J Studios

TD Synnex Corporation (NYSE:SNX) is expected to make strategic investment in growing sectors like the global hybrid cloud market and artificial intelligence, which could accelerate future net sales growth. The company is at the same time implementing very ambitious cost optimization efforts that may also lead to FCF growth in the future. Also taking into account the recent approval of a new $2.0 billion share repurchase program, SNX may draw significant attention of the investment community.

Like other investors, I do think that SNX is quite undervalued given the recent growth from EBITDA, FCF, and net sales. Using a conservative DCF model, I obtained a fair valuation of close to $177 per share.

Business Model: Geographic Diversification, And Large Conglomerates

TD Synnex Corporation presents itself as a distributor and solutions aggregator for the information technology industry. The company runs operations in North and South America, Europe, Asia-Pacific, and Japan. I think that geographic diversification is one of the company’s assets. If there is a global economic recession, revenue may be a bit less volatile than other competitors operating only in the United States.

I appreciate that Apple (AAPL), Cisco (CSCO), and HP Inc. (HPQ) collaborate with TD Synnex. In the last quarter, total revenue associated to these companies represented close to 10% and 11% of the total quarterly revenue. Working with such large conglomerates means that the company’s products are well regarded in the information technology industry.

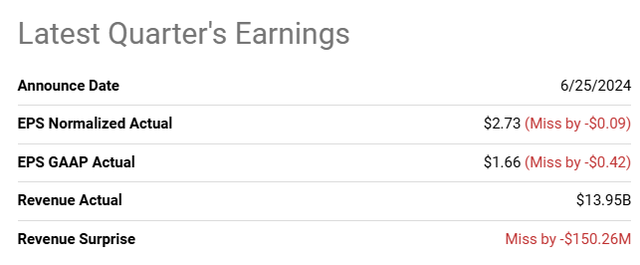

In June, 2024 the company reported lower than expected quarterly earnings including EPS GAAP of $1.66, and quarterly revenue of $13.9 billion. In my view, investors may want to have a look at the long-term performance reported by SNX.

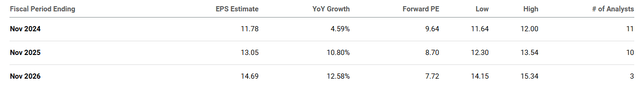

The expectations for 2025, and 2025 seem beneficial. In 2025, analysts expect EPS growth of 10%, and in 2026 EPS growth would be close to 12%. The company appears to be trading at 7x 2026 earnings.

Dividend investors may also appreciate SNX. The company reports dividend yield of 1.3%, and 5 year growth rate of 15.9%. The following information was obtained form Seeking Alpha.

Income Statement, And Balance Sheet Review

Investors may want to have a look at the company’s long-term growth from 2014 to 2024. SNX delivered significant revenue growth, from $13 billion in 2014 to about $56 billion in 2023. In my opinion, further net sales growth will most likely push the company’s stock price north.

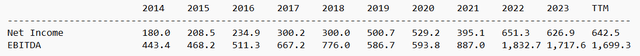

The company’s net income growth and EBITDA growth were also remarkable in the last decade. From $180 million in 2014, SNX reported net income of $642 million in the last report. Besides, the EBITDA figures also increased from close to $443 million to about $1.6 billion in 2024.

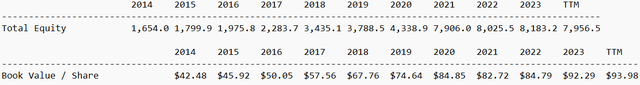

SNX appears to be reinvesting some of the cash received from its activities. As a result, total equity increased from $1.6 billion in 2014 to about $7.9 billion in 2024. In the last decade, the book value per share also multiplied by more than two. It is currently close to $93 per share, which is not far from the current stock price. In my view, the company appears undervalued.

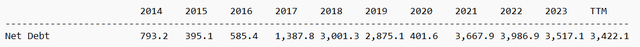

SNX did increase its total amount of debt, however the company seems to maintain the Net Debt/EBITDA ratio close to 2x. I think that investors out there would not be afraid of the company’s total amount of debt.

Debt Agreements, And My WACC Assumptions

I reviewed the company’s credit agreements, which include interest rate close to SOFR plus 1%-1.75%. In addition, in April 2024, the company sold $600 million senior notes including interest rate close to 6.1%. With these figures, I assumed that a WACC close to 7.1% would be quite conservative.

