In recent years, Michela Allocca has built a capsule wardrobe to help cut back on clothes shopping and make getting dressed easier.

The idea is to have a streamlined closet with a limited number of basic clothing items you can mix and match. But Allocca’s closet didn’t get that makeover overnight.

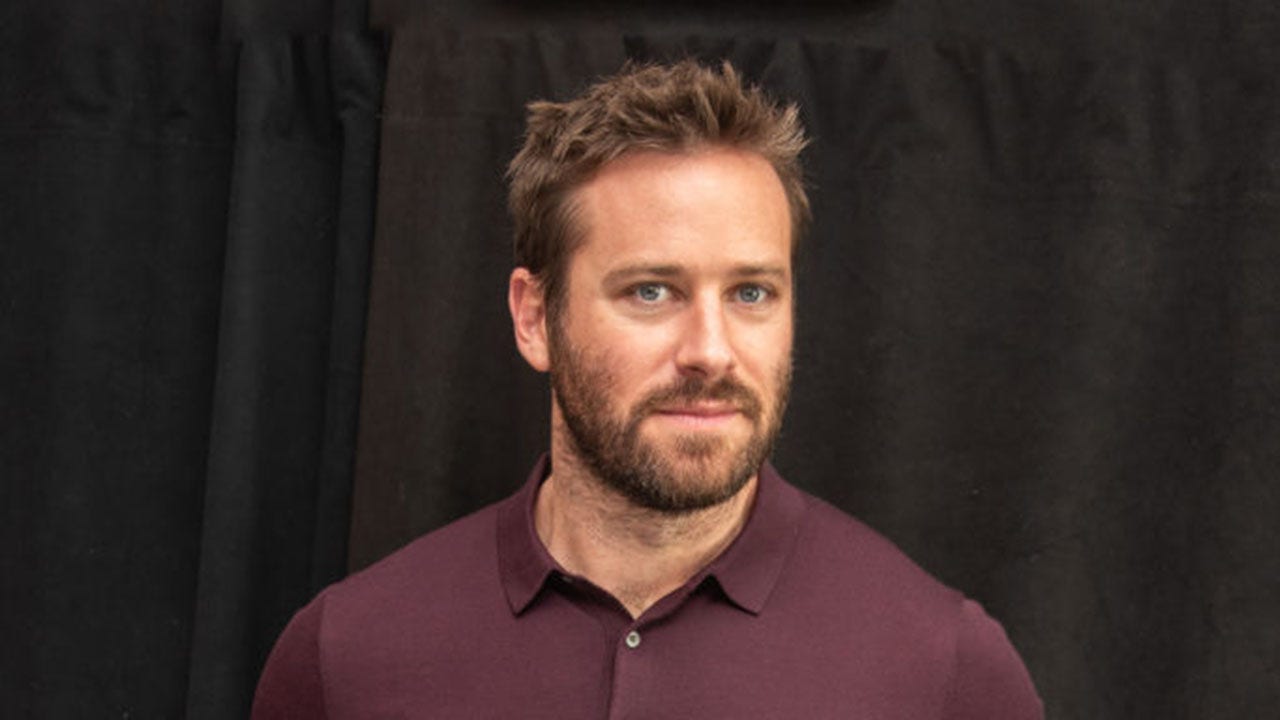

“I have purchased a lot of clothes [in the past] that I liked in the moment, but I was trying to make the clothes fit me, and they just didn’t,” says the personal finance coach and content creator. Her experience working in corporate finance helps her teach others how to use their money wisely, and she tries to model those decisions in her personal life too.

The average U.S. household spent around $1,954 on apparel in 2022, or about $162 per month, according to Bureau of Labor Statistics data. That’s nearly an 11% increase from 2021, and more than consumers were spending on clothes and shoes prior to the Covid-19 pandemic.

DON’T MISS: Achieve Financial Wellness: Be Happier, Wealthier & More Financially Secure

For Allocca, choosing which high-quality pieces to invest in took some trial and error. She says neglecting her personal style was one of the biggest mistakes she made while filling out her capsule wardrobe.

“If you buy a piece of clothing that you don’t wear often, that’s a waste of money,” she says.

Derek Guy, the menswear expert behind the blog and popular X account, “Die, Workwear!” agrees. “The most important dimension [when buying clothes] is not to just think about quality or brand name, but the idea of emotional durability,” he tells CNBC Make It.

“Something can be beautifully built and really durable, but if it’s not something that you’re excited to wear in 10 years, then it kind of doesn’t matter, because it’ll just languish in your closet,” he says.

You might buy items according to a trend or shop a brand because an influencer says it’s a good one. You might even grab pieces when they go on sale. But regardless how much you spend, if it’s not something you are going to wear, it’s going to be a waste of money.

Here are three tips to help you figure out your personal style and stop overspending on clothes.

1. Identify what you’re ‘always reaching for’

You don’t have to commit to a capsule wardrobe in order to minimize your clothing budget. Most of us have a few closet staples — like a pair of jeans or a blazer — that we wear all the time. Those should be the pieces of clothing you invest the most in, Allocca says.

Out of a closet of “elevated basics” from which she can mix and match, “I’m thinking about the items that I’m always reaching for, and how can I make sure that they’re high quality, regardless of the price,” she says.

She feels comfortable splurging on these items because she knows she’s going to get her money’s worth. Though she paid around $500 for one sweater, “it’s a classic style, I wear it all the time,” she says.

While fashion blogs and influencers may try to dictate which items are or aren’t considered timeless, your personal style can help you decide if an item is going to be worth a significant investment.

“If you shop purely based on trends, then you have an entire closet full of clothes that has very low use and probably a very high cost per wear,” Allocca says.

2. Trust your experience

You don’t have to be a fashion expert to know what your personal style is. Both Allocca and Guy say part of the process is figuring out which brands, fabrics and styles you truly enjoy wearing.

“You may buy an item and find out in a couple months that you don’t really like wearing this thing, and then that bad experience hopefully informs future purchases,” Guy says.

If you don’t like the way a fabric or hemline feels on you, trust that instinct to avoid buying another piece you’re not going to wear. Linen, for example, is a good quality material, but if you don’t personally jibe with its texture or appearance, you shouldn’t try to force a linen set into your repertoire.

3. ‘Buy less, but buy better’

When buying anything, Allocca’s motto is: “I want to buy less, but buy better.”

Before making a purchase, she asks herself how often she’ll use the item, whether it will last and how it will benefit her overall.

One example is her rotation of wedding guest dresses. She only owns a couple that she rotates through whenever she attends a wedding, rather than buying a new dress for every event.

“We’ve stopped normalizing using your clothes and actually wearing them for a normal period of time,” she says. “I have a wedding guest dress that I bought back in 2022, and it’s my fall wedding guest dress. If I’m going to a wedding in September or October, I’m wearing this dress.”

In addition to saving space in your closet — or eventually a landfill — aiming to buy fewer items can give you more of a budget to splurge on the pieces you do buy. A higher price doesn’t always mean better quality, but a larger budget gives you more flexibility to be selective.

“Increasing your budget allows you to find certain things that you want to keep longer and still make you excited [to wear] in 10 years,” Guy says.

Want to stop worrying about money? Sign up for CNBC’s new online course Achieve Financial Wellness: Be Happier, Wealthier & More Financially Secure. We’ll teach you the psychology of money, how to manage your stress and create healthy habits, and simple ways to boost your savings, get out of debt and invest for the future. Start today and use code EARLYBIRD for an introductory discount of 30% off through September 2, 2024.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.