yucelyilmaz

One of the companies that I have a very long history with is satellite operator Iridium Communications Inc. (NASDAQ:IRDM). My first bullish article about the company came out in July 2015. At that time, shares were only $8.12. Today, they are at about $26.60. Clearly, my bullish sentiment proved accurate. As time went on, shares of the company rose significantly higher than where they are today. This led me to adopt a more cautious approach to the enterprise. And even though they have come down rather significantly, when I last wrote about the firm in February of this year, I ended up reaffirming it as a ‘hold’ because of the limited upside that the business seemed to offer.

Since then, management has come out with new data and the company has undergone some other interesting changes. On top of that, the stock has pulled back by a further 5.4% at a time when the S&P 500 is up 7.7%. In my prior article on the firm, I stated that it was nearing ‘buy territory’. And finally, I think that the firm has finally crossed that point. Based on management’s own expectations of what the future holds and the overall health of the company, I believe that increasing it to a soft ‘buy’ makes sense at this time.

No longer high-flying

My overall assessment of Iridium Communications today does not hinge terribly on the recent financial performance of the business. This would be the first quarter of the 2024 fiscal year relative to the same time last year. This is the only quarter for which we have new data that we did not have data for when I last wrote about the business. Having said that, I do think it would be useful to at least cover these results slightly.

During the quarter, revenue for the company came in at $203.9 million. This was actually down by 0.7% compared to the $205.3 million reported one year earlier. This drop may seem disconcerting. But the fact of the matter is that it was really only because of a plunge in subscriber equipment revenue from $41.7 million to $24.9 million. This drop, according to management, is largely because sales were temporarily boosted because of customer reactions to supply chain disruptions during the pandemic.

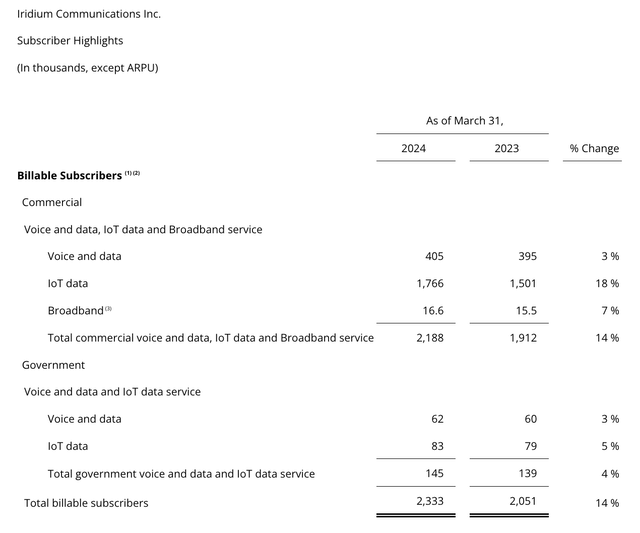

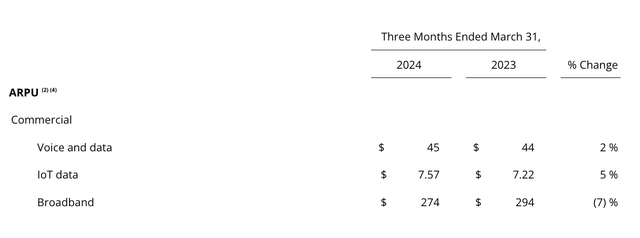

If we remove this from the equation, the overall picture for the company looks quite positive. Services revenue, for instance, rose by 6.6% year over year, climbing from $139.3 million to $148.6 million. This was driven entirely by the commercial side of the company as ARPU for voice and data customers inched up from $44 per month to $45 per month, and ARPU from IoT data subscribers increased from $7.22 per month to $7.57 per month. An even larger contributor to the increase in the business was a rise in the number of commercial users. The number of billable subscribers in the first quarter of 2023 stood at 1.91 million. By the end of the first quarter of this year, that number had risen by 14.4% to 2.19 million. It’s also worth noting that engineering and support services revenue also increased, with that metric rising from $24.2 million to $30.4 million. Management attributed this to a surge in government engineering and support services because of increased work under some government contracts, most significantly those involving the Space Development Agency.

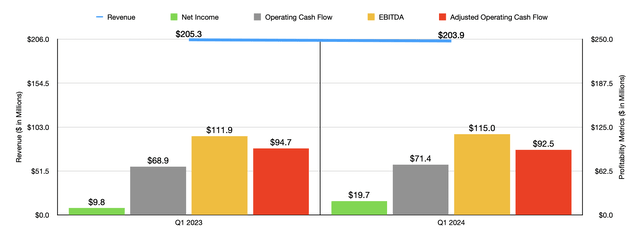

Even though revenue fell, profitability for the metric improved across most categories. Net income shot up from $9.8 million to $19.7 million. Operating cash flow improved from $68.9 million to $71.4 million. If we adjust for changes in working capital, we would get a slight decline from $94.7 million to $92.5 million. However, EBITDA for the company managed to grow from $111.9 million to $115 million.

More important than recent financial results is the guidance that management has for the current fiscal year. They anticipate service revenue growth of between 4% and 6%. With this, EBITDA should come in at between $460 million and $470 million. At the midpoint, that is only slightly above the $463.1 million reported last year. If we assume that adjusted operating cash flow will rise at the same rate, then we would expect a reading for this year of $373.1 million compared to the $371.6 million reported for 2023.

