Adriana Duduleanu

Co-Authored by Analyst Antonio Mello

Thesis

Throughout the last year, there has been a lot of movement through the industrials sector, with gold prices driving upward and copper volatility in particular. The sector provides for a unique investment opportunity, specifically among two competitors, as the landscape of the industry gathers speculation. We believe there is a window of opportunity to capitalize on upside potential from the market discounting Newmont Corporation (NYSE:NEM) and potential underperformance of Teck Resources (NYSE:TECK). We propose 130% long exposure to Newmont Corporation and 50% short exposure in Teck Resources as gold price forecasts suggest significant top line upside for Newmont Corporation, while maintaining higher growth potential through exposure in copper and the company is liquid, providing for more investment opportunity to scale operations or increase total production.

Company Backgrounds

Teck Resources is Canada’s largest integrated natural resources group. Teck Resources has a Dual-class share structure, with the Keevil family holding significant voting control. The company is headquartered in Vancouver, Canada, but has widespread operations among. Specifically, Teck resources produces copper out of its four mines in Canada, Chile, and Peru. Teck Resources also produces zinc out of its Alaska operating mine and produces coal out of its mines in British Columbia. The majority of Teck Resources’ revenue has come from their coal production, as it is the largest producer in North America. The revenue breakdown as of the last fiscal year, follows with 56.86% of revenue coming from coal, 22.82% of revenue coming from copper, and 20.33% of revenue coming from zinc.

Newmont Corporation is one of the world’s largest gold miners and is a publicly traded company. The company is headquartered in Denver, Colorado and has exposure all over the world, with operations in North America, South America, Australia, and Africa. In North America, their large operations lay in Nevada, Colorado, and Mexico. In South America, their presence is significant in Peru and Suriname. Their operations run across all of Australia and penetrate Ghana within Africa. Newmont Corporation produces and mines primarily for gold, but has large secondary exposure to copper and some exposure to silver, zinc, and lead. As mentioned, they focus heavily on gold production and have positioned themselves as the world’s largest gold mining company by production and market capitalization.

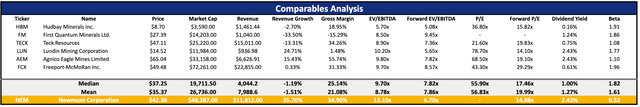

Given the trend of certain commodity prices and the increasing scarcity of natural resources, Newmont Corporation and Teck Resources find themselves in a desirable industry that could see increased penetration, seeking more and more production to supply surging trends. Among the two companies, they share competitors including miners such as Hudbay Minerals Inc. (HBM), First Quantum Minerals Ltd. (OTCPK:FQVLF), Lundin Mining Corporation (OTCPK:LUNMF), Agnico Eagle Mines Limited (AEM), and Freeport-McMoRan Inc (FCX).

Qualitative Analysis

The biggest driver of value for Newmont Corporation will be tailwinds on gold and copper prices. Newmont Corporation exclusively operates in mining for gold and copper, aside from one mine that also produces silver, lead, and zinc. Teck Resources has produced primarily coal in the past, as well as copper and zinc. As a result, we will primarily dig into gold, copper, coal and zinc tailwinds, as they make up most of each portfolio.

Gold is a pivotal aspect of this long/short investment, as Newmont Corporation has large exposure in gold production and Teck Resources has no exposure in gold. As of recently, gold prices have risen, and we hold that they will continue to rise into the foreseeable future, but have maintained a conservative long-term estimate. Gold prices have risen mostly as a result of inflation levels maintaining higher than target levels and historically follow this trend as investors turn to gold when purchasing power decreases and the U.S. dollar is weaker. We hold that if gold can stay higher for longer, as inflation may stay higher for longer in the future, it suggests higher upside for the long leg and no risk on the short leg, as Teck Resources currently has no gold exposure or production.

What the market has told us over the last year is that consumers have become more comfortable with increased prices and an inflationary environment, as CPI has not budged significantly despite the hawkishness of the FED. This bodes well for future investment in gold and could drive gold prices up as a result.

While gold prices have high potential to rise, we remained conservative with our estimates suggesting long-term gold prices will taper off to $1,970 per ounce. In comparison to other gold projections, this is extremely conservative.

