Dmitry Vinogradov

Investment Thesis

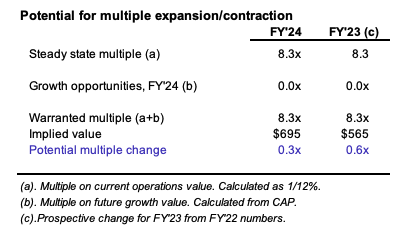

In Q3 FY’23, I advocated heavily to allocating to the basic materials sector as it presented with the highest growth prospects albeit at the smallest weighting of the S&P 500 Index sectors [avid readers of this channel will remember this]. This was still true at the end of Q1 FY’24 (Figure 1). I continue to see value in this domain on a price/value basis, which brought me to determine the investment prospects of Hawkins, Inc.’s (NASDAQ:HWKN).

HWKN is a leading specialty chemical and ingredients company, providing solutions to industrial, water treatment, and health and nutrition sectors. It operates ~60 facilities in 26 states. The company’s operations are segmented into three primary divisions:

- Industrial: Specializes in supplying industrial chemicals, including acids, alkalis, and food-grade products.

- Water Treatment: Focuses on water treatment chemicals and services.

- Health and Nutrition: Provides nutritional ingredients and health-related chemical products.

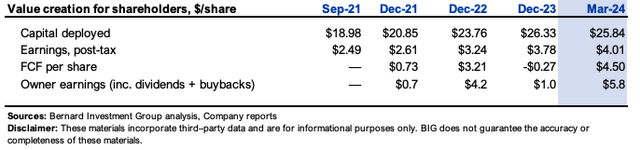

What’s piqued my interest in HWKN is its prioritization of acquiring water utility assets, which are a point of differentiation with hard-to-replicate business advantages in my view. Since it began the acquisition trail on this segment in FY’23, ROICs are ~200-300bps higher and management has a new runway to deploy capital towards. It is currently reinvesting ~65% of NOPAT every 12 months.

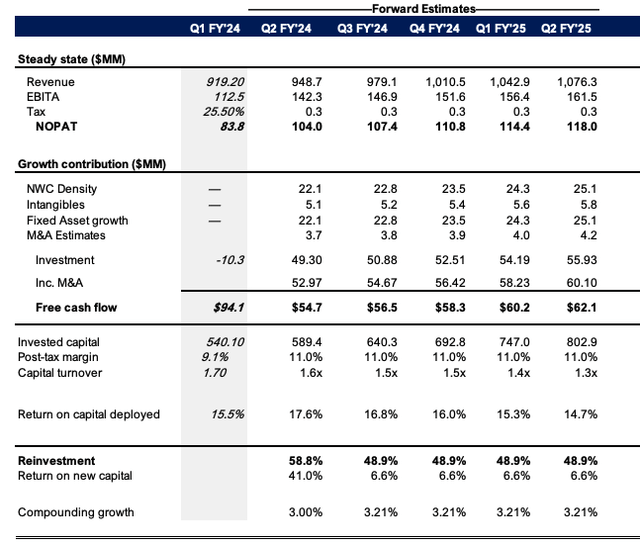

Total sales were ~$919mm in FY’24, down 200bps from a high base in ’23, but gross profit was +17% to $194mm ($9.20/share) – partly due to LIFO decreases – with ~26% in earnings to $0.73/share.

This is but some of the evidence corroborating a buy on this name, including 1) high and increasing ROICs on stable capital base [ROICs are +300bps to ~16% in FY’24], 2) management’s reinvestment opportunities to deploy capital at these rates, and 3) valuations supportive ~$109/share on multiples of capital but ~$160/share on NOPAT multiples indicating marginal risk of error is low.

Net-net, rate buy.

Figure 1. Retrieved from author’s analyses around May FY’24.

