relif

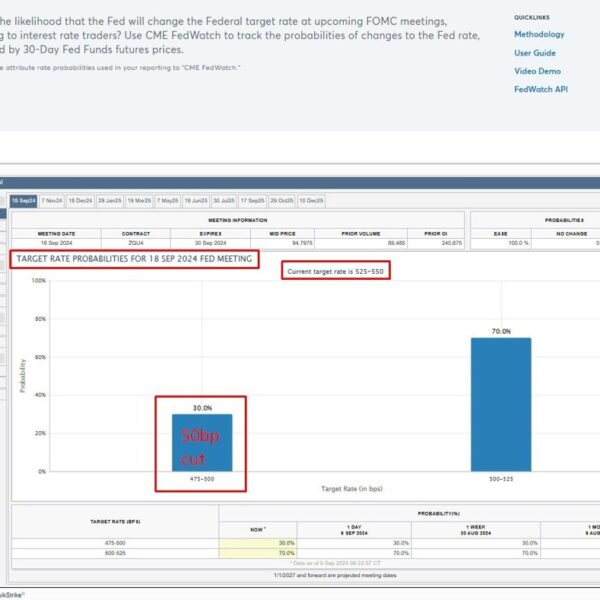

Upstart (NASDAQ:UPST) may be beginning to see the light at the end of the tunnel. With the company having calibrated to the higher interest rate environment, management is now projecting a return to sequential growth and positive EBITDA generation by the end of the year. It is notable that the company appears to have right sized its cost structure to be able to operate profitably even in this higher interest rate environment. The stock is looking more and more investable assuming the status quo, and outright cheap assuming a cut to interest rates. I reiterate my buy rating for the stock.

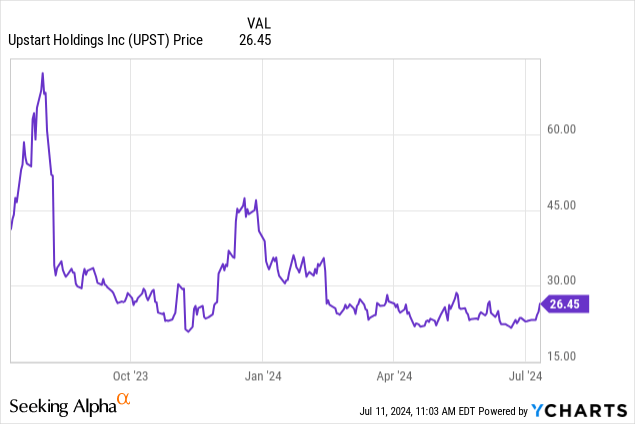

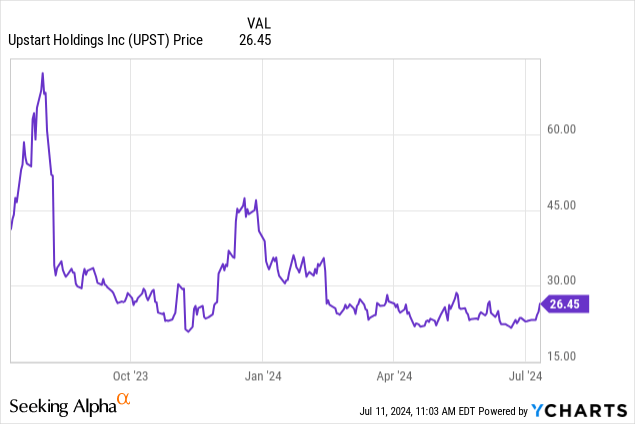

UPST Stock Price

I last covered UPST in April where I called the stock a buy on account of its “coiled spring” upside to lower interest rates. The stock has underperformed the broader markets since then.

While there might not be a more significant catalyst than a cut in interest rates, management continues to execute against making the business work even at these higher interest rates.

