Liz Leyden/iStock Unreleased via Getty Images

Dear readers/followers,

I’ve been a very long-term shareholder of P/F Bakkafrost (OTCPK:BKFKF) (OTCPK:BKFKY). My initial stake of 200 NOK/share still remains in my portfolio, and while the company has “lagged” the broader market for 2-3 years at this point, I believe in an eventual uptick that will see Bakkafrost trading closer to quadruple-digit native share prices, which will see an absolutely superb rate of return for me. This is even considering that the dividend yield for the company is quite poor. I’ve added at times, rotated some at other times, but this one has been a steady holding in my investment portfolio, and I expect this to continue to be so.

Since my last article in March of this year, the company has seen a decline and moved down to 540 NOK, which is at a level where I consider it valid to add more Salmon exposure to my portfolio by buying more Bakkafrost.

Why is that?

Well, a few reasons. When it comes to Salmon, I view it as one of the better future-proof protein alternatives from the animal kingdom that exists. I also have a very positive outlook on this company due to a significant advantage in this company specifically. It owns 50%+ of the fish farming licenses in one of the most attractive salmon farming areas in the entire world, the islands of the Faroes.

So with that out of the way, let’s see what we have going for us with Bakkafrost after 1Q24 and looking forward to 2024-2026E.

Bakkafrost – The upside is well over 20% annually even at conservative estimates, with a foundation of good growth

One of the biggest reasons why you want to invest in Bakkafrost is, as I mentioned above, the fish farming license situation. It’s hard to duplicate the advantage that Bakkafrost has over all of the other players in this field – of which there are many. While there are many local, Norwegian players that offer cheaper Salmon, Bakkafrost Salmon due to the geographies, and the company with its vertical integration, remains one of the better players on the planet.

The disadvantages of the company are well-established. There are only 3,500 shareholders for the ADR, and I invest in the native ticker BAKKA, which is on the Oslo stock exchange despite being a Faroe, meaning Danish, company. It’s based in Glyvrar on Eysturoy on the Faroe Islands, a series of islands north of the British Isles that hold a total population of ~52000. The capital is really no larger than the capitals of some remote Canadian provinces, like the Yukon.

Also, Bakkafrost will likely remain by a fair amount, family-owned – in this case over 20%.

For 1Q24, the volatility in Salmon continues and also continues to affect production and results.

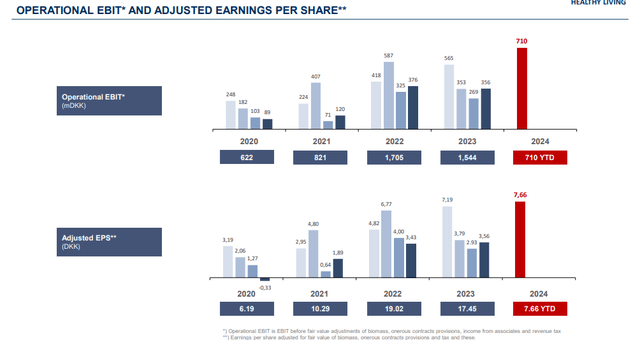

The company, for 1Q24, reported an increase this time around, in revenues and operational EBIT, going against the valuation trends we see for the shares at this time. Harvest numbers were up in the Faroe’s quite significantly, with over 14,200 TGW harvested, compared to 11,000 TGW on a YoY basis. Feed sales were up, sourcing was decent, and only fish oil sales externally were down.

Operational cash flow was positive, and there was positive EBIT from all segments, except Scottish Freshwater, which still saw negative results. The company finalized its dividend at around 2.5%, payable as always during May of 2024.

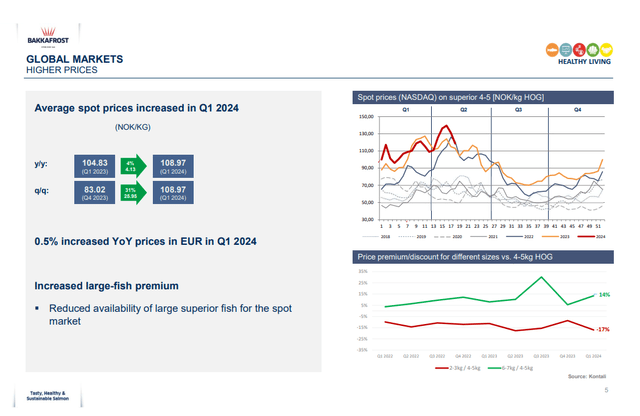

Bakkafrost remains a spot-price-impacted company. And current trends are reversing, but not yet “peaking”.

Since the company remains a “premium” player in fish, any reduced availability is likely to be positive here. In terms of consumption, the only segment that saw any decline or headwinds was US consumption, down 2% due to plenty of substitute availability. That is with the exception of “Impacted markets”, to which I would consider markets like Russia (down 10%) and Ukraine (down 40%) – but for obvious reasons, I’m not going to focus on these.

The main message for Bakkafrost for the quarter is that results are up, and up quite a bit.

