Galeanu Mihai/iStock via Getty Images

How Are the Markets Doing?

Now that the first half of 2024 is over, let’s look at how the performances differ from country to country, from sector to sector, and from large companies to small ones and try to make sense of it all. In USD, price terms:

- The S&P 500 (SP500, SPX) gained 15.3%.

- The MSCI All Country Index is up 11.6%. However, excluding the US from the Index, the rest of the world gained only 6.04%.

- The Canadian market (SPTSX Index) gained a paltry 2.4%.

- If we were to give every stock in the index the same weight, the Equal Weight S&P 500 would have gained only 5.1%.

While it may feel like we all have decent returns in the first six months of the year, unless you own the whole market through the S&P 500 or overweight the top 10 biggest companies in the index, it would be impossible to outperform the S&P 500. The average return of the magnificent 7 (Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta (Facebook) and Tesla) was 38.65%, and they accounted for 70% of the S&P 500 return year-to-date.

Meanwhile, since risk control is the first tenet of our investment philosophy, we’d rather have a more balanced and diversified portfolio of profitable companies. We know it is painful to watch Nvidia (NVDA) go up 150% and not own it. Patience and discipline are virtues in the investment business because, as John Maynard Keynes is reputed to have said many decades ago, “The market can stay irrational a lot longer than you can stay solvent.” Our long-term clients certainly remember several irrational periods, such as The Internet Bubble, the pre-Great Financial Crisis, the Cannabis Run, the EV manufacturers, etc., and the Artificial Intelligence (‘AI’) driven market will not be the exception. But when will rationality be back? We certainly don’t know. However, we’d instead follow Buffett’s advice: “We applaud the endeavour but would rather skip the ride.”

Is the Canadian Market that bad?

