We Are

Summary

I am positive about Omnicom Group (NYSE:OMC). My summarized thesis is that OMC growth is inflecting back to mid-single digits, and growth should easily sustain itself at this level given the various catalysts over the near-to-long term. Margins are also trending nicely back to the high-teen percentage level, and with this performance outlook, I see an attractive 21% upside to the share price.

Company overview

OMC is a company that addresses businesses and organizations’ need for marketing solutions. Through its network of end channels, it provides various marketing services, such as strategic media planning and buying, advertising, digital marketing, public relations, etc. The business has operations in the Americas (57% of FY23 revenue), EMEA (31% of FY23 revenue), and APAC (12% of FY23 revenue).

Earnings results update

In the latest quarter (2Q24) reported on July 16, 2024, OMC reported organic growth of 5.2%, with reported revenue growth coming in at 6.8% y/y. The difference was due to 1% FX headwind and a 2.6% contribution from M&A. By region, organic growth for the US saw 6.3% while international saw 4.1%, both accelerating from the previous quarter of 4.3% and 3.6%, respectively. Splitting international organic growth apart, Latin America organic growth saw 24.5%; MEA saw 8%; and the UK saw 6.9%. Europe saw 4.5%; all of them accelerated from 1Q24 (22.3%, -4.2%, 3.2%, and 3.5%, respectively). The only weak regions were APAC, which saw growth deceleration from 3% in 1Q24 to -0.1% in 2Q24, and North America (ex-US), which saw growth deceleration from 1.1% in 1Q24 to -8.3% in 2Q24. Overall, I believe the topline performance was a really positive sign that growth is gradually inflecting upwards. Even more encouraging was that EBITDA margin improved by 150bps to 16.3% vs. 1Q24, another very positive sign that profitability is tracking towards high-teen percentage levels.

Growth outlook and catalyst

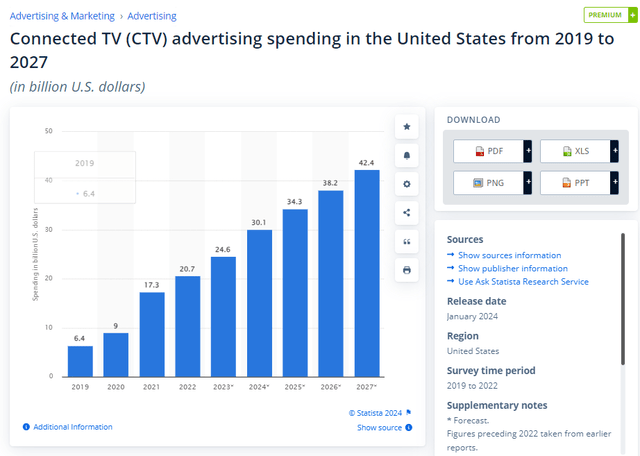

Looking ahead, I am expecting organic growth for OMC’s largest markets to continue inflecting upwards, given the multiple visible catalysts. In the near term (2H24), OMC should benefit from the increase in advertising demand due to the US election and the summer Olympics. Over the medium and longer term, OMC should benefit from the continuous penetration of connected TV [CTV] advertising and Gen-AI utilization.

For CTV penetration, I have written in depth about this in my post for Innovid Corp. For the benefit of readers of OMC, I quote the following:

There has been a great shift in how the world consumes video content over the past decade. Many years ago, video content was broadcast via free-to-air channels to consumers, and TV was pretty much the only way to access this content. We then have CDs, DVDs, rental systems, pay TV, etc. that allow consumers to watch the content they want on their own schedule. This has changed dramatically with the rise of over-the-top [OTT] players like Netflix, Apple TV, Disney+, Amazon Prime, Hulu, etc.

This basically disrupted the entire ecosystem, where content providers now have the upper hand in the value chain since they no longer need to rely on intermediaries (like TV and telecom cable TV providers). Consequently, this resulted in consumers spending more time on COTV than traditional TV, which had a knock-on effect on how advertisers allocate their resources. As more eyeballs shift towards COTV, it is only natural that more advertising dollars will be allocated to it since brands want the best return on advertising dollars spent.

One of the strongest advantages that traditional TV had over COTV (or OTT players) was live sports. However, even that seems to be moving towards COTV. Big OTT players like Amazon Prime, Netflix, and even sports channels themselves are going direct to consumers. As such, my view forward is that COTV is going to continue capturing a share of eyeballs from traditional TV, and the entire COTV ecosystem will attract more marketing dollars from brands.