Copper is uniquely significant regarding its position, as both companies have similar production levels right now and have indicated increased interest in. Because both companies share similar volume in copper and interests in ramping up volume, how much each company increases production will largely determine how this position responds to movement within the copper market. Regarding our projections, we assumed fair, leveled off increases in copper prices per pound for a couple of reasons. The main driver in copper prices will be the push for green energy transition. Specifically, the growth in demand for electric vehicles and the artificial intelligence sector will push prices upwards. Copper prices may also benefit from maintaining higher inflation levels, with the U.S. dollar remaining weaker. Teck Resources will more than likely, benefit more from copper price trends, as they are aiming to invest more into this segment and completed a large sale of a majority portion of their biggest revenue segment allowing for this.

Coal is another pivotal aspect of this investment, as it has been Teck Resources’ biggest revenue segment by far. With the sale of 77% of its unit, this will be significantly reduced, but will still maintain a notable chunk of its revenue segment. Coal prices will more than likely see a decline, and it may be significant. Coal is likely to suffer from an increasing shift towards renewable energy sources, stricter environmental regulations, and improved energy efficiency.

Additionally, Teck Resources has shifted its focus away from coal production despite its current volume. Management has already indicated interest in investing more into copper, which will draw away from coal production, as indicated by the sale that occurred in November of 2023. This makes sense with regard to the demand trends for copper and coal. In our projections, we left production to be 23% of last year’s production (current ownership of its coal business) and a consistent $285 per tonne of coal.

Finally, zinc is the last notable commodity to analyze. Teck Resources has seen declines in zinc production over the last few years and should follow this trend, as they shift focus into other segments, primarily copper. Our assumptions followed that zinc production declines at an appropriate rate, in line with historical numbers and management’s fiscal year expectations, and zinc prices increase steadily within its range of prices over the last few years.

Main Points

Newmont Corporation presents a compelling buy opportunity for a variety of reasons spanning across growth runways, as well as a discounted price via a Forward EV/EBITDA mean multiple.

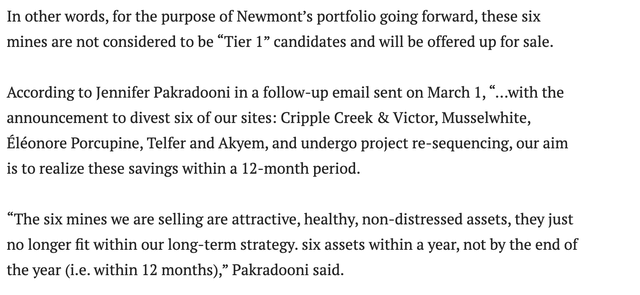

First, the management team has proven to be capable and focused on delivering shareholder value. The company operates primarily in tier 1 mines, where it maximizes production. Management is also proactive in adjusting the company’s positioning by selling off assets that are no longer tier 1 as recently provided. Newmont CEO Tom Palmer indicated their plans to divest eight non-core assets, as well as to trim the workforce to cut debt following their $17.14 billion acquisition of Newcrest. Leadership has also acknowledged that their shares are undervalued and announced an aggressive $1 billion stock buyback.

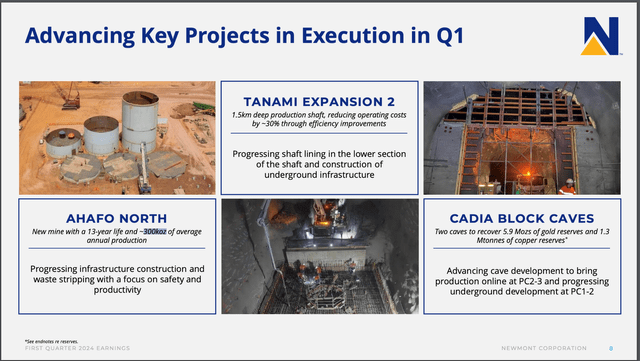

Secondly, Newmont Corporation’s operations are set to continue delivering value in surging segments. All of their mines produce gold, with several additionally producing copper, only one still produces cheaper metals as well. Among all of the company’s mines, they maintain high quality or will more than likely be divested to cut down debt or reinvest into high value operations. Newmont Corporation also boasts impressive margins from operations, with a 34.90% gross margin in comparison to a comparables analysis mean of 21.08%. Not only are their current operations set to continue increasing production in existing mines, which accumulates value through growing prices, but the company is also liquid, providing for more investment opportunities into the business to scale operations or increase total production even further.

