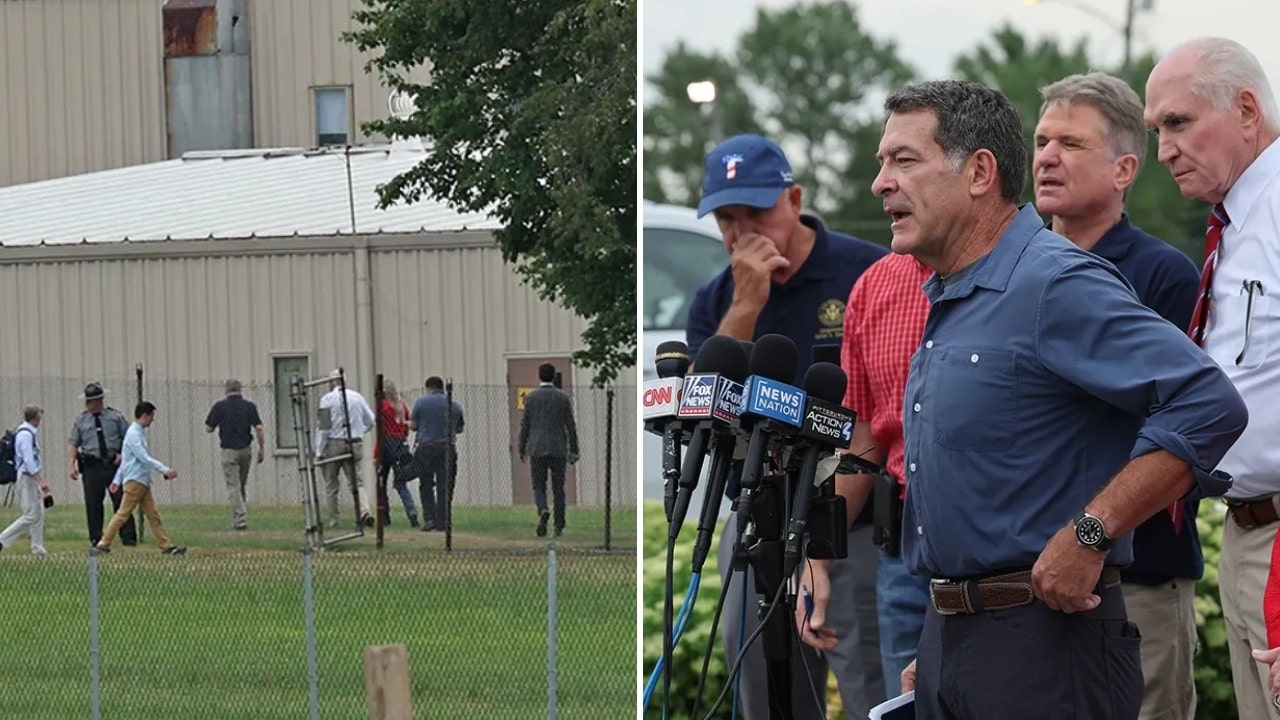

The markets was void of any economic data in the US session today. The key event was the weekend resignation of Pres. Biden as the Democratic Presidential candidate and the endorsement of VP Kamala Harris.

Other party leaders fell in line with their endorsement paving the way for the nomination. To get the official nomination, Harris would need 1986 delegates. She is well on her way in achieving that goal with some estimating that she would have enough delegates by the end of the week.

US stocks moved higher on the news. There was some chatter that Harris might be more friendly to big tech vs Biden, with Harris favoring a balanced/less regulated industry. Harris is also from California, home to many tech firms and startups. That helped the Nasdaq index, and also the small-cap Russell-2000. Both those indices rose by close to 1.60% on the day.

This week will also be a slew of earnings led by 2 of the Magnificent 7 led by Tesla and Alphabet after the close on Tuesday. Markets took both those companies shares up 2.26% and 5.15% in anticipation of good news. Nvidia also announced that have a chip that would be compliant for China and that helped it’s share rise 4.76% .

The final numbers are showing:

- Dow Industrial average, +0.32%

- S&P, +1.08%

- Nasdaq, 1.58%

The small cap Russell 2000, +1.66%

In the US debt market, the reaction initially led to a more negative curve, but as the day concludes, the yields are higher by 1.2 to 2.3 basis points across the curve:

- 2 year yield 4.521%, +1.4 basis points

- 5 year yield 4.175%, +1.2 basis points

- 10 year yield 4.254%, +1.6 basis points

- 30 year yield 4.473%, +2.3 basis points.

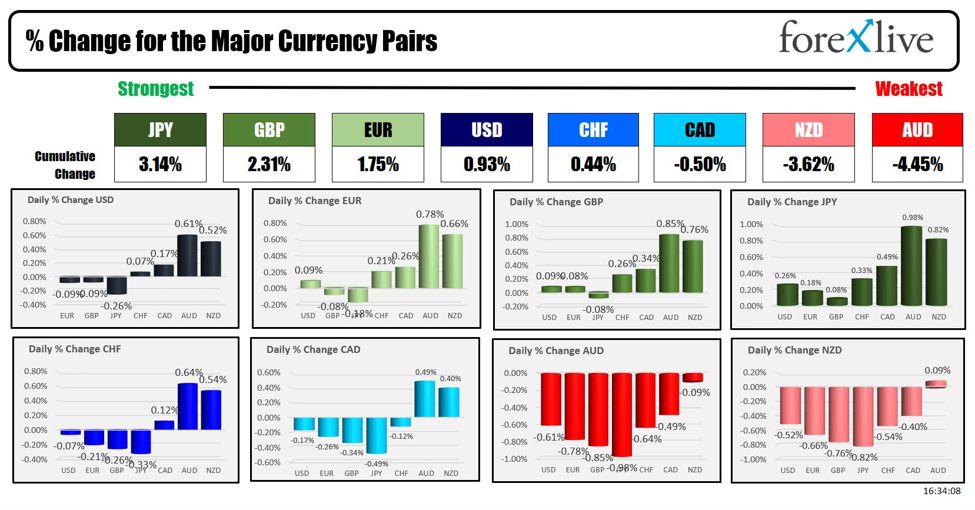

In the forex, the JPY is ending the day as the strongest of the major currencies despite reports that BOJ officials see weak consumption complicating long awaited tightening of policy. The AUD and the NZD are the weakest as they were impacted by concerns about China growth. The PBOC cut rates unexpectedly in reaction to the slowing economy. Moreover concerns about more tariffs ahead from Trump or Harris as the political winds of change favor America first.

The USD was higehr with most of the gains coming versus the AUD and the NZD.

The USD was also higher vs the CAD ahead of their rate decision on Wednesday which is expected to favor a cut of 25 basis points.