Kirpal Kooner

Invitation Homes Inc. (NYSE:INVH), incorporated in 2012 and headquartered in Dallas, owns and leases single-family homes mainly in the Sunbelt.

This REIT is well-capitalized, has strong liquidity, and has been experiencing steady growth which accelerated in the last couple of years. Although the growth expectations could become more modest once interest rates start going down and the dividend yield is indeed very low, the shares are undervalued enough to make this REIT worthy of an addition to either a dividend growth portfolio, a value one, or a combination of the two.

Portfolio and Outlook

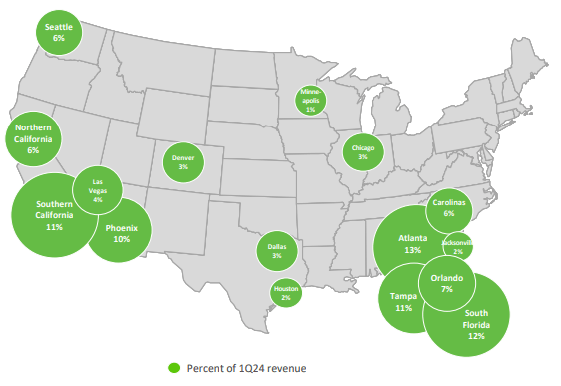

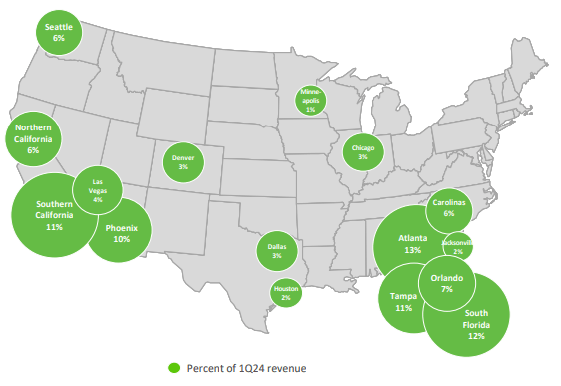

The REIT’s portfolio consists of 84,445 houses that are spread across 16 core markets, with a focus on the Sunbelt. The portfolio has a significant concentration in Florida and a decent exposure to California.

Investor Presentation

Given the fact that the average house here is 1,880 sqft, has three bedrooms, and two bathrooms, it’s no surprise that the average resident age is 39. On one hand, this is good as the average income/rent ratio is 5.4x based on new residents in 2023. But the important implication here is the reasonable assumption that the main driver of the REIT’s recent performance is that many residents in that age group don’t have any economically beneficial alternative right now. The monthly average mortgage payment for a new homebuyer is $2,997; that’s 38% more expensive than apartment rent and ~27% higher than the Invitation Homes’ average rent in the last quarter.

We may disagree regarding our expectations for when interest rates will start declining, but I think that most of us believe and act as if we’ve reached the peak of this cycle. If that turns out to be true and interest rates start decreasing, then SFRs may face more pressure than multi-family assets. The average resident here seems more than able to get a mortgage and buy a home; it just doesn’t make sense to do it now. That’s not necessarily the case with renters in their twenties.

While I don’t think the outlook is great in the short term, the past performance of this REIT seems to indicate that it can do quite well in periods of lower interest rates.

Performance

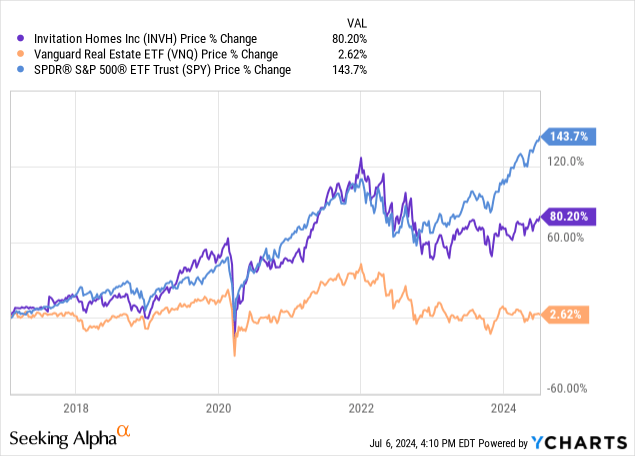

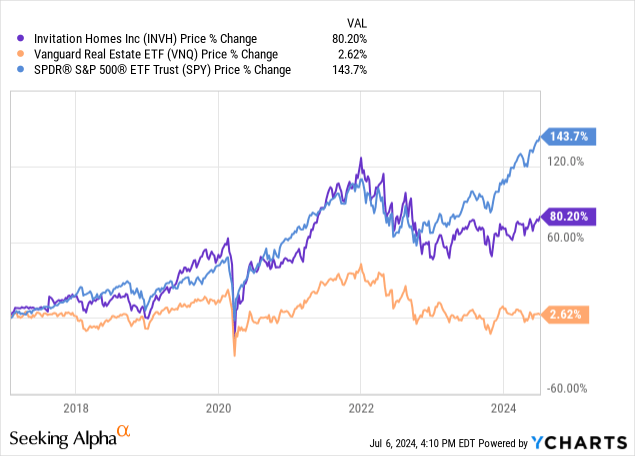

It’s important to note that INVH has experienced some decent growth since the IPO. Because its operating performance has been even stronger recently (more on that in a minute), the market punished it less once interest rates started climbing. Also, its recent recovery was better than VNQ‘s:

