WangAnQi/iStock via Getty Images

Investment Thesis

Company Overview

American Superconductor Corporation (NASDAQ:AMSC), founded in 1987 and headquarters in Ayer, Massachusetts, is a system provider of megawatt-scale power resiliency solutions on the grid™ that protects and expand the capability of the Navy’s fleet, using its proprietary “smart materials” and “smart software and controls” enhance resiliency and improve performance of megawatt-scale power flow. It has two market-facing business units: Grid and Wind.

Strengths and Weaknesses

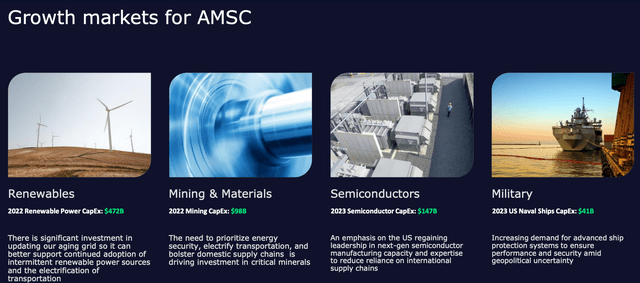

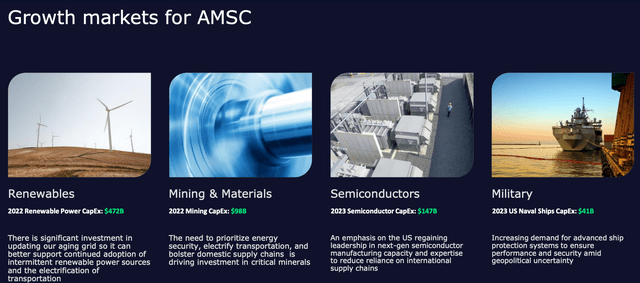

To fulfill its mission of expanding efficient energy delivery, American Superconductor Corporation is implementing transformational changes and system upgrades. One is to incorporate the delivery of clean energy, another is to enhance performance with proprietary products, software, and control solutions that use computerized systems. As the company serves a critical part of the supply chain and military infrastructure, there are four main industries that depend on its services: Renewables, Mining and Materials, Semiconductors, and surely, the Military.

AMSC: Growth Market (Company Presentation)

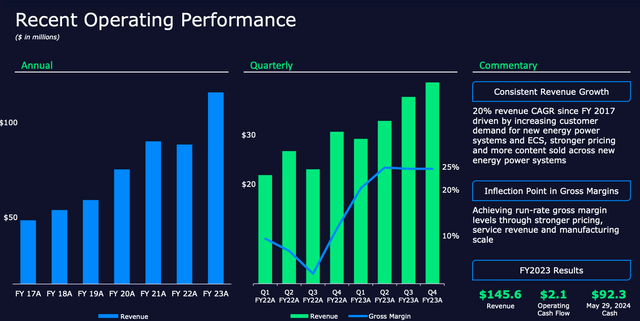

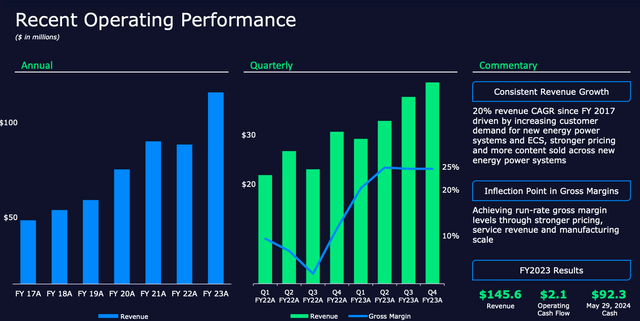

Its revenue grew at 20% CAGR since FY17, which it attributed to the new energy power system and ECS demand, plus stronger pricing power amid rising sales across different categories.

