magnez2

Over the past couple of decades, credit cards have become increasingly ubiquitous in American society. I worked for a major grocery chain about 25 years ago, and credit cards were an anomaly in the checkout line. The vast majority of people paid with cash or check. Today, people behind check writers in a checkout lane are likely to get annoyed because swiping a card or inserting a chip is so much quicker–and people wait to fill out the check until they get a total.

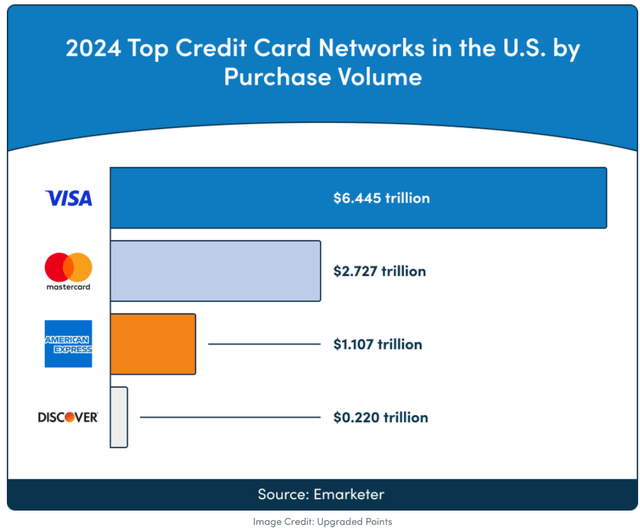

There are three major card processors in the United States, and those are Visa (V), Mastercard (MA), and American Express (NYSE:AXP), four if you count Discover (DFS), which is much smaller. Visa is the largest, and it has provided outstanding returns for investors over the past several years. American express is one of the major players in this space, and it’s gotten a reputation for serving a higher-class clientele.

By purchasing volume, American Express makes up about 10% of the credit card market in the US, well behind Visa and Mastercard. American Express issues its own cards, unlike its main competitors, which work with banks that actually issue the cards. It is also different in the fact that it serves as a bank. Consumers can use American Express for checking and savings accounts, and it also issues personal loans. Regardless, AMEX is a very profitable company, and it could have room to grow.

Part of the issue that keeps the company’s market share lower is the processing network it utilizes. Merchants are less likely to accept cards issued by AXP because of the higher swipe fees it charges to them. Visa and Mastercard tend to charge around 1.5% to 2.5% of the purchase price, while American Express charges a full percent more, on average, at 2.5% to 3.5%. Additionally, relatively few merchants outside of the United States accept AMEX cards. Some in the US are reluctant to sign up to accept cards issued by American Express. My daughter presented one in the US a few days ago, and she said the merchant informed her they don’t accept American Express.

Finances

There is no doubt that AXP is a profitable company. It has shown both revenue and income growth over the past decade. In terms of total revenue, the company brought in $32 billion in 2014. For FY 2023, AMEX brought in $56.9 billion. That’s a healthy 78% increase over a 10-year period. Net income over the same period has grown from $5.9 billion to $9 billion. This is healthy growth, and it’s led to an EPS of $12.16 over the past 12 months.

While AMEX has shown strong growth, it is dwarfed by Visa, which has seen its revenue nearly triple over the same period, from $12.7 billion to $32.7 billion. While its total revenue is lower, Visa’s net income is double that of AMEX, coming in at $17.2 billion as of the September 2023 annual report. EPS is lower, but still healthy at $8.95 over the past 12 months.

American Express shareholders have benefited from healthy share buybacks in recent years. The company’s share count has decreased by 30% over the past decade, although the speed of the buybacks has slowed in the past couple of years. In March 2023, the company announced a new buyback program that would allow it to purchase up to 120 million shares, which is nearly 1/6 of its current outstanding share count. This could benefit shareholders, as the company’s income would be spread across fewer shareholders and have a positive impact on EPS. Theoretically, this should lead to higher stock prices.

