kipgodi

The last few months have been truly wild for shareholders of Funko (NASDAQ:FNKO). For those not familiar with the company, it’s most famously known for its production and sale of Funko Pop! toys, which are vinyl figurines. In short, the company partners up with content owners like The Walt Disney Company (DIS) and creates figurines based on said content. For a couple of years now, things have been pretty questionable for the company. Because of bloated inventories caused by management’s expectation that growth would be greater than it ultimately was, revenue has taken a beating. The firm went from generating positive cash flows to generating cash outflows. And shares took a beating as a result.

In spite of these troubles, the last few months for shareholders have been exciting. Since I last reiterated my ‘strong buy’ rating on the stock in early March of this year, shares are up a whopping 42% at a time when the S&P 500 is up 8.5%. This is in spite of the fact that revenue continues to fall. But when you look at management’s guidance for this year, combined with some other interesting fundamental data, I do still think that further upside is on the table. Because of this, I think that the stock is still worthy of a ‘strong buy’ rating at this time.

A fun time

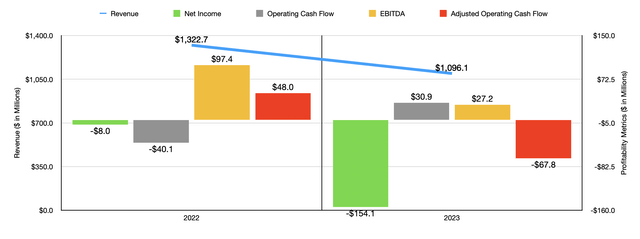

When I last wrote about Funko earlier this year, we only had data covering through the third quarter of 2023. Today, we now have results covering through the first quarter of 2024. Before we get to the most recent data, I think it would be a wise idea to touch on how the company performed in 2023 relative to 2022. By almost every measure, 2023 was a painful time for the company. Revenue, for instance, came in at $1.10 billion. That’s a decline of 17.1% compared to the $1.32 billion the company generated one year earlier. Management attributed this weakness to a slower inventory restocking of the company’s products, and what it described as a challenging retail environment. The biggest weakness for the business involved its operations in the US. Revenue plummeted a whopping 21.8%. By comparison, Europe showed remarkable strength, with sales inching up by 3%.

The bottom line for the company also experienced pain during this time. The company’s net loss expanded from $8 million in 2022 to $154.1 million last year. This was the result of multiple factors, including interest expense expanding from $10.3 million to $28 million, and expansion and depreciation and amortization costs from $47.7 million to $59.8 million, and both cost of sales and selling, general, and administrative costs, that fell by less than what revenue did. Other profitability metrics followed a very similar trajectory. The one exception was operating cash flow, which went from negative $40.8 million to positive $30.9 million. But if we adjust for changes in working capital, operating cash flow fell from $48 million to negative $67.8 million, while EBITDA plunged from $97.4 million to $27.2 million.

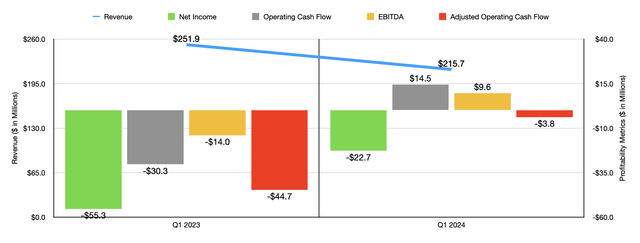

I think a good argument could be made that 2023 marked the worst for the company. If that’s the case, 2024 is looking up in some respects. The one exception to this is from a revenue front. Sales for the company in the first quarter of 2024 came in at $215.7 million. That’s a 14.4% drop compared to the $251.9 million reported one year earlier. The decline in the US was 17.4%, while in Europe sales dropped by 7.2%. Management attributed this weakness to decreased sales made to specialty and other retailers, as well as to e-commerce sites. At some point in time, revenue has to at least stabilize, if not expand, in order for the company to truly be out of the woods. But while the top line took a hit, the bottom line improved markedly.

For starters, in the first quarter of this year, Funko booked a net loss of $22.7 million. That’s well below the $55.3 million net loss reported one year earlier. Even though certain costs like interest expense and depreciation and amortization costs grew, other costs improved. Selling, general, and administrative costs remained virtually flat at 39.7% of overall sales. However, cost of sales plummeted from 80.3% of revenue to 60%. Digging deeper, it becomes clear that a good portion of this margin improvement can be chalked up to the fact that, in the first quarter of last year, the firm incurred $30.1 million in impairment charges involving inventories. Even if we ignore this, cost of sales dropped from a high last year of 68.4% to the 60% we saw this year. Other profitability metrics also improved. Operating cash flow went from negative $30.3 million to positive $14.5 million. On an adjusted basis, it went from negative $44.7 million to negative $3.8 million. And lastly, EBITDA improved from negative $14 million to positive $9.6 million.