AMSC: Recent Operating Performance (Company Presentation)

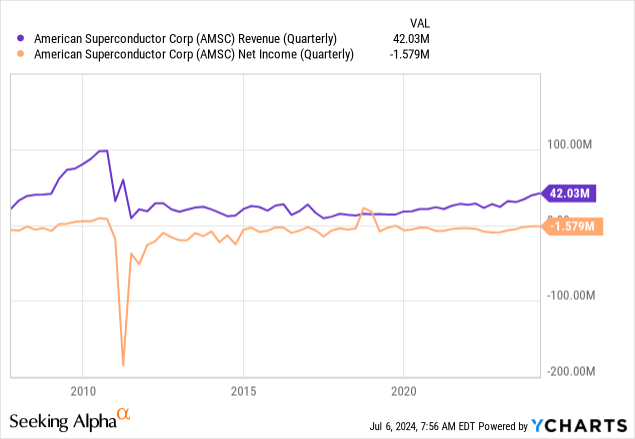

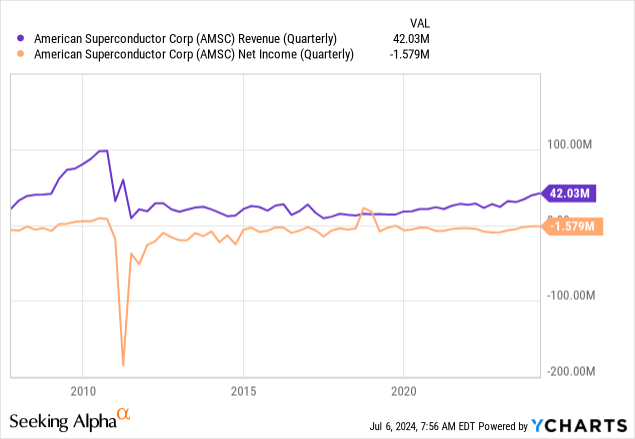

AMSC’s revenue has experienced rapid growth since 2020, up by more than 100%. Since recovering from the 2008 recession, its net income has been hovering around break-even numerous times. Currently, it is once again on the cusp of achieving positive net income.

The company is expanding its revenue not only from the existing customers who are looking to upgrade to the handling of large megawatts energy delivery, but also attract new customers. It was snapping on average $32 million per quarter of announced orders in FY23 compared to just above $15 million in FY 2020, more than doubling the number. No doubt this is the force that was driving its net income close to positive.

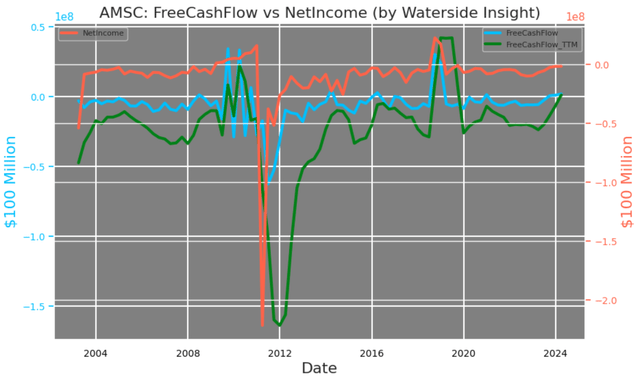

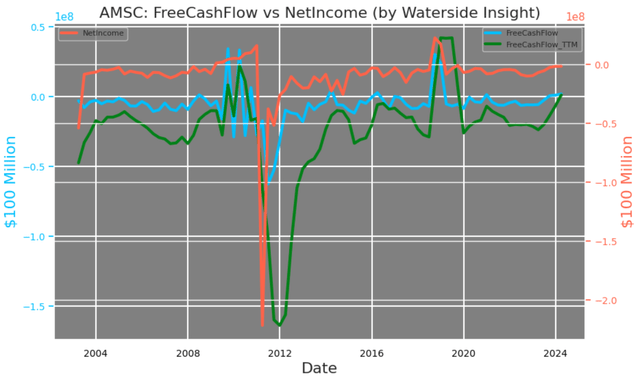

With its net income breaking even, it is also coming close to free cash flow breakeven. In fact, this is the first time its free cash flow reached non-zero on a TTM basis since 2020. Looking at its history, AMSC has never consistently achieved positive free cash flow over an extended period. Is it going to be different this time?

