champpixs

Despite robust returns in the last eighteen months, buying or holding a stake in Invesco NASDAQ 100 ETF (NASDAQ:QQQM) appears to be a prudent strategy given limited downside risk and strong prospects for the uptrend. The robust earnings growth, particularly from the magnificent seven, is likely to be the biggest driver of the uptrend. Moreover, cooling valuations lowers the downside risk. The market is also likely to witness a first rate cut in the coming months, which could increase the greed for high growth stocks. Therefore, I maintain my buy rating on QQQM. The ETF’s price rallied 43% since I last rated it a buy.

Outlook: Downside Risk is Limited

The US stock market continues to generate robust returns amid exceptional tech stocks rally and steady gains from the rest of categories. I believe the uptrend is likely to continue throughout the second half and may extend into the following year due to the declining risk factor and increasing optimism. The Fed’s interest rate policy, corporate earnings and valuations could be the three biggest risk factors which can hinder the current bull run.

Interest rate risk is expected to decline because markets are likely to witness a rate cut in the following months as the latest inflation and job market data appears strong enough to convince the policymakers to review their tightening decision. In June, core CPI plunged for the third consecutive month to the lowest level since mid-2021. Furthermore, the US job market has also been softening, helping to push the unemployment rate to 4.1% for the first time since 2020. An increase in these key indicators early this year compelled the Fed to keep interest rates unchanged in the first half while lowering their rate cut outlook to just one from three. The markets are currently expecting the Fed to make two rate cuts in the second half of 2024 and multiple cuts in the following year. The Federal Reserve Chair Jerome Powell stated in a Congress hearing that holding interest rates at a peak level for a longer time could negatively impact economic growth and unduly weaken employment.

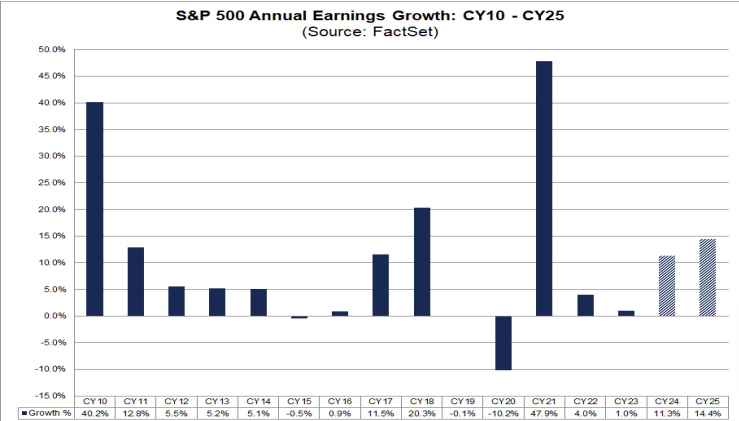

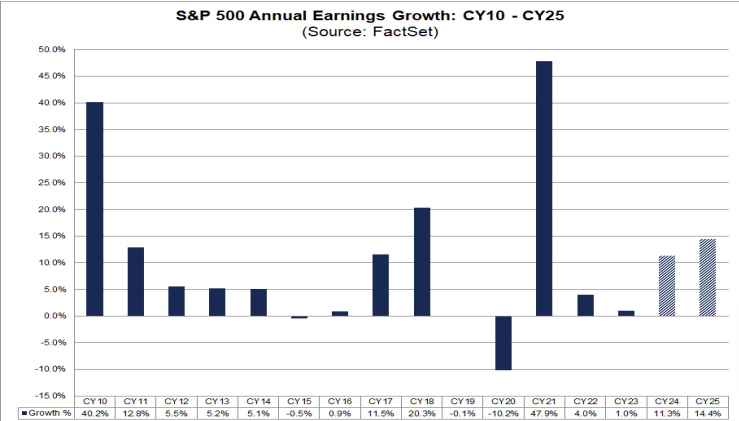

Earnings forecast (FactSet)

Another important indicator for acceleration of the bull run and limiting the downside risk is the robust earnings growth data. After above 5% earnings growth in the first quarter, FactSet data signals 9.3% year over year earnings growth rate for the second quarter, a highest growth rate since the first quarter of 2021. Moreover, analysts are expecting double-digit earnings growth for the full-year, driven mainly by the information technology, communications and consumer cyclical sectors. Furthermore, the trend is expected to amplify in the following year with earnings growth forecast of 14.4%. I believe two consecutive years of earnings growth, mainly driven by large and mega cap tech stocks, will fuel optimism and help mitigate other risk factors.

