Georgijevic

Alpha and Omega Semiconductor or AOS (NASDAQ:AOSL), a supplier of a wide range of devices for the power semiconductor industry, struggled for much of 2024. The stock even hit a multi-year low as recently as April 19. However, the stock has since gone on a huge rally that has resulted in AOSL more than doubling its market cap in less than three months. Why will be covered next.

AOSL turns it around in a big way

A previous article from last April took note of the risks inherent in AOSL, but after weighing the pros and cons of AOSL concluded AOSL deserved to be a rated a buy, with the pros outweighing the cons. On the one hand, AOSL came with a number of cons, which included a stock price in decline that continued to add to previous losses. This made getting in on AOSL a risky proposition, since it could be a case of trying to catch a falling knife.

On top of that, AOSL had to deal with a drop in demand and excess inventories, which caused AOSL to drop into the red. On the other hand, the article took into account the pros, which included low valuations, especially with a long decline in the stock pushing down multiples. AOSL, for instance, traded at about 0.6 times book value in April, which was arguably undeserving. In addition, there was reason to believe demand and AOSL by extension were due for a rebound, especially with seasonality set to turn in its favor.

The chart above shows why the article was right to argue in favor of long AOSL since the stock has gone on to more than double in value in the three months following April. The stock closed at $45.69 on July 15, which means AOSL is up 75.3% YTD after being down 25.6% as recently as April 19 with a 52-weeks low of $19.38. This is quite the turnaround.

Where is AOSL going?

There are a few things worth noting here. While the stock has soared higher in a relatively short amount of time, something that continue to this day, it did slow down around the $30 and $38 price level as seen in the chart above. This was unlikely to have been a coincidence because it appears this is where resistance was present. This temporarily slowed down the stock’s ascent, although not enough to stop it.

The April 2024 low of $19.38 was not just a 52-weeks low, but also a multi-year low. The last time the stock traded any lower was in 2020. Recall how the April 2024 low of $19.38 was preceded by a long decline in the stock that can be traced all the way back to the March 2022 high of $69.99. It’s thus worth noting that the 23.6% Fibonacci retracement of $69.99 to $19.38 is $31.32 and the 38.2% Fibonacci retracement of $69.99 to $19.38 is $38.71.

This could help explain why the stock needed extra time to go higher once it close to the $30 and $38 level. The stock was facing resistance due to Fibonacci retracement levels. The next Fibonacci retracement level following the two aforementioned ones is the 50% Fibonacci level of $69.99 to $19.38, which is $44.69.

Whether by coincidence or not, this is roughly where the stock peaked at on Friday, July 12. On this day, the stock got as high as $44.08, before retreating to close the day up 6.79% at $42.31. But this proved to be a temporary stay because the stock proceeded to blow past $44.69 on a second attempt by closing at $45.69 on July 15.

If we assume the stock has made it past the 50% Fibonacci retracement, then the next Fibonacci level is 61.8% of $69.99 to $19.38, which is $50.66. However, keep in mind the stock is now heavily overbought with a RSI value in the eighties after gaining about 23% in the last three trading days. This suggests the risk of a pullback, if not a correction, is something to be mindful of.

Multiples for AOSL have changed

A key argument made previously in favor of the bull case for AOSL was that multiples were on the low side. However, multiples are up, as one might imagine for a stock that has gained around 130% or so. For instance, AOSL was trading at 0.6 times book value when the previous article was written, but this is no longer the case.

AOSL has a book value of $888,937K with total assets of $1,154,049K and total liabilities of $265,112K. This converts to a book value of $32.15 per share with the number of shares outstanding around 27.65M, which means AOSL trades at 1.4 times book value. This is higher than before, but still below most semis, with the median at 3 times book value.

Other multiples have similarly risen. AOSL had a market cap of around $553M in April, below TTM sales of $657M, but it now stands at $1.3B. AOSL is now valued at about 2 times sales, up from well below one. Note that AOSL is in the red with AOSL, for instance, posting a GAAP loss of $9.5M or $0.34 per share in the last 12 months, but this is expected to improve as we will see next.