AMSC: Free Cash Flow vs Net Income (Calculated and charted by Waterside Insight with data from the company)

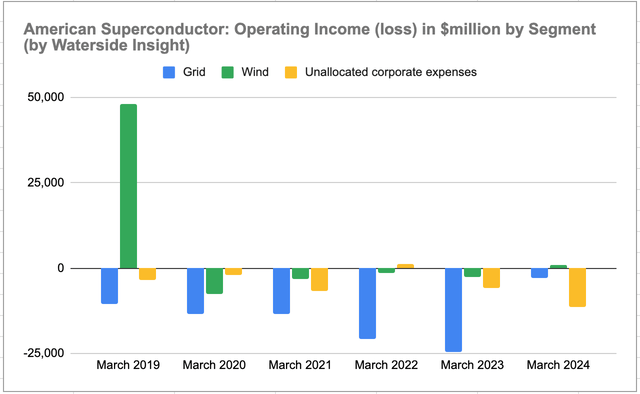

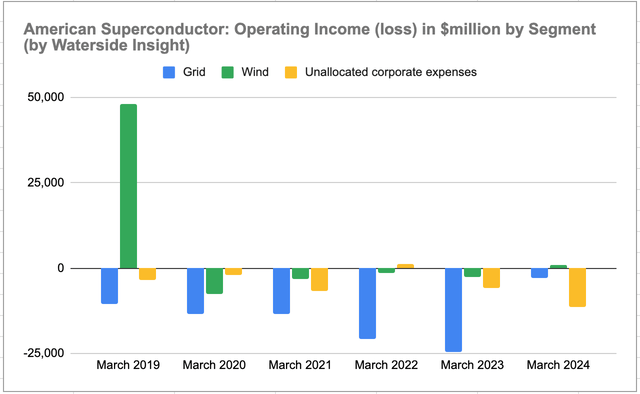

The company has two business segments, Grid and Wind. It also reports “Unallocated Corporate Expenses (‘UCE’)”, mostly consisting of stock-based compensation, as part of its operating income breakdown. It was the first time since 2019 that the Wind segment reported positive operating income in FY 2023, while the loss from the Grid segment was the smallest over the same period. If not for a loss on contingent consideration of $4.9 million that made its UCE unusually large, it would have been one of the best results. There is a small percentage in the Wind segment that delivers solar energy as well.

AMSC: Operating Income by Segment (Calculated and charted by Waterside Insight with data from the company)

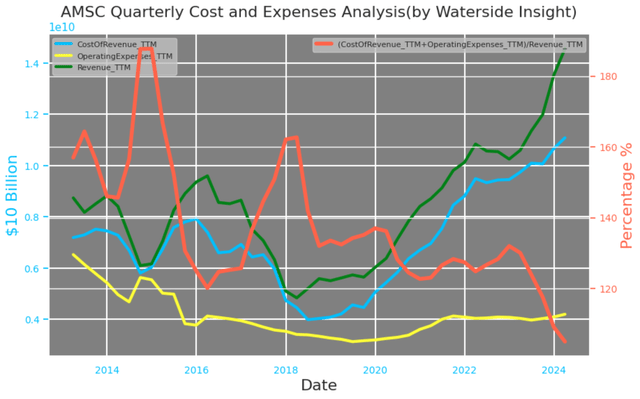

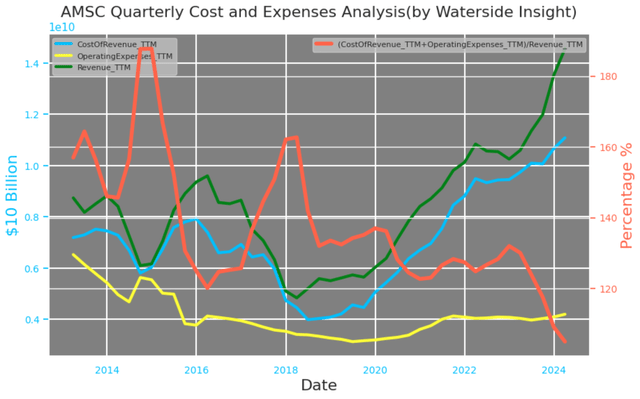

Also for the first time in ten years, AMSC is reporting the lowest costs and expenses with the highest revenue. The price index for wind turbines in the US was cut to $0.96 million per megawatts in 2019 from about $1.58 million in 2008, almost halved in ten years, but revived higher to about $1.2-1.3 million in the past three years due to logistics and inflation. In general, having gone through cost reduction in the past two decades, onshore wind energy is considered mature, while offshore has also been commercialized for at least 15 years. So the future price fluctuation is mostly due to logistics, cost of commodity and capital, and the typical supply and demand dynamics. It is important for the company to stay competitive with innovation and efficiency since the main competition is coming from overseas and cost-cutting was almost a “race to the bottom” in 2023. Compared to the 2010’s when proximity mattered more for the OEMs’ (‘Original Equipment Manufacturers’), now it is the core competencies that differentiate them in the business, because most of them already relocated the production to low-cost countries. So getting back to our questions earlier, to sustainably achieve positive net income and perhaps also positive free cash flow, AMSC needs to crush its costs and expenses curve further by at least 10-20% without compromising its quality and innovation. This is the true challenge it is facing.