When it comes to the 2024 fiscal year and its entirety, management expects revenue of between $1.05 billion and $1.10 billion. At the midpoint, that would translate to a year-over-year decline of only 1.9%. If this is to come to fruition, it means that sales for the rest of this year, covering the second through the fourth quarters, will have to be about 1.8% above what was seen the same time in 2023. On the bottom line, the company anticipates EBITDA of between $65 million and $85 million.

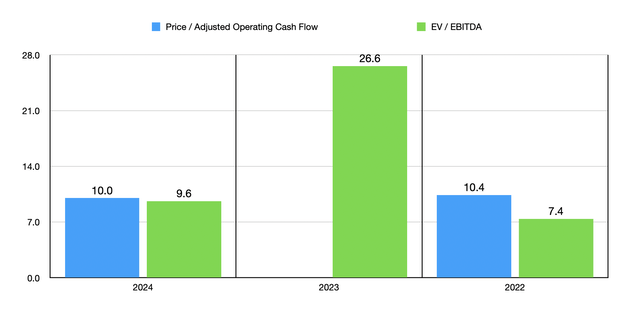

Taking these estimates, you can see how shares of the company are priced as shown in the chart above. The adjusted operating cash flow this year was estimated by taking the midpoint of EBITDA and subtracting annualized interest expense from the first quarter of this year from it. This is pricing that’s not terribly far off from what we get if we value the company based on results from 2022. Also, as a note, there is no price to adjusted operating cash flow multiple for 2023 since adjusted operating cash flow was negative.

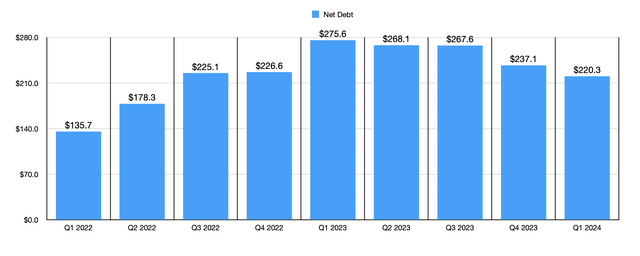

Outside of valuation, there are a couple of other positives about the company and where it stands today. For starters, management continues to reduce net debt. After peaking at $275.6 million in the first quarter of 2023, net debt dipped slightly to $267.6 million by the third quarter of last year. By the final quarter, it had fallen further to $237.1 million. And by the first quarter of this year, it had dropped even more to $220.3 million. This is great to see, especially at a time when the company has been dealing with problems. Lower leverage means lower risk in the grand scheme of things. And even if net debt does not decrease further by the end of this year, that would translate to a net leverage ratio of 2.94. While not low, that is certainly not at levels that would warrant concern.

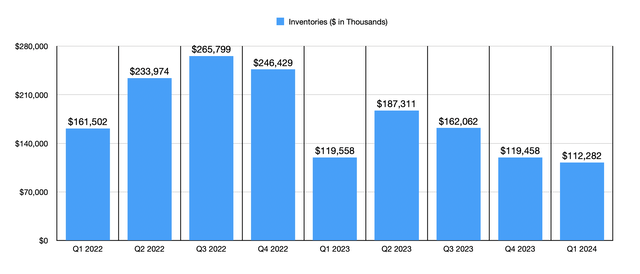

One of the big problems about the company over the past couple of years has been its inventory overhang. This also seems to be largely resolved. In the third quarter of 2022, inventory levels had ballooned to $265.8 million. But in almost every quarter since then, this number has dropped. By the end of the most recent quarter, inventories had declined to $112.3 million. That’s below the $119.6 million reported the same time last year, and it is significantly lower than the $161.5 million reported for the first quarter of 2022. Only time will tell how this picture will change moving forward. But a reduction in inventories, combined with an expected return to growth from a sales perspective, definitely implies fundamental strength of the company that could lead to improved profits and cash flows in the not-too-distant future.

Takeaway

While it may not be the best company on the market to invest in, particularly for those who can’t handle risk and uncertainty, Funko does strike me as an appealing opportunity at this point in time. The company’s fundamental condition is improving nicely, particularly on the bottom line. Management is forecasting a return to revenue growth this year. Net debt has fallen and inventories are lower than they have been in at least two years. Add on top of this how shares are currently priced, and I think that further significant upside could be on the table, especially if improvements continue.