Fokusiert/iStock via Getty Images

Ani Pharmaceuticals (NASDAQ:ANIP) had not provided any details on their three 505(b)(2) NDA submissions currently being reviewed by the FDA. Therefore, analysts have excluded their revenue potential in assessing ANIP’s growth outlook. On ANIP has yet to announce that on July 29, 2024 the FDA approved Tezruly as the first oral solution of terazosin. Tezruly’s related patent expires February 1, 2041. Based on ANIP’s SEC filings, patent applications and clinical trial information and FDA database search, I believe the FDA is currently reviewing applications for the following two drugs, all of which could have global sales implications, as the first of their kind:

- The first testosterone drug designed for use by women – filed in Q3 2024. Undisclosed partner paid the $3.2 million NDA submission fee. (Potential patent protection until March 14, 2037)

- Oral liquid form of hydrochlorothiazide – filed in Q1 2024 (Patent expires December 9, 2041)

The combined peak sales in the US for the Tezruly and hydrochlorothiazide drugs could exceed $500 million. While the first testosterone drug approved for use by women could generate $290 million in royalties, a copromotion deal with a large pharmaceutical company could prove even more lucrative. This does not include any potential international revenue. When combined with revenue from the pending Alimera Sciences acquisition, ANIP could be looking at $1.41 billion in sales and $290 million in royalties by 2028. This is in addition to potential royalties of 5% of global sales of CG Oncology’s cretostimogene grenadenorepvec, which could launch in 2026, assuming they win their litigation, and it gets approved by the FDA. The following will provide information on these drugs and show why I believe ANIP is currently undervalued and a strong buy.

505(b)(2) NDA Submissions

In ANIP’s Q3 2023 earnings release, they disclosed that they submitted two 505(b)(2) NDAs with the FDA, which barely got noticed by the investment community. Interestingly, only one of the two filing fees was paid for by ANIP. It appears that another company paid one of the NDA submission fees. In ANIP’s Q1 2024 10-Q filing they disclosed that they had submitted a third 505(b)(2) NDA with the FDA. This was not included in the related press release. ANIP has not given any additional information regarding these three drugs applications.

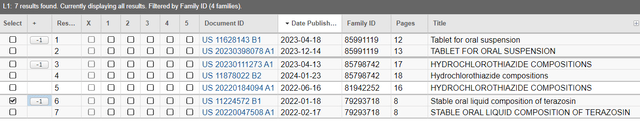

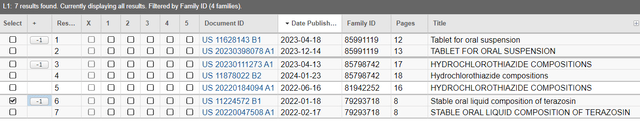

In ANI Pharmaceuticals Is Undervalued When Considering Their Unadvertised Pipeline, I identified several drug projects ANIP was working on, including those obtained through acquiring Novitium Pharmaceuticals in November 2021. ANIP touted that they acquired a strong R&D team and three 505(b)(2) NDA projects under development. A Public Patent Search of Novitium list the following patent applications and patents in Novitium Pharma’s portfolio, which are likely related to the NDAs ANIP submitted.

Novitium Pharma’s Patent Portfolio (USPTO)

Tezruly would be the First Approved Oral Solution Alpha-1 Blocker in the World

Terazosin is currently only available in capsule form and is used to treat high blood pressure (hypertension) and benign prostatic hyperplasia (BPH). It is likely the subject of one of these NDA submissions. As I understand it, globally, there are no approved oral liquid forms of an alpha-1 blocker. This creates a great opportunity for ANIP in treating patients with dysphagia or in a hospital setting. Since the patent titled “Stable Oral Liquid Composition of Terazosin” was the first patent issued to Novitium, it is likely one of the NDA’s submitted in Q3 2023 and could receive approval this quarter. According to the patent, the discovery addresses the need for an oral solution and IV administration capabilities of an alpha-1 blocker.

In Ani Pharmaceuticals is Undervalued When Considering Their Unadvertised Pipeline, I estimated that an Tezruly could arguably generate peak sales of between $166 million and $250 million. This assumed that it would sell for between $100 and $150 per prescription, while capturing 5% of the alpha-1 blocker market in the US. Filling the unmet international need, a liquid alpha-1 blocker could further increase revenue.

Since terazosin is an established and regularly prescribed drug, peak sales could be reached within two years. An additional $250 million in revenue from Tezruly represents a 40.73% increase over the average revenue estimates for 2026 of $613.80 million, currently listed in Seeking Alpha. An FDA approval should put upward pressure on PPS.