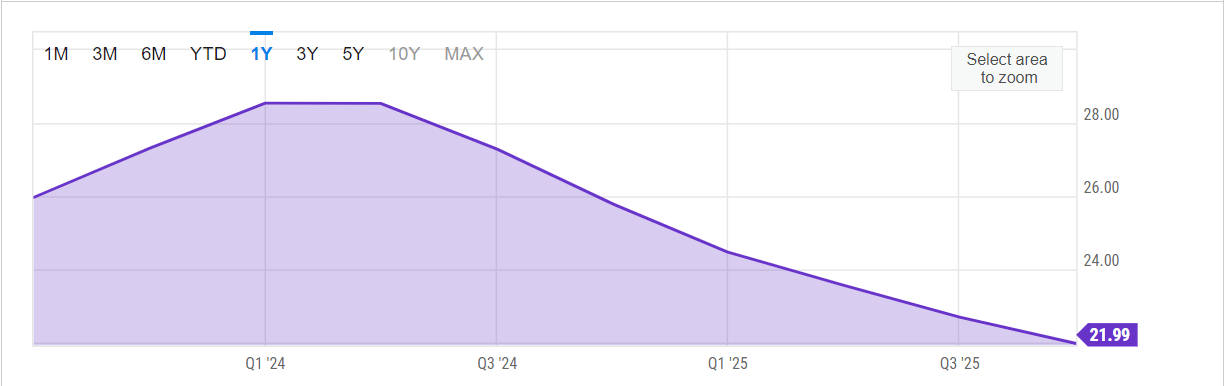

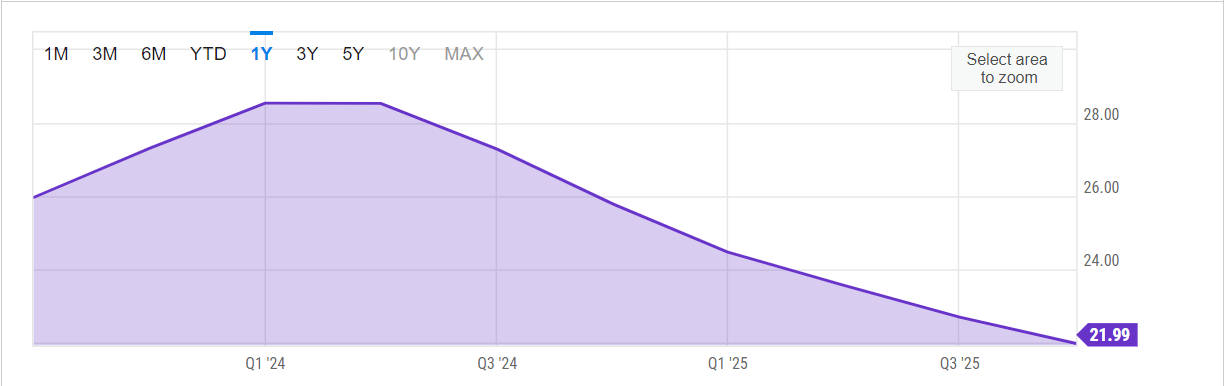

S&P 500 forward PE (Ycharts)

It’s true that a rally in stock prices without enough support from earnings growth generally resembles to a speculative bubble and mostly ends with a big plunge. Last year, a valuation risk spiked because the S&P earnings grew only 1%. However, despite a solid share price performance in the first half of 2024, a valuation risk, has been declining due to the robust earnings growth outlook. For instance, the S&P 500’s forward PE ratio is currently hovering around 21.99x compared to 22.70x in the last quarter and 25.77x in the year ago period.