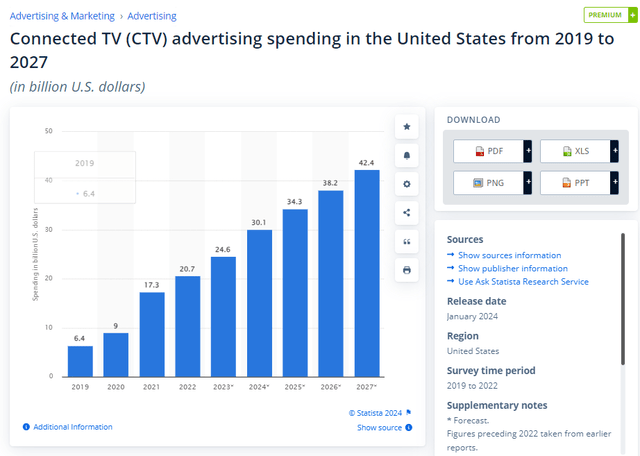

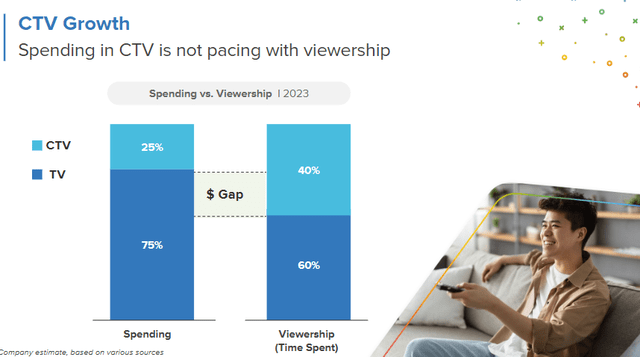

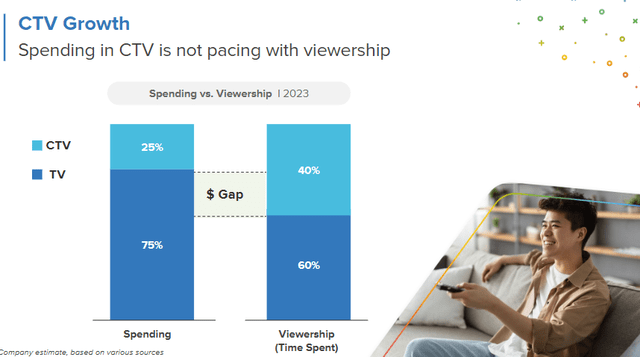

To better illustrate the growth strength and potential, I am representing these two charts:

Statista Innovid Corp

As for Gen-AI, I believe this is going to be the key growth driver over the coming years, one that could structurally improve OMC’s competitive position, growth, and margin profile. Using Gen-AI, advertising service providers like OMC can significantly improve their value proposition to clients in multiple ways. For instance, OMC could deliver personalized campaigns at scale, leveraging Gen-AI capabilities to iterate quickly based on the profile targeted; leverage keener insights to better allocate media spend across multiple platforms; among many others.

Of the many improved value propositions, the one that I am most bullish on is OMC’s ability to deliver better personalization at scale, which leads to more demand, which provides more data for OMC, and this entire cycle repeats itself. More specifically, what I meant by large-scale personalized ad campaigns is that different ads will be shown to different consumers based on profile factors like demographics, location, consumer preferences, and more, rather than showing them the same ad for the same brand or product.

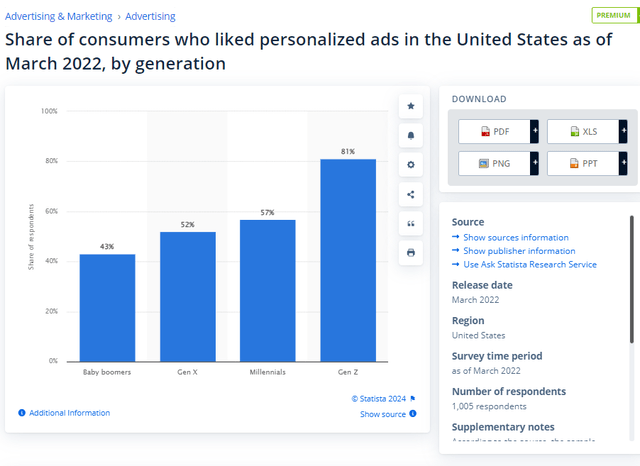

This should naturally attract a lot of demand from businesses and organizations because consumers want personalized ads, especially for the younger generation (Millennials and Gen Z), which represent the largest population mix in the US. There is already evidence of this strong demand, as called out by Publicis Groupe in their 1H24 earnings call. WPP PLC also talked about how personalization has benefited Mondelez in their January Capital Markets Day, where Mondelez saw a 30% uplift in ROI when it comes to personalization at scale, and they are investing more.

