Pgiam/iStock via Getty Images

Investment thesis

THOR Industries, Inc. (NYSE:THO), established in 1980, is the world’s largest manufacturer of recreational vehicles (“RVs”) on a unit volume and absolute dollar volume. With a diverse product portfolio encompassing North American towable RVs + motorized RVs, it serves independent, non-franchise dealers across the U.S., Canada, and Europe. According to Statistical Surveys, the company has ~40% share of the North American travel trailer market and ~48% of the motorhome market. It also holds ~25% share of the EU markets.

THO books sales on the shipment of its units to various dealers (usually non-franchise) who on-sell these products to retail. This includes equipment/components for the various RVs. It also buys revenues through mining the acquisition pipeline. The THO group of companies contains 16 names, with some well-known bands such as Jayco caravans and THOR Motor Coach.

Figure 1. “THOR Motor Coach” RV model. It sleeps 1-7 people, and is ~30-36ft long depending on the model.

THOR Industries Website

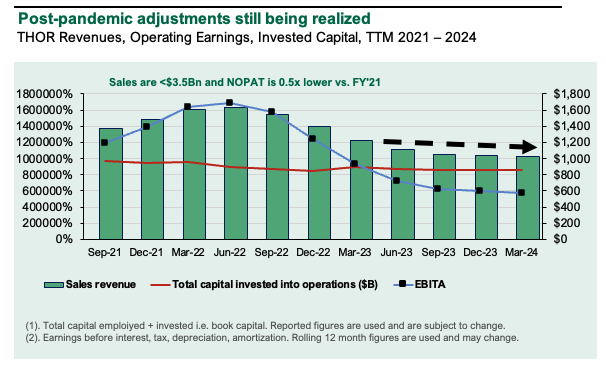

The used car + RV markets underwent tremendous price growth (not necessarily volumes) throughout the Covid-19 period as a result of 1) supply chain blocks and 2) price inflation in these markets. As a result, THO’s revenues are heavily clamped [-$3Bn since FY’21] with post-tax earnings ~0.5x lower in the same time.

Interestingly, the overall RV market grew throughout this period, from ~$51Bn in FY’21 to $58.2Bn in FY’23. But the forecasted CAGR to FY’30 is ~200bps lower at 5.2% vs. 7% previously and this is material — 2% of $58Bn is ~$1.15Bn; times 6yrs = ~$7Bn.

THO stock is -15% this YTD, but still trades ~21x earnings and ~14x NOPAT – the latter is more than 2x its historical range. I wanted to see if the pullback presented an opportunity to harvest some overlooked premia or catch THO in an early phase of the cycle.

I am hold on THO due to 1) unsupportive fundamentals at this point in the cycle [earnings clamped, subdued industry growth, no economic profits on offer], 2) uncertainty of the coming periods due to market dynamics, and 3) valuations suggesting the stock is fairly valued today on the available information at ~$100/share.

Lack or earnings + cash flow predictability

All measures of financial + economic performance are down for the company compared to the FY’21–’22 period. Namely:

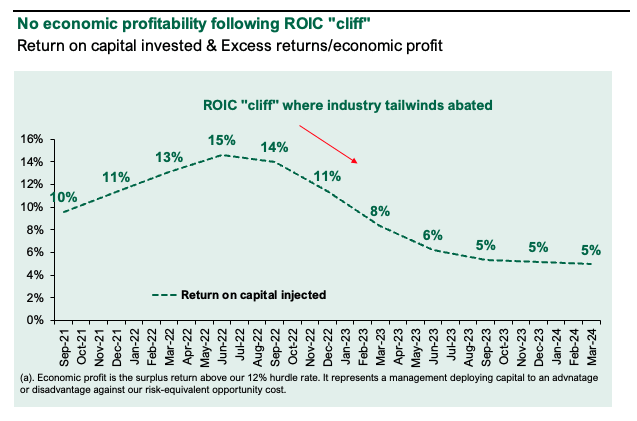

- The effects of RV pricing dynamics were heavily felt to the upside, and now to the downside since then. Sales are ~$3Bn less and NOPAT ~0.5x lower vs. FY’21 – more compared to FY’22 highs – and these adjustments are still being realized (Figure 2). This produced an ROIC “cliff”, resulting in a c.10pt decrease in returns on tangible and intangible capital from 15% to just 5% in the trailing 12 months (Figure 3). These returns are (a) no longer economically valuable [as they are below our critical 12% threshold], nor (b) set to expand back higher any time soon in my view.

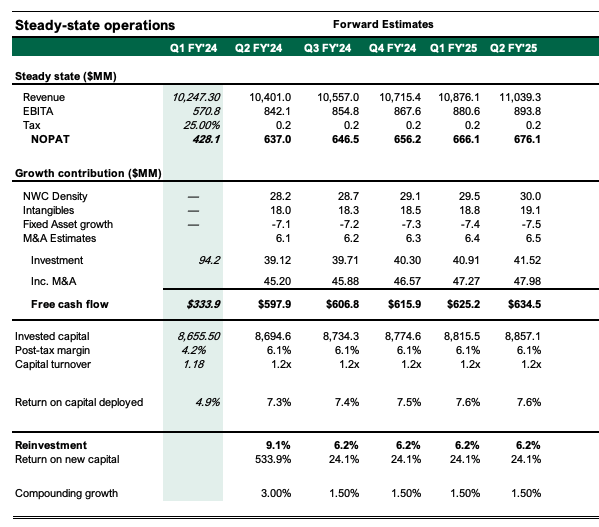

Figure 2.