Why do I rate QQQM a Buy?

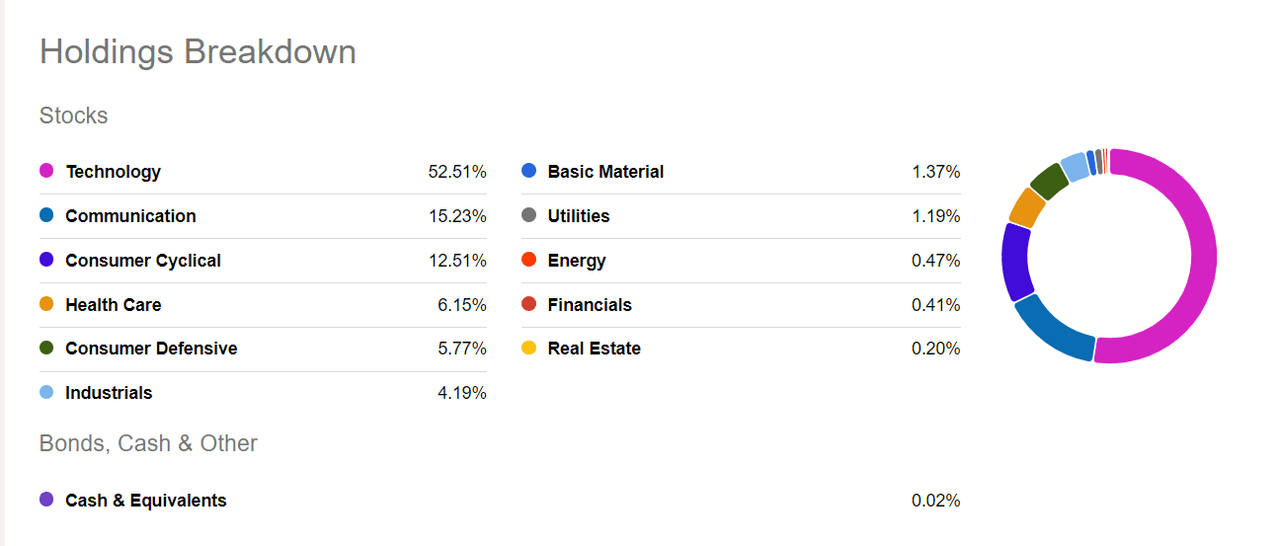

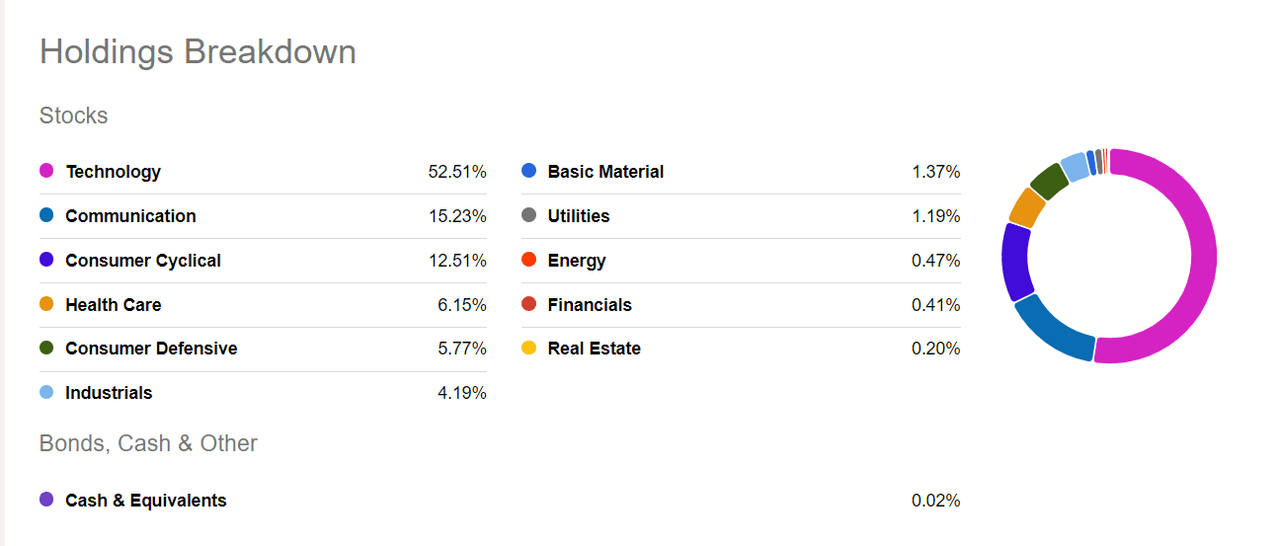

QQQM sector exposure (Seeking Alpha)

I maintain my buy rating on QQQM because of its potential to generate market-beating returns in the bull run. I believe riding bull run with the top 100 NASDAQ stocks could be a prudent strategy because 51% of NASDAQ 100 stocks belong to the information technology sector, which is a key driver of the bull run. Microsoft (MSFT), NVIDIA (NVDA), Apple (AAPL) and Broadcom (AVGO) are among its top holdings from the technology sector. Besides Apple, which underperformed so far, the rest of the QQQM’s top technology stocks have generated substantial returns and contributed significantly to the current bull run due to their large market share. Shares of Microsoft soared 34% in the last twelve months while NVIDIA and Broadcom rallied 194% and 91%, respectively. The price gains of mega-cap stocks are fully backed by their earnings growth power. For instance, Microsoft is expected to generate 9% earnings growth in the June quarter and 20% for the full year while NVIDIA is expected to be a star performer with an earnings growth forecast of above 100%.

On the other hand, QQQM’s portfolio concentration in consumer cyclical and communication stocks enables it to offer a full coverage of the magnificent seven. Having an exposure to the magnificent seven is crucial for generating lofty returns in the current bull run because the group of mega-cap tech stocks made up nearly 60% of the S&P 500’s total return so far in 2024. QQQM held a big stake in Meta Platforms (META) and Alphabet (GOOG) (GOOGL) from the communications sectors. Both stocks generated robust returns for investors in the last eighteen months, supported by their strong earnings growth power. Meta continues to witness solid revenue and earnings growth while Alphabet’s penetration in the AI market along with a rebound in advertisement revenue supports the earnings growth power. Both Meta and Alphabet are expected to generate above 30% earnings growth in fiscal 2024. Overall, the so-called magnificent seven group represents nearly 45% of its portfolio weight. Besides tech and the magnificent seven, its portfolio exposure to healthcare and industrial sectors backs the share price upside and lowers the downside risk. This is because large caps from these sectors have the potential to generate steady risk-adjusted returns over the long term.