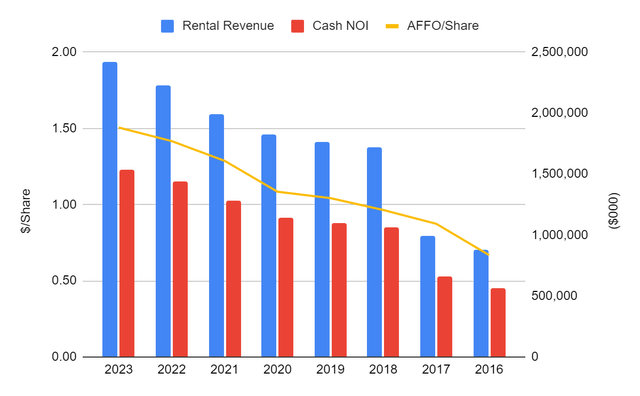

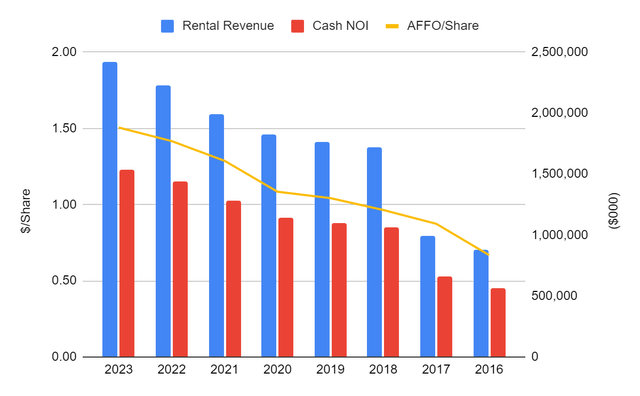

Now, it has grown its rental revenue, cash NOI, and AFFO per share relatively fast since 2016:

10-Ks and author’s calculations

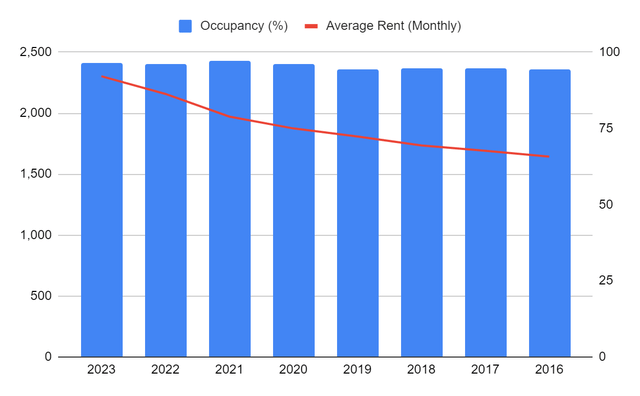

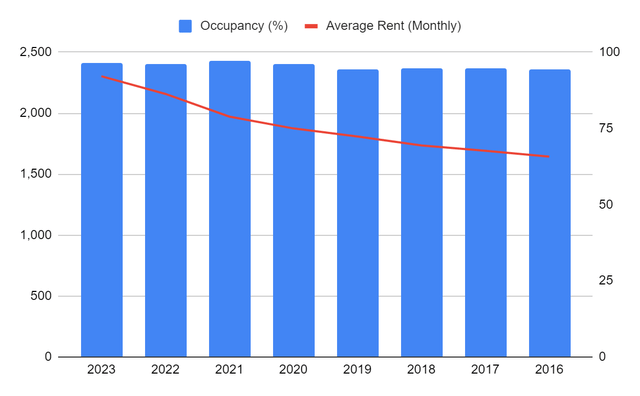

Occupancy has been steadily improving as well and rent experienced rapid growth lately:

10-Ks and author’s calculations

Coming to more recent results, it’s evident that there is strong momentum here. The rental and occupancy rates increased in 2023 since 2022 and same-store NOI enjoyed decent growth, with AFFO per share reaching $1.5:

| 2023 | YoY Change | |

| Avg. Monthly Rental Rate | $2,303 | +6.72% |

| Occupancy | 96.6% | +60bps |

| Same-Store NOI | $1.4B | +4.77% |

| AFFO/Share | $1.50 | +6.38% |

Management expects that same-store NOI will increase by 3.5% to 5.5% in 2024 based on a more or less flat occupancy rate for 2024 but same-store rent growth in the high 4% to low 5% range. AFFO is expected to increase from $1.54 to $1.62 per share.

