Art Wager/E+ via Getty Images

Introduction

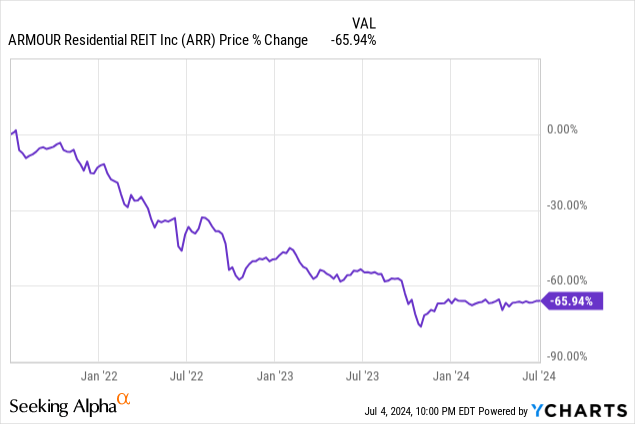

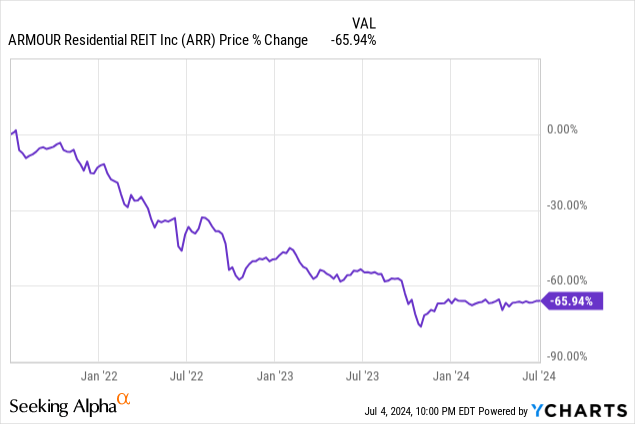

Armour Residential’s (NYSE:ARR) shares have been headed in one direction and one direction only. And that’s down. Over the three years, shares of Armour have tumbled 66%, losing two thirds of their value. While the company has been paying a fat dividend to shareholders, I view the current distribution as being unsustainable, even in spite of several cuts. With the current yield at 15%, the market seems to be hinting at signs of trouble. In this article, I’ll explain the risks I see with Armour Residential and why I would avoid the company’s shares today.

Company Overview

Armour Residential is a real estate investment trust (REIT) that is primarily involved in the mortgage-backed securities market, specifically in residential mortgages. Mortgage-backed securities are financial instruments that are comprised of pools of mortgages, where the securities represent an ownership interest in them.

Essentially, Armour Residential invests in mortgages rather than physical properties, and it earns income from the interest payments on the underlying mortgage loans in its portfolio. As a REIT, Armour Residential is required to distribute at least 90% of its taxable income to shareholders in the form of dividends.

To pay its distributions and earn income on the mortgage-backed securities, Armour Residential ‘arbitrages’ the difference between what it can borrow at versus what it can earn in returns. The mortgages it invests in are generally those issued by a government sponsored entity like Fannie Mae, Freddie Mac, or Ginnie Mae, otherwise known as agency securities. These usually consist of fixed rate loans, but some portion is also backed by hybrid adjustable rate or adjustable rate loans. In addition, to mitigate interest rate risk, the company uses hedges sometimes to manage risk within the portfolio.