UPST Stock Key Metrics

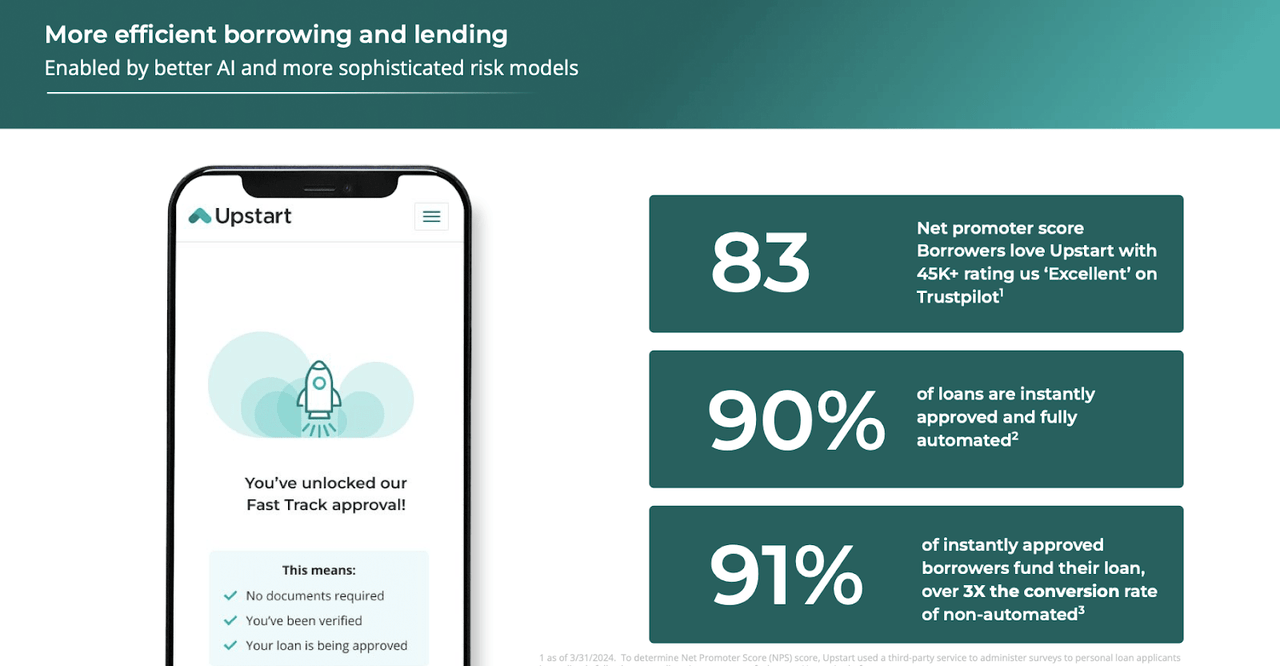

Even prior to the rise of generative AI, UPST was founded as an AI-backed loan origination platform.

The company seeks to offer credit while looking beyond the credit score (made possible using proprietary AI models), with the goal of extending more credit to more individuals at lower loss rates.