That guidance is to some degree supported by the continuous growth as reflected in the first quarter’s results that may show occupancy slightly lower, but rent growth has been good and AFFO per share has increased by as much as 7.89%:

| Q1 | YoY Change | |

| Avg. Monthly Rental Rate | $2,363 | 4.84% |

| Occupancy | 97.6% | -20bps |

| Same-Store NOI | $379.6MM | +4.72% |

| AFFO/Share | $0.41 | +7.89% |

Leverage & Liquidity

Such strong performance is accompanied by low leverage, a high liquidity level, and a low cost of debt. More than half of debt is unsecured and fixed-rate, with a low enough debt/assets ratio to leave a good margin for increased debt financing if the company needs it.

| Unsecured | 56.70% |

| Fixed-rate | 55.00% |

| Debt to assets | 44.48% |

| Debt to EBITDAre | 5.75x |

| Interest coverage | 4.14x |

| WAVG Interest Rate | 3.82% |

| Total liquidity | $1.7B |

Additionally, there are no upcoming maturities for this year and out of the ones coming next year, Invitation Homes could push the maturity date for the term facility ($2.5B) to 2026 if the two six-month extension options are exercised. The rest don’t represent a large portion of total debt:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 |

| Amount Due | $0 | $3.1BB | $0 | $990.8MM | $750MM |

| Percentage of Total Debt | 0.00% | 36.73% | 0.00% | 11.60% | 8.78% |

Dividend & Valuation

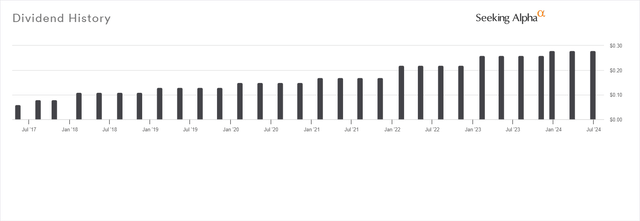

INVH currently pays a quarterly dividend of $0.28 per share which translates into a forward yield of just 3.1%. The payout ratio of 72.72% makes the dividend well-covered and management has been growing the dividend at a 23.16% CAGR in the last five years.

Based on the reasonable assumption that the REIT still has a lot of time before rent growth decelerates to a more average pace, the prospect for further dividend growth is strong. Also, its four-year average yield is lower at 2.43%, so it relatively seems like a good value today.

Now, the REIT’s FFO multiple is only a bit lower than its peers’ average:

| Stock | P/FFO |

| INVH | 19.2 |

| AMH | 21.46 |

| SUI | 16.7 |

| ELS | 22.1 |

| UMH | 17.42 |

| Average | 19.42 |

However, its implied cap rate of 5.48% seriously undervalues the REIT’s net asset value. During the 4Q23 earnings call, the EVP and CFO stated (bolds added by me):

With respect to CapEx, I think that, that is going to continue to grow at sort of an inflationary rate. I think we have done a particularly good job in making smart asset management decisions about where and when it does make sense to reinvest capital into our portfolio and in places where it does not pencil. What we found is, we can sell those homes into an incredibly liquid end-user market at cap rates inside 4% and then recycle that capital into newer assets that are going to have less of a CapEx demand over time.

Moreover, the CEO said that because of the restrained supply they enjoy due to the higher-end assets they manage, they can sell them at 3%-4% cap rates:

It certainly feels like we can continue to sell our dispositions back into the MLS kind of in the mid-to-high 3s, low-4s, depending on the marketplace. Again, we have a much — typically, a much more expensive home than most of our peers. So when we go to market with some of that product, there’s massive demand from home buyers.

For this reason, a 4% cap rate would be more appropriate for Invitation Homes’ portfolio. Assuming that, NAV per share comes at $49.80, so the current price reflects a 27.85% discount to NAV.

Risks

Of course, there are some risks we should note here. First, when interest rates go back to more normal levels, rent growth should decelerate as the portion of renters who have been held back from owning will not renew their leases once the spread between monthly rents and mortgage payments narrows significantly. Consider that the REIT’s annual turnover rate was 32.5% in 2018 as opposed to 23.9% in 2023. As a result, the market may not react well to slower growth expectations in the short term.

The other risk has to do with the fact that with such a low dividend yield, the market may not be too quick to offset the issue that lower interest rates present for the business. The market may be more favorable towards REITs sporting a reasonable yield spread above the risk-free rate. So, there is also an opportunity risk you should consider as well.

Verdict

In any case, the discount here is so deep for such a well-managed business with a high-quality portfolio that the long-term prospects greatly outweigh the short-term risks. For this reason, I rate INVH a strong buy and I will keep monitoring it for any interesting developments or anything that would make me reassess.

What do you think? Do you own this single-family REIT or do you prefer something else? Let me know and I’ll get back to you soon. Also, please leave a comment if you found this post useful; it means a lot! Thank you for reading.