Andrii Baidak/iStock Editorial via Getty Images

Dear readers/followers,

It’s been over two years since I initiated a positive “BUY” stance and bought shares in Deutsche Post AG (OTCPK:DHLGY). Logistics companies are tricky investments because they tend to be very cost-heavy correlated businesses, with a lot of input exposure. What I mean by this is that the companies in this sector can see immense increases in cost from something like an increase in fuel, servicing costs, insurance costs, vehicle costs, and the like. Add to this the fact that we’re in an ESG transition and people moving to EVs, and logistics businesses are probably some of the more volatile industries that we can look at, perhaps aside from specialty chemicals and the like.

There have been times during the past 5 years when Deutsche Post has been excessively overvalued. There have also been times when it has been attractive. It all depends on how you calculate and discount for certain factors and challenges. For something like DHL (which is Deutsche Post), how its express segment moves is of great importance here.

Since my last article, my investment In DHL has seen positive returns in excess of 30%, which is below market in 2 years. However, it’s still a positive return, and I’m not fazed here in terms of investing more. I, in fact, believe the company is “worth” more and would “BUY” more of the business.

In this article, I mean to show you the reason.

Deutsche Post – updated for 2024 and an upside into 2026

So, first off, I am maintaining my “BUY” rating for the stock here. It’s almost 2 years ago that I posted my last piece, a piece that you can find here.

While we’ll mention the native ticker, the ticker here is DHLGY, which is the ADR I would go for If I invested in ADRs, instead of the native German DHL ticker.

This company is one of the largest delivery and logistical companies on the planet, with a still-massive division in legacy posts and letters, and the division that you probably know better, is DHL. Up until a few years ago, it was its own subsidiary, now it’s part of Deutsche Post, and has representation all over the world. The history of this company is relatively short – it’s a privatization of the previously nationalized Bundespost of Germany – which means that as the name suggests, it’s a German logistics and supply chain conglomerate. But it has also expanded into new areas.

2Q24 is the latest quarter we have as I am writing here. The previous quarter, 1Q24 was an “easy” quarter because as a period, it was in line with expectations pretty much at a perfect rate. Like most businesses in this segment, DHL’s overarching current focus is on controlling costs, but 1Q24 also saw the company reaffirm guidance, but continued expectations of stability, not massive growth.

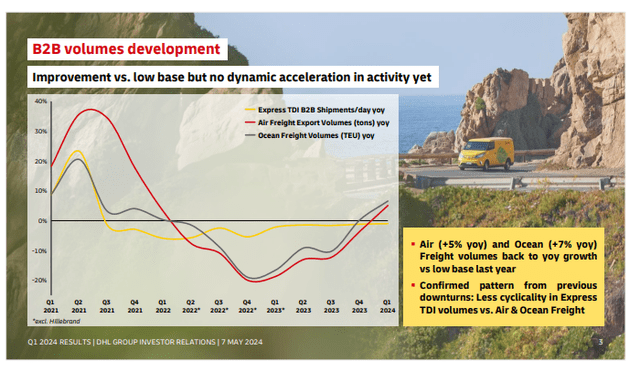

The good levels of earnings for the previous quarter allowed the company to continue to invest, not to drive things significantly higher because investment CapEx is still a major thing here. However, B2B volumes recovered for the period and are continuing to recover.

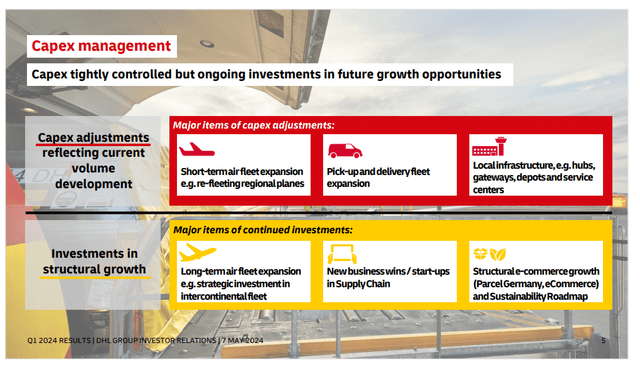

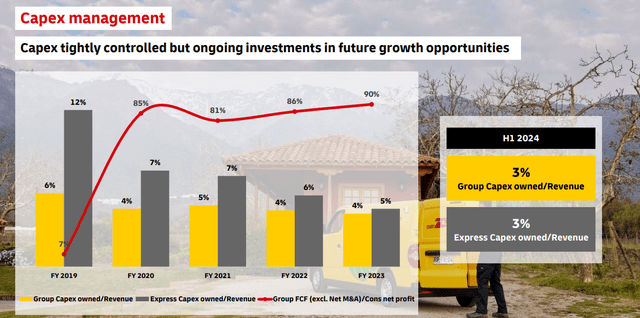

The short-term management plan of cost control continues to be executed. Successful results for the last quarter before 2Q24 include a reduction in overtime and third-party labor/consulting, and productivity is up. In short, personnel at DHL are likely very aware of these savings. Also, flex in airline express capacity has resulted in air fleet reduction, which in total has had a >100 bps reduction in indirect costs for the group. DHL is also seeing the normalization pressure in EBIT.

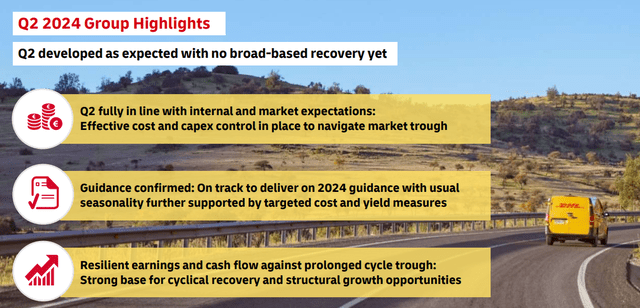

I also fully expected this to continue into 2Q, which looking at results that were out recently is something that materialized. The company’s results are up slightly in revenues/top line but continued to see declines in line with expectations in EBIT and FCF. Full-year guidance for the year was confirmed, however.

