Fundamental

Overview

The USD has been rallying

steadily against most major currencies in the recent couple of weeks, although

the catalyst behind the move has been unclear. A good argument has been that

most of the moves we’ve been seeing were driven by deleveraging from

strengthening Yen.

Basically, the squeeze on

the carry trades impacted all the other markets. Given the magnitude of the

recent appreciation in the Yen and the correlation with many other markets, it

looks like this could have been the reason indeed. It will be interesting to

see how things evolve in the next days now that the BoJ decision is in the rear-view

mirror and if this correlation fades.

From the monetary policy

perspective, nothing has changed as the market continues to expect at least two

rate cuts by the end of the year and sees some chances of a back-to-back cut in

November. Today, we will also have the FOMC rate decision where the Fed is

expected to keep rates steady and signal a rate cut in September.

The data continues to

suggest that the US economy remains resilient with inflation slowly falling

back to target. Overall, this should continue to support the soft-landing

narrative and be positive for the general risk sentiment.

The GBP, on the other hand,

has been supported against the US Dollar in the past months mainly because of

the risk-on sentiment, although the recent events with the Yen boosted the US

Dollar against many major currencies.

On the monetary policy

front, the market is assigning a 60% probability of a rate cut from the BoE

tomorrow although the recent data was a disappointment for the central bank as

the UK CPI figures were unchanged from the prior month

and the labour market report showed wage growth remaining

at elevated levels.

GBPUSD

Technical Analysis – Daily Timeframe

GBPUSD Daily

On the daily chart, we can

see that GBPUSD dropped below the key 1.29 handle and extended the losses as

the sellers piled in with more conviction. The natural target should be the major

trendline around the 1.2780 level where we

can expect the buyers to step in with a defined risk below the trendline to

position for a rally into a new cycle high.

GBPUSD Technical

Analysis – 4 hour Timeframe

GBPUSD 4 hour

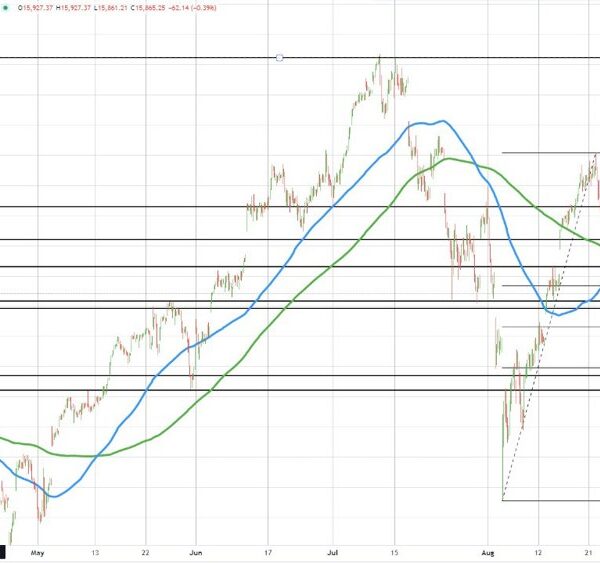

On the 4 hour chart, we can

see that we have a minor downward trendline defining the current bearish

momentum. The sellers will likely keep on leaning on it to position for further

downside, while the buyers will want to see the price breaking above the trendline

and the 1.29 handle to pile in for new highs.

GBPUSD Technical

Analysis – 1 hour Timeframe

GBPUSD 1 hour

On the 1 hour chart, we can

see more clearly the recent price action with the trendline acting as

resistance. A breakout to the upside should give the buyers more confidence for

a rally into new highs, but a break above the 1.29 level would give much more

conviction. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US ADP, the US Employment Cost Index and the FOMC Policy

Decision. Tomorrow, we have the BoE Policy Decision, the latest US Jobless Claims figures and the US ISM

Manufacturing PMI. Finally, on Friday, we conclude the week with the US NFP

report.