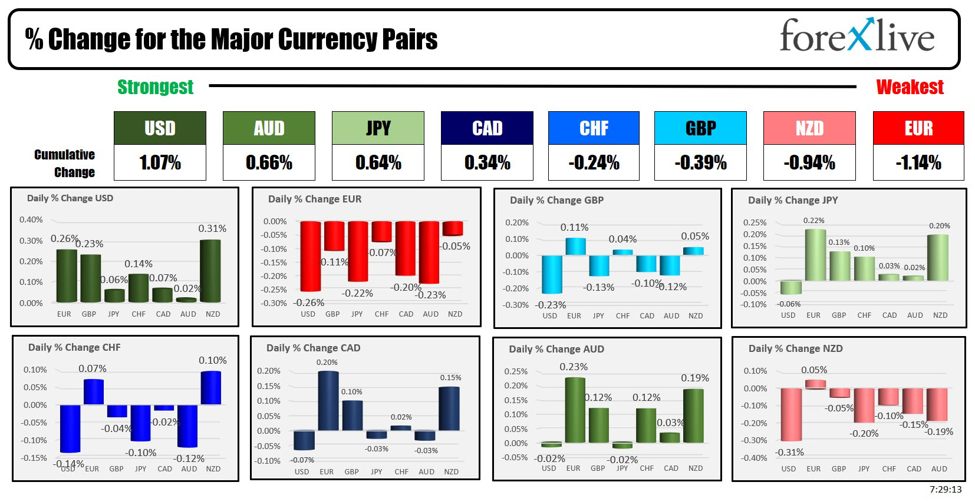

As the North American session begins, the USD is the strongest and the EUR is the weakest. The recovery from Friday in stocks is continuing ahead of a busy week. US yields are lower ahead of the FOMC rate decision on Wednesday. The BOE (chance for a cut at 60%), and the BOJ (they could hike and cut bond buying).

Over the weekend at Bitcoin 2024 in Nashville, GOP nominee Trump promised not to sell any of the federal government’s Bitcoin holdings, aiming to create a strategic national Bitcoin stockpile. He criticized the government’s past actions of selling seized Bitcoin. Additionally, he pledged to fire SEC Chairman Gary Gensler on his first day in office if elected which was met with rousing applause. For more details, CLICK here.

This week, the FOMC will announce its interest rate decision on Wednesday. The Fed is expected to keep rates unchanged but could look to pave the way for a cut at their next meeting in September. Over the weekend, some commentary on the decision included the following:

- Morgan Stanley predicts that the upcoming FOMC statement will set the stage for three rate cuts this year, starting in September. They cite significant progress on inflation as a key factor. Although Federal Reserve Chair Powell is expected to express increased confidence in lowering rates, he will likely avoid specifying a precise timeline during his press conference following the FOMC meeting on July 30-31. For more details, you can read the full article here.

- UBS forecasts that the Federal Reserve will pivot its policy soon, anticipating a 25 basis point rate cut in September. They believe the US economy is heading toward a soft landing, with below-trend growth, rising unemployment, and broad disinflation in place. UBS sees no imminent risk of a hard economic landing. For more details click here.

The Bank of England will announce its rate decision on Thursday. Deutsche Bank anticipates a close decision at the Bank of England’s upcoming meeting, predicting a 5-4 vote in favor of a 25 basis point rate cut. They expect this to initiate the first rate cut of the cycle, bringing the Bank Rate down to 5%. The forecast hinges on the Monetary Policy Committee’s increasing reliance on inflation projections and forward-looking indicators of wages and service prices. For more details, click here.

Earnings will also be front and center this week. McDonald’s announced their earnings this morning.

McDonald’s Corp (MCD) Q2 2024 (USO):

- Adj. EPS: $2.97 (expected $3.07) – Missed expectations

- Revenue: $6.49 billion (expected $6.61 billion) – Missed expectations

- Comp sales: -1% (expected 0.84%) – Missed expectations

For the trading week, Microsoft, Meta, Amazon and Apple will highlight the earnings with other industry titans also announcing. Below is the schedule of some of the major companies announcing :

Monday

- Before the open: McDonald’s, Phillips

- After close: Tilray

Tuesday

- Before the open: SoFi, Pfizer, PayPal, BP, P&G, Corning, Merck

- After close: AMD, Microsoft, Starbucks, Pinterest

Wednesday

- Before the open: Boeing, Kraft Heinz, Altria

- After close: Meta (Facebook), Qualcomm, Carvana, Lam Research, Western Digital

Thursday

- Before the open: Moderna, ConocoPhillips, Wayfair, SiriusXM

- After close: Amazon, Apple, Intel, Coinbase, DraftKings

Friday

- Before the open: ExxonMobil, Chevron, Frontier Communications

As if the above isn’t enough, the week ends with the US jobs report where the expectations is for US to add 177K jobs with the unemployment rate remaining at 4.1% and earnings expected at 0.3%. The preview employment releases will be a prelude to that report with the ADP released on Wednesday, the JOLTS on Tuesday.