Company filings, author

- Management downgraded guidance, further calling for ~$200–$400mm less revenue in FY’24 at both ends of the range – It now calls for ~$9.8–$10.1Bn at the top line on a gross margin of ~14%. But several factors are true – 1) this run-rate is above pre-pandemic range of ~$7.9Bn in FY’19, but 2) operating earnings are flat at $438mm vs. $422mm, 3) operating margins are down ~100bps despite the extra $2Bn in annualized sales, and 4) ~$8–$9Bn of investor capital has now been put into this business [inc. retained earnings] – an additional $4Bn vs. FY’19, for just $12mm extra operating earnings (TTM basis). The pre-tax ROIC is thus ~30bps on this. This is a classic case of where not all growth is created equal. A thoughtful appraisal on the capital investment required to produce such sales growth is critical, along with what incremental earnings it produced. Growth has not added value for THO.

Figure 3.

Company filings, author

Mixed divisional growth

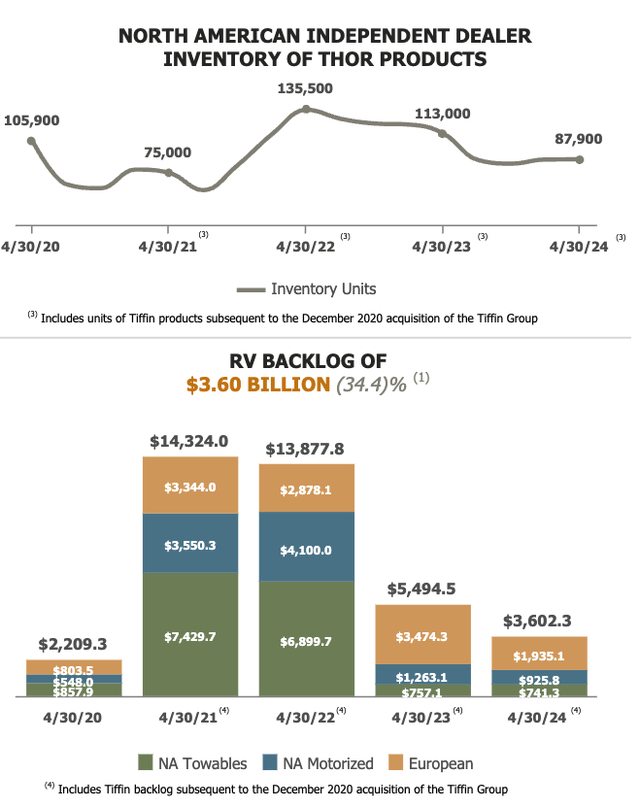

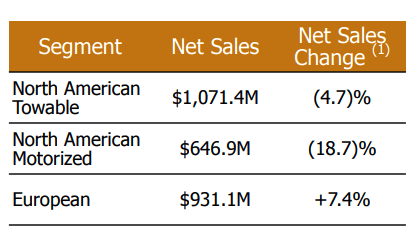

US + Canada sales were weak in THO’s Q3 FY’24, offset with strength in EU volumes + pricing. Order backlog for North American towable + motorized RVs was $741mm and $925mm respectively ($1.6Bn NA total backlog), and is >$1.9Bn in Europe (Figure 5). As such, it appears its EU markets could be a midterm growth driver for the business.

The divisional takeouts were as follows (see: Figure 4 for breakdown).

North America

- Towable RVs:

- Net sales were -470ps YoY driven by a +15.1% unit shipments, offset by a 19.8% decrease in the overall net price per unit.

- Gross margins were +100bps YoY to 12.9% due to product mix.

- Motorized RVs:

- Net sales down 18.7% YoY due to a 20.0% reduction in unit shipments. Gross profit margin was down ~600bps to 11.1% as a result.

Europe

- RVs:

- Net sales were +740bps YoY from 1) +8.9% price/unit and 2) changes in product mix. It clipped ~17.5% gross on this.

Figure 4.

THO Q3 Investor Presentation

Figure 5.

