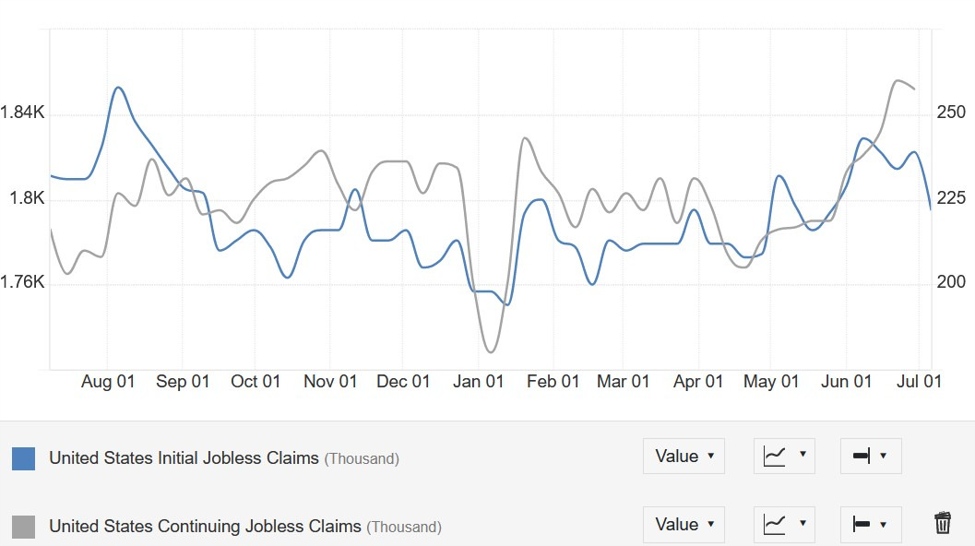

Yesterday, we got some goldilocks US data with another soft US CPI report and good US Jobless Claims. First of all, better than expected jobless claims should quell fears of a deteriorating labour market, at least in the short term. One thing to note is that the data might have been distorted by the shorter week as we had Independence Day last week. Nonetheless, the next week release should give a better picture.

US Jobless Claims

The US CPI, on the other hand, surprised to the downside and it was good news across the board. Moreover, we saw further easing in the policy sensitive OER measure with the Y/Y rate easing to 5.4% and the 3-month annualised rate to 3.6%. The Cleveland Fed new tenant index is considered a leading indicator and it points to further easing in the months ahead. Below you can see the changes in various measures.

CPI measures

The market is now basically certain that we will get a rate cut in September and December, but it has also started to price in a third cut in November. There are some speculations that the Fed might even cut rates in July but I think that’s out of the equation. I can see the Fed cutting rate in July only if initial claims spike big in the next weeks or the stock market crashes like in 2018 signalling a possible policy mistake.

It’s highly likely though that the Fed will be dovish in July and if we get another benign CPI report in August, Fed Chair Powell will deliver a rate cut in August by pre-committing to a cut in September at the Jackson Hole Symposium. September will just be a formality, but if the data will give them even more confidence, then they will be able to ease conditions even more with a dovish SEP.

The current estimate for the Core PCE Y/Y measure is 2.4%, which would be very good news for the Fed. We will see how the estimate will change today after the US PPI data.