AMSC: Costs and Expenses (Calculated and charted by Waterside Insight with data from the company)

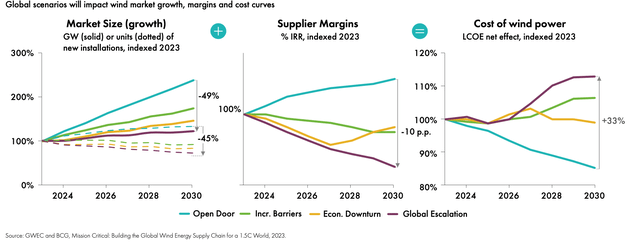

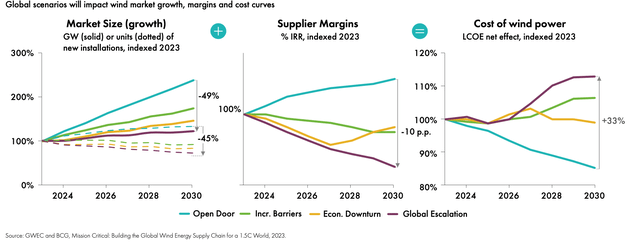

From the projection by Global Wind Energy Council’s Global Wind Report 2024, it is estimated that the supplier margin will risk declining by 10% and the cost of wind power will increase by 20-33% in the next five years. AMSC has its work cut out for it in terms of maintaining a competitive cost structure.

Global Scenario for Wind Market Growth (Global Wind Report 2024)

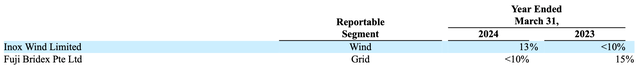

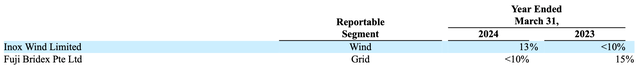

Fuji Bridex is its largest grid client, contributing 15% of its total revenue in FY23 but dropped to less than 10% in FY24, while Inox is its largest wind turbine client, accounting for 13% of its total revenue in FY24, up from less than 10% in FY23. No other customers accounted for more than 10%. Fuji Bridex, headquarters in Singapore, is one of the largest local power and thermal energy providers.

AMSC: Top Clients (Company 10k)

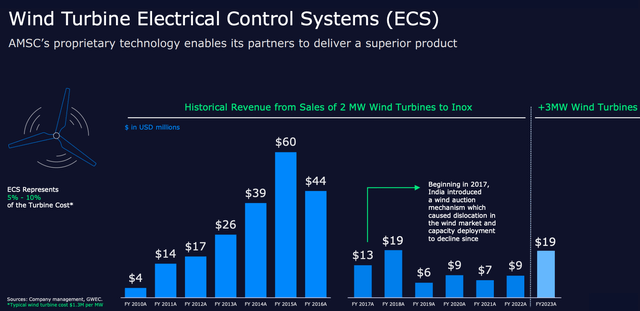

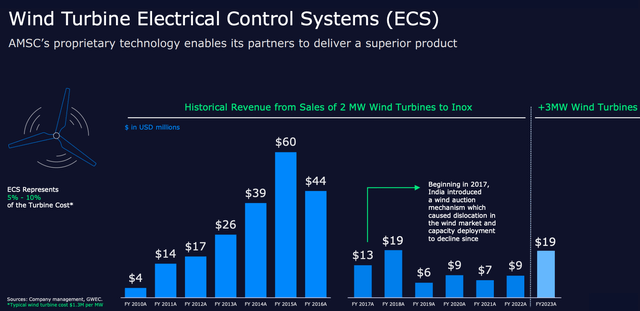

Inox in India and Doosan in South Korea are both notable clients in the Wind segment, according to its 10K. Inox has been active in the new government auction regime in India and the company reported that Inox has a cumulative order book of over 2.6 GW by the end of 2023. The order from Inox obviously will be related to its success in winning the Indian local and state auctions and the ability to deliver its wind turbines. Therefore, there is a risk associated with its demand from AMSC in ECS (“Electrical Control System”) shipments, just as historically Inox has failed to “post letters of credit and take delivery of forecasted ECS quantities”.