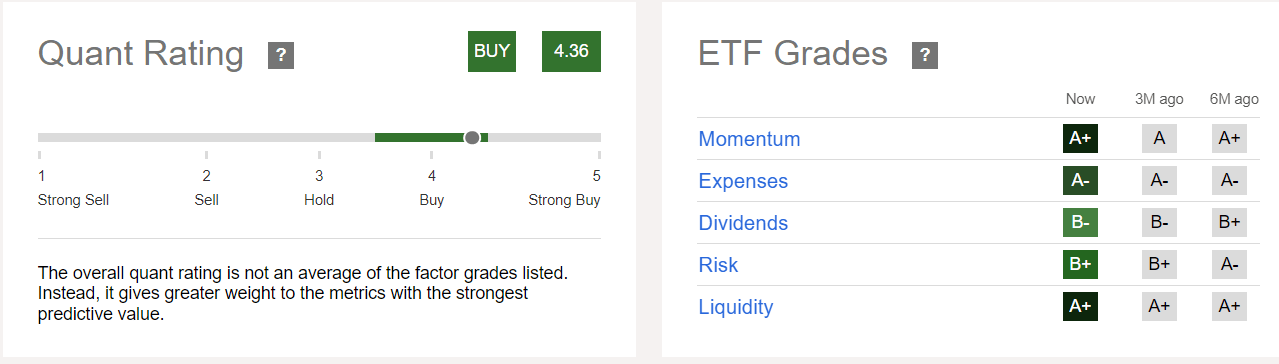

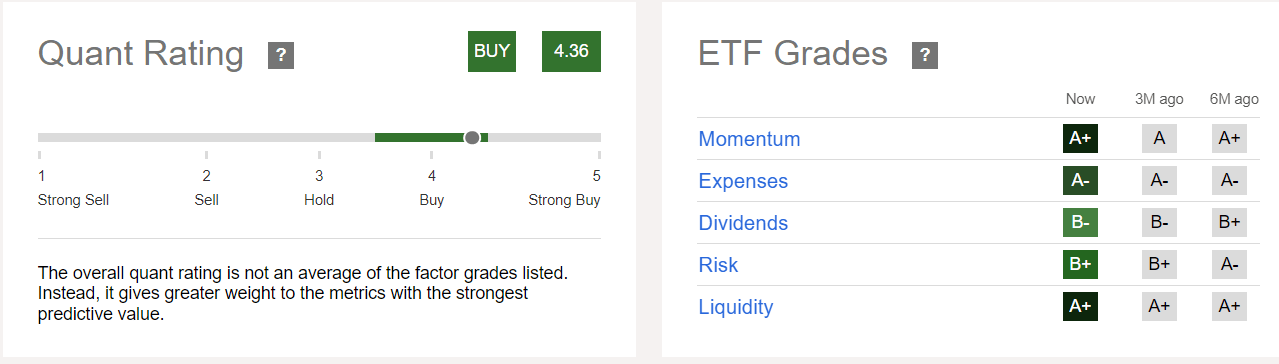

Quant Rating

QQQM quant rating (Seeking Alpha)

QQQM earned a buy rating based on Seeking Alpha quant rating. Its A plus score on the momentum factor indicates that the ETF has a strong share price upside. Technically, stocks or ETFs with a strong momentum are deemed to extend the trend in the short term. On the other hand, its low expense ratio of 0.15% compared to the median of all ETFs of 0.49% helped it receive a negative A quant grade. QQQM achieved a B plus grade on dividend factor because of a whopping 30% increase in dividends in the trailing twelve months. Big tech companies’ strategy of returning significant cash to investors in the form of dividends helped QQQM to raise its dividends. For instance, Meta and Alphabet started returning cash to investors in the form of dividends while NVIDIA and Microsoft significantly raised their dividends in the recent quarters. Moreover, the greater diversification and a low short interest ratio helped it receive a B plus score on the risk factor.

