In a potentially highly politically charged move, the US. Democratic government orchestrated the transfer of 29,800 Bitcoin, valued at approximately $2 billion, to a newly created address on Monday. This development, first identified by the crypto intelligence platform Arkham, not only stunned the market but also sparked significant speculation and debate among the industry.

Arkham’s report detailed that this large sum of Bitcoin was split into two separate addresses: 10,000 BTC now residing in bc1qlap8 and 19,800 BTC in bc1qngy. Analysts at Arkham believe the 10,000 BTC represents a deposit to an institutional custody or service, signaling a potential preparation for sale.

These transactions occurred shortly after the former US President and current presidential candidate Donald Trump declared at the Bitcoin 2024 conference on Saturday that he intends to prevent the US government from selling its significant BTC holdings. Before yesterday’s move, the US government held over 213,000 BTC.

Trump promised to block any sales of the government’s BTC holdings, envisioning them as the cornerstone of a new “strategic national Bitcoin stockpile.” Simultaneously, advisors for Vice President Kamala Harris, also a Democratic presidential candidate, have been engaging with leading crypto companies to “reset” relationships. This outreach reportedly aimed to bridge gaps between the Democratic party and the Bitcoin and crypto sector, which recently emerged as a crucial supporter of Trump, Harris’s direct competitor in the presidential race.

However, the recent activity involving the sale of BTC tells a different story. This move indicates a possible shift in strategy, contrasting sharply with the outreach efforts. According to various experts from the Bitcoin and crypto industry, this development suggests a move to thwart Trump’s “stockpile” plans. Despite this sale, the US government still possesses 183,439 BTC, valued at approximately $12.6 billion—assets that could be further liquidated before Trump’s potential inauguration in January 2025 if he were to win the election.

Reactions From The Bitcoin Industry

David Bailey, CEO of Bitcoin Magazine and a advisor to the Trump campaign, was among the first to criticize the move, stating: “Just landed in Miami and see the Harris administration is preparing to dump 30,000 BTC just to spite DJT. Would be a massive political blunder for Dems. If they continue plundering America’s bitcoin they will permanently spurn a generation of voters.”

Eric Weiss, CEO of the Bitcoin Investment Group, echoed this sentiment, highlighting the political risk involved: “The Biden/Harris administration giving a master class on how to lose 30 million votes.”

Mike Novogratz, CEO of Galaxy Digital, criticized the decision’s timing and political sensitivity, especially following Trump’s public commitment to preserving the government’s holdings. “Tone deaf anyone??? Moving Silk Road BTC two days after Trumps pledge to not move them is just dumb!!!!” he commented.

Tyler Winklevoss, co-founder of the crypto exchange Gemini, pointed to the broader implications for the Biden-Harris administration’s relationship with the crypto industry. Winklevoss’s ironic remark underscored the tensions between the crypto industry and US dems: “On Saturday, Donald Trump pledged to never sell any of the U.S. government’s bitcoin. Two days later, the Biden-Harris Administration moves $2 billion of Silk Road bitcoin. Great look and great way to reset with our industry.”

Crypto analyst MacroScope (@MacroScope17) speculated on potential countermeasures from Trump, suggesting a political retaliation that could resonate with Bitcoin advocates and voters alike: “If the government now sells BTC after Trump’s pledge, watch for him to hit back hard by promising to instruct the Treasury to re-buy it (RFK/Lummis-type proposal) to restock US reserves.”

Peter Schiff, a known critic of Bitcoin, critiqued Trump’s original plan, noting: “If Trump really intended to use seized Bitcoin to start a U.S. ‘strategic’ reserve, he’d have kept his intention a secret until he was actually in office. Now that the Biden administration is wise to his plan, they’ll make sure to sell every Satoshi before Trump takes office.”

At press time, BTC traded at $66,656.

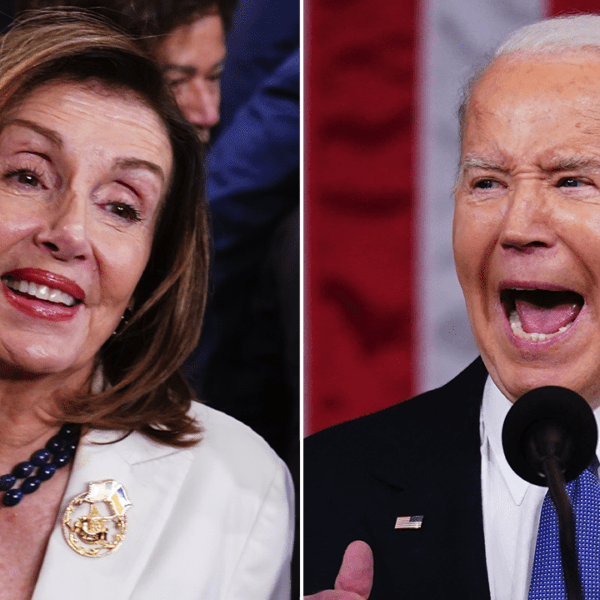

Featured image from TheDailyGuardian, chart from TradingView.com