Company net debt is down, and Bakkafrost aside from having over 900M NOK in available undrawn cash from bank facilities and accordions, also has undrawn credit of 2.2B, meaning it has 3B NOK available to it if needed.

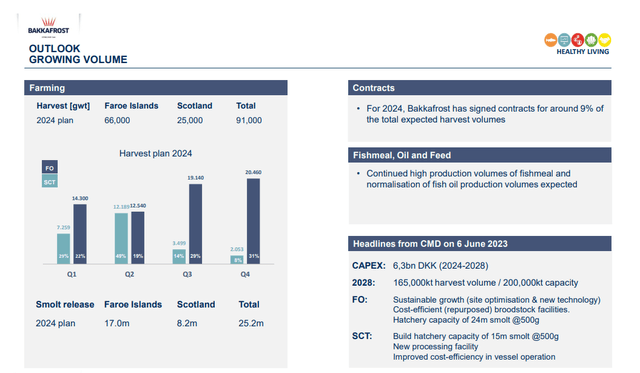

The company is using capital to advance its capacity and productivity. This includes a new hatchery that has begun building in Skalavik on the Faroes, with a 3,500-tonne capacity and a finished target of 2026E. This means that the company’s total FO hatchery capacity will grow to 12,000 tonnes per annum, with annual production in the Faroe capacity at 24M at an average weight of half a kilo, or 500 grams.

The company’s expectations and analyst expectations include quite a bit of growth in the next few years – and in part, it’s coming from this.

Bakkafrost IR (Bakkafrost IR)

Another factor for the company is turning around Scottish production. The company’s facilities at Applecross are under construction with a 7M á 500g Smolt capacity, and this is for 2024E. The strategy for the Scottish assets is self-sufficiency of Smolts, with the second facility at Fairlie still in the planning stages.

With the current harvest in the Faroes, the company has seen good returns by postponed harvests in order to maximize harvest values for the company, with harvest weights and values up. At the same time, the company hasn’t had any real issues with Sea lice or any of the other waterborne pests for the Salmon this year, another advantage.

Going forward from 1Q24, the company expects continued high levels of harvest, with a large expected level of Smolt release in 2H and 2025E. Chile and Norway are expected to see reduced levels of Smolt releases, which means that the overall supply growth is expected to be down 2%, with 1% growth for all of 2024 (the former being 1H24.)

Bakkafrost has already signed contracts for almost 10% of the total harvests. The company is already forecasting all the way to 2028, once all capacity additions are online.

The main company concerns that I personally look at in terms of risks and rewards are things like Scottish farming costs/OpEx, which are at elevated levels due to biological factors (high mortality of smolt/fish) and continued ramp-up of assets. I do not expect Scotland to become a good segment for either this or next year. Also, the impact of overall delays in the Faroe smolt facilities which should have been up and running before, but weren’t. For the time being the company guides for a short delay for 2025E, but nothing major beyond that.

So this being clear, I do not consider there to be any huge risks to Bakkafrost that have not been discussed before. But overall volatility is something we need to continue to expect from this – and from any Salmon-oriented company.

Let’s look at the company valuation.

Bakkafrost Upside Potential – Even at well above 200 NOK, the company has a good upside

My strategy, as always, is to buy good companies at cheap prices and sell them when they turn expensive – like I did when I saw over 200-300% RoR and sold Bakkafrost shares at over 800 NOK before buying them back when the company dropped. I now believe the company has the potential to touch quadruple-digit share prices in the next few years.

Bakkafrost currently trades at a valuation of 545 NOK/share, which means a yield of just above 2.5% – which is below average.

However, the company also has less than 29% long-term debt/cap, and is one of the premium-product world-leading companies in its field, with a market cap of over 32B NOK even now. It’s also trading at an overall P/E ratio of 17.6x, and this is compared to a 5-year average of 28x.

Is it worth 28x?

It could be.

I believe the company is set to grow at a rate of 17% per year until 2026E. These growth estimates come at an accuracy rating of less than 75%, but above 50%, which means there’s a decent amount of historical accuracy. Bakkafrost also beats targets by more than 10% and 25% of the time (Paywalled FAST Graphs link). So there’s a not unlikely potential for the company to manage that 15-18% growth rate, at which point I would say that the company could be worth more than 25x P/E.

My previous target for the company was 735 NOK, representing about a current 21-22x P/E, and I maintain this target at this particular time. However, the fact remains that if you accept 15-17% growth, you can expect a 23%+ annualized RoR at any P/E of 19-25x.