Valuations overstretched with potential downsides

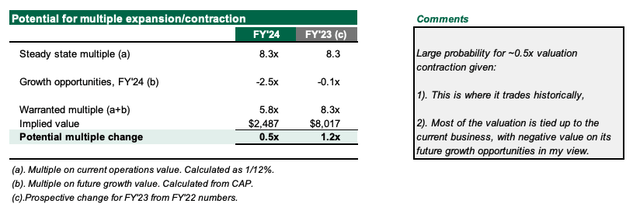

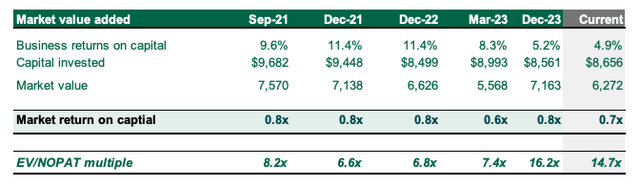

My conviction is that THO is still overvalued on a multiples basis and the propensity for contraction off of these ranges is high. There are several insights into this.

Valuation insights

- It sells ~14-15x NOPAT – more than 2x historical range from FY’21–’22, when it might deserve these higher valuations. Nevertheless, the market never valued it >1x EV/IC and has compressed this multiple to 0.7x as we speak. This says 1) the money that’s been invested into THO’s operations isn’t valued at 100 cents on the dollar by the market, and 2) it is not a statistical discount thanks to the slack earnings on operating capital.

Figure 6.

Author, using data from Bloomberg and Seeking Alpha

- Consequently most of the valuation lies in the value of the current business (i.e. not the future growth or not of the business). My view is there is scope for a ~0.5x contraction to ~7x NOPAT and this plagues the stock price, given 1) this is where it trades historically, 2) negative economic earnings, 3) ~200bps p.a. less in industry growth estimates, and 4) the market’s current appetite for high-quality fundamentals [it won’t pay for sloppy numbers].

Figure 7.

- At 7x NOPAT the business is fairly valued at my FY’24–’26E estimates which are show in Appendix 1. I want to stress that 1) these projections award THO with high growth, and 2) illustrate the valuation is mostly tied up to the multiple paid vs. fundamentals, telling me the market has to still digest the situation. A 5% contraction in valuation means THO needs +25% earnings growth to push the stock toward an acceptable return of ~20% from today. On the upside, the risk is ROICs expanding – this could warrant ~10-14x NOPAT – but the probability of this is low in my estimation. On the downside, even though this implies <1x EV/IC it’s not a statistical discount.

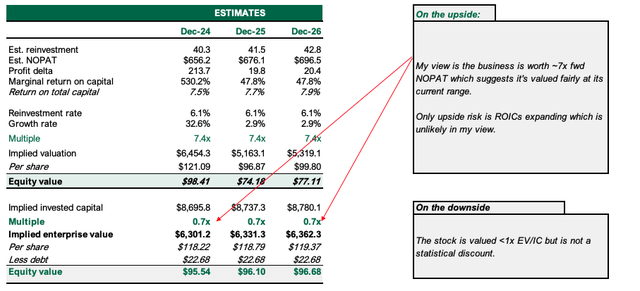

Figure 8.

Figure 9.

Author

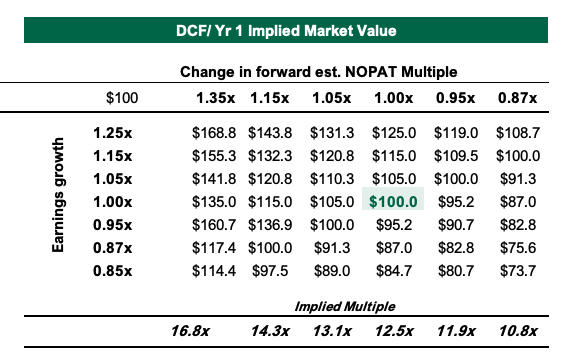

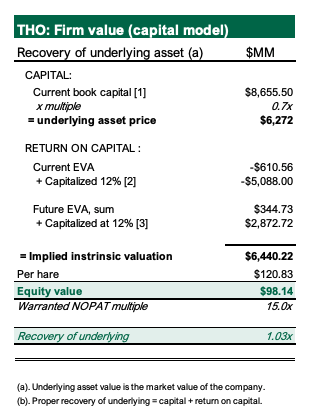

- Finally, my FY’24–’26E assumptions assume no recovery of underlying asset value (inc. capital + return on capital), and that the business is fairly valued at ~$98/share, where it trades today, offering no value asymmetry (Figure 10). In other words, it is worth <1x EV/IC as earnings on its business assets are below returns that investors an generally achieve elsewhere. The risk is clearly skewed away from our favour, corroborating a hold view.

Figure 10

Author

Risks to thesis

Upside risks to the thesis include 1) ROICs shifting back >10% (although unlikely), 2) rates coming off earlier than expected, resulting in a tailwind for broad equities, and 3) large upshift in RV demand due to demographic trends i.e. aging population, more work from home, and so forth.

Downside risks are centered around the macroeconomic situation, namely the current inflation/rates axis. Any negative news here is a further compression to THO’s valuation.

In short

Following a sharp correction the economics don’t support a buy rating on THO at this point in the cycle. The business has to work out its balance sheet and establish sales stability, whereas the market still has to digest all this. As such, there is high propensity for a contraction in multiples to ~7x NOPAT in my view, THO’s 3yr and 5yr historical range. Based on all these factors, I rate THO a hold.

Appendix 1.

Author