Finally, as mentioned earlier, the spot prices of the metals that Newmont Corporation produces are set to grow and increase in demand, which will accumulate value in their reserves and new production. The metals themselves will become pricier and the sales yield of the metals that are produced will likely increase, as will their position in the market as they are the largest producer.

On the other side, Teck Resources seems to be trading near fair value, and its growth outlook is minimized by its portfolio of operations.

In particular, the largest draw for Teck Resources will be the boom in the copper market. Considering this, it is important to look at how the revenue streams have shifted and will follow price trends. Considering the large production increases in copper as management indicated, this revenue segment will see substantial growth.

However, looking on a cumulative scale, the growth will be limited as they see significant declines to revenue from their biggest segment in coal making, where it will offset the large growth they would see in copper prices. Thus, their growth in copper revenue will need to be extremely significant and aggressive to provide the returns necessary to suggest upside and by comparables analysis mean multiples, Teck Resources trades at a fair value price.

A large benefit of the long/short position here, is that markets have been very hot lately, so in the event of a market wide correction, our position offers protection while still earning upside, as we believe Newmont Corporation will outperform Teck Resources across any time frame.

Valuation

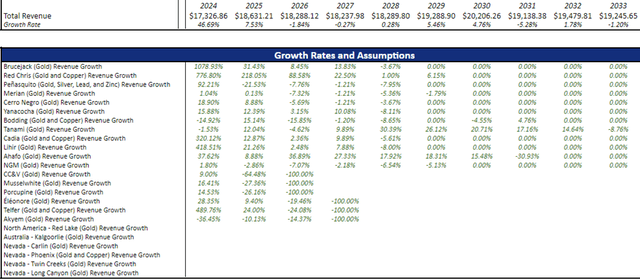

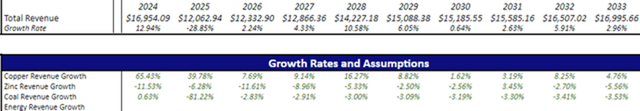

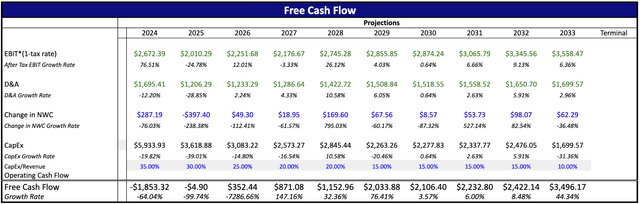

First, we will look through the Newmont Corporation Valuation. Revenue was projected via each mine, where six of the mines were sold off in line with management statements, that would accumulate a total of around $2 billion. Additionally, newer mines experienced larger growth spurts and 2024 values were used from management expectations for full year production.

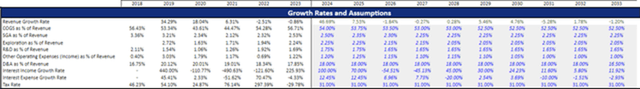

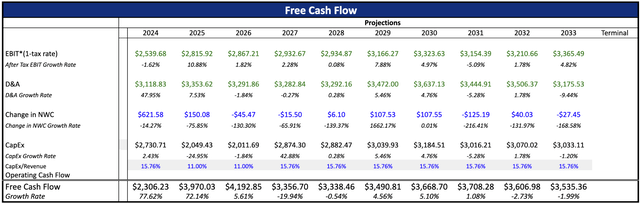

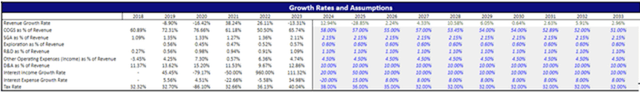

To project net income and net income growth, we used the above revenue numbers and projected the operating expenses as a percentage of revenue, and utilized historic trends for the other assumptions.

Change in Net Working Capital was calculated by growing accounts receivables by the revenue growth rate and inventory and accounts payables by the cost of goods sold growth rate.