The Reserve Bank of Australia meet on August 5 and 6. Important for that decision will be the CPI inflation data for Q2 2024 and June 2024. Both are due at 11.30 am Sydney time on Wednesday, July 31 (0130 GMT and 2130 US Eastern time on Tuesday).

Snippet preview points via Commonwealth Bank of Australia highlight the importance of the data for future policy action. :

- The Q1 24 CPI and recent monthly CPI indicator outcomes have been above expectations, and the RBA has sharpened language on the inflation outlook

- the prospect of a hike in August hinges on the RBA’s preferred measure of underlying inflation, the trimmed mean.

The Commonwealth Bank of Commerce sees 3 scenarios for the decision.

- Their forecast for next week is for trimmed mean inflation to increase by 0.9%/qtr and 3.9%/yr. They see that number would give the RBA enough breathing room to leave rates on hold, despite it being marginally above their implied forecast of 0.8%/qtr.

- If CPI in at 1.0%/ it would be in the “grey zone” where they could hold or could hike depending on the component details.

- Finally, a print of 1.1%/qtr or above would test the Board’s resolve and shift the balance of probabilities to an interest rate increase.

EU CPI (Wednesday), PMI data (Thursday), initial jobless claims (Thursday), Swiss CPI (Friday) will also be released.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$0.33 or -0.40% at $76.83. At this time Frida, the price was at $77.91.

- Gold is trading near unchanged at $2387.90. At this time Friday, the price was trading at $2373.

- Silver is trading up $0.10 or 0.35% at $28.01. At this time Friday, the price is trading at $27.73.

- Bitcoin trading higher at $69,435 after the bitcoin conference in Nashville. At this time Friday, the price was trading at $67,298

- Ethereum is trading higher as well as $3373.30. At this time Friday, the price was trading at $3246

In the premarket, the snapshot of the major indices ahead of the earnings tidal wave this week are trading higher.

- Dow Industrial Average futures are implying a gain of 160 points. On Friday, the Dow Industrial Average closed higher by 654.27 points or 1.64% at 40,589.35

- S&P futures are implying a gain of 21.90 points . On Friday, the S&P index closed higher by 59.86 points or 1.11% at 5459.09.

- Nasdaq futures are implying a gain of 110.59 points . On Friday, the index closed higher by 176.16 points or 1.03% at 17357.88

- On Friday, the Russell 2000 index rose by 37.08 points or 1.67% at 2260.06.

European stock indices are trading mostly higher. For the week the indices are also mixed:

- German DAX, + 0.23%

- France CAC, -0.44%

- UK FTSE 100, +0.86%

- Spain’s Ibex, +0.19%

- Italy’s FTSE MIB, +0.07% (delayed 10 minutes).

Shares in the Asian Pacific markets closed lower:.

- Japan’s Nikkei 225, +2.13%

- China’s Shanghai Composite Index, +0.03%

- Hong Kong’s Hang Seng index, +1.28%

- Australia S&P/ASX index, +0.86%.

Looking at the US debt market, yields are trading mixed:

- 2-year yield 4.3709%, -1.8 basis points. At this time Friday, the yield was at 4.434%

- 5-year yield 4.048%, -3.3 basis points. At this time Friday, the yield was at 4.132%

- 10-year yield 4.160%, -3.8 basis points. At this time Friday, the yield was at 4.240%

- 30-year yield 4.414%, -4.3 basis points. At this time Friday, the yield was at 4.41%.

Looking at the treasury yield curve, it has gotten more negative. The two – 30 year spread is back in negative territory after trading in positive territory for most of last week,

- The 2-10 year spread is at -21.2 basis points. At this time Friday, the spread was at -19.6 basis points.

- The 2-30 year spread is -2.1 basis points. At this time yesterday, the spread was +4.5 basis points.

In the European debt market, the benchmark 10-year yields are lower: