Maskot

Investment summary

My recommendation for Check Point Software (NASDAQ:CHKP) is a buy rating. Growth is expected to continue to be robust as various operating points point to positive growth ahead, especially the accelerating billings growth, turnaround in the PNL segment, and new products becoming a sizeable portion of the business (indicating good demand).

Business Overview

CHKP is a cybersecurity company that offers a portfolio of network and gateway security solutions, data and endpoint security solutions, and management solutions. They serve a range of industries, from retail to the public sector, healthcare, financial services, etc. Segments wise, CHKP reports in two segments. Product & Licenses [PNL] account for 21% of FY23 revenue, and Updates, maintenances and services [UMS] account for 79% of FY23 revenue.

2Q24 results update

Released late last month, CHKP 2Q24 revenue grew 6.6% to $627.4 million (organic growth of 5.4%), beating the consensus estimate of $623.2 million. Segments wise, PNL grew 1% to $118.1 million, while subscription revenue grew 13.7% to $271.1 million, both driven by strong demand for the Infinity Platform and Harmony email. Lastly, maintenance grew 2% y/y to $237.6 million. Adj EBIT margin saw 42.3%, falling slightly behind consensus estimates of 42.9%, and this offset the positive revenue growth, leading to adj EPS of $2.17 (barely beating consensus estimate of $2.16).

Growth reacceleration is a very positive sign

CHKP’s 2Q24 results were music to bullish investors’ ears as signs of growth acceleration became apparent, and this sets a very positive outlook for 2H24 and FY25. CHKP reported 2Q24 billings of $620 million, implying a growth of 9.5% y/y, which is the second consecutive quarter of growth acceleration (300 bps sequential improvement in 2Q24 vs. 730 bps sequential improvement in 1Q24). Notably, the strength behind this acceleration was driven by new deal momentum and renewal cycles, which I take as a sign that demand is coming back online. Two other convincing data points that demand has come back are: (1) that annualized new business bookings grew double-digits across all geographies; and (2) that large deals are coming back to the table, wherein CHKP signed three large fortune global 500 deals that in aggregate accounted for $130 million in bookings (21% of 2Q24 total billings). More importantly, these larger deals were not pulled forward from 2H24, as per management, which means demand has improved organically.

This translates directly to another quarter of revenue growth acceleration since 2Q23, marking 2Q24 as the fourth consecutive quarter of acceleration. The PNL segment also saw a turnaround in growth after five consecutive quarters of negative revenue growth, and I take this as a very positive sign that the refresh cycle is happening. If true, CHKP should see accelerating growth in the coming quarters. Note that management mentioned bookings growth outperformed revenue growth for this segment in 2Q24, so this is definitely a sign of demand recovery.

But in terms of bookings, the bookings grew higher than the 1% that we see in revenues. Again, because some of them are coming for Infinity, some of the bookings for the firewall are coming for Infinity and you don’t see it in the revenues yet. 2Q24 earnings transcript

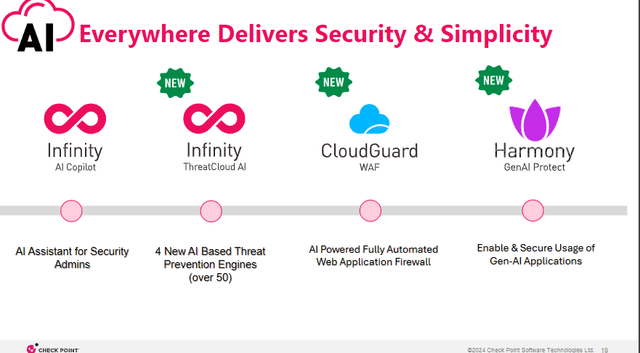

CHKP’s new products continued to see amazing traction. Harmony email and the Infinity platform have now reached around 15% of total revenue (these products were launched ~3+ years ago). The decision to expand sales capacity should continue to drive demand for these new products, and the latest update on this front is that CHKP has started to see salesforce productivity improvements from new salesforce investments that began roughly 9-12 months ago. On a y/y comparison basis, 2H24 and 1H25 should see stronger sales growth as CHKP benefits from a mature salesforce. Also, remember that CHKP should have its SASE solution fully integrated by this year, which should allow for more cross-sell opportunities.

