wayra/iStock via Getty Images

Dear clients and fellow shareholders:

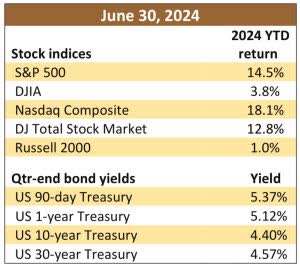

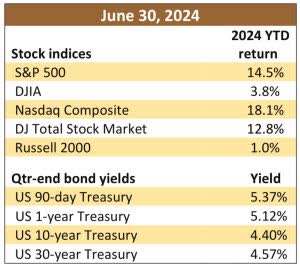

Our original intent was to avoid any reference to politics in this quarter’s letter and wait until our October missive to make fun of the two candidates – that is, assuming we would have some clarity on whether either nominee might be confined to a prison cell or nursing home. But the dominant investment theme of this year has clearly been Artificial Intelligence, which is only fitting, given we see so little of the natural variety exhibited in this year’s election process. Wall Street apparently prefers the artificial kind, evident in the S&P 500’s (SP500, SPX) 14.5% increase in the first half of 2024, driven by a staggering 157% surge in the shares of chip maker Nvidia (NVDA) – now a $3 trillion market cap company that might consider investing in an additional vowel for its corporate moniker.

Driven by its heavy tech (more AI!) influence, the Nasdaq Composite (COMP:IND) soared 18% in the first half, contrasting sharply with the stodgy Dow Jones Industrial Average (DJIA), which was up a “scant” 3.79 percent. (For context, the average six-month stock market return is about 4.75 percent.)

Our stock portfolio increased approximately 13% in the first half of 2024, although your equity returns may differ from our model portfolio due to your specific asset allocation, possible legacy positions in your account and/or rounding errors.

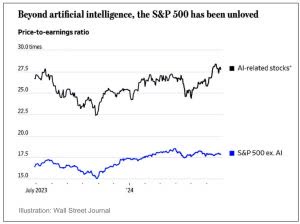

The divergence of the Nasdaq and DJIA returns hints at a stock market that has split into two separate markets: the seven AI-ish stocks and everyone else. Those Magnificent Seven stocks (Nvidia, Microsoft, Apple, Amazon, Meta (Facebook), Alphabet (Google), and Tesla) single-handedly produced the S&P 500’s second quarter 5.1% return, while the other 493 stocks experienced a cumulative decline during the three months.

Nvidia – a company whose name you might struggle to pronounce and likely hadn’t heard of several years ago – is now the third largest company in the S&P 500, at least by market capitalization.

While the S&P 500 P/E ratio of 24 may offer little appeal to a value investor, excluding AI-related companies brings the index down to a multiple of 17.5 times earnings – still not inexpensive, but notably less concerning than the 27.5 times multiple observed in AI-related stocks or Nvidia’s lofty P/E of 78. (The P/E of our stock portfolio is approximately 11 times earnings.)

Artificial Intelligence for Dummies

We have recently received a number of questions about Artificial Intelligence, so we decided it makes sense to spend a paragraph or two explaining it – which we will have to do in terms we understand – so please don’t be insulted by our simplicity.

Much of what is now described as AI is, in our opinion, traditional input-output computer applications, albeit often presented with a much more elegant interface. Just a year ago, companies eagerly inserted the word “blockchain” into every investor presentation. As the term “algorithm” started to gain similar traction, it was quickly replaced with “AI.”

Despite the fact that many people don’t fully grasp what AI entails, some investors aren’t willing to let a little ignorance affect their investment decisions. Given our own limitations on the topic, instead of attempting to provide a detailed technical explanation, we can look to a 40-year-old movie that offers an example of AI in action.

In the 1983 Matthew Broderick film War Games, the North American Air Defense Command (NORAD) utilizes a computer called the War Operation Plan Response (the WOPR) as a part of the U.S. nuclear launch apparatus. In the movie, the WOPR (appropriately pronounced “whopper”) mistakenly interprets a war game simulation as a genuine Soviet nuclear attack and attempts to launch hundreds of actual U.S. nuclear warheads into Russia.

As the countdown to Armageddon approaches, a young Matthew Broderick instructs the WOPR to begin playing itself in tic-tac-toe, which the computer does repeatedly, with each game ending in a tie. The WOPR apparently “learns” that it can’t win at tic-tac-toe and, complete with laughable 1983 movie special effects, begins running hundreds of different nuclear war scenarios – each of which, like the tic-tac-toe games, ends in a tie.

Finally, the WOPR learns that the only winning move in thermonuclear war is not to play the game – and cancels the launch.

This scenario illustrates machine learning, a significant branch of AI focused on algorithms that allow computers to learn from and make decisions without explicit programming.

Machine learning requires massive amounts of computing power, which requires the production of massive quantities of computer chips – an industry that has historically been dominated by Intel (INTC) and Advanced Micro Devices (AMD). Since 1993, Nvidia has specialized in making graphics processing chips, initially designed for video games. As it turns out, these graphics chips can perform concurrent math calculations more efficiently than the AMD or Intel chips, making Nvidia the choice for calculation intensive applications – like cryptocurrency mining. And machine learning/AI.