A significant portion of our Wind segment revenues have historically been derived from Inox and a significant decrease in revenues from Inox could adversely impact our Wind segment

AMSC: Wind Turbine Electrical Control System (Company Presentation)

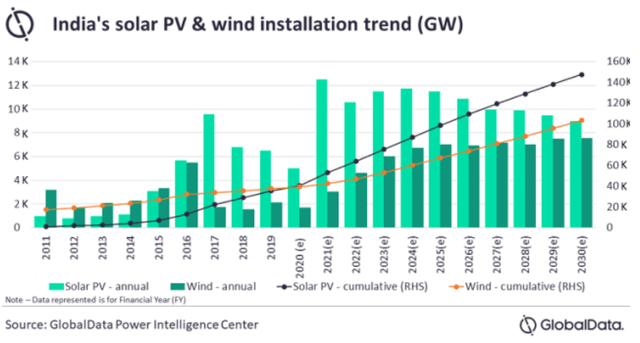

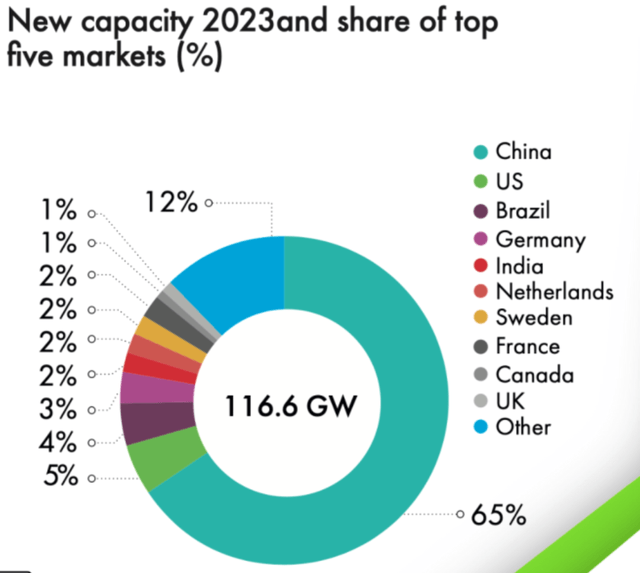

AMSC quoted from GlobalData that the wind generation capacity worldwide will grow YoY from 92 GW to 102 GW in 2024. We looked into GlobalData’s information, particularly for India. Although India’s total wind capacity is rising fast, the annual wind installation, although about 10% higher than last year, is expected to stay at the current level marginally. There are two implications for AMSC here. One is it is likely to be able to maintain its current sales and revenue from Inox. Another is such revenue may not expand further in the next five years due to both the inherent risk of local bidding and the trend of marginal growth. Also, ___________

India’s Solar PV & Wind Installation Trend (GlobalData)