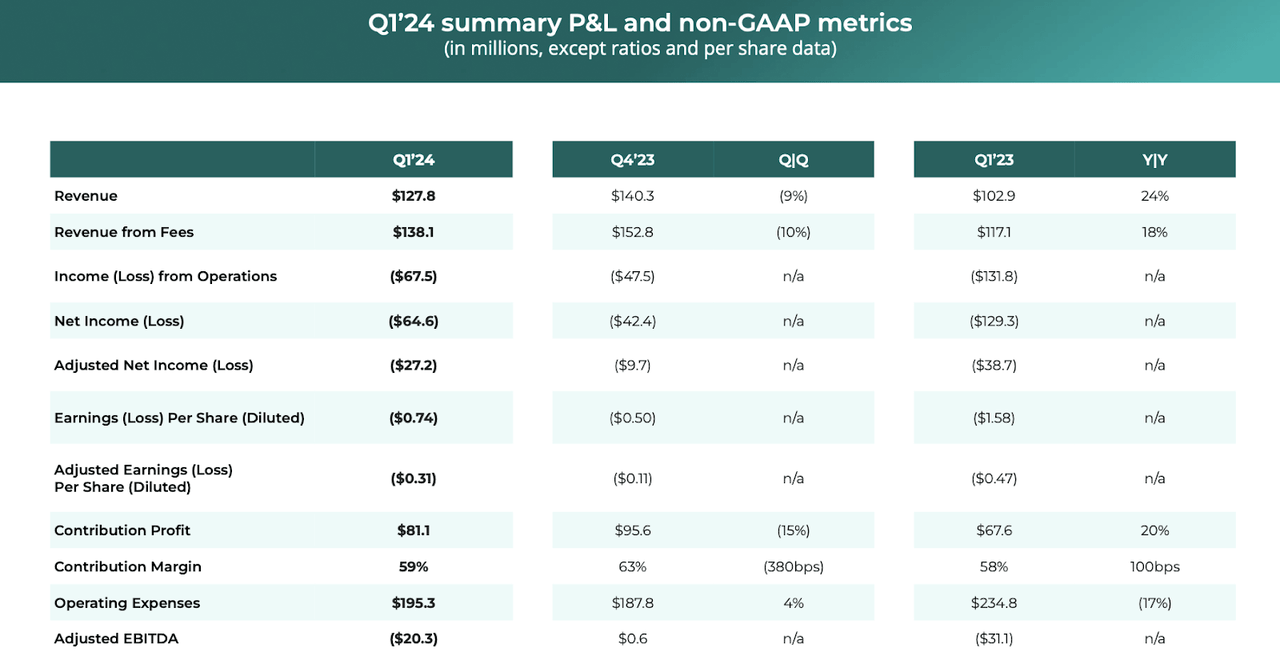

In its most recent quarter, UPST saw revenues jump 24% YoY as the company finally started lapping easier comparables. The company also made progress on its adjusted net loss, and adjusted EBITDA turned slightly positive.

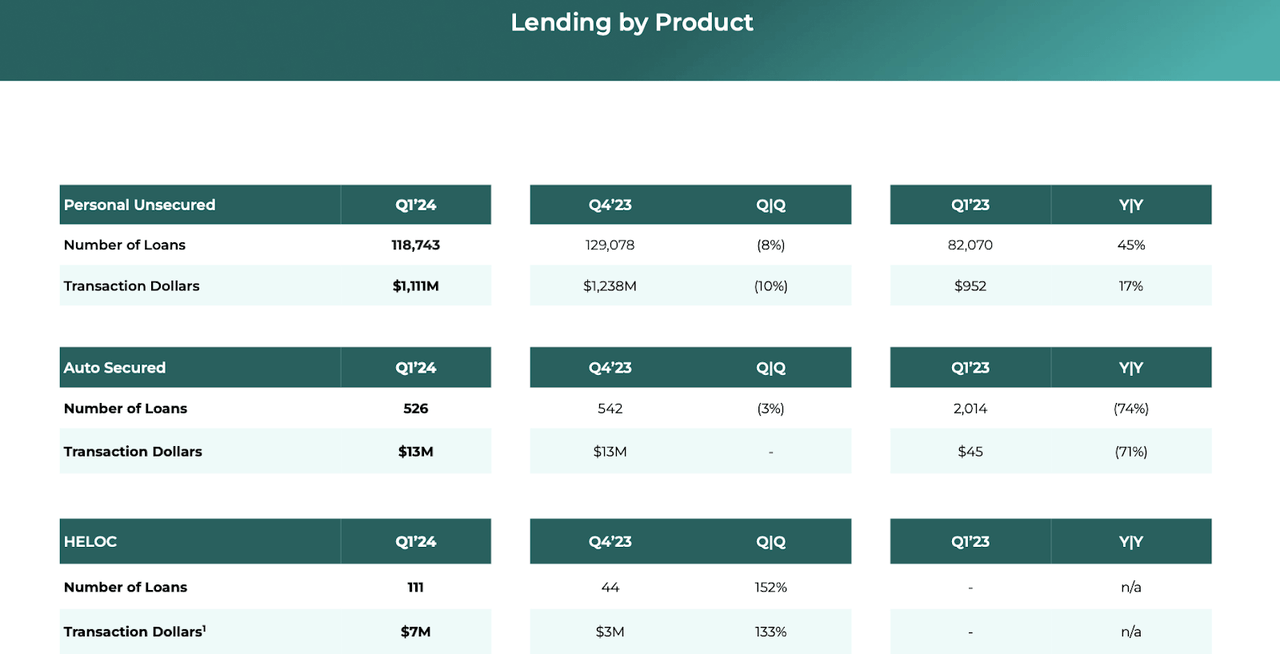

The company saw 45% YoY growth in the number of personal unsecured loans originated, but auto secured loans continue to struggle.