Monitoring near-term margin movements

The area to watch out for is how margins will move in the coming quarters, as CHKP needs to strike a balance between investing for growth (e.g., expanding sales capacity) and protecting margins. Currently, the balance is tilted against the former, as OPEX grew 11%, much faster than revenue growth. As a result, adj. EBIT growth in 2Q24 was just 0.8%. This has resulted in FCF being pressured as well (2Q24 FCF margin saw 30.8% vs. 31.8% in 2Q23). That said, it is still early to say whether margins will remain pressured as growth is inflecting upwards, especially with salesforce productivity seeing sequential improvements. I would monitor next quarter’s margin movement and management comments on 4Q24 and FY25 before concluding whether earnings margins will accelerate back to pre-covid levels.

Valuation

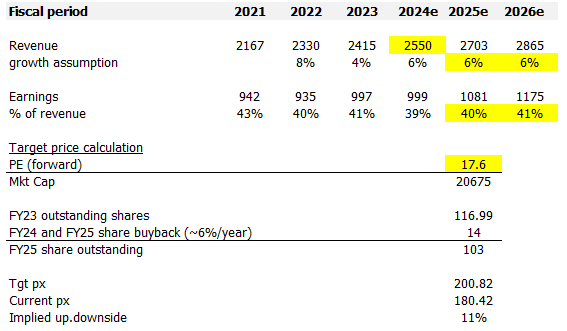

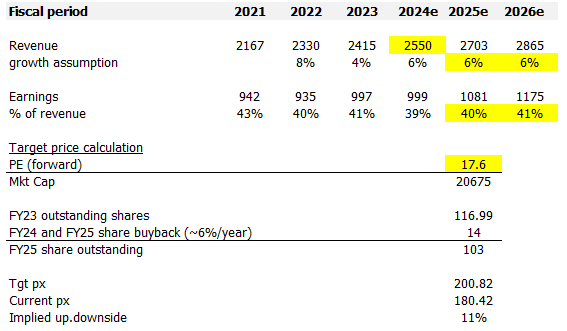

Redfox Capital Ideas

I model CHKP using a forward PE approach, and using my assumptions, I believe CHKP is worth ~$201. CHKP should have no problem growing at the guided 6% for FY24 since 1H24 is trending at 6.2% and underlying operating metrics are pointing to accelerating growth. Without being too aggressive with my assumption, I assumed CHKP to grow at 6% for FY25/26. In terms of margins, FY24 net margin is likely to come in at 39% (1H24 margin is ~39%) as management steps up on growth investments. As for FY25/26, I am conservatively modeling 100bps improvement per year, assuming that CHKP will continue to invest in growth and that margins do not recover to pre-covid levels of mid-to-high 40% (so there is upside potential). With my fairly muted margin expansion assumption, I assumed CHKP to trade at its historical average of 17.6x forward PE instead of the current 18.7x (I don’t think it should trade at a premium if earnings margins are being pressured).

Risk

The new CEO brings new uncertainty to the business with regards to strategic decisions, investment plans, and culture. This is especially important considering that the new CEO lacks experience running a mature public company (with a similar size to CHKP). All of these are uncertain at this point since this is a new CEO. The good news is that the transition will be relatively gradual, so there won’t be any drastic changes to the business outlook.

Conclusion

My view for CHKP is a buy rating as the growth outlook is a positive one. The business has shown accelerating billings, a turnaround in the PNL segment, and very positive traction in its new products. CHKP is also expanding its sales capacity and seeing results in sales productivity, which are further growth supporters. The completion of integrating the SASE solution should provide further cross-sell opportunities (more growth potential).