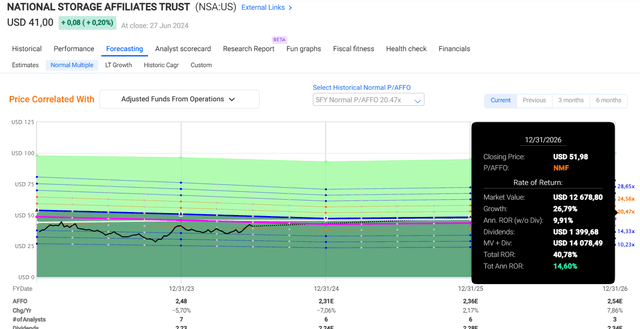

In terms of AFFO trends, I don’t see much positive for this company for 2023 or 2024. The 2024E forecast is for a decline of at least 7% at this time (Paywalled F.A.S.T graphs Link)

Beyond that, there is growth estimated – but I would take these estimates with perhaps a grain of salt.

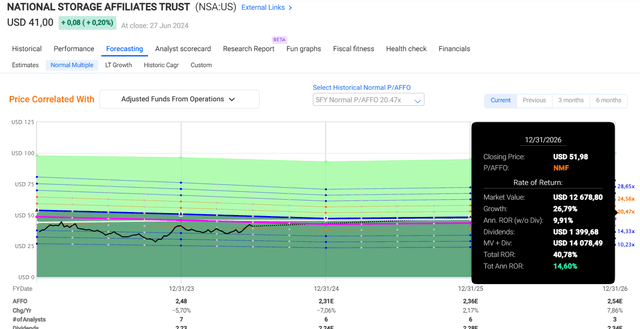

The saving grace for the company, and why NSA remains compelling for me is the valuation and the upside to the normalized P/AFFO. Market-leading self-storage plays like NSA and PSA trade at over 20x P/AFFO. Because NSA has over 5.45% yield, it also goes some way to explain this premium, even if the payout ratio for this year is set to increase to over 90% of AFFO, at $2.24/share in dividends versus a forecasted AFFO of $2.31.

However, this is set to improve to over $2.5 in as little as 2 years.

How likely is this?

Let’s look at historicals.

National Storage Upside (National Storage Upside)

So, you can see the likelihood of this company not meeting its targets is actually quite low. Furthermore, the upside here is over 14.5% per year for the company if we forecast it at the 5-year average.

NSA Upside F.A.S.T graphs (NSA Upside F.A.S.T graphs)

So while you’re not getting 15%, which typically is my minimum required upside, I’m willing to make a small exception here – the company is still attractive. In my last article, I gave NSA a PT of $50/share. As you have probably come to expect from me, I will not change my PT here. I don’t change my PTs that often because I don’t derive them from momentary or short-term assumptions, but usually very long-term sort of assumptions with estimates that can go 2-5 years in the future. I also typically invest in turnarounds, and NSA when it was cheap at almost below $30/share, was certainly cheap in a big way.

Analysts went sour very quickly on this company when it started encountering trouble. Back when I started covering the company, a high-end PT of $73/share and an average of $61 was the standard for S&P Global. That is not a target that I even consider valid though. Today, as of June/July 2024 we are down to a high of $45/share and an average of $37. Despite the company being very cheap for what it offers, we’re still at only 2 analysts at “BUY” here – compared to the 6 prepared to “BUY” the company when it was trading at over $41/share. I continue to be surprised by the short-term nature of the market, and the unwillingness to recognize what I view as undervaluation with a great upside.

However, that means more cheap stocks for me.

And in this case, I say that NSA is no longer cheap, but it’s still buyable. If it were to rise above $42-$43 however, then I would move to a “HOLD” here.

Thesis

-

NSA is the “smaller sibling” of market leaders like PSA. It operates in the same sector but has a better yield and more upside due to a more compressed overall valuation.

-

NSA may be a higher-risk/reward play than PSA and similar REITs, but it also would be unfair to characterize the company as a somehow “excessively risky” investment. Its portfolio and sector have outperformed for years, and I forecast the self-storage industry to make money for decades to come – there is little to suggest this is going away, even if it’s going down in growth.

-

Based on this, I would call NSA a “BUY” with a PT of $50/share, but no more than that. I’m not changing my PT as of this article.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I believe NSA fulfills every single investment criterion I hold, even without a CR, and that makes it a “BUY”. I may buy more NSA here, and may slowly expand my self-storage exposure.