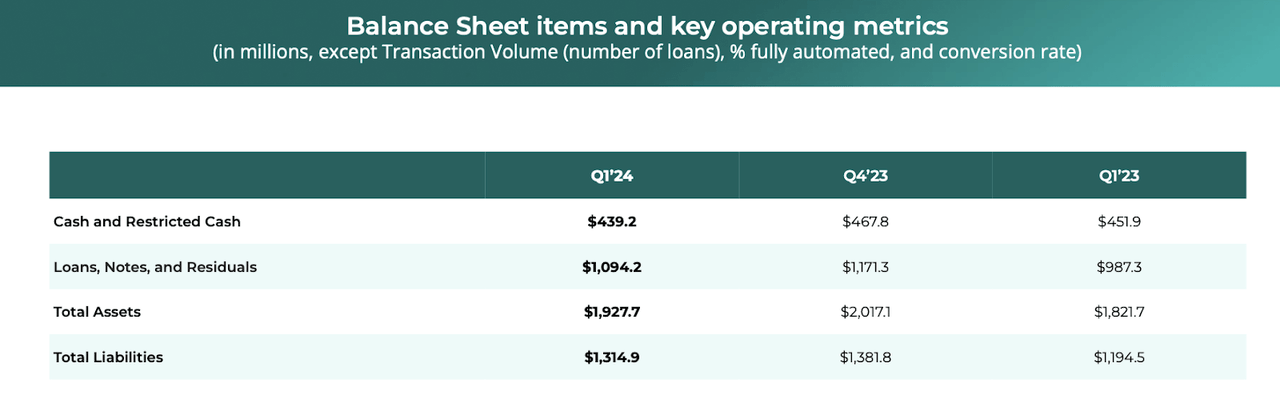

The company ended the quarter with $439 million of cash and $1.1 billion of loans, versus $1.3 billion in total liabilities.

