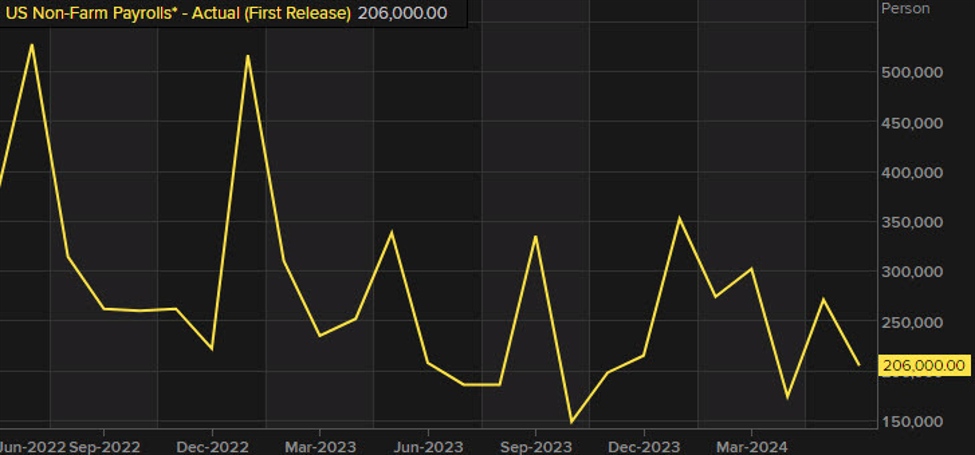

- Prior was +206 (revised to +179K)

Details of the July 2024 jobs report:

- Two-month net revision -29K vs -111K prior

- Unemployment rate 4.3% vs 4.1% expected

- Prior unemployment rate 4.1%

- Participation rate 62.7% vs 62.6% prior

- U6 underemployment rate 7.8% vs 7.4% prior

- Average hourly earnings +0.2% m/m vs +0.3% expected

- Prior avg hourly earnings +0.3% m/m

- Average hourly earnings +3.6% y/y vs +3.7% expected

- Average weekly hours 34.2 vs 34.3 expected

- Change in private payrolls +97K vs +148K expected

- Change in manufacturing payrolls +1K vs -1K expected

- Household survey +67K vs +116K prior

- Government jobs +17K vs +70K prior

- Full time +448K vs -28K prior

- Part time -325K vs +50K prior

Fed pricing was for 32 bps at the September meeting and 89 bps at year end ahead of the report. US 2-year yields were trading at 4.11% and USD/JPY was trading at 149.00.

There have been some huge moves on the back of this report, particularly in USD/JPY, which has plunged to 147.39. US 2-year yields fell to 3.91%. In terms of Fed pricing, we’re up to 42 bps for September, implying a 70% chance of 50 basis points. FOr year end, pricing is at 109 bps.