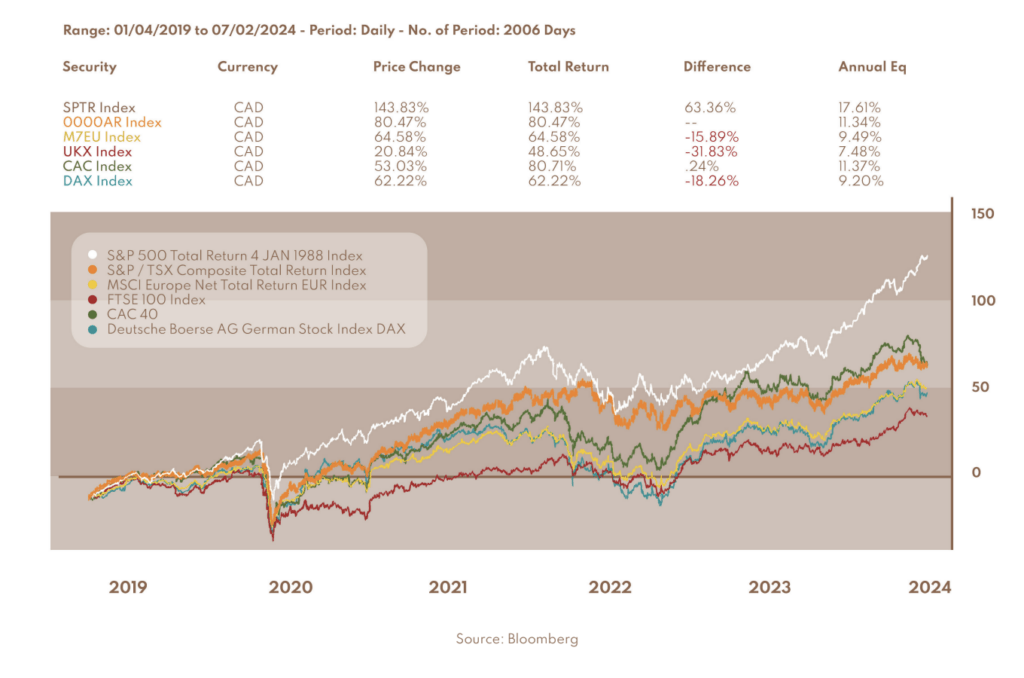

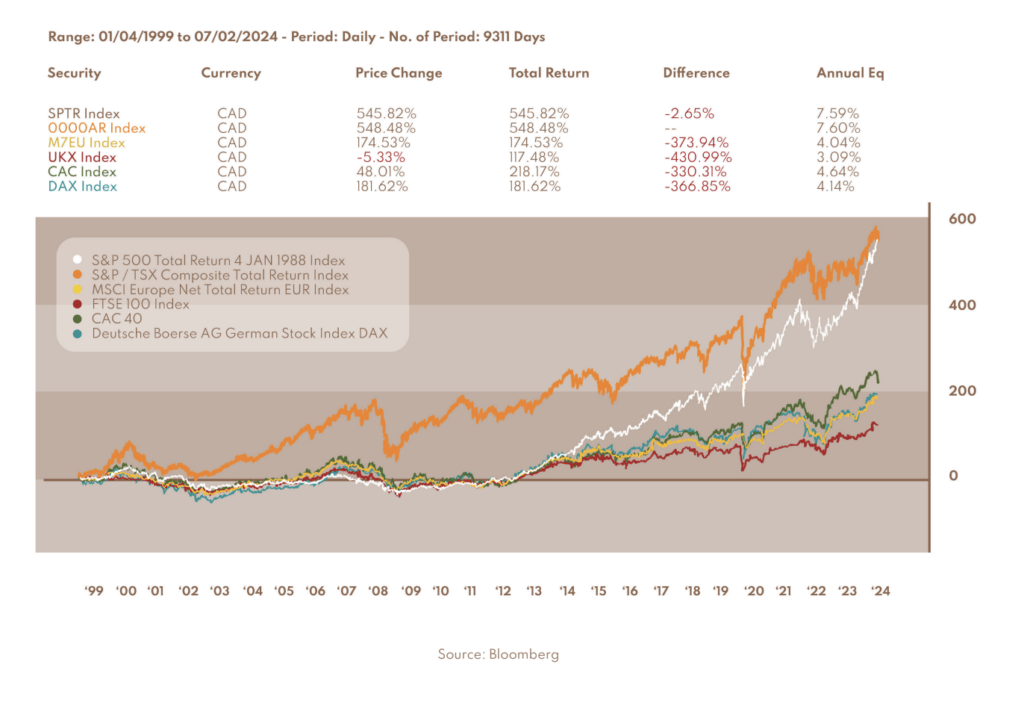

We recently came across multiple articles regarding the underperformance of the Canadian Stock Market, citing reasons such as the economic performance, its weak currency, its index being wrongly made up, too many multi-voting shares, Canadian companies being too small, etc. Except for the US, as the graph below shows, we think it did not perform so badly in the last five years, especially relative to other developed markets such as the UK, France, Germany and Europe overall.