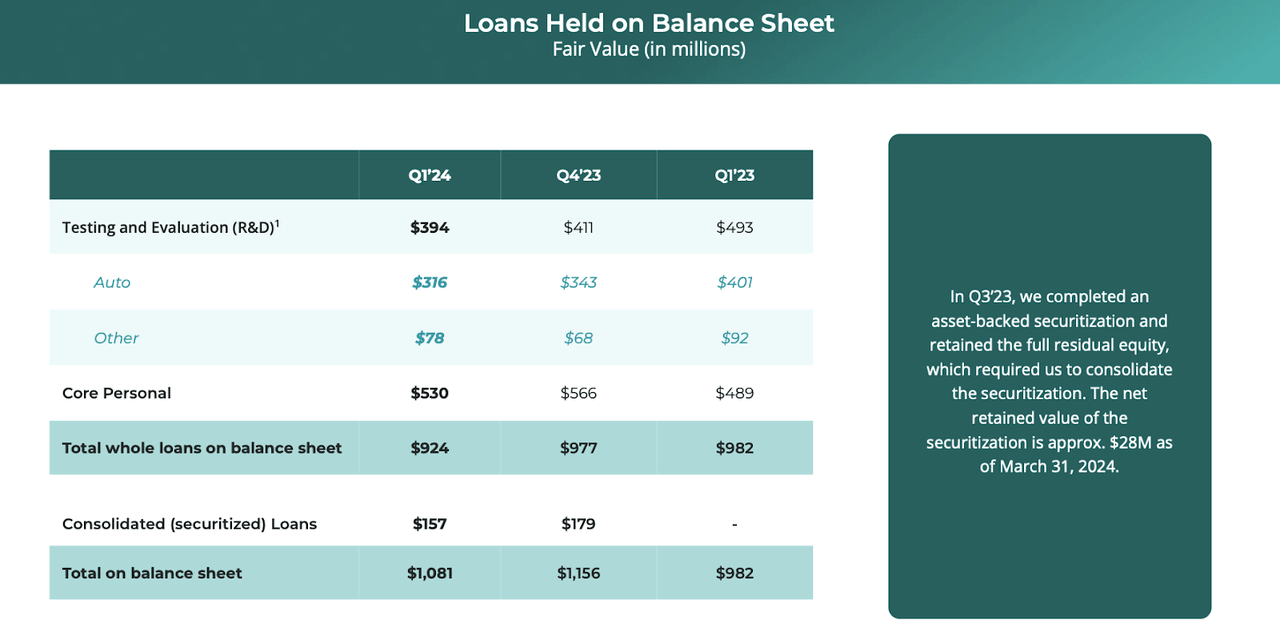

Of the loans held on the balance sheet, management estimates $530 million to be considered “R&D.”

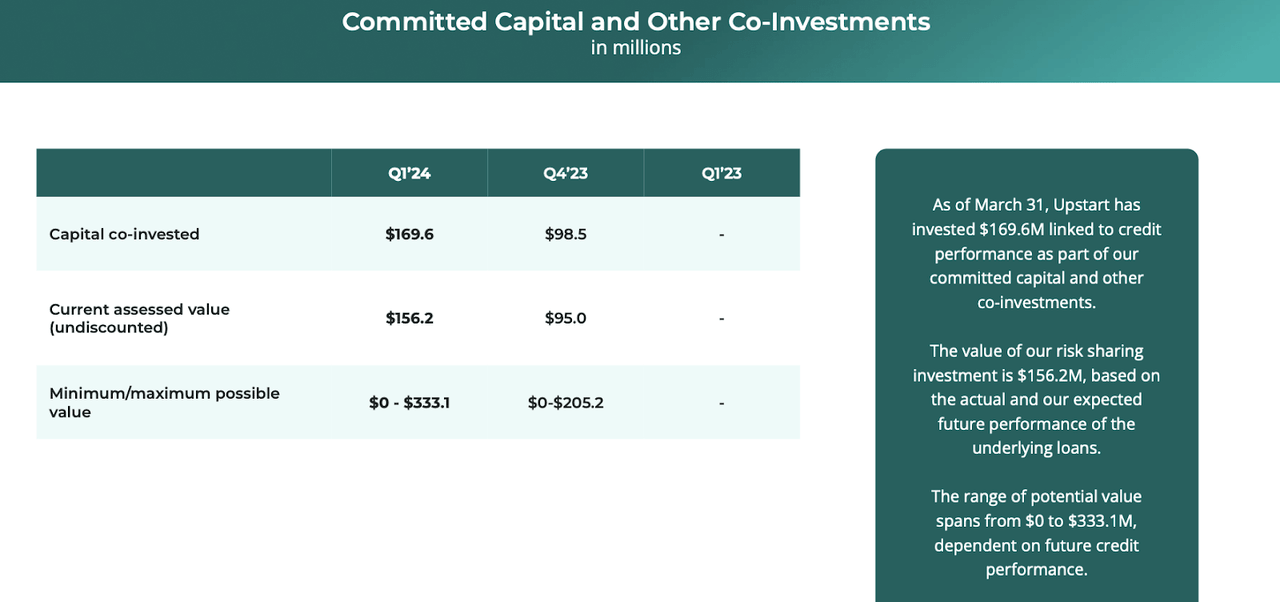

UPST had previously secured some committed partner capital, an important development given that its funding sources dried up after its post-pandemic loans did not perform as well as historical levels. The company had invested $169.6 million in these partner arrangements, currently worth $156.2 million after accounting for expected performance.