NDA for First Female testosterone drug likely has a larger pharma partner.

In Q3 2023 earnings release, ANIP announced they submitted two 505(b)(2) NDAs. However, according to the related 10-Q filing, ANIP only paid the fee for one of the filings. Having extensively reviewed ANIP’s SEC filings, patent applications and clinical trial information, it looks like the NDA paid for by a partner is for the first testosterone drug designed for women (Libigel) to treat hypoactive sexual desire disorder (HSDD). It could be approved in this quarter. AN NDA is supported by the fact that a certification request to delay submitting trial results was submitted for ANIP’s (Biosante Pharmaceuticals) long-term safety/efficacy testosterone trial. Mid-trial results discovered that restoring testosterone levels to premenopausal levels, in postmenopausal women at a higher risk of experiencing a cardiovascular (CV) event, reduced their risk of experiencing a CV event by at least 70% and reduced the risk of having a breast cancer event by an undisclosed amount. Over the last couple of years, ANIP has been reluctant to update investors on the status of their testosterone drug, possibly bound by an agreement with the company who appears to have paid the $3.2 million NDA submission fee. This may be about to change. The results were due to be posted by October 27, 2023, and remains outstanding. If this is the drug, the partner could be AbbVie (ABBV), as Michael C. Snabes, AbbVie’s Senior Medical Director of Global Clinical Research and Development was the Study Director for all Libigel trials.

If AbbVie is financing this NDA, they likely have collected 10 years of safety and efficacy data from the 3,656 participants. In addition, AbbVie could supply Intrinsa related information, acquired in their merger with Allergen, to support an NDA. The FDA panel rejected testosterone patch for women on safety grounds, as they required additional long term safety data prior to approving it. It is unknown what indications were included in NDA, as secondary efficacy outcomes were not listed for the trial in the Clinical trial.gov site.

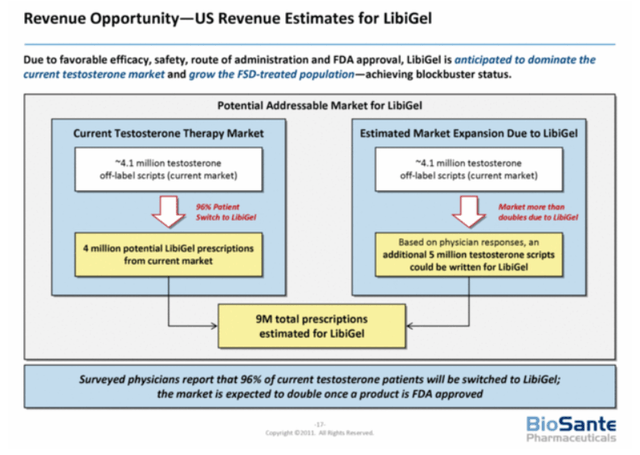

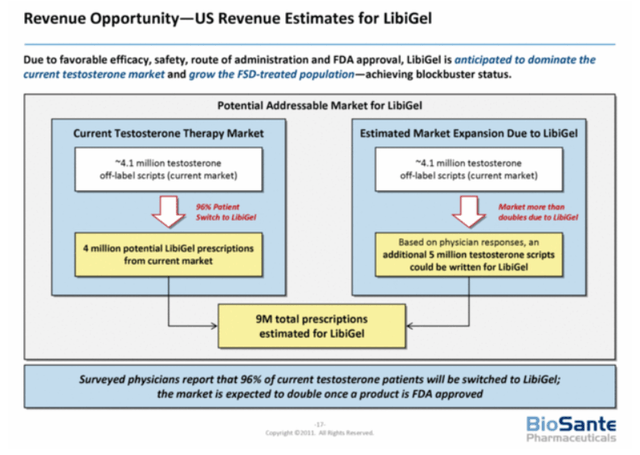

In ANI Pharmaceuticals Is Undervalued, As Royalty Potential Is Overlooked, I describe how the first FDA approved female testosterone drug could generate $290 million in royalties for ANIP. In 2011, Biosante Pharmaceuticals estimated between four and nine million prescriptions being issued annually. With no competition and a price of $500 per prescription, it arguably could generate $4.5 billion in sales in treating HSDD.