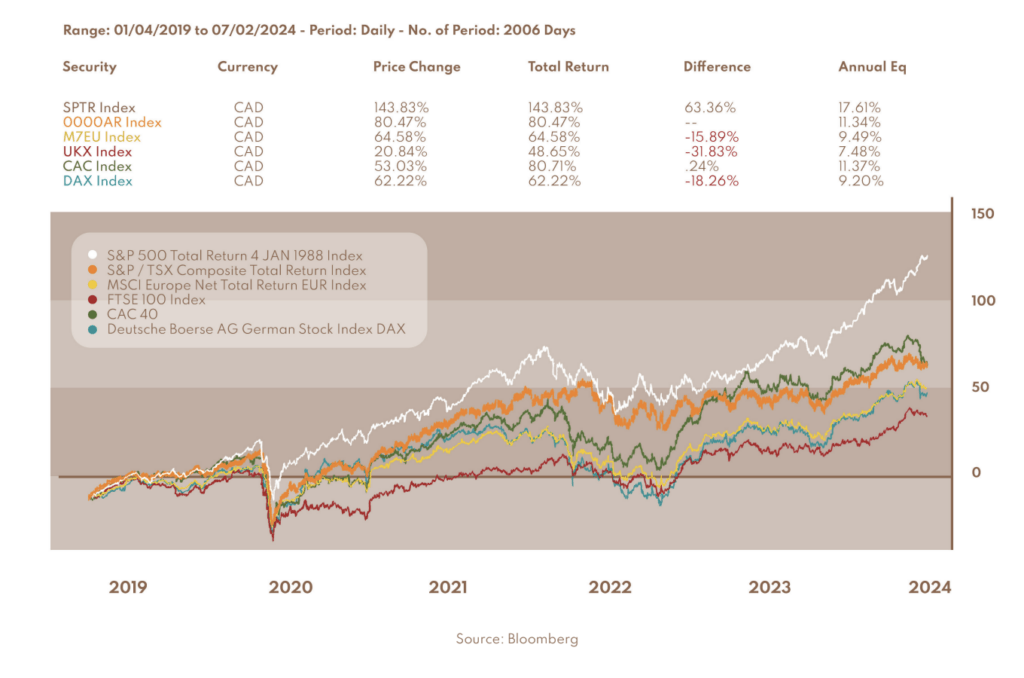

Moreover, if you look at Canada from a longer-term perspective, let’s say, the last 25 years, as the graph below shows, it has been actually darn good, matching the US.