“In-line” was the best that could be expected here. Volume improvements were showing some signs here as well, but any sort of widespread acceleration is not within the current expectations of the market. However, Express B2B was up again and is now showing growth.

The point that would make DHL attractive as an investment for me here is if the company is exceeding its pre-COVID levels. As to that question, the answer is that yes, the company is indeed exceeding its pre-pandemic levels. There’s some inflation in that, of course, but to me, without a doubt, the next few years will see growth that will mean solid rates of return for investors that manage to buy the company at a cheap level. The company also continues to have very tight reins on its spending.

DHL Express and DHL remain well-positioned overall in the global market, especially in the parcel markets in Europe and NA. Together with its air fleet and ocean fleet, the company is in a good position to see benefits from increased automation. Together with other IT measures, it’s likely we’ll see further efficiency improvements which will add to the bottom line here. This is to be seen in context next to reduced demand for logistical services (seen above), as package demand dipped significantly following COVID-19.

What we’re looking for here, as with many other businesses, is a normalized level of valuation in the context of where things are now, and are likely to go.

Let’s look at that valuation.

DHL Valuation – There is plenty of upside in the case of even a slight reversal, I am positive here

Valuation in this sector, which includes peers (depending on what you look at), like FedEx Corporation (FDX), and United Parcel Service, Inc. (UPS), specifies a situation where this company is very cheap in terms of sales multiples and book multiples (a lot cheaper than the two mentioned here), while also yielding more than both.

That’s a very good situation for an investment. DHL’s earnings per share cratered by 30% in 2023 due to normalization. They are not, by 2024E, expected to recover to any major degree this year. Instead, that normalization estimate comes at around 2025E, with current forecasts expecting an EPS rising around 20% on an adjusted basis. In the case of such a development, or in fact, even in the case of a flat development, the company is being traded at significantly less than I consider it worth here.

An upside for either ADR or native here, even to a relatively conservative 5-year average of 14.7x, implies an upside of 17.7% here, inclusive of the yield of 4.51%, which given the latest confirmation from the company AGM, I consider both well-covered and potentially increasing not in 2024 (flat results), but 2025-2026E.

DHL also has very conservative leverage, below 41% long-term debt/cap, and goes In the current traditions of companies worldwide trying to reduce debt (a very positive trend).

The ADR DHLGY trades at $44.4/share at the time of writing and is actually quite an easy one to handle because it’s a 1x ORD ADR. That means that one native share of DHL equals one share of DHLGY, and you can use straight currency conversion to get the PT. My current PT for DHLGY is a conservatively adjusted and 20% discounted 2025-2026E 15x P/E, coming to around $55/share, which implies an upside, and not a small one. For a 2025-2026E upside to current forecasts, DHLGY is estimated to return between 17-20% annualized – inclusive of the DHLGY yield of 4.5% at a rate of just south of $2/share.

DHLGY also holds a valuation grade of A- from Seeking Alpha, which underscores the significant premium available next to peers here. In short, DHLGY is “lagging” the sector and sector averages. DHL has no profitability issues aside from a currently lagging gross margin, otherwise, its OCF and return KPIs are top-notch. There is, to my mind, little reason for the company to be lagging its current realistic and conservative estimates in the way that it currently does.

For all of these reasons, I consider the likely upside for DHL here to be significant enough for an investment. I will be buying shares in DHL again, and I will add more going forward as well if the company continues to show undervaluation.

Risks to the thesis

Any thesis and “Buy” has risks, and DHL is no different. Because of DHL’s large exposure to packages and the like, I would view the primary risk to a positive thesis as a continued low level of package volume. Due to in part increasing geopolitical tensions, it’s hard to say exactly at what level this will normalize. The EU and several EU nations have introduced punitive fees and tolls on import packages, which is pressuring volumes here. B2B is seeing similar muted trends. Continued muted industrial, and consumer demand likely means a muted 2024E.

Furthermore, we have a German company with many employees. Like any German company I write about, DHL has a lot of Union exposure, and therefore wage exposure. The price and PT are discounted for that, but it could get worse.

Some tech-savvy investors would also calculate the risk of Amazon as an entrant as a logistics player into Europe as something to consider. As things stand now, it can be mentioned, but I don’t believe quick moves here are likely. This is further confirmed by the fact that Amazon.com, Inc. (AMZN) is largely failing and being turned down in some new European markets, like Sweden. (Source: Swedish link) I, personally, don’t even use Swedish Amazon, I continue to use the German one, which also ships here using local post and DHL. So we’ll see where this goes.

But taking all this in, I say that the positives outweigh the negatives, and the following DHL thesis is valid as of 2Q24.

Thesis

- Even just considering a 15X forward upside, that RoR is still potentially over 15% – and that’s with the yield supposedly at 4.5%, with the native yield at very similar numbers. As always, I believe the native through IBKR or one of the brokers that accept EU stocks is the way to go here.

- Investing in Deutsche Post DHL means exposure to the attractive EU logistics and legacy post/parcel market. This is not going anywhere, despite the current issues. The yield is well-covered, and the company has already reported excellent run-rate 1Q24 results. It also continues to deliver solid guidance for the rest of the year, but above everything, for the next 2-3 years.

- At below 14X P/E, you’re locking in the capital at a very low multiple, with a 15%+ annualized upside – and that’s what I’m all about. The PT for DHLGY is $55/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 4 out of my 5 criteria, making it a “Buy” here. I would also call it cheap below $40/share for the ADR.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.