Background

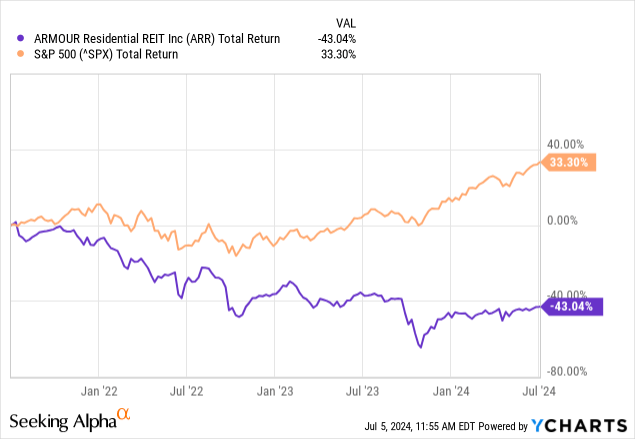

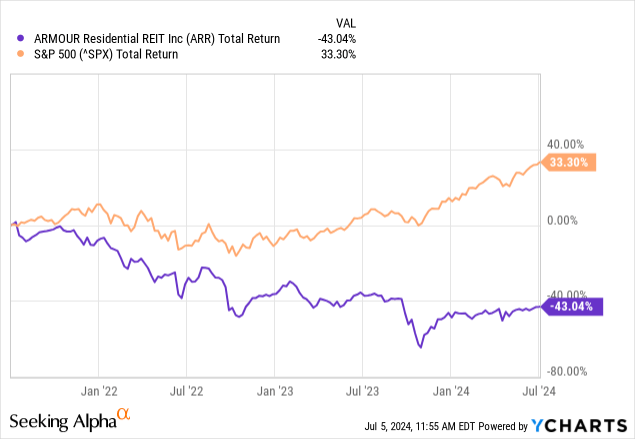

When looking at the share price action of Armour Residential over the last three years, investors have lost nearly half of their investment (-43%), even when including huge dividends paid to shareholders. Comparing the return over the last three years to the S&P500’s positive total return of 33% illustrates a widening divergence in performance over time, particularly one that I would characterize as destructive of shareholder value.

So what’s been going on? In my view, Armour Residential pays out an unstable amount of dividends to shareholders that isn’t backed up by current free cash flow and earnings. The mortgage REIT model in general is one that’s highly levered, so any movement in spread between the cost of borrowing and return on investment of securities could have serious implications to the business.

We see this impact through the company’s dividend history over time. As observed below, there’s been a series of at least four cuts in the last five years to the dividend, highlighting that the current dividend warrants scrutiny and could be at risk.

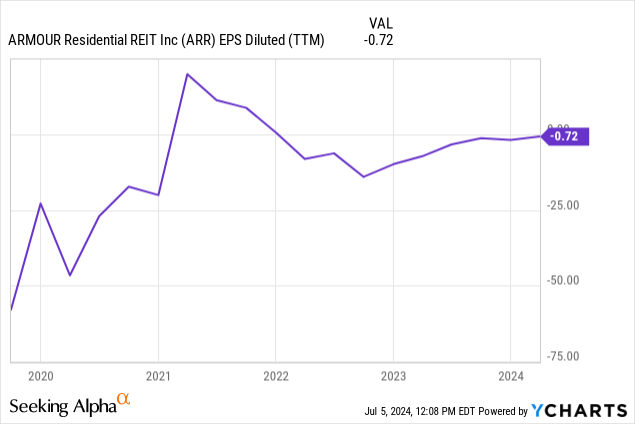

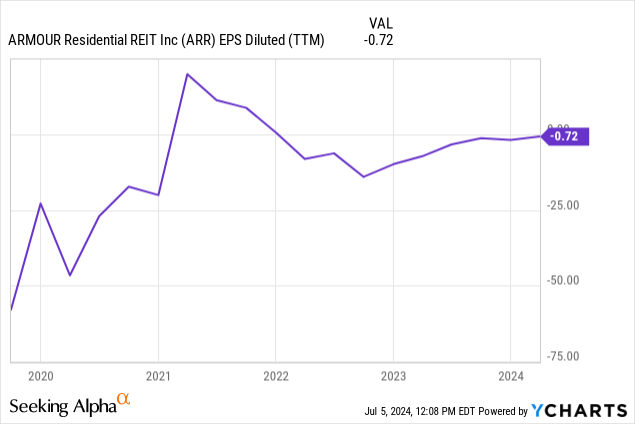

Whenever you see dividend cuts like this, it’s often helpful to ask whether the current dividends are supported by current cash flows and earnings. Over the last five years, with the exception of 2021 when interest rates were near zero, Armour has been generating losses in earnings per share. Since the situation has become somewhat troubling, on the earnings call, management noted that it is suspending management fees until further notice. Previously, the company suspended management fees during the pandemic due to the uncertainty surrounding the business, and since then, they haven’t reinstituted that back.