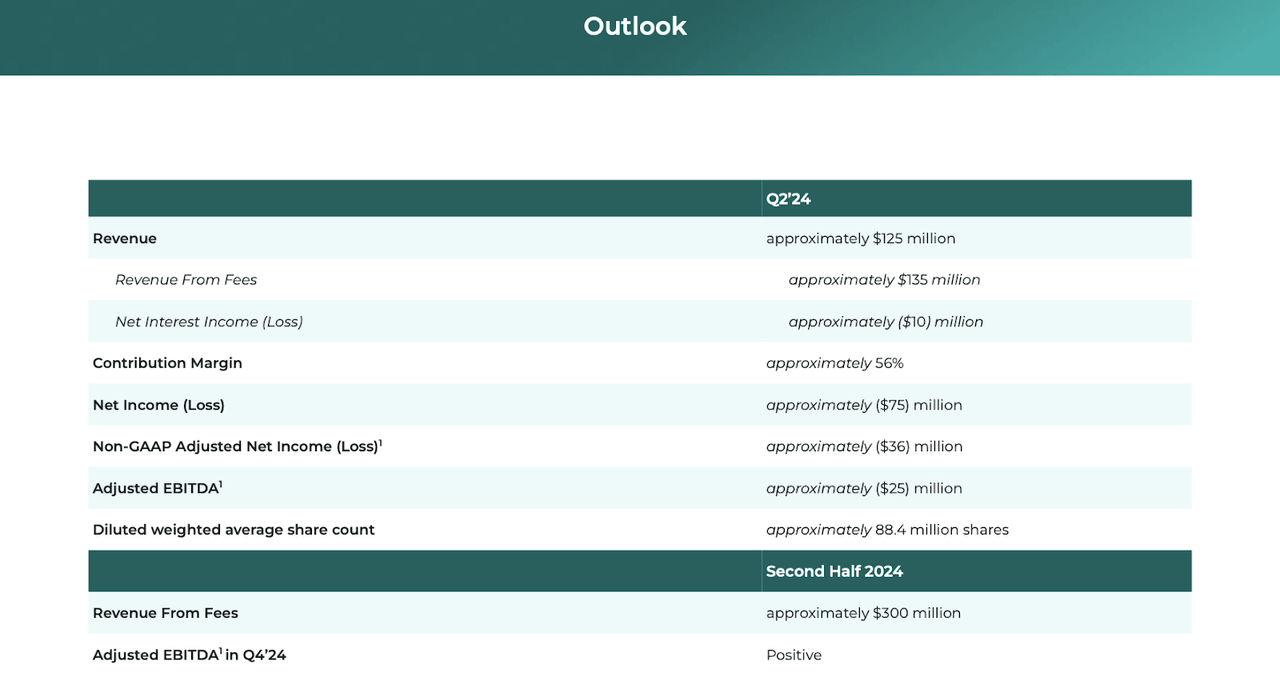

Looking ahead, management has guided for $125 million in revenue, with adjusted EBITDA turning negative again.

On the conference call, management noted that headcount has been reduced to 2021 third quarter levels. That is in part due to a reduction of $20 million in fixed expenses since the start of 2024. Management also noted a 23% reduction in their infrastructure costs with additional savings expected in that area. The key development this quarter was management finally appearing more upbeat. Management outlined expectations to reduce the loans held in the balance sheet that are not held for R&D purposes. Management has a history of flip-flopping on this point, at some points emphasizing an asset-light model and at other points prioritizing the interest income. But it appears that management may finally have the confidence to return to a more asset-light model. Management noted that they expect to secure approximately $2.7 billion in committed capital funding over the next 12 months, suggesting an expansion of its committed capital arrangements. Subsequent to the end of the quarter, the company reached an agreement with Castlelake LP to sell up to $1.2 billion in installment loans over the next 12 months. Management believes that the worst may be over, namely, that the post-pandemic wave of defaults is “now at or very close to its peak.” Management guided for a return to sequential growth and positive EBITDA by the end of the year. The business was always going to bottom at some point, but prior to this quarter investors were left waiting to see if more suffering was needed before then. Now it appears the tide may be finally turning.

Is UPST Stock A Buy, Sell, or Hold?