Loans borrowed under the TD SYNNEX Credit Agreement bear interest at a per annum rate equal to the applicable SOFR rate, plus 0.100% credit spread adjustment, plus the applicable margin, which may range from 1.000% to 1.750%, for borrowings under the TD SYNNEX Revolving Credit Facility and 1.125% to 1.750% for the TD SYNNEX Term Loan, in each case based on the Company’s Public Debt Rating. Source: 10-Q

On April 12, 2024, the Company issued and sold $600.0 million of 6.100% senior notes due April 12, 2034 (the “2034 Senior Notes” and such offering, the “2034 Senior Notes Offering”). Source: 10-Q

I revised the WACC reported by other analysts out there. The WACC used of 7.1% is close to the cost of capital reported by other investment analysts. My figures are a bit more conservative that the financial figures I have seen out there.

- Long-term bond rate: 3.9%-4.4%

- Equity market risk premium: 4.6%-5.6%

- Adjusted beta: 0.66-0.82

- Additional risk adjustments: 0.0%-0.5%

- Cost of equity: 6.90%-9.50%

- Tax rate: 21.00%-22.70%

- Debt/Equity ratio:0.4-0.4

- Cost of debt: 5.30%-5.80%

- After-tax WACC: 6.2%-8.0%

Cash Flow Review, And DCF Model

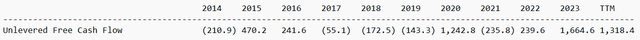

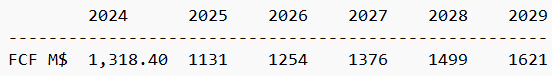

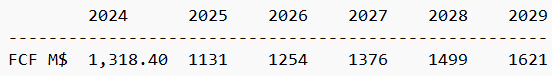

The company’s FCF was negative in the past, however the most recent FCF reported in 2023 and 2024 indicates an upward trend. I took a look at previous FCFs to make forecasts about the future. Hence, I invite investors to review the company’s FCF growth.

Under my financial model, I assumed that the company will successfully invest in strategic technologies like hybrid cloud, data analytics, artificial intelligence, and new infrastructure. Some of these target markets, like the global hybrid cloud market, are expected to grow at close to 21% CAGR from 2024 to 2032. In my view, SNX will most likely accelerate net sales growth thanks to these target markets.

The global hybrid cloud market size was approximately USD 45.19 billion in 2023. The market is projected to grow at a CAGR of 21.2% between 2024 and 2032, reaching a value of USD 256.04 billion by 2032. Source: Global Hybrid Cloud Market Report and Forecast 2024-2032

Besides, with new additions to the company’s end-to-end portfolio of products including technology-as-a-service and recurring revenue models, I think that we could expect net sales growth to trend higher. Finally, I assumed that ongoing digital transformation and greater automation will most likely be able to increase the customer base, and accelerate net sales growth.

In 2023, the company note a voluntary severance program that appears to be part of the company’s optimization efforts. In my view, we will most likely see an acceleration in free cash flow thanks to these initiatives. The company talked about these efforts and the amount of money invested in the program in the last quarterly report.

In July 2023, the Company offered a voluntary severance program (“VSP”) to certain co-workers in the U.S. as part of the Company’s cost optimization efforts related to the Merger. The Company incurred $2.9 million and $10.1 million of costs in connection with the VSP during the three and six months ended May 31, 2024, respectively, including $2.0 million and $8.0 million of severance costs and $0.9 million and $2.1 million of duplicative labor costs, respectively. Source: 10-Q

I would also expect that the company’s three-year $1.0 billion share repurchase program and the new authorized $2.0 billion share repurchase program may accelerate the demand for the stock. In my view, the company’s cost of capital could lower if a sufficient number of investors buy shares as a result of the stock repurchase program.

In January 2023, the Board of Directors authorized a three-year $1.0 billion share repurchase program. In March 2024, the Board of Directors authorized a new $2.0 billion share repurchase program, supplementing the $196.7 million remaining authorization under the prior program, pursuant to which the Company may repurchase its outstanding common stock from time to time in the open market or through privately negotiated transactions Source: 10-Q

My DCF model includes positive FCF from 2024 to 2029, with a WACC of 7.1%, and an assumption of net debt of close to $3.4 billion. The implied equity valuation would be $15.8 billion, and my target price would stand at $177 per share.

Source: Seeking Alpha

- NPV: $6,421.17 million

- NPV of TV: $12,889.68 million

- Total Value: $19,310.85 million

- Net Debt: $3,422.10 million

- Equity: $15,888.75 million

- Shares: 89.30 million

- Target Price: $177.93

Peers, And Information From Other Analysts

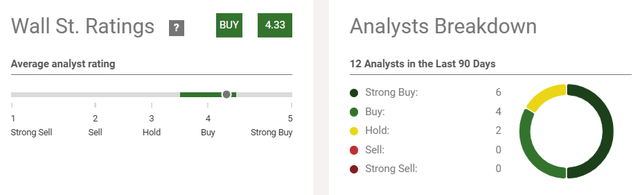

I revised the opinion of other Wall Street analysts. Out of 12 analysts that offered reports in the last 12 days, six included a strong buy mark, and 4 included a buy mark. No analysts reported a sell, or strong sell mark. In sum, I am not the only one thinking that SNX is a buy.