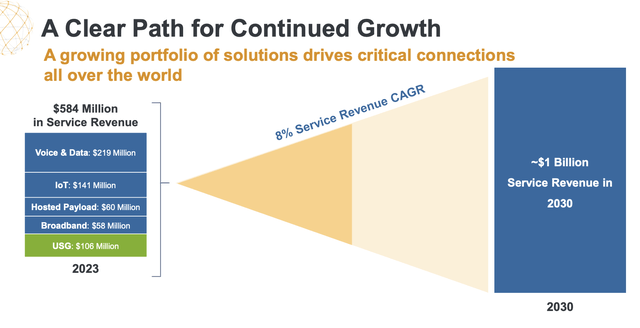

When it comes to the longer-term outlook, management seems incredibly optimistic. They expect revenue from services alone to hit around $1 billion by the year 2030. That would be about 8% growth per annum from the $584.5 million generated from service activities last year. In the last article that I wrote about the firm, I projected what the overall financial condition of the business might look like if we assume steady growth during this window of time. This analysis assumed that management would continue to buy back stock each year and it factored in capital expenditures and debt reduction.

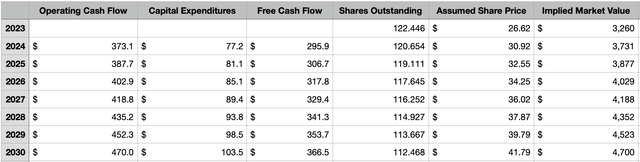

Using the most recent data provided by management, I’ve decided to recreate those results as shown in the table below. Using the assumption that the company should be worth about 10 times the adjusted operating cash flow, we project out how shares should be priced in each year from 2023 through 2030. By the end of the decade, we would be looking at a market capitalization of $4.70 billion. Having said that, the analysis needs more detail than just this to determine ultimate value.

For starters, even though we factor in a reduction in share count, we have not yet figured out how much extra cash the company will spin off to investors over the years. Total free cash flow from 2024 through 2030 should be around $2.31 billion. Based on the projections, about $334 million will be used to buy back stock during this window of time. In addition to this, management stated that, by the end of the decade, they expect a net leverage ratio of 2 or lower. Factoring in the $115 million that the company just paid to acquire the remaining 80% of Satelles it did not previously own, this would imply a net debt reduction of $354.1 million.

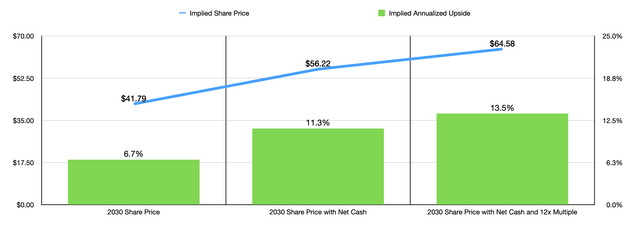

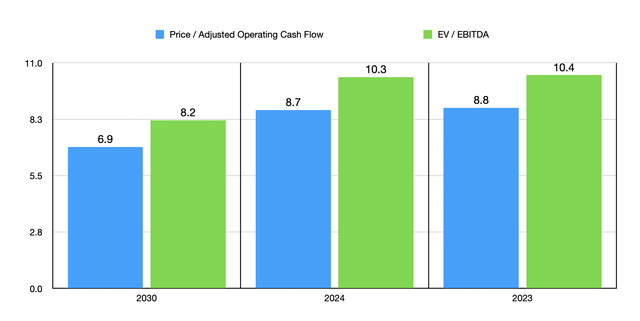

Ultimately, this leaves us with net cash of $1.62 billion. As you can see in the chart above, this will take the total value to investors of $56.22 per share. From where the stock is currently, that would imply an annualized increase for shareholders of 11.3%. That’s approximately double the 6.7% if we don’t include the cash changes. And it’s also in line with what the broader market should achieve. However, our assessment does not end here. Even though this is subjective on my part, I have to imagine that a steadily growing cash cow in the space industry would be worth at least 12 times the adjusted operating cash flow. Add the cash distributed to investors on top of this, and you end up with $64.58 per share, for an annualized increase of 13.5%. That meets my standard for exceeding the broader market. And in all likelihood, I would say that this is conservative considering the quality of the operation that we are talking about. Also, in the chart below, you can see the trading multiples of the firm based on historical results for 2023 and estimates for 2024 and 2030.

It is always possible this data could change. And there is evidence to suggest that the future of the company might be better than previously expected. To begin with, I already talked briefly about the firm’s acquisition of Satelles in exchange for $115 million net of cash acquired. That business helps to provide more accurate time and location data that can serve as an alternative to traditional GPS. Considering that this is a recent development, it’s unlikely that financial projections for it are fully incorporated into Iridium Communications’ forecast for the future. By 2030, management expects that this particular operation will generate over $100 million in service revenue annually, on top of equipment and engineering revenue.

There have been other, even more recent, developments. On June 4th, the management team at Iridium Communications announced that they were awarded a five-year contract by Space Systems Command that will involve leveraging the company’s network for communication purposes. Initially, this contract is valued at $94 million. But it could be worth up to $103 million under certain circumstances. This follows a previous contract that was similar to it that was signed in 2019 and that lasted for four-and-a-half years. It was valued at $54 million. I believe new contract awards like this have the potential to add even more value to the company as time goes on.

Takeaway

It’s always difficult to remain objective when you are talking about a company that you have a great deal of interest in. It is true that I find Iridium Communications to be a remarkable business that has tremendous potential down the road. The strict value investor in me, however, has made sure to ground myself when shares got too expensive. But now, just barely, I think that the company has reached the point where it is worth considering buying. Due to this, I’ve decided to upgrade the stock to a soft ‘buy’ at this time.