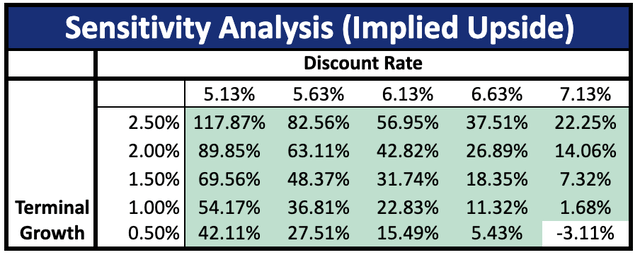

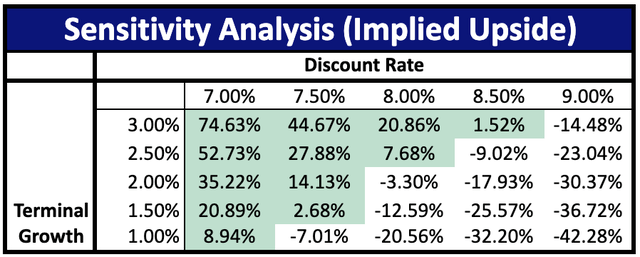

There is significant upside and minimal downside regarding the change in the WACC and terminal growth.

In addition to our DCF model, we calculated an EV/EBITDA valuation with a mean forward EV/EBITDA multiple from our comparables analysis.

Weighting the DCF $55.81 implied share price at 80% and the EV/EBITDA $55.34 implied share price at 20%, we reached an implied share price of $55.71 indicating an upside of 31.52%.

Teck’s Valuation

Now we will look at the Teck Resources valuation. Revenue was projected by each resource segment. The company indicated a shift towards interest in copper, following the sale of its coal business, which is reflected in the revenue projections.

We utilized the same process as before to project net income growth and free cash flow growth.

Teck Resources offers much less wiggle room than Newmont in its valuation regarding changes to its WACC or terminal growth.

We used the same set of competitors for the comparables analysis with Newmont Corporation.

Weighting the DCF, $45.70 implied share price at 80% and the EV/EBITDA $58.97 implied share price at 20%, we reached an implied share price of $48.35 indicating an upside of 2.32%.

Risks

With this position, the severe risk that would be endured is the scenario where gold prices decline and copper and zinc prices boom. We aimed to mitigate this risk in our analysis by putting a haircut on our Gold Forecast when projecting revenue. Our average per ounce gold price schedule is as below:

| 2024 | 2025 | 2026 | 2027 | Long-run |

| $2,155 | $2,195 | $2,070 | $2,045 | $1,970 |

The lower expectation in 2024 is to reflect supply sold at pre-run-up prices in Q1.

The direction of each company has been outlined by both management teams and follows that Newmont Corporation will continue to produce gold, while also increasing production growth of copper in light of demand trends. As for Teck Resources, they are aiming to transition primarily into copper while maintaining reduced stakes in zinc and coal.

Regarding this, the largest downside comes from the scenario that gold prices will decline and copper and zinc prices soar. In this scenario, given Newmont Corporation also produces and sells copper, the risk is somewhat minimized but not without potential for losses, as Teck Resources seems to be more aggressively aimed at expanding their copper business segment ahead of the push for green energy.

Teck Resources seems to be more poised to reinvest into its copper segment from the sale of 77% of its coal business, which will allow it to gain more from the growth of the copper industry, than that of Newmont Corporation. Given our suggested short position in Teck Resources, a rise in copper prices and decline in gold prices could be significant enough where this position leads to negative returns.

Another notable risk that could lead to significant downside would be more aggressive investment into the copper business by Teck Resources than projected. If Teck Resources is able to increase production significantly above estimates ahead of price trends, then they would be able to benefit fully from a boom in copper price growth, exposing our position to negative returns in a flourishing copper market.

Conclusion

We believe there is an attractive opportunity to benefit from upside potential on Newmont Corporation’s operations portfolio and potential underperformance of Teck Resources. We again propose 130% long exposure in Newmont Corporation and 50% short exposure in Teck Resources, as commodity price forecasts suggest significant top line upside for Newmont Corporation while minimizing downside through a hedged overlap in Teck Resources’ biggest potential revenue stream in the foreseeable future. The 130/50 long/short position will leave the position beta positive with a net long exposure of 80%, which is justified in the portrayed upside for Newmont Corporation.

We are bullish on Newmont Corporation and if Teck Resources loses value, as we assume it will in light of their adjusting into the copper business and trading at fair value even in a very hot market, the position should be rebalanced into a 130% long exposure in Newmont Corporation and a 30% short exposure in Teck Resources.