The Bank of England in the City of London.

Mike Kemp | In Pictures | Getty Images

LONDON — Inflation in the U.K. may have come in directly on the Bank of England’s 2% target in the last two readings, but that still may not have given the central bank enough confidence to reduce interest rates this week.

Market pricing on Wednesday morning suggested a 60% probability of a rate cut at the BOE’s Aug. 1 meeting. That is far less conviction than traders had before the European Central Bank enacted its own rate cut at the start of June; while pricing for the U.S. Federal Reserve to cut for the first time in this cycle in September has hit 100%.

One reason for the uncertainty, and relative lack of strong signaling from the BOE, is that the members of its voting Monetary Policy Committee are divided.

The MPC described its decision to hold rates in June as “finely balanced,” with some members concerned by wage growth and the elevated rate of services inflation, and others more focused on the broader disinflationary trajectory.

In both May and June, seven MPC members voted to hold, as two voted to cut by 25 basis points. The BOE’s statement also spoke of division over the level of data required to support monetary easing.

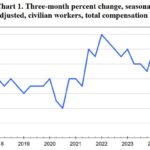

Headline U.K. inflation spiked higher than in the U.S. and euro zone over the last two years, but has also cooled more quickly.

However, price rises in the nation’s dominant services sector remained hot at 5.7% in June, higher than expected in BOE projections. Core inflation, excluding energy, food, alcohol and tobacco, held at 3.5%.

The BOE will also be weighing up the impacts of the recent uptick in U.K. economic growth and gains made by the British pound.

Another factor that has muddied the waters for those trying to guess its next move has been the six-week period from May 23 to July 4 in which the U.K. held a general election campaign, restricting central bank communications — including across its June 20 meting.

Since then, rate-setter Jonathan Haskel — considered one of the most hawkish MPC members — has said in a July 8 speech that shocks from the wage-price system continue to play out in the U.K. economy and that the labor market is “tight and impaired.”

“I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably,” Haskel said.

Case for a cut

Despite this caution, numerous economists and analysts believe the doves will win out on Thursday.

“We’re leaning towards a cut, though we agree nothing is for certain … We’ve heard very little from officials since the general election was called in June, and that means it’s tricky to gauge how they are interpreting the recent upside news on services inflation,” Dutch bank ING said in a Monday research note, adding that the BOE is generally more sparing with its forward guidance than the Fed or European Central Bank.

The vote will come down to the four or five middle-ground members who tend to move as a group, more likely swaying the decision toward a cut as policymakers focus on longer-term disinflationary trends than recent “noise,” James Smith, ING’s developed markets economist, said last week.

But the lack of certainty could lead to sharp market moves Thursday, while the start of the BOE’s easing cycle would “present a headwind to the resurgent pound,” according to Smith.

The August meeting “provides an ideal opportunity for the first rate reduction” because it will be accompanied by the quarterly Monetary Policy Report and a press conference, allowing the MPC to explain its decision in detail, Matthew Ryan, head of market strategy at financial services firm Ebury, said in emailed comments Tuesday.

“As this is not yet fully priced in, an immediate rate reduction would likely trigger some downside in the pound, albeit an upbeat set of communications, particularly a sizable upward revision to the GDP forecasts, could limit the extent of any sell-off,” Ryan added.