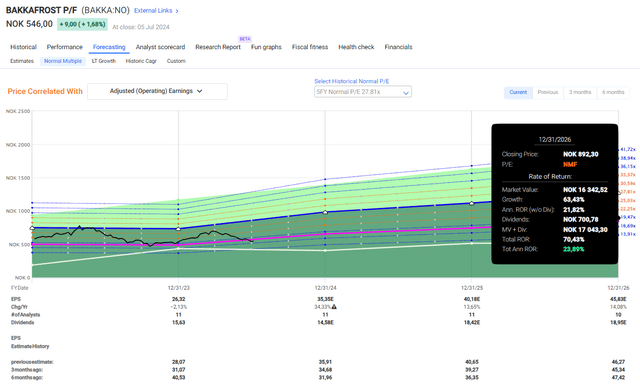

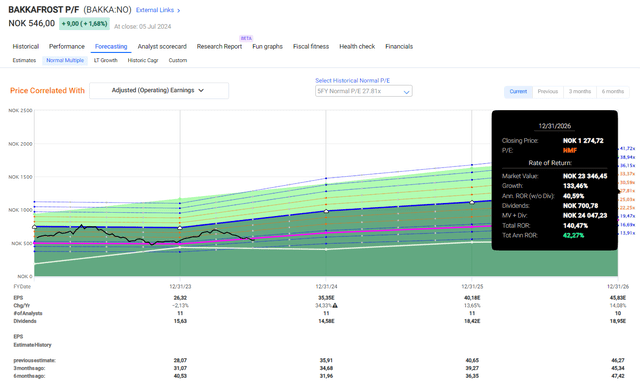

This is what things would look like if Bakkafrost managed 17% at 19x P/E.

FAST Graphs Bakkafrost (FAST Graphs Bakkafrost)

And this, dear readers, is the bearish thesis in my opinion.

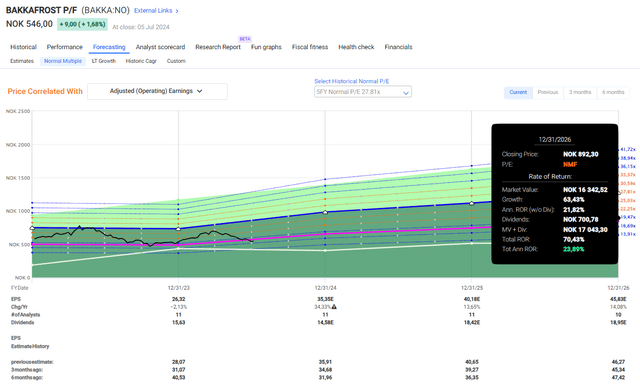

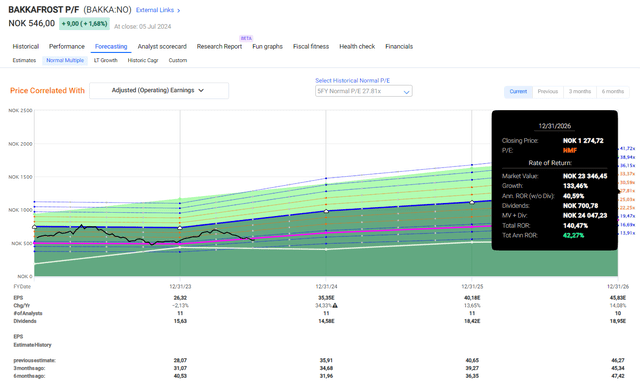

If we go for a more bullish scenario, I estimate between 25-27x P/E, and then we get this.

FAST Graphs Bakkafrost Upside (FAST Graphs Bakkafrost Upside)

You might think this unlikely – but remember that the relational move has already been seen by Bakkafrost more than once before.

So for Bakkafrost to manage this again, is not unlikely in the least. And this is why I consider the company worth holding, worth buying, and worth investing in here. I could easily hold 1-2% of my portfolio in Bakkafrost and not really be worried here at all. I would hold it until we saw 750-800 NOK at the very least, at which point I would look at what else was available on the market for purchasing.

My position in this company is in fact larger than my positions in competing Norwegian businesses, such as Mowi. Bakkafrost simply does not only have better circumstances, they also execute better – the proof only needs to be looked at here if you’re interested.

However, at the same time, let me be very clear with the fact that risks to Salmon farming are not trivial. By far, one of the largest is farming, where Bakkafrost is exposed to biological and climate risks such as storms, diseases, algae blooms, and other things. Bakkafrost does not control this.

This is in addition to your typical pricing and cyclicality risks. My point is, that this is not an investment where you want to be asleep at the wheel – but if you follow the trends and pricing as I do, then this can be a very profitable sort of potential.

But a strong stomach is definitely required to invest in, if not eating, salmon.

Here is my current thesis for the company.

Thesis

- I do need to mention that I at one point owned Bakkafrost shares acquired at a share price of 200 NOK/share. This was years ago and shows just how early I started accumulating stock in this company, which I view as the best in its field. I sold most of these later when the company hit close to 800, with the plan of buying them back when the company dropped.

- I did this the second time around when the company dropped below 500, then again when it touched 400 NOK, only to sell again at close to 750 NOK/share.

- Now we’re back to the fourth time. This time I bought at 545 NOK not long ago, I’ve raised my PT due to growth targets, and I give the company a PT of 735 NOK this time around. I’d trim once again at 800 NOK or above as of the 2024 period.

- That makes the company a “BUY” for me here – and I am buying more as of July 2024, and keeping a close eye on the business.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I still can’t call Bakkafrost “cheap” here – it’s just not possible. But it fulfills every other criterion I hold for a solid investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.