LibiGel Revenue Opportunity (Ani Pharmaceuticals )

However, guidelines now recommend ruling out other treatments options for HSDD before prescribing testosterone. Therefore, the total prescriptions in treating HSDD will likely be lower. Guidelines may be updated once ANIP’s results are released, potentially alleviating some concerns in prescribing the drug. The reduction could also be offset by additional indications. At the very least, an approved form of testosterone for women would generate more studies, including but not limited to areas of breast cancer, cardiovascular disease, cognitive function and osteoporosis. Until ANIP announces the details of the partnership, it will be difficult to assess how much additional revenue this could generate. I estimated that the drug could generate royalties of $290 million per year, with potential increases for additional indications and international sales. However, a co-promotion and co-development deal would drive ANIP’s revenues significantly higher.

On September 02, 2019, the first “Global Consensus Position Statement (Position Statement) on the use of Testosterone to Treat Hypoactive Sexual Desire Disorder (HSDD)” was released. The Position Statement provides the first expert global agreement about how testosterone should be measured in women and how it should be therapeutically prescribed. The Position Statement found that though no established indications for testosterone therapy for women existed, clinicians have been treating women with testosterone for decades, uncertain of the benefits and the risks. In most countries, including the United States, testosterone therapy is prescribed off-label male testosterone or compounded therapies. They also found that further investigation is warranted with respect to an individual’s well-being, musculoskeletal and cognitive health and long-term safety. They only recommend transdermal or cream applications of testosterone. Note: Since the Position Statement was issued Australia has approved Lawley Pharmaceuticals’ Androfeme 1. However, they lack the long-term safety data required by the FDA and many other drug approving authorities.

Testosterone Related Patent Suspicious Activities.

Shortly after the Position Statement was issued two patents, which would benefit the most from the global consensus on using testosterone to treat HSDD, expired for non-payment of the $500 maintenance fee. A time when these patents would have gained in value. It leads me to believe they were acquired by ANIP’s partner in preparation for the NDA submission. The patents in question include:

- Antares Pharmaceuticals, now Halozyme Therapeutics’ (HALO) Methods and Apparatus for Transdermal or Transmucosal Application of Testosterone patent, which claims to provide a method for treating HSDD or female sexual dysfunction. This patent has an adjusted expiration date of December 30, 2028, which could be extended to December 30, 2033 with an FDA patent term extension. NOTE: Biosante Pharmaceuticals developed Libigel under a licencing agreement with Antares Pharmaceuticals, yet on 2020-01-06, four months after the Position Statement was issued, Antares Pharmaceuticals let the patent expire for nonpayment of maintenance fees.

- Noven Pharmaceuticals’ transdermal patch technology was originally used for Intrinsa by Watson Pharmaceuticals, who licenced from Proctor & Gamble. Watson later became known as Warner Chilcott, an AbbVie subsidiary through their merger with Allergan PLC. Oddly, on April 26, 2020, a little over seven months after the Position Statement was issued, Noven Pharmaceuticals’ patent titled “Transdermal Testosterone Device and Delivery” was allowed to expire for non-payment of the $500 maintenance fee. This patent was a for a 50% smaller version of the Intrinsa patch, previously marketed by Warner Chilcott in the UK. Warner Chilcott conducted a clinical trial titled Bioequivalence of Testosterone Reduced-size Patch Relative to the Testosterone Reference Patch which was used to support the patent application. The patent was set to expire March 14, 2032. If this patch is the subject of was an NDA, an FDA patent term extension, could give patent protection up to March 14, 2037. NOTE: Noven Pharmaceuticals has let patents expire in the past for drugs which were later announced as being sold.

Analyst forecast ANIP’s average EPS to be $7.03 in 2028. Since this would be the first testosterone drug for women, it would generate revenue quickly by switching over existing off-label male testosterone and compounded testosterone. However, peak sales for treatment of HSDD may take between 3 to 5 years. The $290 million in royalties from US sales alone could be reached by 2028. Using a corporate tax rate of 21%, the royalties could add approximately $11.80 (less dilution) to ANIP’s EPS. This is a 168% increase over current EPS estimates and should put upward pressure on PPS.

Q1 NDA Likely for the First FDA Approved Hydrochlorothiazide Oral Liquid.

According to Mayo Clinic, hydrochlorothiazide is a thiazide diuretic used to treat hypertension and edema and is only available in capsule and tablet form. Oral liquid form of the drug is currently only available through compounding pharmacies. Approval of this drug addresses the unmet need for patients having difficulty ingesting and swallowing solid oral dosage forms such as tablets and capsules, particularly pediatrics and geriatrics, as well as hospitalized patients that may require a feeding tube. According to Lifetime Risk of Hypertension, hypertension increases with advancing age to the point where more than half of people 60–69 years of age and approximately 75% of those 70 years of age and older are affected.