What is powering the furious rally in AOSL?

The stock has more than doubled in value in less than three months, after spending the better part of the last 2-3 years going down. This rally did not happen for no particular reason. On the contrary, the rally seems to have been enabled by a couple of catalysts, which gave the stock the lift it needed to achieve the gains it has made in the last few months.

This included a 20.9% jump on May 8, the day after AOSL released its most recent report. The Q3 FY2024 report was able to elicit a strong response from the market and trigger a huge rally for several reasons. For starters, not much was expected from AOSL due to the downturn, but AOSL blew past the consensus estimate when it posted a non-GAAP loss of $0.04 per share, or $0.10 better than expected.

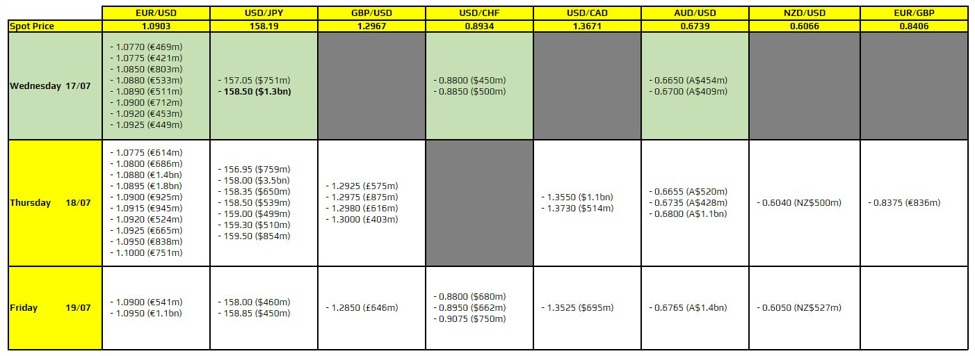

Note that the third fiscal quarter tends to be down due to seasonality. The table below shows how the Q3 FY2024 numbers improved YoY, even if they declined QoQ. EBITDAS, for instance, rose by 77.7% YoY and revenue increased by 13.2% YoY. In terms of GAAP, AOSL still lost $11.2M or $0.39 per share, but the key takeaway for the market was that while AOSL has ways to go, the numbers got better.

|

(Unit: $1000, except for shares, margins and EPS) |

|||||

|

(GAAP) |

Q3 FY2024 |

Q2 FY2024 |

Q3 FY2023 |

QoQ |

YoY |

|

Revenue |

150,060 |

165,285 |

132,560 |

(9.21%) |

13.20% |

|

Gross margin |

23.7% |

26.2% |

23.2% |

(250bps) |

50bps |

|

Operating income (loss) |

(10,504) |

(1,134) |

(14,402) |

– |

– |

|

Net income (loss) (attributable to AOSL) |

(11,212) |

(2,923) |

(18,907) |

– |

– |

|

EPS |

(0.39) |

(0.10) |

(0.68) |

– |

– |

|

Weighted-average shares outstanding |

28,433K |

27,939K |

27,710K |

1.77% |

2.61% |

|

(Non-GAAP) |

|||||

|

Revenue |

150,060 |

165,285 |

132,560 |

(9.21%) |

13.20% |

|

Gross margin |

25.2% |

28.0% |

25.1% |

(280bps) |

10bps |

|

Operating income (loss) |

(1,124) |

8,385 |

(2,854) |

– |

– |

|

Net income (loss) (attributable to AOSL) |

(1,203) |

7,197 |

(5,876) |

– |

– |

|

EPS |

(0.04) |

0.24 |

(0.21) |

– |

– |

|

Weighted-average shares outstanding |

28,433K |

29,874K |

27,710K |

(4.82%) |

2.61% |

|

EBITDAS |

11,594 |

20,658 |

6,523 |

(43.88%) |

77.74% |

Source: AOSL Form 8-K

What to expect from AOSL when it reports next?

