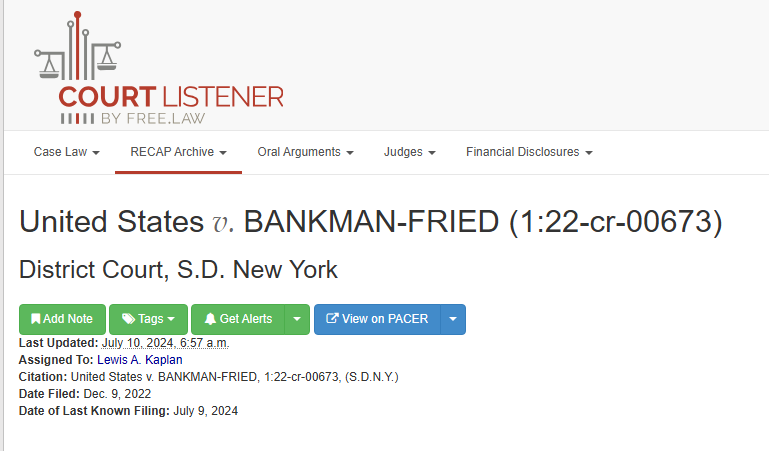

The stunning fall of Sam Bankman-Fried’s (SBF) once-mighty FTX exchange, in November 2022, is still causing havoc in the crypto space. Nearly two years later, the legal reckoning is still ongoing as former FTX executives Nishad Singh and Gary Wang are ready to face punishment for their part in the multi-billion dollar scam.

Cooperation Might Get Lighter Penalties

According to a most recent update to the court docket, Singh and Wang will be sentenced on October 30th and November 20th respectively. Both CEOs chose plea agreements, acknowledging guilt on several offences including wire fraud and conspiracy. Although their collaboration with prosecutors against SBF might result in reduced penalties, the crypto sector’s reputation suffers unquestionably.

Singh’s account presented a bleak image of a business barely surviving. He acknowledged voicing worries about SBF’s ostentatious spending patterns and the lack of control over Alameda Research, FTX’s alleged sister firm with a particular, and finally dishonest, trading advantage.

Wang’s testimony strengthened these assertions by demonstrating the non-existence of a purportedly “Backstop Liquidity Fund” promoted by FTX and so highlighting another instrument utilised to control the market.

From FTX Wunderkind To Felon: The Web Of Lies

FTX was a golden lad of the crypto scene during its height. Valued at more over $32 billion, SBF, the youthful and dynamic creator, was considered as a visionary leader. He developed ties to influential people in politics and business, therefore confirming his reputation as a genius.

This illusion was dashed, though, by a November 2022 leaked financial statement. It exposed that using its own illiquid token, FTT, FTX was artificially raising its value. Panic followed, and within a week the whole house of cards collapsed.

Prosecutors untangled a sophisticated network of lies. Customer money went to support Alameda Research, the failed trading company owned by SBF. Outragesous personal spending that hid behind the mask of socalled “normal corporate activities” were the lifestyle of these top honchos. The once-trusted wunderkind turned out to be a phony. He’s serving a 25-year prison sentence as we speak.

The Unraveling

The collapse of FTX caused the bitcoin market to experience a jolt, which made investors less confident and highlighted the importance of enacting stricter regulations. Although the penalties handed down to Singh and Wang are a start in the right direction towards resolution, the aftermath of the exchange is still continuing to get more complicated. The sector is struggling to regain the faith that was lost as a result of Bankman-Fried’s intricate strategy, and investors are being forced to cope with the enormous losses themselves..

Featured image from Pexels, chart from TradingView