According to ClinCalc data, in 2021, hydrochlorothiazide was the US 12th best selling drug with 39,038,822 prescriptions being filled. According to Drugs.com – Prescription Drug Information hydrochlorothiazide capsules currently sell for between $12.81 and $13.12 per 30 capsule prescription. The only oral liquid form of the drug should capture at least 5% of this market. Assuming prescriptions are priced around $130, ANIP could be looking at revenues for the drug exceeding $250 million. An additional $250 million in revenue from oral liquid hydrochlorothiazide represents a 38.54% increase over the average revenue estimates for 2027 of $648.59 million, currently listed in Seeking Alpha. An FDA approval should put upward pressure on PPS.

ANIP Total Revenue Potential

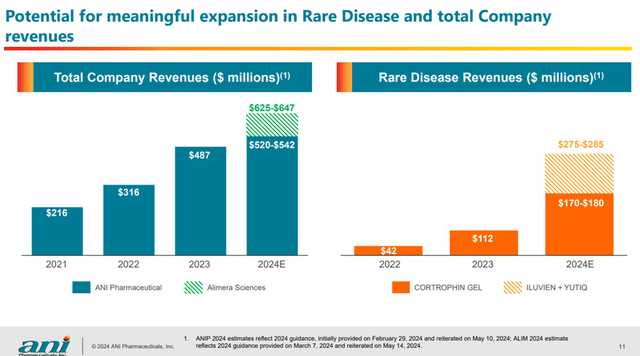

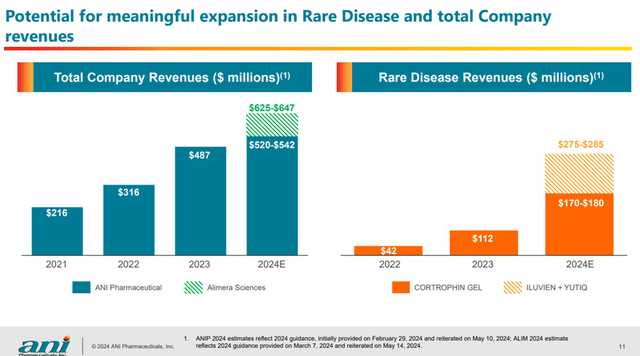

According to ANIP’s presentation Acquisition of Alimera Sciences, Inc. ANIP is guiding between $625 and $647 million in revenue (pro-forma) for 2024, once the acquisition of Alimera Sciences completed in Q3. ANIP anticipate significant growth from the deal, moving forward. According to Seeking Alpha, in 2028, analyst estimate ANIP generating $682.67 million in revenue and Alimera Sciences generating $229.45 million in revenue for a total of $912.12 million.

Combined Revenue after Alimera Sciences Acquisition (Ani Pharmaceuticals)

Risk

The following risks must be considered when assessing ANIP’s value. The drugs related to the NDAs under review by the FDA have not been announced by ANIP and may relate to other drugs with lower sales potential. ANIP may not get FDA approval on one or more of these drugs. Though according to Lachman Consultants 84% of New Drug Therapy were approved by the FDA in the first cycle review, making it highly likely that the drugs will be approved especially as they all address unmet needs. Other oral liquid alpha-1 blockers may eventually be approved, potentially reducing ANIP’s market share.

Conclusion:

ANIP has the potential to grow revenue and EPS significantly above current analyst estimates. ANIP only has 20.96 million shares outstanding and only 33.33 million authorized shares (very low for a pharmaceutical company) of which 6.51 million shares have been issued to the employee stock incentive program. Tezruly, the first liquid form of an alpha 1 blocker, the first oral liquid hydrochlorothiazide and the first female testosterone drug, if approved, each should independently drive PPS upward, two of which could occur this quarter. Assuming these three NDAs get approved, ANIP should see a rapid acceleration in PPS. All three drugs address unmet needs and face no competition, which gives them a competitive advantage in establishing market share. Once the undisclosed partner is announced regarding the testosterone drug for women, it should draw investors to ANIP further pushing up PPS. Tezruly sales could drive revenue up by an addition 40.73% over current analyst estimates by 2026. Female testosterone could increase ANIP’s EPS by $11.68 (less dilution) by 2028. Hydrochlorothiazide could increase revenue 38.54% by 2027. Combined with the addition of Alimera Sciences, ANIP could grow revenues from $517.5 million (TTM) to $1.41 billion in sales and $290 million in royalties by 2028. An additional $125 in annual royalties could be added from cretostimogene grenadenorepvec sales by 2031. This far exceed current analyst estimates, making ANIP undervalued strong buy.