Author’s estimates, Bloomberg, Seeking Alpha

Why HWKN is a high-quality business

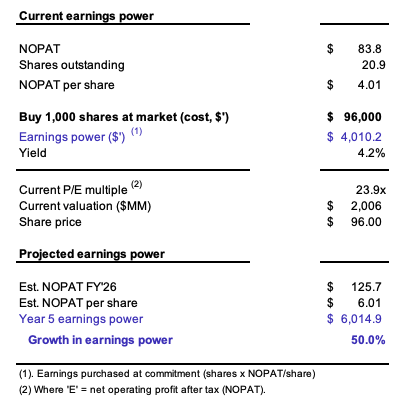

The company was founded in 1938 and produced ~$920mm in FY’24 sales with just 970 employees [~$947k in revenue/employee]. It booked net profit per employee of ~$81K in FY’24, fourth highest in the commodity chemicals industry [behind (CBT), (LYB), and (MEOH) respectively – MEOH did >$115K profit/employee, so the gap isn’t wide either]. It’s not just the return on talent driving the business – capital productivity + profitability is equally high, thanks to exceptional drivers. My view is we can expect ~50% cumulative earnings power by FY’26E (Figure 3).

I start with the company’s business drivers:

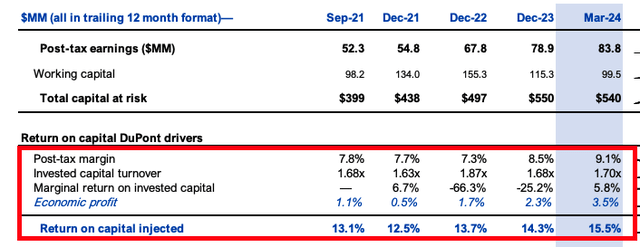

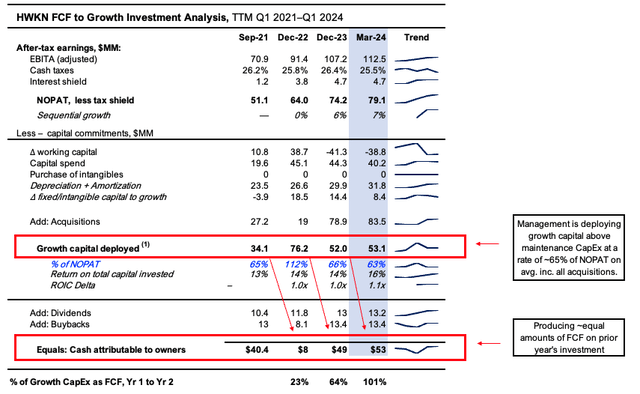

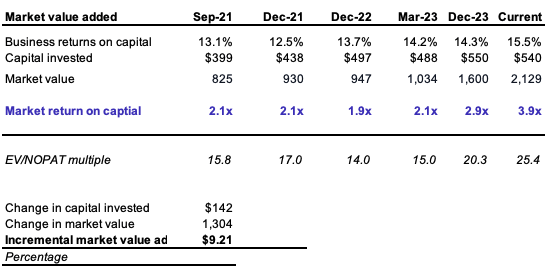

- HWKN is earning more on the growth + legacy capital that’s been put into the business + invested since FY’21 – ROICs are +350bps to 15.5% in FY’24 as 1) NOPAT margins have expanded ~120bps, and 2) capital turns remained at ~1.7x. Specifically, its FY’23-’24 acquisitions – EcoTech, Water Solutions Unlimited, Miami Products & Chemical + Industrial Research Corp – have added ~$70mm in incremental sales. Critically, I get to ~14% ROICs by FY’25 driven by 3.2% compounding sales growth, ~15% pre-tax margin and capital deployment rate of $0.48-$0.50 per new dollar of revenues [see: Appendix 1].

- These economics see HWKN throw off ~$550mm in FCF [+$200mm since FY’21] used for 1) growth reinvestment, 2) dividends, and 3) buybacks. Since FY’21, management reinvested ~$6.85/share into the business [predominantly acquisitions] and grew NOPAT $4.50/share – 22% marginal return on capital (Figure 3). The trailing owner earnings yield (i.e., FCF with all dividends + buybacks paid up) is ~6% as I write.

Figure 2.

Figure 3.