In the long run (whatever “long” means these days), artificial intelligence will be important because it promises significant advancements in leveraging technology to enhance our decision-making and our quality of life. In the short-term, however, it’s important because the market’s fixation on a few chip companies is masking the health of the broader stock market. That is, the U.S. stock market hasn’t performed nearly as well as the S&P 500 suggests – because the prices of a handful of AI-related stocks have skyrocketed.

As seductive as it might be to rush into the “newest hot thing,” investing based solely on hot trends is often unwise. And it is certainly not a strategy we will be accused of with our most recent purchase: a bank in the Cayman Islands.

Portfolio addition

Bank of N.T. Butterfield (NTB) is an offshore bank and trust company operating in Bermuda, the Cayman Islands, the Bahamas, and the United Kingdom. With a strong presence in Bermuda and the Cayman Islands, holding over 30% of the deposit market share, Butterfield provides a range of banking services to a diverse clientele, ranging from high-net-worth individuals to reinsurance companies and hedge funds.

Not surprisingly, one of NTB’s key strengths lies in its well-established trust and asset management business, which offers wealth management services to high-net-worth individuals, family offices, and institutional/corporate clients. The company’s trust business has over $132 billion in assets under administration, while the custody business has another $30 billion in assets – both of which generate highly attractive economics.

The trust business requires minimal capital to grow assets under management and generates higher margins and returns on equity than traditional banking activities. Unlike a traditional retail bank, approximately 40% of the company’s revenues are generated from fees – which are largely uncorrelated to interest rates. This creates recurring, interest rate agnostic revenue and provides Butterfield with a greater degree of operating leverage than standard banking models. As a wealth management bank with limited competition in Bermuda, its deposit base is sticky, providing a relatively low cost of funds.

The unique attributes of the business, combined with Bermuda’s corporate tax-free status, have created a bank that generates high returns on equity throughout the economic cycle.

NTB has a long history of acquiring smaller trust and wealth management units of larger banks in the Bahamas and Cayman Islands, the most recent being the acquisition of trust assets from Credit Suisse. Larger banks often view trust and wealth management operations in so-called ‘tax havens’ as subscale and potentially risky for their reputation. The increased compliance costs make it challenging for these smaller businesses to generate attractive economics. However, Butterfield specializes in trust and wealth management within markets where it has established scale, making it an ideal acquirer for local competitors that are smaller in size.

Butterfield takes a conservative approach to managing its liquidity and overall balance sheet. The company holds roughly 21% of its assets in cash and cash equivalents, compared to 3% for the average U.S. bank. When interest rates spiked in early 2023, resulting in the failure of Silicon Valley Bank and scores of other banks with mismatched assets/liabilities, NTB sailed through unfazed and even generated record profits.

Butterfield also has minimal commercial real estate exposure, with a loan-to-deposit ratio of roughly 38% (compared to 70% for the U.S. peer median). The company has conservative lending standards, with a loan book that mostly consists of underwritten mortgages in Bermuda with a loan-to-value profile below 60%. While the company’s loan book generates significant net interest income, the company also maintains a high quality fixed-income portfolio that is 100% comprised of AA or higher rated securities, that are primarily U.S. government guaranteed, which helps create a capital buffer well in excess of regulatory requirements.

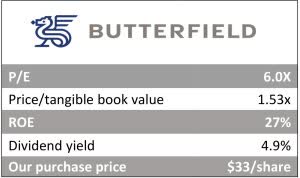

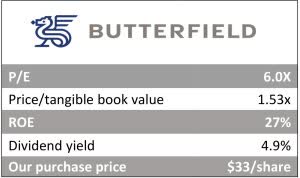

NTB currently trades around $34 per share (just slightly above our purchase price), with a tangible book value of $20. Over the last five years, the company has earned an average return on equity of 23% – and this return has actually increased with higher interest rates (the return on equity was 27% in 2023). Longer term, NTB has consistently delivered top quartile returns relative to U.S. regional banks, achieving these returns with a highly liquid balance sheet that mitigates risk through the cycle. At our purchase price, NTB traded at approximately six times earnings.

We aren’t alone in viewing NTB equity as undervalued. The folks running the bank agree, as the company has been repurchasing shares, reducing the outstanding share count by 6% over the last twelve months. Furthermore, Butterfield has historically targeted a 50% dividend payout, but has not raised its dividend in five years despite substantially growing its core earnings power. We suspect that the company has chosen to maintain flexibility to potentially manage any bond losses from increased interest rates in its held-to-maturity bond portfolio. As this portfolio seasons over the next two years, we think Butterfield could easily raise its dividend from $1.76 to more than $2.80 per share. At that point, we believe its shares would reprice substantially, as we know of no other banks generating returns on equity in excess of 20% and offering a 9% dividend yield.

|

© 2024. Moon Capital Management, LLC is a Registered Investment Adviser with the Securities & Exchange Commission. SEC registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. SEC file number: 801-49240. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.