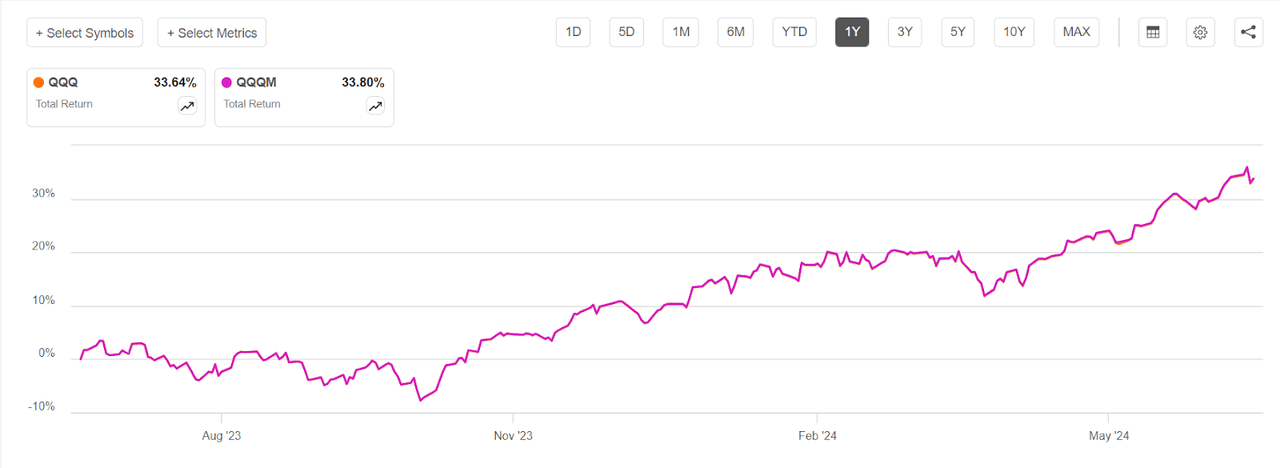

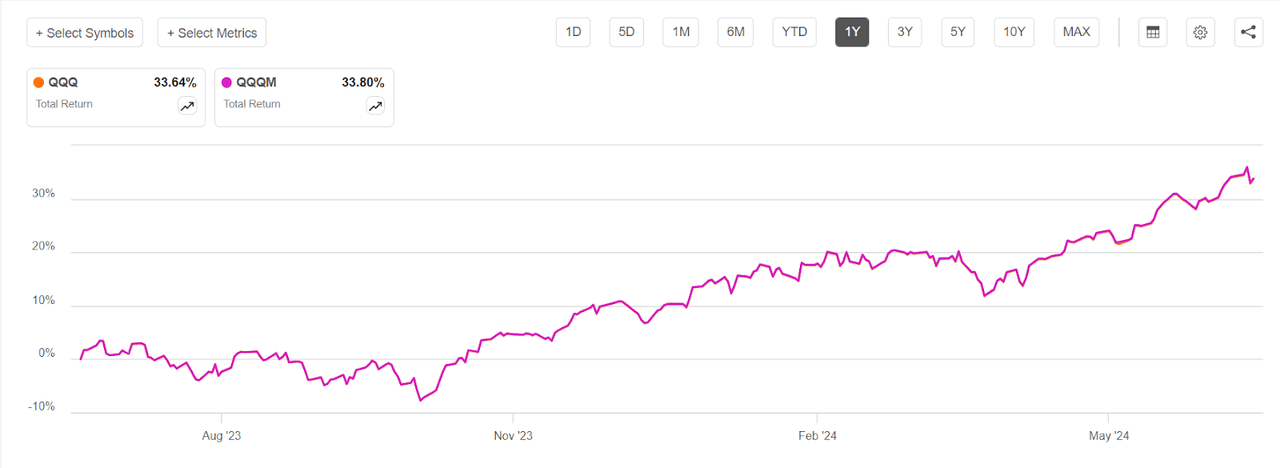

Why choose QQQM Over QQQ?

QQQM and QQQ share price change (Seeking Alpha)

Although there is no significant difference in returns and portfolio composition of both ETFs, I still believe multiple characteristics, such as an expense ratio and a cheap share price, provides QQQM with an edge over Invesco QQQ Trust ETF (QQQ). QQQM’s expense ratio of 0.15% is low compared to QQQ’s 0.20%. Expense ratio is important as it directly impacts total returns. Moreover, QQQM’s low share price of $203 compared to QQQ’s nearly $500 also matters because low share price enables investor to buy shares in bulk. For example, one can buy 985 shares of QQQM with a capital of $200K compared to QQQ’s 404 shares. The number of shares also improves trading flexibility. When an investor has a large number of shares, there is greater flexibility of selling some shares to capitalize on gains or reducing the impact of a downturn. Although QQQ has a significantly higher trading volume, QQQM’s trading volume of $30 billion also appears enough to satisfy a fast trading requirement.

In Conclusion

As there are strong chances of the extension of the bull-run over the long term, it’s prudent to choose the investment vehicles with a market-beating potential. QQQM is among the investment options investors can use to generate lofty returns in the bull run. Its portfolio concentration in the bull run drivers, including the magnificent seven and other tech stocks, positions it to fully capitalize on the potential gains. The ETF also has a low expense ratio, a solid dividend growth rate and a healthy trading volume.