- My view is that based on 1) sales growth estimates, 2) rate of capital deployment [reinvestment rate is conservative at ~13% of NOPAT] and 3) ROICs of ~19%, this could see us obtain ~50% cumulative growth in earnings power to obtain ~$6.00 NOPAT/share by FY’26E (Figure 4). I’ll run the scenario with owning 1,000 HWKN shares at market today with cost = ~$96,000. For this, we obtain ~$4 NOPAT/share for an earnings power of ~$4,000. By FY’26E, if the business grows at the assumptions above, this produces ~$6,000 in earnings power [~14% CAGR, ahead of our 12% required rate of return].

Figure 4.

Author’s estimates [see: Appendix 1]

Valuations supported by robust economics

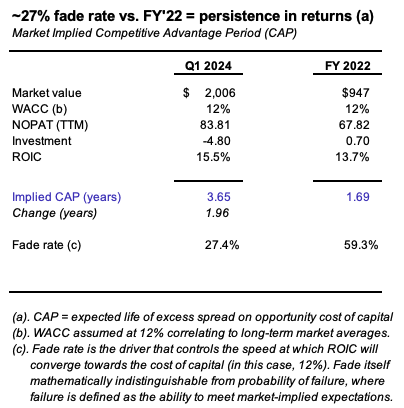

The combo of 1) higher and increasing ROICs, 2) longer reinvestment runway to deploy capital [esp. within the water utilities sector] and 3) +10% earnings growth projected to FY’26E my view is the company’s competitive advantage period (“CAP”) has extended to >3.6 years and the fade rate on this has reduced to ~27% vs. 60% in FY’22 [note: fade is analogous to the probability of failure]. The <30% fade rate indicates persistence in its recent business returns; I am constructive on this (Figure 5.a.).

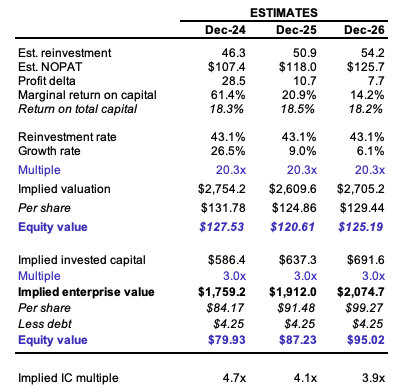

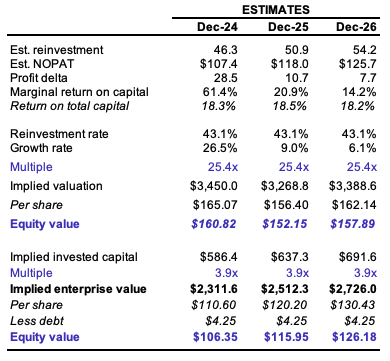

Multiples on capital + earnings have stretched higher since ’21 – (i) EV/IC is +1.8x and (ii) ~EV/NOPAT is +9.5x, valuing the current business operations at 3.9x and 25x respectively (Figure 5). The expansion is well-supported by the economic data. The rate of capital deployment + subsequent returns justify ~$127/share today, even at a reduced 20x NOPAT multiple [reminder from above: it trades at ~25x today]. I’ll run with these conservative assumptions for now, although I’m acutely aware that the market may continue paying more (which is bullish to the thesis).

Figure 5.

Company filings, author

Figure 5.a.

Company filings, author

Valuation insights

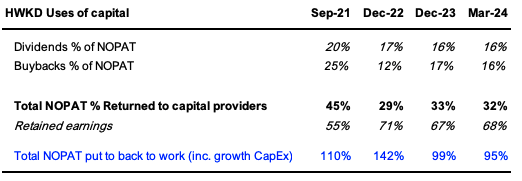

- The +1.8x growth in EV/IC multiple from FY’21-’24 results from management’s economic performance – The reinvestment runway is obvious with 1) +$30-80mm in growth CapEx allocated each 12 months [growth investment = all CapEx above the maintenance capital charge, which is approximated at depreciation + amortization], and 2) the >12% ROICs which increased by +300bps, as mentioned earlier. Management is thus aggressively deploying funds in this business, directly reinvesting ~65% NOPAT back into operations on avg. [inc. all acquisitions] and returning ~30% to shareholders [down from 45% in FY’21 as evidence of the greater business opportunities]. The split is currently ~16%/16% dividends + buybacks, respectively.