Publicis Groupe in their 1H24 earnings call: Second, our capabilities allow us to take the leadership in personalization at scale. Our ability to capture a disproportionate part of the increasing demand for data-led marketing transformation, boosted by AI, in a soon-to-be cookie-less world, is reflected in the double-digit performance for the third year in a row of our combined data and media offer, which represents circa 50% of our net revenue.

Publicis Groupe in their 1Q24 earnings call: The first, and I talked about it a minute ago, but it’s extremely important, is we see a material acceleration of demand from our clients, when it comes to personalization at scale.

Gen-AI can certainly speed up content creation, but it’s important for readers to understand that this Gen-AI strategy requires effective use of data, which is to a good extent dependent on how much data one has. As such, the differentiating factor as to how personalized an advertisement can become will boil down to the underlying data, and this is where large players like OMC will win against subscale players. Such an advantage provides multiple other positives for large players as well. For instance, they could charge more since their personalized ads are more effective. On top of that, big professional advertising agencies are probably going to see more demand given the need to manage the entire advertising process given that personalization at scale increases ad volume, which makes media buying and planning more complex.

Hence, all in all, I believe the potential is huge, and encouragingly, execution on this front has been great so far. Management highlighted in the 2Q24 call that tools are now live across OMC for employees and clients, and very positively, this implementation was done while revenue growth accelerated and margins improved.

Valuation

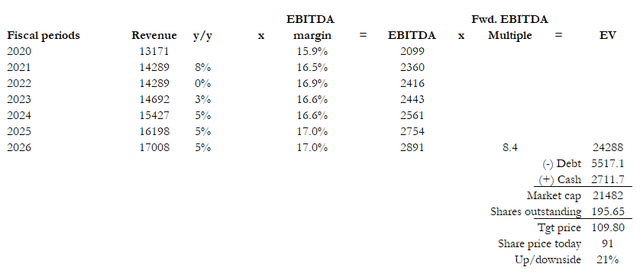

I believe OMC is worth 21% more than the current share price. My target price is based on FY26 ~$2.9 billion in EBITDA and a forward EBITDA multiple of 8.4x.

Earnings bridge: Recent financials have shown growth inflecting back to mid-single-digit growth, which I believe OMC can sustain moving forward given the various catalysts ahead. Margins have also inflected back to the high-teen profile in 2Q24, and giving the topline growth outlook, I modeled EBITDA margins to trend to 17% (FY22 reported 16.9% EBITDA margin, for reference).

Valuation justification: OMC deserves to trade at a premium to where Interpublic Group (7.6x forward EBITDA) and WPP PLC (6x forward EBITDA) are trading today because of its better growth performance, suggesting that OMC is recovering faster (Interpublic Group saw a 1% decline and WPP PLC saw a 1.4% revenue decline in 1Q24 vs. OMC growth of 5.4%). As another reference point, Publicis Groupe (a closer peer to OMC) trades at 8.4x forward EBITDA, and it has a similar growth performance as OMC (both grew ~6.7% in 2Q24) and a similar EBITDA margin profile.

Investment Risk

Any weakness in the US and global economy due to a recession or any other outlier events (like COVID) will hurt OMC growth and profit performance as clients pull back on advertising spend. While Gen-AI benefits OMC, especially for the larger players, it also lowers the barriers to entry for small advertising firms. If these small players are able to develop a better way to personalize ads without the need for a lot of data, it could hurt OMC’s competitive position.

Conclusion

My positive view on OMC is because the recent earnings report showcased accelerating organic growth across regions, with positive margin trends. Importantly, factors like the upcoming US election, Olympics, and the continued penetration of CTV advertising should drive near-term growth. Over the longer-term, OMC’s competitive position should be further enhanced by leveraging Gen-AI tools for personalized advertising at scale. This will not only attract more clients but also allow OMC to capture a larger share of the advertising budget.