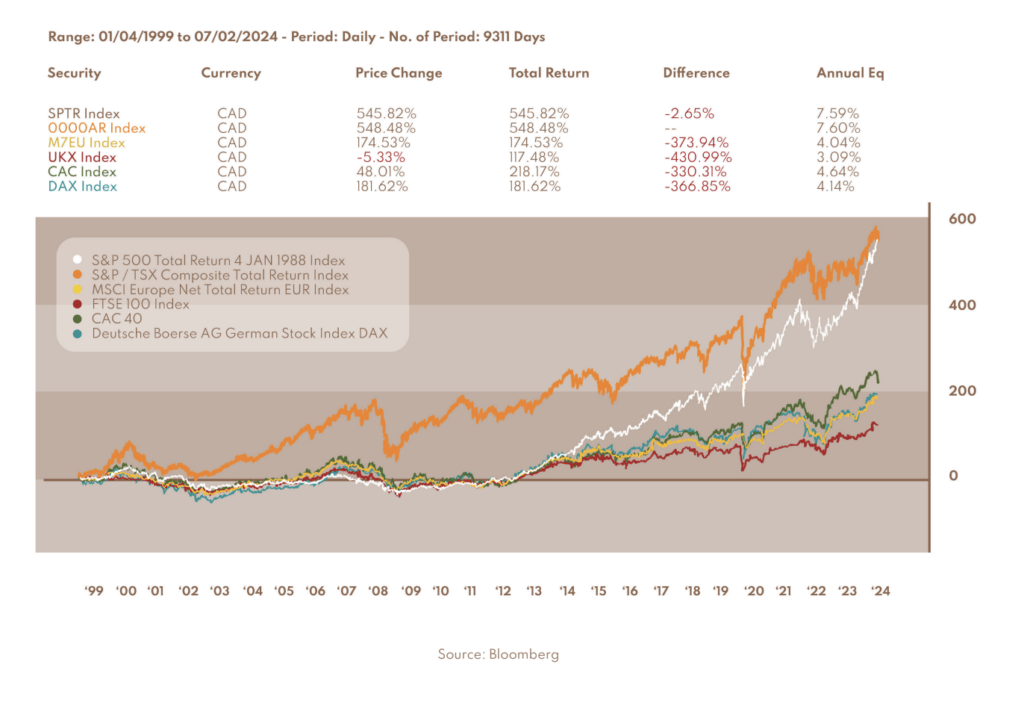

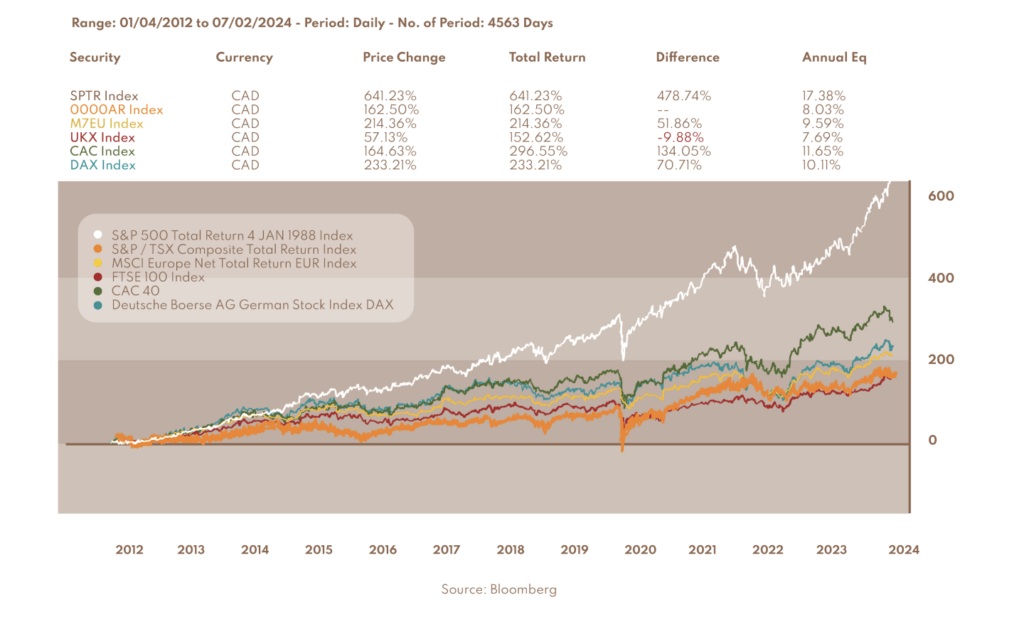

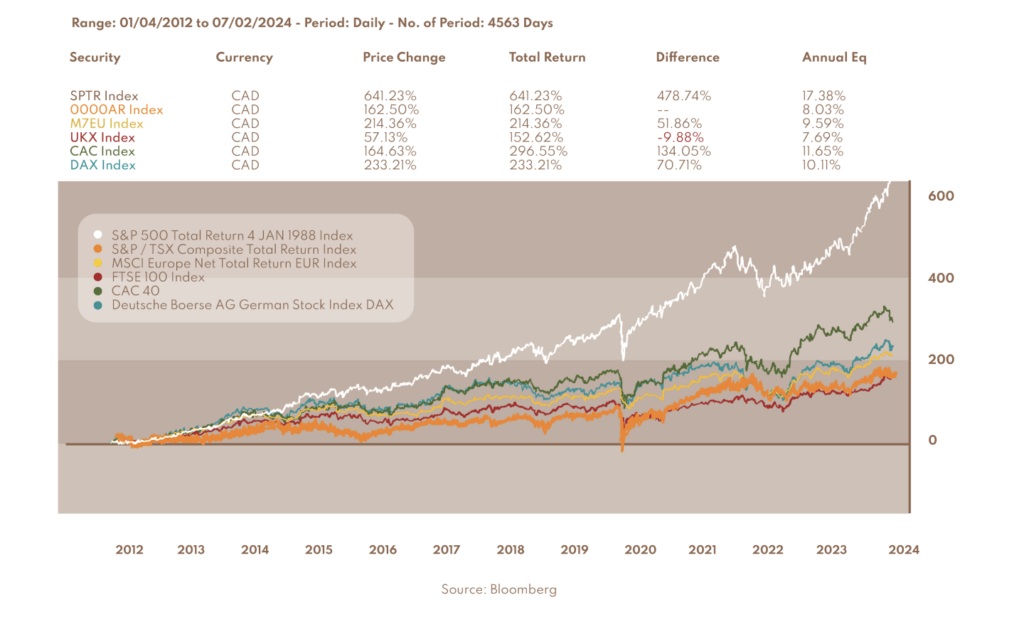

The reality is that you can always find a period when the numbers show that Canada is trailing behind, for example, from 2012 until today, as shown below.