- Mind you, it is now rolling off ~100% cash return on each year’s growth investments [using Yr2 FCF / Yr1 growth CapEx = cash ROI as a crude measure of this] – (note, see: Figure 6 and Figure 7).

Figure 6.

Figure 7.

Company filings, author

- The existing business is valued ~25x NOPAT, but my view is the market could value its future investments at ~20x which still implies ~$127 market value today – Interesting dilemma here in that 20.3x NOPAT is ~20% contraction from the current c.25x multiple, but implies the stock is worth 4.7x capital – a 20% expansion. My take on this is 1) the market values its acquisitions highly, and more critically 2) HWKN’s earnings are becoming more valuable with every dollar management throws back into the business. Thus – (i) management should get high marks for any further reductions in dividend/buyback payout ratios, and (ii) any decisions to re-route that capital into operations should be viewed very favourably.

- Value of HWKN’s future business could be ~20x NOPAT if multiples contract ~0.3x from current prices. The risk of contraction is lower [fade rate ~27% vs. ~60% in FY’22], but the market may have HWKN running a little too hot anyway, as mentioned. Presuming it does value all future earnings this way, my numbers get to +$26mm in NOPAT from Q1 ’24 (TTM values – see: Appendix 1), producing $110mm in post-tax earnings for FY’24. A 20.3x multiple on this indicates ~$524mm or $25/share in additional market value (20.3 x $26 = $524mm).

Figure 8.

Author’s estimates

Figure 9. The value of earnings is getting more valuable with each $1 of incremental capital that management employs into the business.

Author’s estimates

Figure 10. Valuation ranges if investors continue valuing HWKN at ~25x NOPAT.

Author estimates

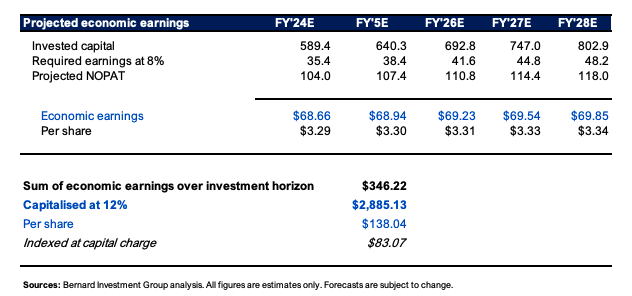

- Finally, discounting the estimated surplus cash flows above similarly-risked investments at a 12% hurdle rate implies the stock is worth ~$138/share today in the base case. Mind you, this case is highly conservative with (a) 3.2% compounding sales growth, (b) ~15% EBIT margins, and (c) capital deployment rate of ~50% of NOPAT – below the current figures. I am thus projecting 1) lower multiples, 2) tighter reinvestment rate, 3) a fade in ROICs to 14% by FY’25, and 3) a high discount rate and still showing asymmetrical upside reward in this case.

Figure 11. Excess earnings above 6% investment-grade corporates’ starting yields, discounted at 12% hurdle rate.

Author’s estimates

Risks

Downside risks to the thesis include 1) EBIT margins contracting <15%, 2) valuations compressing <20x NOPAT, 3) management making poor acquisition choices [thus spoiling the ROIC profile] and 4) the inflation/rates axis that continues to plague equity markets. Further bad inflation data is a major downside risk.

Investors must understand these risks in full before proceeding any further.

In short

HWKN presents with exceptional economics that warrant a buy rating due to 1) high and expanding ROICs, 2) successful acquisitions now pulling their economic weight, 3) increased reinvestment runway to deploy funds back into the business at an advantage vs. market returns, and 4) valuations supportive despite highly conservative assumptions.

To illustrate, I have 1) reduced implied multiple ~20%, 2) contracted implied capital deployment rates, 3) faded the ROICs to 14%, and 4) applied heavy discounting to projected cash flows, and still, I believe the stock is worth ~$127-$138/share today. Rate buy.

Appendix 1.