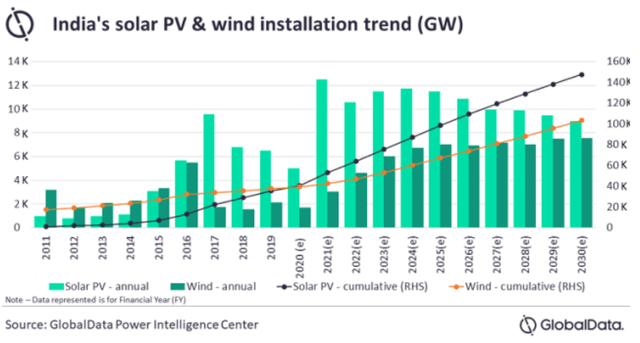

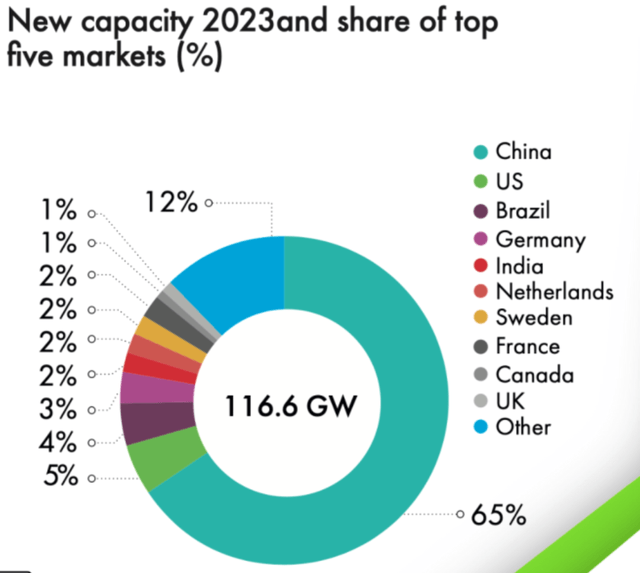

GlobalData also showed that the onshore wind generation from China could grow by 80-90% in the next five years, although AMSC has dissolved and liquidated its Chinese entity entirely in 2022, due to both geopolitical tensions and fierce competition locally. Indian market currently ranks fourth place globally in wind energy capacity at less than 46 GW, and its new installation in 2023 is the 5th.

New Wind Capacity 2023 and share of Top Markets (Global Wind Report 2024)

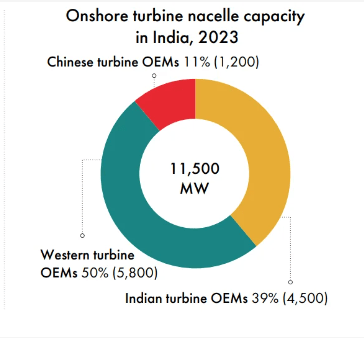

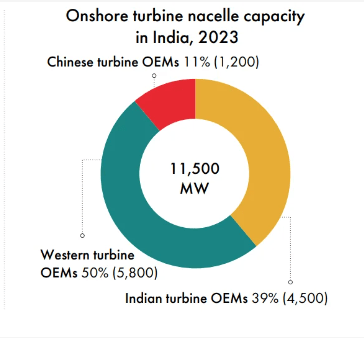

India’s onshore wind turbine nacelle market is 50% supplied by local and Chinese OEMs, and the other 50% is supplied by the western companies, AMSC included.

Onshore Turbine Nacelle Capacity in India 2023 (Global Wind Report 2023)

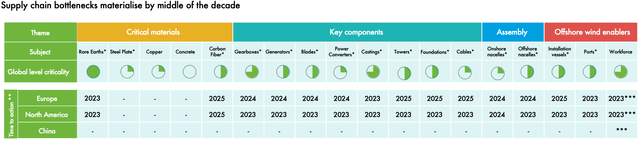

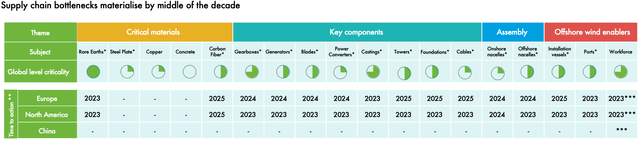

However, a localized trend is expected to grow according to the Global Wind Report 2024. It expects that local supply chains in China, India, and LATAM “will have enough nacelle production capacity to accommodate demand” from 2023 to 2031, while the rest of the world will need more imports. In particular, Europe and the US will have a bottleneck in their capacity starting in 2026. For these reasons, it is possible AMSC’s revenue from Inox to maintain at the current level, but unlikely to have a major expansion in the next five years.

Supply Chain BottleNeck for Wind Market by Country (Global Wind Report 2024)

On the other hand, while facing fierce competition overseas, AMSC’s unique competitive advantage is being one of the only four wind turbine nacelle facilities in the US. Given the importance of an efficient grid for the US to achieve the green energy future, AMSC naturally will become the choice for local market expansion, if legislative and commercial tailwinds start to come into place in the next two years. But it will also need to have more CapEx spending. It won’t be a straightforward boost to its bottom line.

