Teka77

Eni S.p.A. (NYSE:E) (OTCPK:EIPAF) looks pretty attractive. While having a solid E&P business, they also have a growth engine in Enilive and Plentitude. Enilive alone could be commanding a significant corporate valuation of between 11.5-12.6 bn EUR in equity. Plentitude was something around 8 billion EUR when it received investment from EIP. The residual businesses in E&P look quite shored up with some recent acquisitions that have considerable growth potential. The chemical and refining business doesn’t look great, mainly because of how non-competitive European chemical assets are, and gas is dealing with tough comps. But when taking the residual businesses’ valuation, it looks cheaper than peers, which gels well with the solid income and buyback proposition from Eni that we’ve always liked since our coverage from some years ago.

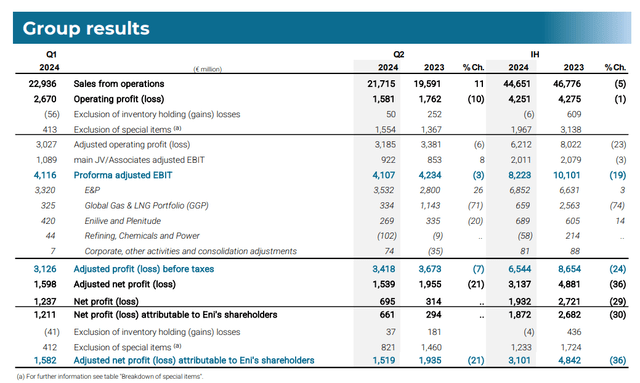

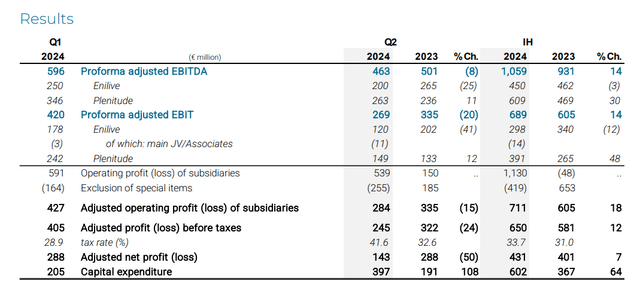

Latest Earnings

They’ve come out just the other day, and the results are in tune with what one would expect. New acquisitions such as Neptune Energy (a bit less than 10% of boe/d figures) and ramp up in the E&P business are adding nicely to revenues and offsetting natural declines, with price realisations having also improved YoY thereby strongly growing the adjusted EBIT figure (as a note the adjusted figure’s main element in the reconciliation is impairment costs). Most of the volume growth is inorganic currently, but at least the growth profile has shored up and there are enough assets coming online to create a stable profile for the E&P business. The outlook for oil in particular remains good in our view. While supply cuts are being phased out at the behest of the UAE within OPEC+, the very predictable timelines have meant that the situation has become quite normalised, and the outlook for oil can be considered quite stable.

For the global gas and LNG business, less volumes have been sold. Prices are also down YoY. While price comps aren’t as tough as they would have been in Q1 2024 and Q4 2023, or any other quarter with dislocated years in the base, the significant volume decline of around 16% for worldwide gas sales has a rough impact on results due to operating leverage. Adjusted segment EBIT is down over 70% as a consequence.

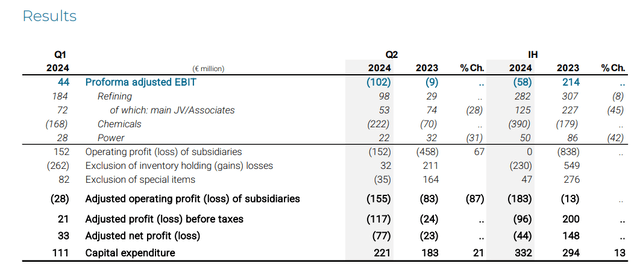

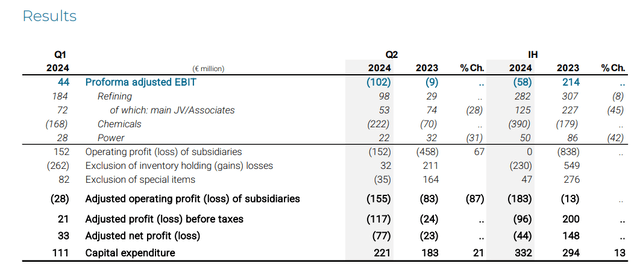

Refining, chemicals and power is a mixed business. Crack spreads are up for refining, although run-cuts in the industry also mean some of their geographies like Italy saw lower throughputs. On balance, however, the recovery in the crack spread was the more important factor, and refinery results are up.

The chemicals situation is grim. European chemical assets in many cases are now totally uncompetitive globally due to the input price situation. They are on the wrong side of the most important moat for an industrial business. The losses are widening here.

Chemicals, Power and Refinery (Q2 PR)

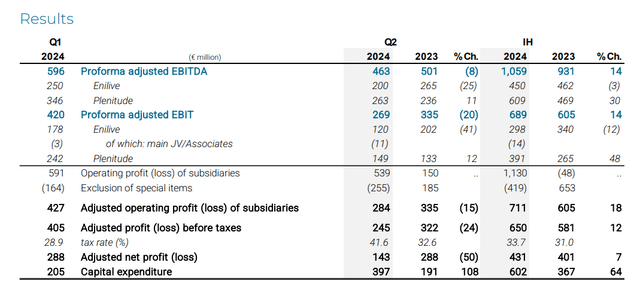

What’s left is Enilive and Plentitude. Plentitude is emerging as a serious competitor in the world of retail utilities as well as renewable power generation. They capitalised heavily on the ECOBONUS initiatives in Italy, still offering special contracts that include financing options for solar panels while becoming a retail customer. They are also growing installed capacity quickly on the generation side, with production likely to double from 2023 to the end of 2024. The expectation is that, together with Enilive, EBITDA for these businesses will be doubling twice over by 2030.

Enilive is in biorefineries. Their assets aren’t world-class – that’s gotta go to Valero (VLO) due to feedstock advantages – but they are increasing utilisations from a pretty nascent level and are able to find partnerships and markets for its renewable diesel and HVO volumes. However, poor margins have caused the business to decline.

Plentitude and Enilive (Q2 PR)

Bottom Line

We have some precedents for the Enilive and Plentitude business that help triangulate a value case. Plentitude received investment already from EIP, with the announcement having been made in 2023. This values the equity of the business at around 8 billion EUR or 10 billion EUR with debt. Enilive is apparently in the process of getting funds from KKR (KKR), which should value them at around 12 billion EUR including debt.

Keeping the debt consolidated into Eni, you can use the EV figures in an SotP valuation. Eni EV is around 63 billion EUR. Subtracting around 22 billion EUR leaves 40 billion EUR in EV for the residual businesses. Annualising the pro forma adjusted EBIT of the residual businesses from run-rate data gets you to around 15 billion EUR in adjusted EBIT. The implied multiple is around 2.6x by this calculation. EV/EBITDA multiples, which include the substantial D&A of industrial businesses, tend to be a lot higher for vertically integrated E&P peers. Exxon Mobil (XOM) is around 6x. Eni looks quite cheap.

It’s nice to see them plan around 1.6 billion EUR in buybacks by April 2025. That’s a 3.3% buyback yield. It seems they’ve also approved a 1 EUR per share dividend for fiscal 2024, which is around a 4% yield. Managing overall net earnings growth also sets a lower bar for capital appreciation to be achieved. Eni looks good.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.