The consensus is that the numbers will get even better when AOSL releases its next report on August 7. Expectations are that AOSL will get back into the black by reporting a non-GAAP profit of $0.04 per share in its Q4 FY2024 report. These expectations are in part based on the belief that AOSL is past the trough in the downturn, as suggested by AOSL itself. From the Q3 earnings call:

Looking at a broader view of the overall semiconductor cycle, inventory corrections across the majority of our end markets are now approaching their conclusion, positioning us for a gradual rebound as we move forward into the rest of calendar year 2024. For example, the rate of decline in gaming and quick chargers slowed during the quarter and we saw sequential growth in tablets, appliances and e-mobility.”

Source: AOSL earnings transcript

Why AOSL may have turned into an AI play

The previous chart shows how the rally shifted into higher gear on June 20. This was also no coincidence because that was when reports emerged that AOSL stood to benefit from changes in Nvidia’s (NVDA) certification process. Ming Chi Kuo, for example, tweeted that AOSL is poised to become a new supplier for Nvidia’s GB200.

The reports seem to confirm what AOSL itself had previously suggested, which is that AOSL is tapping into the market for artificial intelligence or AI for a more favorable bill of materials in order to grow earnings.

Looking beyond 2024 to the growth phase of the next cycle, AOS is transitioning from a component supplier to become a comprehensive solution provider, enabling us to go deeper with increasing BOM content and penetrating new products and verticals. We have built upon our core competencies of high performance silicon, advanced packaging and intelligent ICs to expand our product offering. For example, we now have multi-phase controllers in addition to smart power stages to power not only computing Vcore, but also extending to graphics and AI data center applications for advanced computing.”

The ramifications for AOSL are profound. If AOSL is successful in tapping into the market for AI, the stock is very likely to reap the benefits, similar to what has happened to other stocks.

Investors are clamoring for AI plays, and these reports may have turned AOSL into one. NVDA is the leading play when it comes to AI, and many other companies have seen their stocks soar due to having exposure to NVDA. So it was not unusual for AOSL to have its stock soar now that AOSL apparently offers investors exposure to the red-hot AI market. This gives investors a powerful incentive to get in on AOSL, hence the recent spikes in the stock.

Investor takeaways

The difference between the last three months and the two preceding years is like night and day. AOSL has gone from a stock in persistent decline to a stock that has gone almost vertical, especially in recent days. This rally in the stock was and continues to be made possible by a couple of catalysts favoring AOSL.

AOSL is still dealing with the effects of a downturn in demand, but it appears the worst has passed and demand is getting better. However, while the former got the party going, it was AI that send the stock into hyperdrive. As a result, AOSL has gone from being down 26% as recently as April 19 to up 75% YTD.

The market seems to believe AOSL offers exposure to NVDA and the AI market in general, which could be a game changer for AOSL. The market keeps pushing AI-related stocks higher, even in instances where the connection to AI is borderline. If this continues, this bodes well for AOSL and its stock.

It is not easy to argue in favor of getting in on a stock that has soared higher the way AOSL has done, but I am going with bullish on AOSL with the caveat that the stock is way overbought and thus at risk of a correction. Buyers should be mindful of this if they intend to get in on a stock that has gained a quarter in value in three days. It may be better to wait for the stock to cool down somewhat before getting in.

Those who got in earlier can ride out the ongoing rally. AI has shown to be a potent catalyst for many stocks, and there is no reason why this should be any different for AOSL. While multiples are no longer as low as before, they are still not in lofty territory like some other AI-related stocks. AOSL is also entering a time of the year when seasonality is in its favor.

Bottom line, AOSL is red-hot right now and probably due for a correction in the stock after going almost vertical in the past few days. Bulls should be on the lookout for a stock that may decline in the short term. Those who are in it for the short term or solely rely on momentum are taking a sizable risk if they place bets on AOSL as things currently stand.

However, those with a longer horizon can be confident that AOSL has what it takes to overcome a short-term correction. Improving demand and quarterly results by extension, relatively low valuations, seasonality, and most of all, the AI factor are all tailwinds that can push the stock even higher than where it is.