Investors tend to view the stock market as a big block that ebbs and flows with the economic cycle. Forecasting its direction is a very profitable business, primarily for forecasters. We would rather see it as a market of stocks, big and small companies that operate in the economy with different levels of profitability. Our job is to find the consistently profitable ones and try to acquire them at a reasonable price.

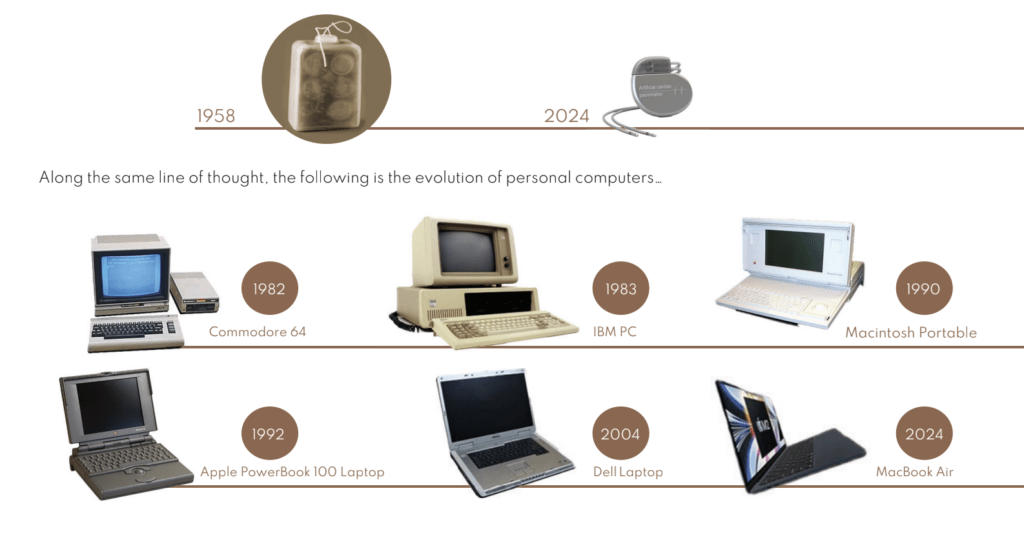

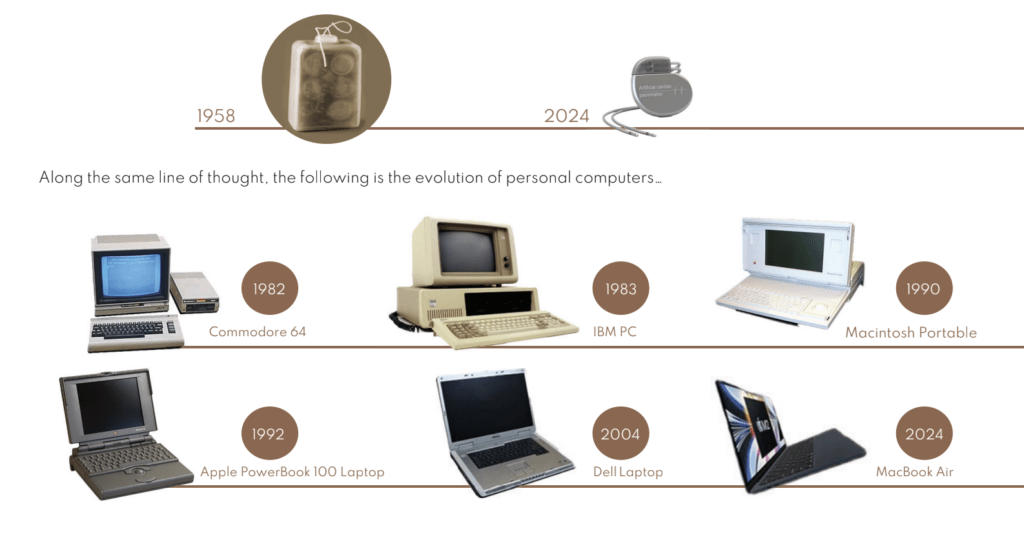

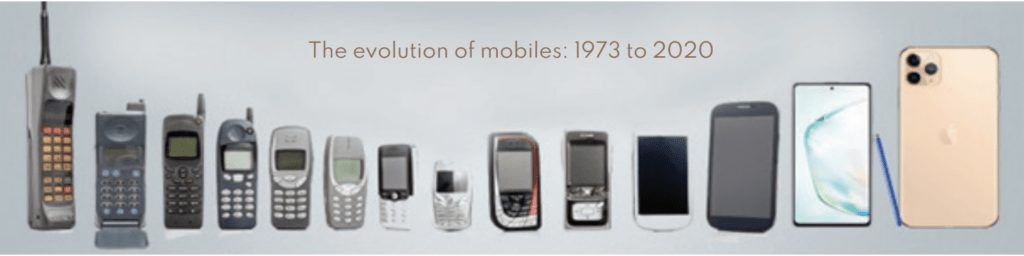

Recently, a good friend of mine had open heart surgery and needed a pacemaker. So, I got interested in the evolution of the pacemakers through time. Little did I know the first pacemaker was implanted in a person in 1958. This early device didn’t last very long, but the patient lived to age 88 and had 26 pacemakers in his lifetime. It was the size of a pack of cigarettes (see picture below), and my grandmother-in-law was the second person in Quebec to receive one in the early 60s, and she lived to be 87 years old.

Now, look at a 2024 pacemaker: it is the size and the thickness of the face of a wristwatch. It is implanted on the top part of the patient’s chest, and the batteries generally need replacement after 5 to 10 years, along with the entire unit.

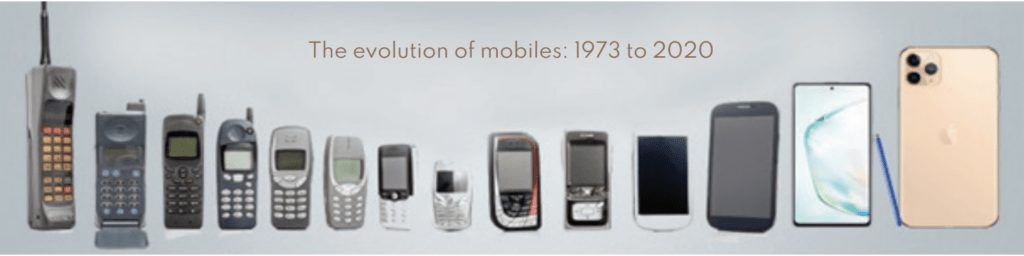

…and cellphones, although the picture doesn’t tell the whole story. The one on the left weighed about 5 lb and often got terrible reception; the one on the right fits in your pocket and is, in fact, a computer on which you can run your house, car, banking, and often your job.

The moral of the story is:

- Technology and science are the main drivers of economic progress.

- Economic systems that encourage research and development produce the highest productivity over time.

- Trust technology, trust science. Do not trust economists and certainly do not trust politically driven economic policies.

In that regard, there seems to be a change in leadership and economic policy taking place in many countries around the globe. Hopefully, we will get some strong leadership where the constituents can feel confident in the representation they have chosen. Either way, it should be an interesting second half in 2024.

Hopefully, there will be a more focused emphasis on “succession”, which we do focus on here at Claret, and also on how the elected elite will actually carry out all the promises for which they have been chosen – which always take longer to realize than planned. Leadership requires more than just an intense focus on the here and now, it requires the long view for success – exactly as it does in investments.

We wish you all a wonderful, warm, and fun summer.

Alain Chung, CFA,

Chairman and CIO, on behalf of the Claret team

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.