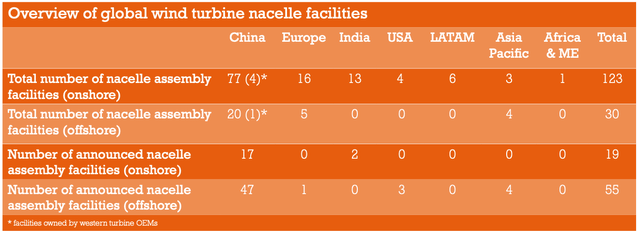

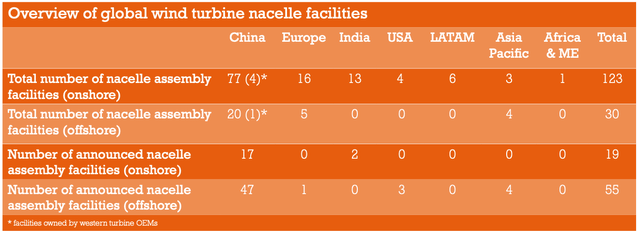

Overview of Global Wind Turbine Nacelle Facilities (Global Wind Report 2023)

AMSC has been working on the transformation we alluded at the beginning for at least two decades. In November 2006, AMSC acquired Windtec for 1.3 million shares of AMSC common stock, which was valued at around $13.1 million at the time. Soon after, it made an acquisition of Power Quality Systems (PQS), a provider of Static VAR Compensators using proprietary thyristor switch technology, in March 2007 in an all-stock transaction worth around $3.8 million. Again in September 2017, it acquired Infinia Technology Corporation (‘ITC’), a cryo-cooler provider to the Navy that strengthens the Ship Protection System, for $3.75 million. At the time of acquisition, AMSC explained the vision of integrating ITC’s technology into its own proprietary system. And seven years later, it seemed to have helped it to win the $75 million “multi-year and multi-unit delivery contract” with Canadian shipbuilder Irving Shipbuilding, the company that builds 80% of Canada’s navy ships.

The most significant effort is the acquisition of upstate-New York-based Northeast Power Systems Inc. (NEPSI), which supplies medium voltage metal-enclosed capacitor banks, harmonic filters, fast-switching reactive power solutions, and surge protection products, in October 2020, for $26 million. NEPSI had about $5 million operating income per year at the time of acquisition. It didn’t seem to have improved AMSC’s operating income in the two fiscal years immediately following the acquisition. But we recently covered Eversource in which we discussed its efforts and progress in building one of the largest offshore wind farm projects on the East Coast of the US. There is no mention that AMSC is participating in the build-out of Eversource’s wind turbines, NEPSI’s leadership position in the static voltage management market for industrial applications will help it secure more shares when New England plus New York set out to harvest more wind energy at a scale. Most recently, it acquired Neeltran, who designs and manufactures DC power systems, rectifiers, and transformers, for $16.4 million. In general, as described by its own presentation, these acquisitions have been “leading to larger sales in multiple markets”. With its current cash ratio at 1.15x, we expect it will continue using this path to strengthen its proprietary technology and acquire additional market shares.

AMSC: Inorganic Growth (Company Presentation)

2023 was the year that the worldwide wind capacity reached the milestone of 1TW (‘Terawatt’) on June 15, 2023, and it is projected to reach 2 TW in just seven years, according to the Global Wind Energy Council. It is important to incorporate AMSC’s growth path within the global supply and demand dynamics that will determine where its next growth engine will be. As we discussed above, it will either need to continue becoming more efficient or maintain its current level of growth until the US market takes off in about two years, if everything comes into place. Otherwise, the current inflection point of positive net income could be a fleeting scenario, as it has happened more than once in the past.

Financial Overview & Valuation

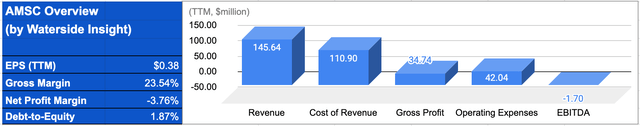

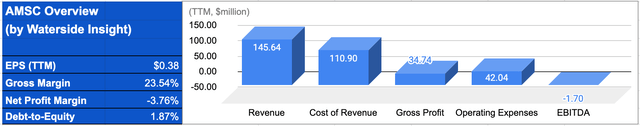

AMSC: Financial Overview (Calculated and charted by Waterside Insight with data from the company)