Outlook

Can Armour right the ship? In my view, if the latest results are any indication, management hasn’t been making the right bets to generate earnings for shareholders. At the end of the quarter, book value per share was $22.07 per common share. In the 23 days after quarter end, the book value fell 7.2% to $20.48 per common share.

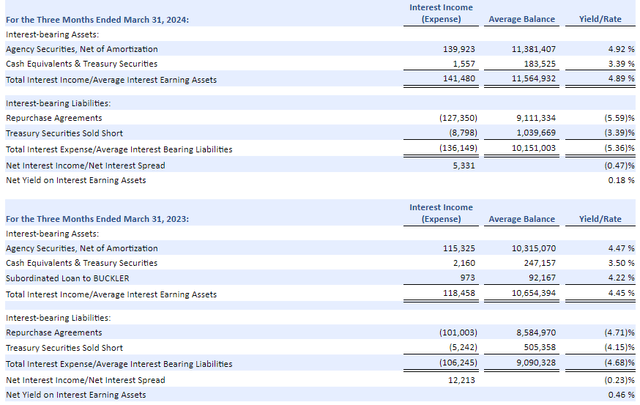

When looking at the yield spreads, during the quarter, net yield on interest earning assets was $5.3 million vs net interest income of $12.2 million. While the quarter had positive net income of $14.5 million, this was in large part due to a favorable move in interest rates and spreads. Going back to FY’22 and FY’23, net income was a loss of $230 million and $67 million, which I think are more reflective of what returns would look like in this business during this interest rate environment. At present, the company pays $3.0 million in dividends to preferred stockholders and 35.3 million in dividends to common shareholders each quarter, which is much higher than current earnings run rate, even for this most recent quarter of positive net income.

How should one approach Armour as an investment? With respect to the macroeconomic outlook, the way I would think about Armour is essentially a bet on interest rates. If you’re constructive on spreads longer term and that the Fed will begin to aggressively start cutting rates, then an investment in Armour could make sense.

Based on what’s being priced into the curve, Jerome Powell’s latest comments noted that if the Federal Reserve cuts too much and too quickly, inflation could re-accelerate, which would force policymakers to reverse course and impose punishing rate hikes. On the other hand, if they wait too long to reduce borrowing costs, the Fed risks a weakening of the economy, which could trigger a recession if the market isn’t ready.

At present, inflation is at 3.27%, slightly above the Fed’s long-term target of 2%. In my view, I don’t foresee the Fed cutting too much. Why? The dollar remains strong (ability to print more money if needed given political issues in Europe), rhetoric from the Fed has been hawkish, and overall GDP growth looks poised to climb at least 2% this year.

Overall, I think most investors have underestimated the resiliency of the U.S. economy, and it may, in fact, turn out that we get few rate cuts than previously expected. Earlier this year, the market was pricing in 5 rate cuts, and it’s looking less likely that’s about to happen.

Given this, I’m inclined to avoid shares of Armour. With implied leverage of 7.4 and Debt/Equity of 6.8, I find Armour to be carrying risk above my comfort level.

Conclusion

Ultimately, an investment in Armour is a levered bet on interest rates. However, even if you think interest rates are going to come down faster than expected, I’d still avoid shares. Over the last ten years, shares have lost about 88% of their value and so even as interest rates have dropped over time, there’s still been somewhat of an impairment in value. While the company pays generous dividends at a 15% yield, investors should be cautious investing in what I see as a value trap and a yield that’s not adequately supported through the company’s earnings and cash flows. In my view, with an unsustainable yield and a leveraged balance sheet, I would avoid shares today and rate shares as a ‘sell’.