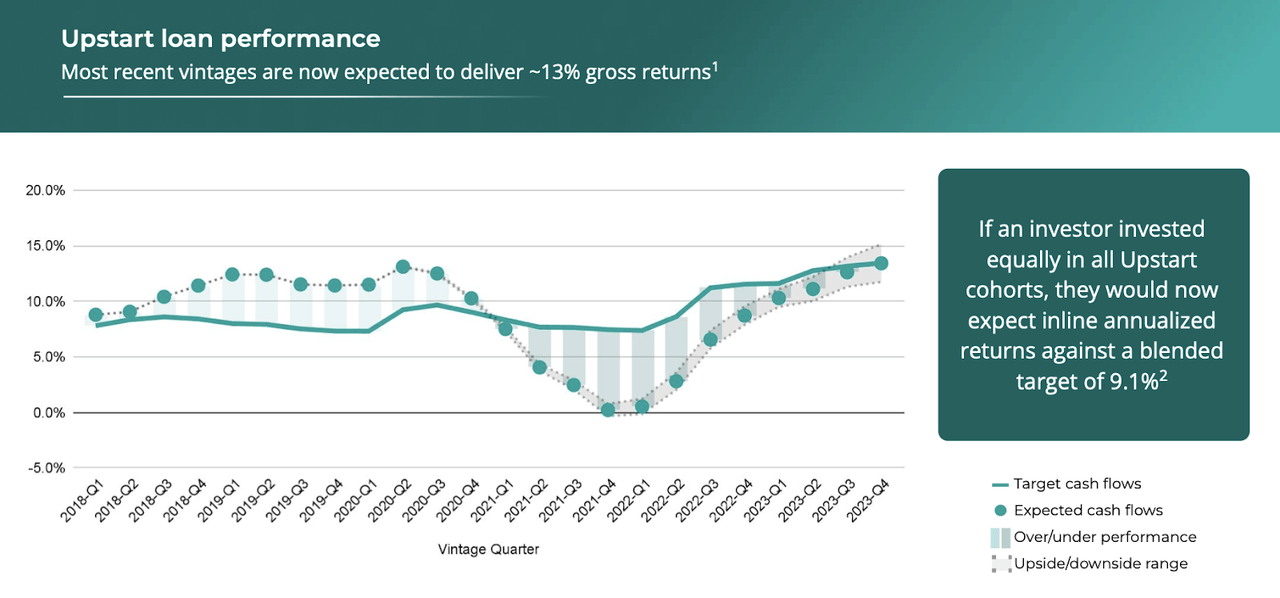

UPST had seen growth disappear (and the stock price plummet) after its originated loans began to underperform their target ROIs. The company had not been prepared for the post-stimulus and subsequent higher interest rate environment. The company has finally calibrated their models.

The stock recently traded hands at just around 4x sales.

This is a company which I can see generating 20% to 30% net margins over the long term. The company’s highly automated processes may allow for these high profit margins especially as funding sources return and the company is able to benefit from operating leverage. At the low end of that range, the stock is trading at around 20x long term earnings, which is a reasonable multiple when considering that revenues might move sharply higher following a material cut to interest rates. It is difficult to assign a precise price target given the reliance on a lower interest rate environment to drive a re-rating, but as management executes on driving margins higher in the current environment, I can see the stock being deserving of a 3.5x to 4x sales multiple (equating to 14x to 16x earnings based on a 25% margin). That may mean that the stock might deliver forward returns roughly in-line with topline growth rates, which might be substantial upon an inflection in interest rates.

UPST Stock Risks

UPST is still not yet profitable and thus may be very volatile on market turmoil or fears of further interest rate hikes. Funding sources might not emerge, even if the company is able to further improve investment performance. Competitors might adopt similar models, reducing demand for UPST’s products and limiting their growth rates. I note that similar operator LendingClub (LC) trades at a sizable relative discount and might suggest downside under such a scenario.

UPST Stock Conclusion

UPST remains a play on lower interest rates, but management appears confident in an improving profit picture even in the current environment. I look forward to seeing if management will follow through on promises to reduce loans held on the balance sheet and to drive positive EBITDA generation by the end of the year. I reiterate my buy rating for the stock.