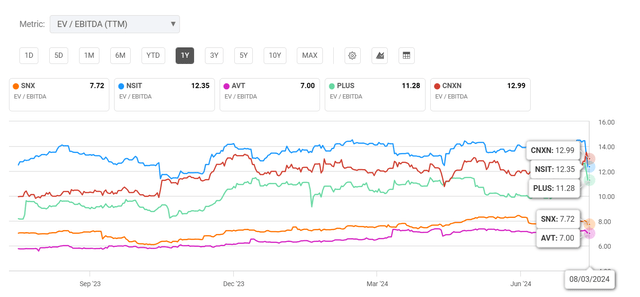

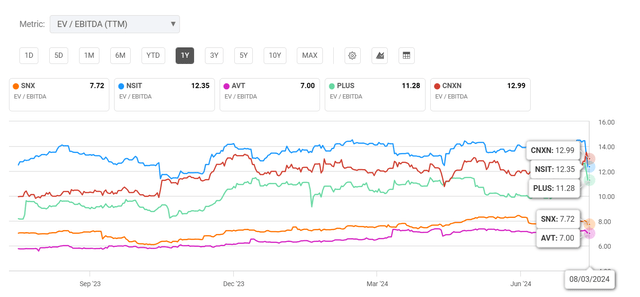

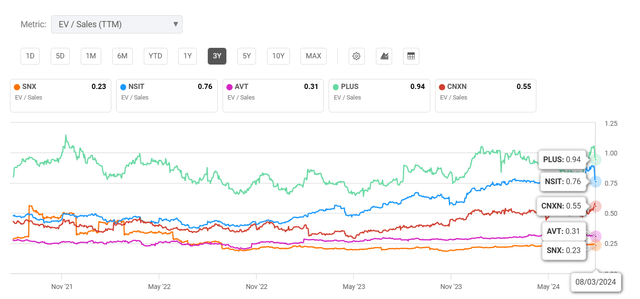

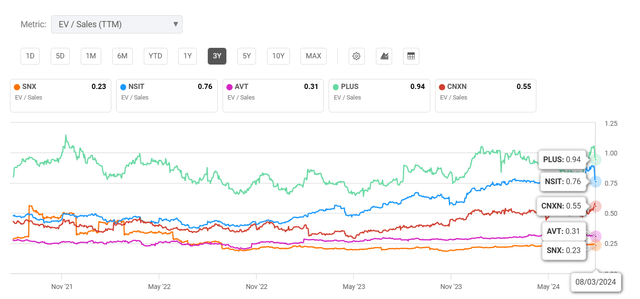

Competitors trade at 12x TTM EBITDA, and 11x TTM EBITDA. In my view, there is significant room for improvement. SNX is currently trading at about 7x TTM EBITDA. The company’s EV/ TTM Sales is also significantly undervalued as compared to that reported by peers.

Source: Seeking Alpha Source: Seeking Alpha

Risks

SNX depends quite a bit on the terms offered by OEM suppliers. If OEM suppliers change the distribution agreements applicable to the level of purchase discounts or incentive rebates, I would expect a significant decline in total revenue. In the annual report, the company also noted that sometimes it conducts business without formal agreements, which may bring significant risks to the company’s operations.

From time to time we may conduct business with a supplier without a formal agreement because the agreement has expired or was otherwise terminated. In such case, we are subject to additional risk with respect to products, warranties and returns, and other terms and conditions. If we are unable to pass the impact of these changes through to our reseller and retail customers, our business, financial position and operating results could be adversely affected. Source: 10-k

SNX could also suffer from supply shortages of certain products due to strong demand or any problem reported by OEM suppliers. The price of certain items may also increase, which could lead to lower FCF margins in the future. OEM suppliers could also decide to work with other partners, or they may organize their own dealer networks. In the worst case scenario, these problems may affect future net sales growth.

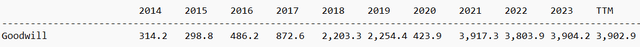

Goodwill accelerated significantly since 2014. In my opinion, if the companies acquired are worth less than expected, accountants could execute goodwill impairments. As a result, we could see declines in the book value per share. The market may also lose its trust about the company’s ability to find new targets. In sum, I think that the stock price could fall.

Conclusion

In my view, planned strategic investments in global hybrid cloud market and artificial intelligence could bring significant net sales growth thanks to the expected growth of these markets. In addition, the company’s cost optimization efforts and the new $2.0 billion share repurchase program seem good reasons to review the companies operations. SNX appears significantly undervalued considering previous FCF growth and equity growth. My discounted cash flow model including very conservative assumptions implied a fair valuation of $177 per share.