As of the last quarterly report, AMEX has a solid net debt number, indicating that it would have about $3 billion on hand if it used its cash and equivalents to pay off debt immediately. This indicates that the company is not highly levered.

For Income Investors

Those interested in short-term income will definitely find better options than American Express. It currently has an anemic yield of 1.12%, which is below that of the overall market. For every share of AXP you own today, you’d receive $0.70 per quarter, given the current share price of $248.99.

While short-term income is not likely, those with a longer time horizon will likely fare better. AMEX has grown its dividend by 10.76% over the past five years, and its most recent increase was 17%. Additionally, the company uses very little of its income for dividends. The current payout ratio is just above 20%. This number is very close to its long-term average, as most years over the past decade have seen a dividend payout of between 17% and 22% (a couple of numbers around 45% are outliers). AXP has been able to pay a dividend that’s grown from $1.01 to the current $2.80 over the past decade while buying back 30% of its shares and maintaining relatively low leverage through debt.

Those who invest for the long run could theoretically see their income double every seven years at the current dividend growth rate. It would likely take some time, but this could pay off for those who make an investment earlier, rather than later.

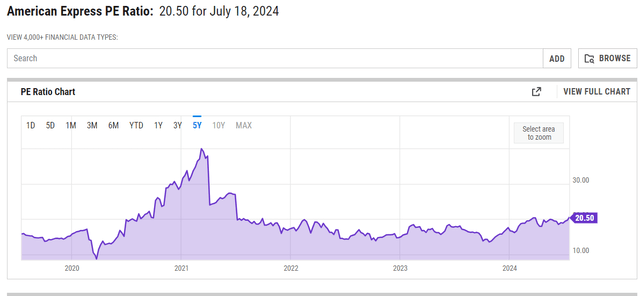

The current P/E ratio for American Express is 20.52, which is not terribly out of the ordinary for the company. However, AXP has seen its share price grow by 41% over the past year, which has caused this number to increase.

PE Ratio for the Past Five Years-AXP (YCharts)

This number would seem to make AMEX a better buy than Visa at present. V has a P/E ratio of about 30. Visa has not seen the share price increase that American Express has over the past year. Otherwise, this number would be even higher.

Overall, AMEX saw revenue grow at a 9% year-over-year clip for the first quarter of 2024. It’s net income grew by a healthy 39%. The most recent report gave an estimated EPS guidance of $12.65 to $13.15 for the full year, which would be a 9% to 11% increase over FY 23.

Risk?

One possible risk for AMEX is the possibility that Congress will regulate rewards cards out of the market. Some legislators argue that prices would come down if swipe fees were lower. AMEX and Visa effectively return some of the swipe fees to customers in the form of frequent flyer miles or cash back. Credit card interest hurts those who have to pay it, while those who hold rewards cards and pay no interest benefit. However, it is unlikely that prices would come down, as most businesses would be happy to just hold on to the difference. The ripple effect could hurt the travel industry, as well.

What might happen should this legislation go into effect, at least on the margin, would be higher-earning individuals spending less with cards, which could lower revenue. Many people use cards for convenience and the rewards. Without the rewards, it’s possible people would switch to a debit card or (hopefully not–for the sake of time in grocery lines) checks. Additionally, many of the biggest spenders are high-income individuals, as people with poor credit cannot always access credit and they have less to spend. Removing credit card rewards could hurt the bottom line of companies like AMEX and Visa. Also, a recession would possibly hurt a company like American Express. People would, in general, have less money to spend as unemployment increases. This would likely lead to lower swipe fees and more loan defaults, which could hurt the company’s bottom line.

Conclusion

American Express is a profitable company. It effectively competes with Visa in the credit card industry, and it also serves as a bank. Revenue and income have grown fairly steadily in recent years, and the company anticipates a strong year of growth in 2024. With a low dividend payout ratio and a decent buyback program, it is possible that shareholders could be rewarded well in the next few years. That is not to say that there are no risks with this investment. One of the biggest is the proposed Credit Card Competition Act, which would disincentivize the use of credit cards and theoretically lower swipe fees and revenue.