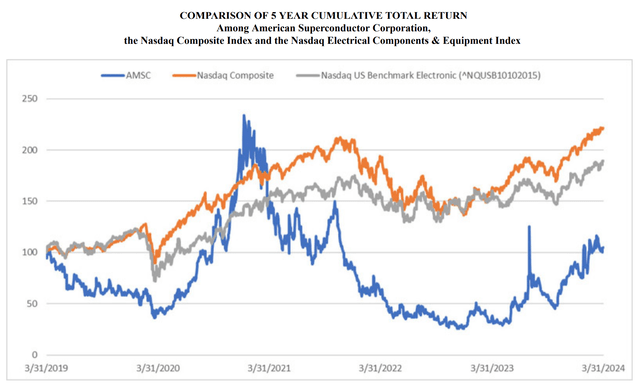

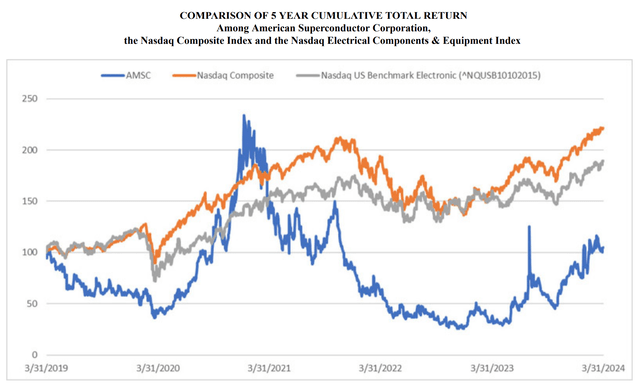

AMSC has been underperforming the benchmark and the broader market for the past five years. Currently, it is trailing by almost 100 bps from the Nasdaq Composite and Nasdaq US Benchmark Electronic. More notable is the volatility of its total return in the past five years, up and down by almost 250 bps. In general, it is a high beta stock.

AMSC: Past Five Years Total Return (Company 10K)

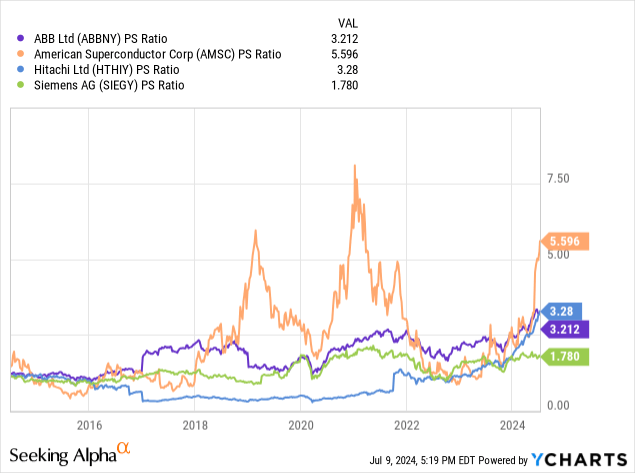

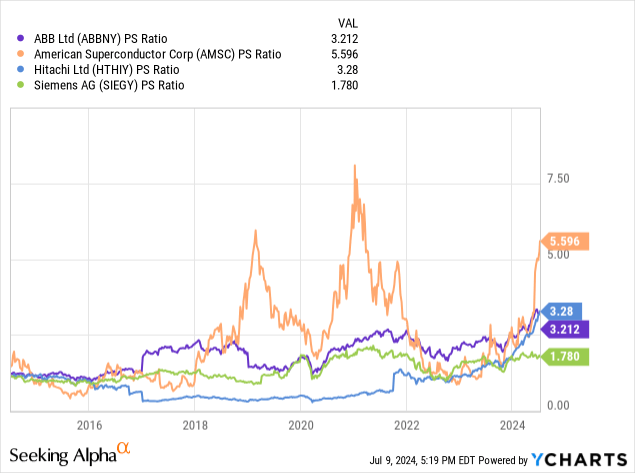

Since AMSC still has negative earnings, using the price-to-sales ratio can be another way to look at its valuation. Currently, its 5.59x ratio is more than 80% higher than the median of its peers at about 3.2x. For the past ten years, its valuation has risen twice before at an even higher ratio than now compared to its peers, such as in 2019 and 2021. Each time it crashed back down to the average range. Although the premium can be explained by an improved fundamental and bullish outlook, a higher valuation than where it is now would be too rich.

Conclusion

America Superconductor’s recent fundamentals have obvious improvement and the outlook is bullish for its revenue growth. However, maintaining or crushing the cost curve is still a challenge going forward, which is critical to turning the current inflection point into a sustainable growth momentum. From macro and industrial supply/demand dynamics, it will have difficulty to go beyond where it is now. We think for its stock to fetch a higher valuation than it is now would be too rich. We recommend a hold.